10 Lakh Loan Without Interest In Pakistan: In Pakistan, pursuing personal and entrepreneurial ambitions, individuals and entrepreneurs often find themselves in need of financial support.

Nevertheless, within a nation that promotes entrepreneurship and personal growth, there exist institutions that are dedicated to empowering individuals through interest-free loans.

This article aims to highlight the leading institutions that offer 10 Lakh loans without interest in Pakistan, addressing both personal and business requirements.

Recommended Reading:

- How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

- Online Loan In Pakistan Without Interest {10K-5Lakh} (Personal+Business)

- How To Get An Interest-free Loan Online [20K-75K]

- Kashf Foundation Loan Apply Online (15K-3Lakh) {Interest-Free}

How To Get 10 Lakh Loan Without Interest In Pakistan

Table of Contents

10 Lakh Loan Without Interest In Pakistan

10 Lakh Loan Without Interest In Pakistan: Years ago, banks and other financial institutions would have required you to have a steady job and make a specific amount of money before they’d give you the money you needed.

Thankfully, times have changed, there are many welfare organizations and loan schemes that provide interest-free loans! Now you can get that 10 lakh loan without interest in Pakistan regardless of your employment status or income level! Let’s take a look at how you can do this!

Prime Minister Youth Loan Scheme

10 Lakh Loan Without Interest In Pakistan: The Prime Minister Youth Loan Scheme 2023 offers an incredible opportunity for every Pakistani citizen to fulfill their entrepreneurial aspirations and drive economic growth.

With loan amounts ranging from 0.5 million PKR (10 Lahks) to a substantial 7.5 million PKR (75 Lahks), this scheme aims to empower young individuals with the financial means to realize their business dreams.

Designed to support entrepreneurship and encourage economic growth, the Prime Minister Youth Loan Scheme 2023 is a beacon of hope, providing individuals with the means to turn their dreams into reality.

Whether it’s starting a small business or expanding an existing venture, this scheme offers substantial financial support to fuel the aspirations of young Pakistanis and pave the way for a prosperous future.

PM Youth Loan Eligibility

10 Lakh Loan Without Interest In Pakistan: To be eligible for the PM Youth Loan Scheme, applicants must meet certain criteria. Here are the key points regarding eligibility:

| Eligibility Criteria | Details |

|---|---|

| Citizenship | Applicants must be citizens of Pakistan and hold a valid Computerized National Identity Card (CNIC). |

| Age Limit | General: 21 to 45 years. IT/E-Commerce: 18 to 45 years. |

| Business Type | Focus on Small and Medium Enterprises and startups. Priority for businesses in IT/E-Commerce or other eligible sectors. |

Prime Minister Youth Loan Program Online Apply

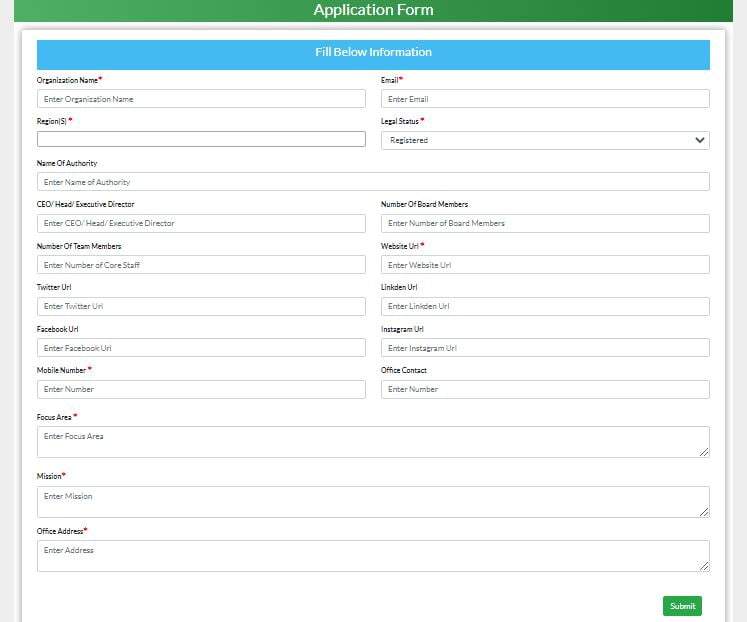

10 Lakh Loan Without Interest In Pakistan: To apply for the Prime Minister Youth Loan Program online and fill out the application form, follow the step-by-step process outlined below:

| Step | Action | Details |

|---|---|---|

| 1 | Visit the Website | Open your web browser and go to the Website or PM Youth Loan Program App. |

| 2 | Review Instructions | Check the application form for instructions and eligibility criteria. |

| 3 | Personal Information | Provide your full name, CNIC number, date of birth, gender, address, phone number, and email. |

| 4 | Educational Qualifications | Fill in details about your educational background, degree, institution, and year of completion. |

| 5 | Business Information | Describe your business or startup, its location, number of employees, and estimated project cost. |

| 6 | IT/E-Commerce Details (if applicable) | Provide additional info for IT/E-Commerce businesses, such as business model and target market. |

| 7 | Specify Loan Amount | Indicate the loan amount you seek (between 0.5 Million PKR and 7.5 Million PKR). |

| 8 | Review Information | Check all information for accuracy and completeness. Make corrections if needed. |

| 9 | Submit Application | Submit the form electronically through the website. |

| 10 | Confirmation | Receive a confirmation message with a reference number or confirmation details. |

| 11 | Await Communication | Wait for further communication regarding your application status. Be ready to provide more information if required. |

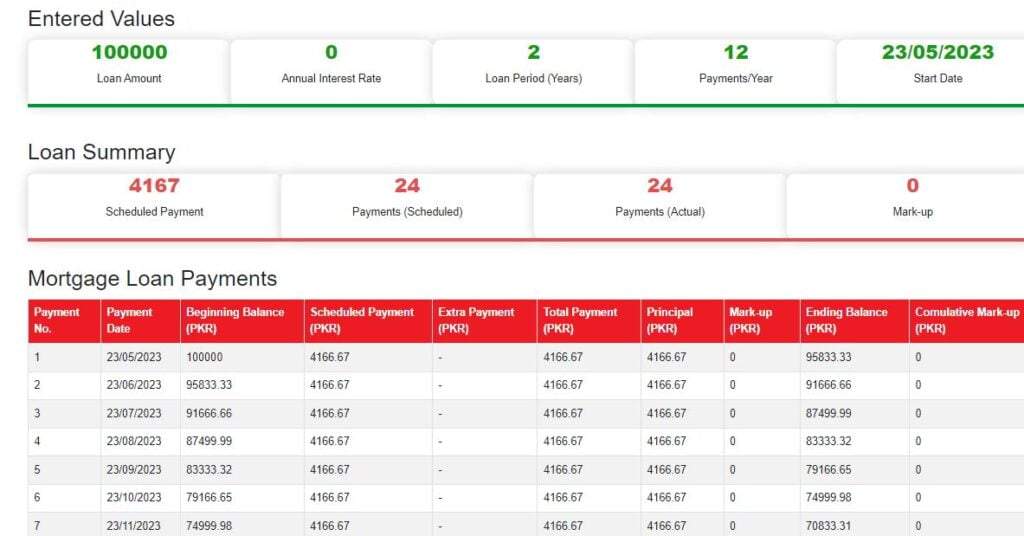

PM Youth Loan Calculator

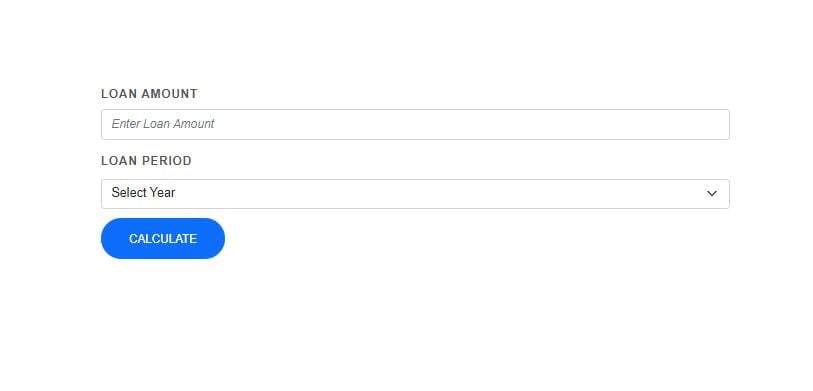

10 Lakh Loan Without Interest In Pakistan: To calculate the estimated installment plan and duration for your loan under the PM Youth Loan Program, follow these steps:

- Step 1: Open your web browser and visit the official website of the PM Youth Loan Program at https://pmyp.gov.pk/pmyphome/Calculator.

- Step 2: On the website’s homepage, you will find the loan calculator tool. This tool allows you to estimate your installment plan and loan duration.

- Step 3: Fill in the required information in the loan calculator tool.

- Step 4: Once you have entered the necessary details, click on the “Calculate” or similar button to initiate the calculation process.

- Step 5: The loan calculator will process the information and generate an estimated installment plan and loan duration based on the provided data.

- Step 6: Review the results displayed on the screen.

- Step 7: Take note of the estimated installment amount and duration for your reference.

PMYP Loan Track Application

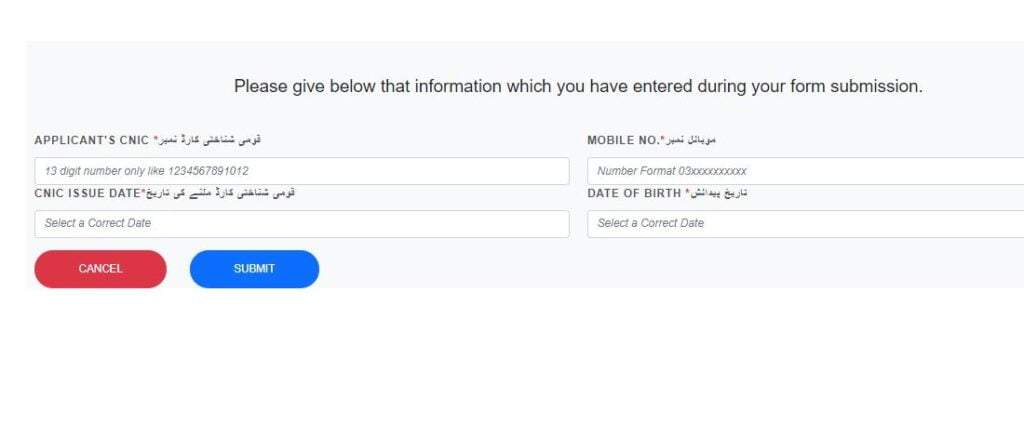

10 Lakh Loan Without Interest In Pakistan: To track your PMYP loan application, please follow these steps:

| Step | Action | Details |

|---|---|---|

| 1 | Visit the Website | Open your web browser and go to PM Youth Loan Program. |

| 2 | Find the Tracking Form | Locate the form to track your loan application on the website page. |

| 3 | Enter CNIC | Type in your 13-digit CNIC number without dashes or spaces (e.g., 1234567891012). |

| 4 | Enter Mobile Number | Enter your mobile number in the format 03xxxxxxxxxx. |

| 5 | Select CNIC Issue Date | Choose the correct date when your CNIC was issued from the provided options. |

| 6 | Enter Date of Birth | Provide your date of birth in the specified format. |

| 7 | Review Information | Double-check the accuracy of all entered information. |

| 8 | Submit | Click on the “Submit” or similar button to track your loan application. |

| 9 | View Status | The website will process your details and display the status of your loan application on the screen. |

If you encounter any issues or have specific inquiries about your application, it is recommended to contact the PM Youth Loan Program helpline.

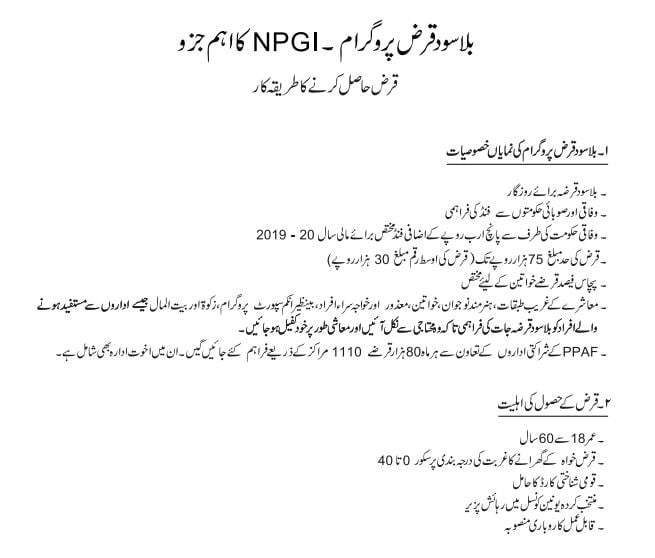

Pakistan Poverty Alleviation Fund Interest-Free Loan Scheme

10 Lakh Loan Without Interest In Pakistan: The Pakistan Poverty Alleviation Fund Interest-Free Loan Scheme is a remarkable initiative that aims to empower individuals through income-generating micro-enterprises.

| Feature | Details |

|---|---|

| Funding Source | Collaboration and funding from both Federal and Provincial Governments |

| Total Funds | Rs. 5 billion |

| Core Principle | Provide interest-free loans to eligible applicants for establishing or expanding micro-enterprises |

| Maximum Loan Size | Up to Rs. 75,000 |

| Average Loan Size | Rs. 30,000 |

| Gender Equality Commitment | 50% of loans reserved for women to support their role in entrepreneurship and economic growth |

| Purpose | Support aspiring entrepreneurs and contribute to poverty alleviation efforts across the country |

PPAF.ORG.PK Loan Eligibility

10 Lakh Loan Without Interest In Pakistan: To be eligible for the loan program offered by PPAF.ORG.PK, applicants must meet the following criteria:

| Feature/Procedure | Details |

|---|---|

| Program Name | Interest-Free Loan Program Key component of NPGI |

| Purpose | Interest-free loan for employment |

| Funding | Funded by federal and provincial governments Additional fund allocation of five billion rupees by the federal government for the financial year 2019-20 |

| Loan Limit | Up to Rs 75 thousand The average loan amount is Rs 30 thousand |

| Reserved Loans for Women | 50% of the loans are reserved for women |

| Target Beneficiaries | Poor sections of society Skilled youth Women Disabled individuals Eunuchs Beneficiaries of Benazir Income Support Program, Zakat, and Baitul Mal |

| Loan Disbursement Centers | 80 thousand loans are provided every month through 1110 centers with the support of PPAF’s partner institutions |

| Eligibility Criteria | Age: 18 to 60 years Borrower’s household scores 0 to 40 on the poverty scale Holder of National Identity Card Resident in the elected Union Council |

| Action Plan Required | Actionable ROBari Plan |

| Procedure for Getting Loan | Apply to the nearest center Provide necessary documents and meet eligibility criteria Attend an interview if required Await approval and disbursement |

www.ppaf.org.pk Apply Online

10 Lakh Loan Without Interest In Pakistan: To apply for a loan through the Pakistan Poverty Alleviation Fund (PPAF) or any affiliated organization, follow this step-by-step guide:

| Step | Action |

|---|---|

| Step 1 | Identify the nearest PPAF Center or an affiliated organization’s center. Find information on www.ppaf.org.pk. |

| Step 2 | Visit the chosen center in person during working hours with the necessary documents and information. |

| Step 3 | Approach the designated staff or representative responsible for loan applications. |

| Step 4 | Fill out the loan application form accurately and completely. Include personal, contact, financial details, and business plans (if applicable). |

| Step 5 | Attach necessary supporting documents: valid CNIC, proof of residence, income statements, business plan, etc. |

| Step 6 | Submit the completed application form and supporting documents. Receive a receipt or acknowledgment. |

| Step 7 | Pay any application fees or processing charges if required. Follow the staff member’s instructions. |

| Step 8 | Keep a copy of your submitted application form and supporting documents for your records. |

| Step 9 | Await further communication regarding the status of your loan application. Be prepared to provide additional information if requested. |

| Step 10 | Follow up with the center if you have not received updates within the specified timeframe. |

FAQs | Loan Without Interest In Pakistan

Is there any Interest-free loan offered by the Pakistani Government?

Yes, through the Pakistan Poverty Alleviation Fund (PPAF), the Government of Pakistan is giving interest-free loans from 20,000 to 800,000 Lakhs.

Can I get a loan at zero interest rate?

Yes, one can get the loan at zero interest rate, but for this, you have to maintain a credit score of at least 720 and these loans are available for short terms only i.e. 24 months.

Who can get Karz-e-Hasana in Pakistan?

Students who have been admitted to a university or college

He/She should not be an employee

His/her parents are unable to pay his study dues, because of financial constraints

Which university gives Qarz-e-Hasana in Pakistan?

COMSATS University gives Qarz-e-Hasana to its students who do not qualify for any other schemes or scholarships.

Who is eligible for the interest-free loans offered by PPAF?

To be eligible for these loans, individuals must be between the ages of 18 and 60.

They should come from households with a score of 0-40 on the Poverty Score Card, possess a valid National Identity Card (CNIC), be residents of targeted union councils within specific districts, and have an economically viable business plan.

How can I apply for an interest-free loan through PPAF?

To apply for an interest-free loan, visit the nearest PPAF Center or an affiliated organization’s center.

Fill out the loan application form with accurate and complete information. Attach the required supporting documents, and apply to the center’s staff.

Keep a copy of the application and await further communication regarding the status of your loan application.

What is the loan size offered by the PPAF loan program?

The loan size can go up to Rs. 75,000, with an average loan size of Rs. 30,000. These loan amounts are designed to be accessible and suitable for income-generating micro-enterprises.

Which organization or program provides a 10 Lakh Loan Without Interest In Pakistan?

Several organizations and programs offer 10 Lakh Loan Without Interest In Pakistan, such as:

Prime Minister Youth Loan Scheme,

Pakistan Poverty Alleviation Fund (PPAF).

Are there any specific requirements or documentation needed to apply for a 10 Lakh Loan Without Interest In Pakistan?

Yes, every scheme has specific eligibility criteria especially when you are going to apply for a 10 Lakh Loan Without Interest In Pakistan.

Generally, applicants may need to provide personal information, proof of identity (such as a valid CNIC), a business plan or project proposal, and any other documentation specified by the loan program.

Are there any risks or potential drawbacks of getting a 10 Lakh Loan Without Interest In Pakistan?

While a 10 Lakh Loan Without Interest In Pakistan offers several advantages, borrowers should be aware of any fees, charges, or penalties associated with the loan program.

It is essential to carefully review the terms and conditions, repayment obligations, and any other stipulations to ensure a clear understanding of the loan’s implications.

What are the eligibility criteria for a loan without interest in Pakistan?

Eligibility criteria may include factors such as age, residency, entrepreneurial potential, and a viable business plan. Specific requirements can vary based on the program or organization offering the loan.

What is the Pakistan Poverty Alleviation Fund (PPAF) and its loan program?

The Pakistan Poverty Alleviation Fund (PPAF) is an organization that aims to alleviate poverty and empower individuals through various initiatives. One of its key programs is the interest-free loan scheme, which provides loans for income-generating micro-enterprises.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment