The Maryam Nawaz Loan Scheme 2025 | CM Punjab Asan Loan Asan Karobar Loan Scheme, spearheaded by Chief Minister Maryam Nawaz Sharif, delivers interest-free financing to small and medium enterprises (SMEs) across Punjab. This program empowers entrepreneurs with accessible loans, fostering business growth and economic independence without markup burdens.

Here’s what you’ll discover in this in-depth resource:

- Core features of Asaan Karobar Finance Scheme and digital Asaan Karobar Card

- Step-by-step eligibility and application procedures

- Loan tiers, repayment structures, and zero-interest advantages

- Application tracking, helplines, and support mechanisms

- Connections to broader Maryam Nawaz welfare programs like housing and subsidies

Understanding CM Punjab Asan Karobar Loan Scheme | Maryam Nawaz Loan Loan

Table of Contents

What Exactly is CM Punjab Asan Karobar Loan Scheme?

The CM Punjab Asan Karobar Loan Scheme stands as a pioneering effort by Chief Minister Maryam Nawaz Sharif to provide interest-free loans ranging from Rs 1 million to Rs 30 million for SMEs. Launched to stimulate entrepreneurship, it eliminates traditional barriers like immediate NOCs, enabling swift business launches.

This scheme marks Punjab’s first fully interest-free large-scale business financing program, with billions allocated and disbursements exceeding Rs 61 billion to over 107,000 beneficiaries in recent months.

Key pillars include:

- Zero markup on principal

- Digital transparency and utilization tracking

- Priority for women, youth, and priority sectors like agriculture

- Targets for 100,000+ startups and job creation

Detailed Breakdown of Asaan Karobar Finance Scheme Components

The Asaan Karobar Finance Scheme splits into two arms: higher-tier loans up to Rs 30 million and the Asaan Karobar Card for up to Rs 1 million via digital channels. Administered through the Bank of Punjab, it ensures structured fund use for vendors, utilities, and growth.

Recent updates highlight phased expansions and simplified processes for broader reach.

Core components:

- Interest-free across all tiers

- Grace periods and flexible installments

- No collateral for lower amounts

- Digital card restricts cash withdrawals to 25%

In What Ways Does Asan Karobar Loan Scheme Boost Punjab’s Entrepreneurial Landscape?

The Asan Karobar Loan Scheme drives entrepreneurship by offering collateral-free, interest-free capital, allowing “loan today, business tomorrow.” It has fueled thousands of startups, with incentives like subsidized land and export zone perks.

Impact statistics show rapid disbursements creating employment and sectoral growth.

Contributions include:

- Empowering marginalized groups with quotas

- Enhancing export-oriented businesses

- Reducing unemployment through self-employment

- Aligning with provincial economic revival goals

Qualifying for CM Punjab Asan Karobar Loan Scheme

Core Eligibility Standards

Applicants for the CM Punjab Asan Karobar Loan Scheme must hold Punjab residency, be aged 25-55, possess a valid CNIC, and maintain good credit standing. Active tax filer status or registration within months is encouraged.

Essential standards:

- Punjab domicile proof

- No prior loan defaults

- Viable business proposal for larger amounts

- Inclusive for men, women, transgender, and disabled persons

Who Qualifies for Asaan Karobar Finance Scheme Participation?

Qualifiers include Punjab residents aged 25-55 with clean financial records, spanning small traders, startups, and existing SMEs. Special emphasis on youth, women entrepreneurs, and priority sectors.

Broad categories:

- New business starters

- Expanding micro-enterprises

- Agri-business owners

- IT and export-focused ventures

Age and Domicile Prerequisites for Applicants

The scheme targets working-age individuals (25-55) with verified Punjab residency to ensure local economic benefits.

Proof requirements:

- CNIC showing Punjab address

- Domicile certificate if needed

- Supporting utility bills

Essential Documents for Asan Karobar Loan Scheme Applications

Required documents streamline verification: CNIC copies, business details, income proof, and premises evidence.

Document checklist:

- Valid CNIC scan

- Business plan outline

- Lease or ownership proof

- Recent bank statements

Who Can Access the Asaan Karobar Card Specifically?

The Asaan Karobar Card suits micro-entrepreneurs needing quick digital funding up to Rs 1 million, with usage focused on business payments.

Ideal for:

- Street vendors and shopkeepers

- Home-based women enterprises

- Daily operators scaling up

Income Considerations in Related Financing Options

While primarily business-oriented, stable income evidence strengthens applications, though no rigid salary minimum applies for core scheme.

General guidelines:

- Proof of viable revenue streams

- Focus on business potential over salary

Opportunities for Freelancers and New Ventures in Asan Karobar Loan Scheme

Freelancers and startups qualify, especially in IT sectors with priority at hubs like Nawaz Sharif IT City.

Benefits include:

- No mandatory prior experience

- Innovation-focused approvals

- Mentorship linkages

Agricultural Focus Within Maryam Nawaz Business Loan Initiatives

Agriculture receives dedicated support, aligning with export and food security goals.

Supported areas:

- Equipment and modernization

- Input supplies financing

- Agri-startups

Application Process for CM Punjab Asan Karobar Loan Scheme

Complete Step-by-Step Guide to Applying

Applications occur fully online via dedicated portals, ensuring transparency and speed.

Process outline:

- Register on official site

- Input CNIC and details

- Upload documents

- Submit and track

How to Submit Applications for Punjab Business Loan Programs

Access PITB-managed portals like akc.punjab.gov.pk for seamless submission under Asan Karobar.

Tips for success:

- Prepare scans beforehand

- Pay processing fees digitally

- Seek helpline clarification

Online Application Portal for CM Punjab Loan Initiatives

The primary portal facilitates registration, form filling, and OTP verification for secure access.

Features:

- Real-time dashboard

- Update capabilities

- Integrated status checks

Navigating Asaan Karobar Online Registration Effectively

Select scheme type, enter details accurately, and ensure complete uploads for faster processing.

Key steps:

- Scheme selection

- Personal/business info

- Document attachment

- Fee payment and submission

Official Channels for Maryam Nawaz Loan Scheme Submissions

Use punjab.gov.pk or affiliated sites for authentic applications, avoiding unofficial sources.

Advantages:

- Secure data handling

- Direct Bank of Punjab linkage

Verification and Documentation Submission Details

Verification involves CNIC checks, credit history, and potential site visits for fairness.

Stages:

- Automated initial screening

- Manual review

- Approval notification

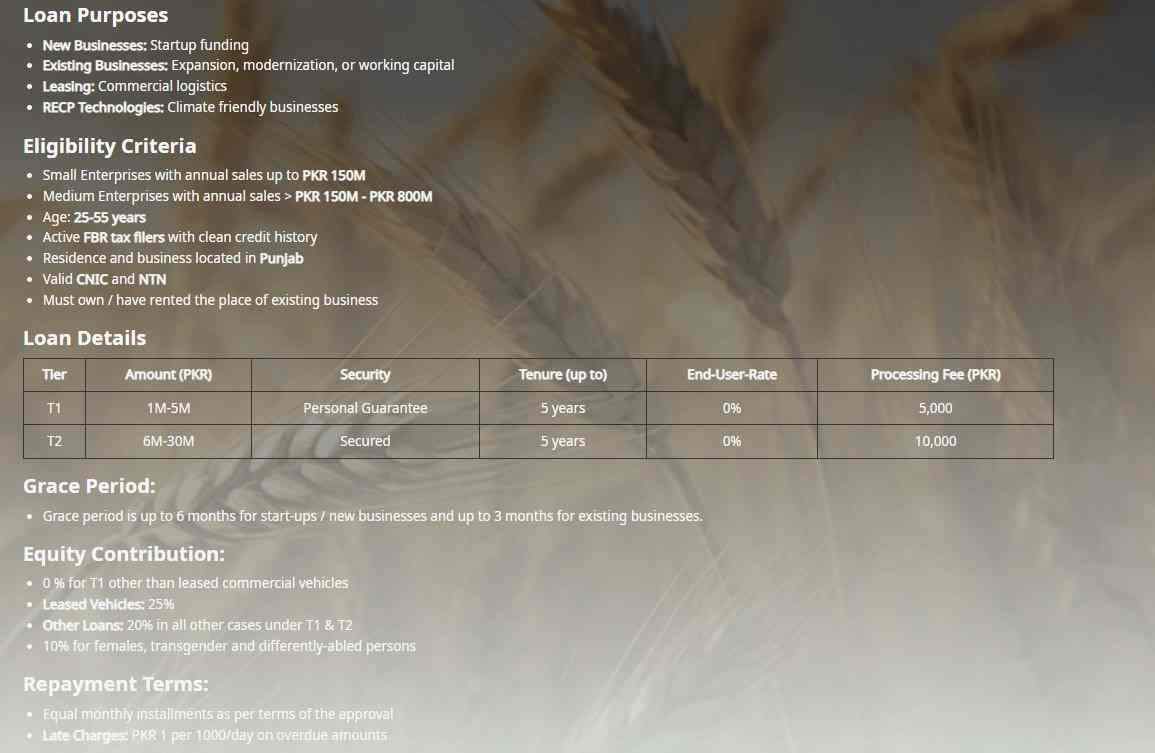

Financial Structure of Asan Karobar Loan Scheme

Available Loan Tiers and Limits

Loans tier from Rs 1 million (Card) to Rs 30 million (Finance), with unsecured options up to certain thresholds.

Tier summary:

| Tier Level | Amount Range | Security Required |

|---|---|---|

| Asaan Karobar Card | Up to Rs 1 million | Personal guarantee |

| Finance Scheme Tier 1 | Rs 1-5 million | Unsecured often |

| Higher Tiers | Up to Rs 30 million | Varies by amount |

Maximum Funding Under CM Punjab Asan Karobar Loan Scheme

Maximum reaches Rs 30 million interest-free for qualifying high-potential SMEs in priority areas.

Higher allocations for:

- Export businesses

- Agri and IT sectors

Repayment Schedules and Interest Policies

All loans feature zero interest, with up to 5-year terms and grace periods.

Repayment overview:

| Scheme Type | Term Duration | Grace Period | Monthly Minimum |

|---|---|---|---|

| Card | 3 years | Varies | 5% of balance |

| Finance | Up to 5 years | 3 months | Easy installments |

Availability of Zero-Interest Financing Options

The scheme guarantees 100% interest-free loans, principal-only repayment easing burdens.

Unique aspects:

- Government-subsidized markup

- Transparent digital enforcement

Categories of Supported Loan Purposes

Funding covers working capital, equipment, expansion, and sectoral priorities.

Main categories:

- General SME growth

- Agriculture inputs

- Startup capital

Tracking and Assistance for Asan Karobar Loan Scheme

Methods to Monitor Application Progress

Track via portal login or SMS alerts using CNIC.

Options:

- Online dashboard

- Periodic notifications

Checking Asaan Karobar Card Status Online

Login to akc.punjab.gov.pk for instant updates on approval or issues.

Simple process:

- Enter credentials

- View status

- Resolve if needed

CNIC-Based Status Verification for Asaan Karobar Card

Quick CNIC entry with OTP provides status without full login.

Efficient for:

- Initial checks

- Error resolution

Available Helplines and Support Services

Toll-free 1786 offers comprehensive guidance, alongside Bank of Punjab lines.

Support covers:

- Application queries

- Document help

- Technical issues

Contact Options for Asaan Karobar Card Assistance

Primary helpline 1786; additional BOP support at 111-267-200.

Common resolutions:

- Status clarifications

- Re-submission guidance

Portal Login and Management Features

Secure login enables profile updates and progress monitoring.

Benefits:

- Edit submissions

- Download approvals

Complementary Programs in Maryam Nawaz Welfare Ecosystem

Overview of Housing Support Initiatives

Apni Chhat Apna Ghar provides interest-free loans up to Rs 1.5 million for home construction on owned land.

Progress: Over 86,000 loans disbursed, billions in funding.

Details on Apna Ghar Housing Loan Program

Targets low-income families with small plots, repayable over 9 years at Rs 14,000 monthly.

Key facts:

- Staged disbursements

- Merit-based allocation

Application Process for Related Housing Schemes

Register via acag.punjab.gov.pk with property proof.

Includes offline options for accessibility.

Eligibility for Apni Chhat Apna Ghar Initiative

Requires owned land (1-10 marla), no prior house, low-income verification.

Focus on deserving families.

Maximum Limits in Punjab Housing Loan Programs

Capped at Rs 1.5 million interest-free for construction.

Dedicated to plot owners.

Connections to Employment and Skill Development Programs

Rozgar schemes link with loans for trained youth employment.

Enhances loan utilization success.

Mobility and Vehicle Assistance Options

Bike and e-vehicle schemes support students and workers.

Promotes green, affordable transport.

Subsidy and Relief Mechanisms

Includes Rashan cards, wheat subsidies, and financial aid packages.

Targets vulnerable groups.

Rashan and Essential Support Eligibility

Low-income via surveys qualify for subsidized rations.

Monthly benefits distribution.

Comparative Analysis and Broader Perspectives

Asan Karobar Loan Scheme Versus Conventional Financing

Outperforms banks with zero interest, faster approvals, and no collateral demands.

Superior for SMEs.

Integration with Provincial Development Goals

Aligns with export boosts, job creation, and inclusive growth.

Model for other regions.

Frequently Asked Questions on CM Punjab Asan Karobar Loan Scheme

How Do I Apply for Asaan Karobar Card Online?

Visit akc.punjab.gov.pk, register with CNIC, complete form, upload documents, and submit.

What Defines the Higher-Tier Loan Options in Punjab?

Up to Rs 30 million interest-free for established or high-potential SMEs.

Are Loans Truly Interest-Free Under This Initiative?

Yes, 100% markup-free with principal-only repayment.

Steps to Verify Asaan Karobar Card Application Status?

Login to portal or use CNIC quick check; contact 1786 if issues arise.

Who Specifically Qualifies for Asaan Karobar Card?

Small entrepreneurs aged 25-55 in Punjab with viable micro-businesses.

Overview of Linked Rozgar Employment Programs?

Focuses on skill-based job placement complementing business loans.

Upper Limits for Agricultural Financing?

Up to Rs 30 million in priority agri-sectors.

Add a Comment