In this article, we will explore the distinctive features, charges, and location of Bank Alfalah’s Digital Lifestyle Branch and a step-by-step guide on Bank Alfalah Digital Account Opening Online For FREE.

- What is Bank Alfalah Digital Account?

- Bank Alfalah Digital Lifestyle Branch Key Features

- Bank Alfalah Digital Account Opening Requirements

- Document Required For Bank Alfalah Digital Account

- Bank Alfalah Digital Account Opening Online

Read the details to explore the future of banking convenience through Bank Alfalah’s Digital Lifestyle Branch and Bank Alfalah Digital Account Opening online for FREE.

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

Bank Alfalah Digital Account Opening Online | Bank Alfalah Digital Lifestyle Branch

Table of Contents

What is Bank Alfalah Digital Account?

Bank Alfalah has embraced the digital revolution in the banking industry with its innovative Digital Lifestyle Branch. As customers increasingly seek convenience and seamless banking experiences, Bank Alfalah Digital Lifestyle Branch offers a groundbreaking solution.

Firstly, we will introduce our readers to Bank Alfalah’s Digital Lifestyle Branch, shedding light on its distinctive features, associated charges, and a comprehensive list of branches and locations and providing a step-by-step guide to effortlessly opening an account within this cutting-edge banking ecosystem.

Secondly, we will explore eligibility, document requirements, and the step-by-step process of Bank Alfalah Digital Account Opening online for free, from the comfort of your home without visiting any branch. So, let’s get started!

Bank Alfalah Digital Lifestyle Branch Key Features

Bank Alfalah’s Digital Lifestyle Branch exemplifies its commitment to digital innovation, convenience, and customer-centricity.

By embracing the power of technology, the branch aims to redefine traditional banking norms and empower individuals to integrate banking into their modern lifestyles seamlessly.

Key Features of Bank Alfalah Digital Lifestyle Branch:

| Feature | Details |

|---|---|

| Digital Account Opening: | Easily open a bank account online without paperwork or visiting a branch. |

| 24/7 Digital Lobby: | Access banking services anytime, day or night, for tasks like checking balances, transferring funds, and paying bills. |

| Statement Printing: | Get physical copies of your account statements for auditing, tracking expenses, and record-keeping. |

| Cheque Deposit: | Deposit cheques digitally by taking a picture instead of going to a branch. |

| Video Agent: | Connect with a bank representative via video call for personalized assistance with transactions and inquiries. |

| Digital Lockers: | Securely store important documents and belongings digitally, saving physical space and ensuring safety. |

| Buy Now Pay Later: | Make purchases and pay in installments, offering flexibility and enhanced purchasing power. |

| Digital Facilitation Desk: | Receive help with digital banking services from knowledgeable staff at a dedicated desk. |

| Work Hall: | Utilize a modern workspace with amenities for remote work or business activities. |

| Eating Hall: | Relax and enjoy refreshments while managing your banking tasks, enhancing comfort and customer satisfaction. |

Bank Alfalah Digital Account Opening Requirements

Bank Alfalah Digital Account Opening Requirements:

| Eligible Applicants | Ineligible Applicants |

|---|---|

| Unemployed (including Housewives, Students, etc.) | Business category individuals |

| Retired individuals | Joint Account Holders |

| Business Individuals | High-risk individuals (e.g., based in high-risk areas, associated with high-risk professions) |

| Salaried Pakistani Resident Individuals aged 18 or above | Politically Exposed Persons (PEPs) and their families, associates, employees, etc. |

| Customers with signatures different from CNIC, shaky signatures, or photo account holders |

Document Required For Bank Alfalah Digital Account

| Required Documentation | Details |

|---|---|

| General Documentation of Natural Person | Provide a photocopy of one of the following identity documents, attested by a Gazetted Officer, Branch Officer, or Administrator: |

| – CNIC/NICOP/SNIC/SNICOP/SNICOP/POC/ARC/POR/Juvenile Card issued by NADRA/CRC/Form B, etc. | |

| – Passport with valid visa or proof of legal stay (for Foreign National Individuals only) | |

| Note: | |

| 1) ARC is limited to local currency accounts only | |

| 2) For Non-resident Pakistanis (excluding Roshan Digital Account), provide a copy of a valid Passport, Exit Stamp, valid Visa/Resident Permit, etc., along with applicable ID documents. | |

| 3) For joint accounts, separate documents are required as listed above (wherever applicable). |

Bank Alfalah Digital Account Opening Online

Step-by-Step Guide for Bank Alfalah Digital Account Opening Online:

- Visit the Official Website or App: Go to the Bank Alfalah app or the official website of Bank Alfalah at https://rapid.bankalfalah.com/alfalahrapidprod/AsaanAccount. This is the dedicated webpage for opening a digital account with Bank Alfalah.

- Choose Account Type: On the website, you will find different types of accounts offered by Bank Alfalah. Select the account type that suits your needs.

- Fill in Personal Information: You will be directed to a page where you need to provide your personal information. Fill in the required fields accurately.

- Agree to Terms and Conditions: Read and understand the terms and conditions presented on the webpage.

- Provide Additional Details: You may be required to provide additional details depending on the account type and regulatory requirements.

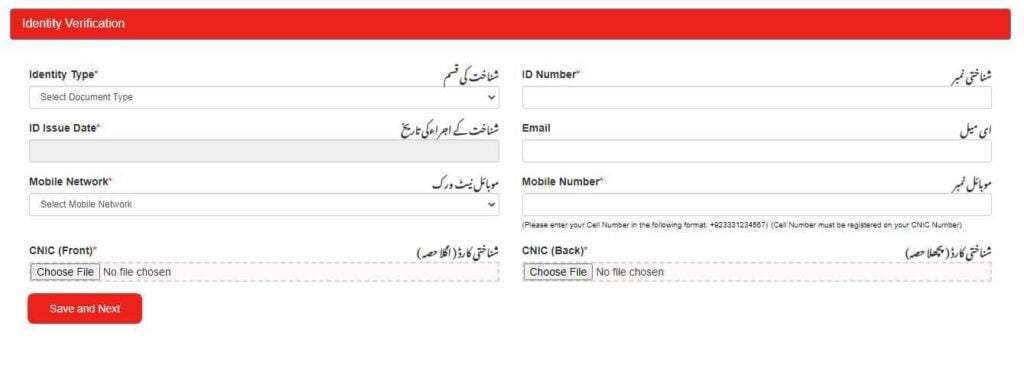

- Verify Your Identity: As part of the digital account opening process, you will need to verify your identity. This is typically done through a two-step verification process.

- Submit Your Application: After providing all the necessary information and completing the verification process, review your application to ensure accuracy.

- Await Confirmation: After submitting your application, you will receive a confirmation message indicating that your application has been received. Bank Alfalah will review your application and perform the necessary checks to process your request.

- Account Approval and Activation: Once your application is approved, you will receive a notification regarding the approval and activation of your digital account.

- Access and Manage Your Digital Account: Once your digital account is activated, you can log in to the Bank Alfalah online banking portal or mobile application to access and manage your account.

Bank Alfalah Digital Account FAQs

What Is Bank Alfalah Digital Lifestyle Branch?

At Bank Alfalah Digital Lifestyle Branch customers can open accounts online within minutes and can deposit and withdraw cash amounts 24/7 without any additional charges/fees.

How can I open a Bank Alfalah Digital Account?

To open a Bank Alfalah Digital Account, you can visit the Bank Alfalah website (https://rapid.bankalfalah.com/alfalahrapidprod/AsaanAccount) or download the mobile application.

Follow the instructions provided for account opening, which typically involve providing personal information, verifying your identity, and completing the necessary documentation electronically.

What are the benefits of opening a Bank Alfalah Digital Account?

Opening a Bank Alfalah Digital Account offers several benefits, including:

Convenience: The digital account opening process eliminates the need to visit a physical branch, saving time and effort.

Accessibility: You can access your account anytime and anywhere through the Bank Alfalah website or mobile application.

Range of Services: A Bank Alfalah Digital Account provides access to various banking services, such as fund transfers, bill payments, and account statements, all available at your fingertips.

Enhanced Security: Bank Alfalah implements robust security measures to protect your account and personal information.

What documents are required for opening a Bank Alfalah Digital Account?

The specific document requirements may vary, but generally, you will need:

Valid CNIC issued by NADRA: This serves as proof of your identity and is required for verification purposes.

Registered Mobile Number: A registered mobile number is necessary for communication and account verification.

Live Photograph: You will be required to provide a live photograph during the account opening process.

Additional Documents: Depending on the account type and regulatory requirements, you may be asked to provide proof of income/occupation or other supporting documents.

Can I open a joint account digitally?

Yes, Bank Alfalah allows the opening of joint accounts digitally. The process typically involves providing the necessary information and documentation for all account holders during the digital account opening process.

What services are available through Bank Alfalah Digital Account?

Bank Alfalah Digital Account offers a wide range of services, including balance inquiries, funds transfers, bill payments, statement generation, account activity monitoring, and access to various digital banking features.

You can explore the Bank Alfalah website or mobile application to discover the full range of services available.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment