In this article, we will lead you through a step-by-step guide on how to create a Skrill account in Pakistan, so, you can send and receive international payments online round the clock.

Here are a few key insights you’ll gain from this guide:

- What Is Skrill And How Does It Work?

- Advantages of Skrill in Pakistan

- Skrill Account Requirements

- Skrill Account Opening Process (Step-By-Step)

- How To Add A Bank Account To Your Skrill Account?

- Which Bank Supports Skrill In Pakistan?

- How To Withdraw Money From Skrill In Pakistan?

- Fee/Charges Involved While Making Transaction With Skrill Account.

Before starting here is a brief overview of the whole process at a glance, to help you understand account creation process in case you are in a hurry:

| Step | Description |

|---|---|

| 1. Access Skrill | Go to the Skrill app. |

| 2. Sign Up | Tap “Sign up” and enter your details. |

| 3. Choose Country | Select Pakistan and currency details. |

| 4. Provide Email | Enter a valid email and create your password. |

| 5. Complete Registration | Go to the Skrill website or app. |

| 6. Verify Account | Log in, verify identity, and proof of address. |

| 7. Add Bank Account | Follow the prompts to finish registration. |

| 8. Confirm Transaction | Access Skrill, and add bank details accurately. |

| 9. Verification Process | Review and confirm your details. |

With that said, let’s dive in!

Recommended Reading: International Payment Gateways In Pakistan (Shopify+Woocommerce)

How To Create A Skrill Account In Pakistan Online | How To Open A Skrill Account In Pakistan

Table Of Contents

- How To Create A Skrill Account In Pakistan Online | How To Open A Skrill Account In Pakistan

- What Is Skrill And How Does It Work?

What Is Skrill And How Does It Work?

Here’s the information presented in bullet points:

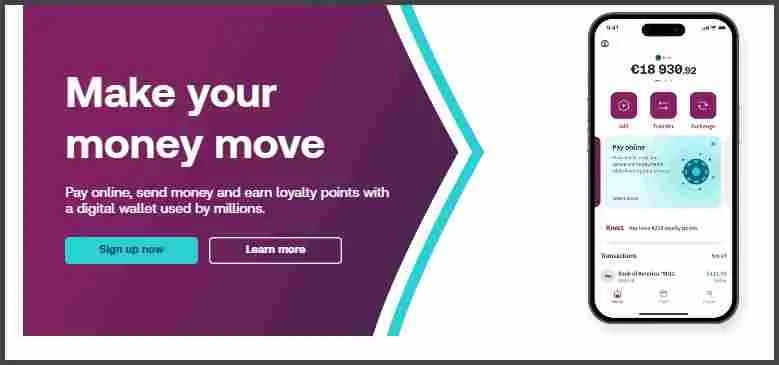

Skrill, a leading digital wallet brand owned by Paysafe Limited, is a worldwide payment platform providing various online payment and money transfer solutions.

Founded in 2001, Skrill operates across 100+ countries and facilitates transactions in over 40 currencies, including Pakistan.

Skrill’s Key Features:

- Skrill provides a safe and reliable payment gateway for seamless transactions.

- Skrill’s digital wallet allows users to store and access funds for online transactions securely.

- Skrill offers a prepaid card option, enabling users to make purchases using their Skrill balance.

- Skrill serves as a PSP, facilitating payments for merchants and providing a platform for customer transactions.

- Skrill supports cryptocurrency trading, allowing users to buy, sell, and hold digital currencies within their accounts.

- Skrill enables fast and cost-effective international money transfers, making it a convenient choice for individuals and businesses needing to send funds globally.

Advantages of Skrill in Pakistan | Skrill Digital Wallet Perks

Benefits of Skrill in Pakistan | Skrill Digital Wallet Advantages:

- Speedy and Cost-Efficient Payments: Skrill offers a quick and cost-effective method to pay various merchants, including for online purchases, gaming, betting, and more.

- Effective Money Management: Skrill helps users manage their finances wisely by allowing them to track transactions, set spending limits, and organize their finances efficiently within the digital wallet.

- Convenient Fund Transfers: Skrill enables users to easily send funds to friends, relatives, or colleagues for personal reasons or to fulfill financial obligations promptly.

- Seamless Fund Reception: Users can receive money from various sources, such as friends, relatives, employers, or clients, with ease via Skrill, whether it’s for monthly payments, contractual work, or freelance services.

- Quick Access to Gaming Winnings: Skrill allows users to swiftly receive their winnings from a variety of gaming merchants, ensuring instant access to funds for further use or withdrawal.

- Instant Cash Access with Skrill Card: With the Skrill Card*, users can instantly access their funds in cash from ATMs or make purchases at stores, providing unparalleled convenience and flexibility.

- Local Rates for International Transfers: Skrill enables users to make international transfers at local rates, ensuring the best exchange rates and minimizing transfer fees for cross-border transactions.

- Rewards and Discounts: Users can earn rewards and enjoy discounts with various retailers through Skrill’s partnerships and promotions, maximizing the value of their digital wallet usage.

Recommended Reading: Shopify Payment Methods In Pakistan (Shopify+Woocommerce)

Skrill Account Requirements

- Business Registration:

- To open a Skrill account, you need to be registered as a business entity or a sole proprietor.

- You must provide the relevant certificate of incorporation or similar documentation to verify your business status.

- Address and ID Verification:

- Each business owner must provide proof of address and identification during the account verification process to comply with regulatory requirements and enhance account security.

- Operational Website Requirement:

- Your website must be at least in the beta version when applying for a Skrill account.

- This allows Skrill to review the services or goods offered on your website to ensure compliance with their policies and guidelines.

- Multiple Website Applications:

- If you intend to apply for Skrill accounts for multiple websites, it’s crucial to inform your Sales Manager of the URLs associated with each website.

- This ensures a smooth application process and timely account setup for all your online ventures.

How To Open A Skrill Account In Pakistan? (Step-By-Step Guide)

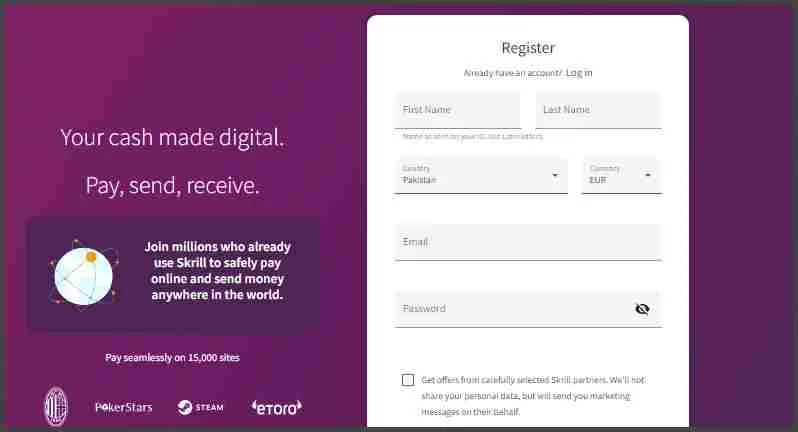

Below is a step-by-step walkthrough for opening a Skrill Account in Pakistan online:

Access the Skrill website or download the Skrill app

To start creating your Skrill account in Pakistan, follow these steps:

Visit the Skrill website directly at https://account.skrill.com/wallet/account/sign-up?locale=en.

Alternatively, you can download the Skrill app from the Google Play Store at https://play.google.com/store/apps/details?id=com.moneybookers.skrillpayments&hl=en&gl=US.

Tap on “Sign up” (For App Users)

If you choose to use the Skrill app, open the app and tap on the “Sign up” button to start registering your account.

Enter your Personal Details

Provide your first and last name, ensuring they match the information on your identification document.

Choose your Country and Currency

Select Pakistan from the country drop-down list as your country of residence. Also, choose the currency you prefer for your Skrill account.

Input your email address and password

Enter your valid email address, which will be used as your primary contact for Skrill account notifications. Create a secure password to protect your account.

Finish the registration process

Follow the prompts to finish the registration process, which may include additional verification steps to authenticate your identity as required by Skrill.

Recommended Reading: Top 5 Payment Gateways In Pakistan (Shopify+Woocommerce)

How To Verify Skrill Account In Pakistan? | Verifying Your Skrill Account

Here are the steps to verify your Skrill account in Pakistan:

- Log in to Your Account:

- Sign in to your Skrill account by entering your credentials on the Skrill website or mobile app.

- Navigate to Settings > Verification:

- Once logged in, go to the “Settings” section and click on “Verification.”

- Complete the Verification Process:

- Follow the instructions to complete the verification process. You will need to provide identification documents such as your passport, ID card, or driver’s license, as well as proof of address issued in the past three months. Once you submit all the required documents, your account can usually be verified within minutes.

Adding a Bank Account to Your Skrill Account

Here’s a step-by-step guide to adding/linking your bank account to your Skrill Account:

- Log in to Your Skrill Account: Access your Skrill account by logging in using your credentials on the Skrill website or mobile app.

- Navigate to Withdraw Section: From the left panel of your Skrill account dashboard, locate and select the “Withdraw” option.

- Choose Bank Account: Within the withdrawal options, select “Bank Account” to proceed with adding your bank details.

- Add Bank Account Details: Click on the “Add a Bank Account” button to input the necessary information. This includes selecting your country, entering your account number, and providing your bank details accurately.

- Review and Confirm: Carefully review the details you’ve entered to ensure accuracy. Once verified, check the acknowledgment box to confirm that the information provided is correct.

- Complete the Process: Finally, click on the “Add Bank Account” button to complete the process. Skrill will then verify your bank account details to ensure seamless transactions.

Which Banks Supporting Skrill in Pakistan

Accessibility of Skrill Services in Pakistan:

- Skrill services are available to residents of Pakistan, enabling them to use its platform for digital payments and money transfers.

No Direct Affiliation with Local Banks:

- Skrill operates independently and is not directly affiliated with any specific local bank in Pakistan.

Wide Compatibility with Banks:

- Although Skrill is not associated with any particular bank in Pakistan, it is designed to be compatible with most banks operating in the country.

Support for Deposits and Withdrawals:

- Pakistani users can typically deposit to and withdraw from their Skrill accounts using their local bank accounts.

My Experience:

- In my personal experience, I have successfully used Meezan Bank with Skrill, and it has worked efficiently for me.

How To Withdraw Money From Skrill In Pakistan?

Here’s how to withdraw money from Skrill in Pakistan:

Verify Your Account:

- Ensure that your Skrill account is successfully verified to enable withdrawal transactions.

Log in to Your Skrill Account:

- Access your Skrill account by logging in with your credentials.

Go to Settings:

- Locate and select the “Settings” option from your account dashboard.

Select Withdraw:

- Within the Settings menu, choose the “Withdraw” option to start the withdrawal process.

Provide Account Details:

- Enter the necessary details of your local bank or mobile account where you want to transfer the funds.

Enter Withdrawal Amount:

- Specify the amount you wish to withdraw from your Skrill account.

Confirm Transaction:

- Review the withdrawal details and confirm the transaction to proceed.

Transfer to Local Bank:

- After confirmation, the withdrawn amount will be transferred to your designated local bank account in Pakistan within a few minutes.

Skrill Exchange Rate for USD to PKR

Skrill Dollar Rate in Pakistan: The Skrill dollar rate in Pakistan is determined by the current market exchange rate of the dollar, which Skrill adjusts to reflect prevailing market conditions.

Transaction Fees for Local Payment Methods: Skrill charges a fee of 0.00% for transactions made through local payment methods.

Skrill Crypto Withdrawals (via a Merchant): When withdrawing funds via a merchant using Skrill crypto, a fee of 1.75% is applicable.

Bank Transfer Fees: Skrill imposes a fee of 1.99% on the transaction amount for bank transfers.

Card Mastercard and Card Visa Fees: Using Mastercard or Visa cards for transactions incurs a fee of 2.00%.

Withdrawal to Crypto Fees: Withdrawals to cryptocurrency wallets are subject to a fee of 3.49%.

NETELLER Fees (Global Payment Methods): For global payment methods like NETELLER, Skrill charges a fee of GBP 4.70 or EUR 5.50.

Additional Information:

Network fees, also known as mining fees, and other charges related to currency conversion may apply depending on the transaction.

For Skrill crypto withdrawals, a minimum fee of EUR 3.50 is applicable, but the actual fee may vary depending on the transaction amount. Maximum and minimum withdrawal limits are applicable as per clause 12.2 of Skrill’s Terms of Use.

Legal Status of Skrill in Pakistan

| Legal Status of Skrill in Pakistan |

|---|

| Overview |

| Skrill is legal for Pakistani residents to use and available for online registration and sign up. Skrill is an international organization allowing Pakistanis to use cryptocurrency. It’s authorized by the Financial Conduct Authority (FCA) but lacks physical presence or local bank affiliations in Pakistan. Almost every bank in Pakistan supports Skrill deposits and withdrawals. |

| Bank Affiliations |

| Skrill does not have direct affiliations with local banks in Pakistan. However, Pakistani users have reported successful transactions with various banks, including UBL and Meezan Bank. |

| Personal Experience |

| Personal experiences vary, but users have reported successful Skrill transactions with banks like UBL and Meezan Bank for both deposits and withdrawals. |

Skrill vs PayPal: A Comparative Analysis for Pakistani Users

Here’s a comparative analysis of Skrill vs PayPal for Pakistani users:

| Feature | Skrill | PayPal |

|---|---|---|

| Availability | Available in Pakistan | Available in Pakistan |

| Services Offered | Digital wallet, money transfers, cryptocurrency trading | Digital wallet, money transfers, online payments |

| Supported Currencies | Supports transactions in 40+ currencies | Supports transactions in 100+ currencies |

| Fees | Varies depending on transaction type and currency exchange rates | Transaction fees typically range from 2.9% + $0.30 to 4.4% + fixed fee |

| Transfer Speed | Instant transfers within Skrill accounts, international transfers may take 1-3 business days | Instant transfers within PayPal accounts, international transfers may take 3-5 business days |

| Bank Affiliations | No direct affiliations with local banks | Works with most major banks worldwide |

| Cryptocurrency Support | Supports cryptocurrency trading within the platform | Does not support cryptocurrency transactions |

| Security | Offers two-factor authentication, encryption, and fraud prevention measures | Provides buyer and seller protection, encryption, and fraud detection |

| Customer Support | Offers email and live chat support | Offers email, phone, and live chat support |

| Transaction Limits | Limits may vary based on account verification levels and country regulations | Limits may vary based on account type and verification levels |

| Merchant Integration | Widely integrated with various online merchants and gaming platforms | Widely accepted by online merchants and retailers |

| Withdrawal Options | Withdraw funds to bank accounts, mobile wallets, and cryptocurrency wallets | Withdraw funds to bank accounts and debit cards |

| Ease of Use | User-friendly interface for transactions and account management | Intuitive platform with easy navigation and transaction processing |

| Mobile App | Offers mobile app for iOS and Android devices | Offers mobile app for iOS and Android devices |

| Personal Experience | User experiences may vary based on individual preferences and needs | User experiences may vary based on individual preferences and needs |

Recommended Reading: International Payment Gateways In Pakistan (Shopify+Woocommerce)

FAQs | Skrill Account

What is Skrill, and how does it benefit users in Pakistan?

Skrill is a global payment platform that offers online payment and money transfer services. It allows users in Pakistan to send, receive, and manage funds efficiently and securely.

How can I open a Skrill account in Pakistan?

You can open a Skrill account in Pakistan by visiting the Skrill website or downloading the Skrill app from the Google Play Store.

What are the steps to open a Skrill account in Pakistan?

The steps include logging in to your account, selecting Pakistan as your country of residence, choosing your preferred currency, providing your email address and password, and completing the verification process.

Which banks in Pakistan support Skrill transactions?

Skrill is not directly affiliated with any specific local bank in Pakistan. However, it is designed to be compatible with most banks operating in the country.

How can I verify my Skrill account in Pakistan?

To verify your Skrill account in Pakistan, you need to log in to your account, go to the “Settings” section, and follow the instructions for account verification. This may include providing identification documents and proof of address.

What are the fees associated with Skrill transactions in Pakistan?

Skrill charges fees for various transactions, including deposit and withdrawal fees, transaction fees for local payment methods, and fees for using Mastercard or Visa cards. It’s important to review Skrill’s fee structure for up-to-date information.

How long does it take to withdraw money from Skrill to a bank account in Pakistan?

Withdrawal times may vary depending on the bank and the withdrawal method used. However, Skrill typically processes withdrawals to local bank accounts within a few minutes.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions, contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment