As e-commerce continues to thrive, the demand for reliable international payment gateways compatible with popular platforms like Shopify and WooCommerce has surged.

In this article, we will explore the top international payment gateways available to Pakistani merchants, highlighting their features, benefits, and compatibility with leading e-commerce platforms.

We will cover the following globally recognized payment systems, renowned for their reliability, which are accessible to Pakistani consumers either directly or through third-party services:

- PayPal

- Stripe

- Amazon Pay

- Adyen

- Braintree

- Worldpay

- 2Checkout

- Sage Pay

- Square

- Bill pay

- DynaPay

- GoCardless

- Payoneer.

Before starting out their detail, here is a brief overview of these platform in a bird eye view:

| Payment Gateway | Key Features | Integration with Shopify | Integration with WooCommerce |

|---|---|---|---|

| PayPal | – Credit card processing – Flexible payment options – Cryptocurrency transactions | Yes | Yes |

| Stripe | – Tailored solutions for startups, enterprises, and SaaS – Accept and optimize global payments – Set up recurring revenue | Yes | Yes |

| Amazon Pay | – Streamlined checkout process – Option to delay payments – Automatic payments for subscriptions | Yes | Yes |

| Adyen | – Comprehensive financial technology platform – Unified platform for payment acceptance and financial management | Yes | Yes |

| Braintree | – Global commerce tools – Support for popular payment methods – Level 1 PCI compliance | Yes | Yes |

| Worldpay | – Customized platform for business needs – Seamlessly process transactions – Ensure regulatory compliance | Yes | Yes |

| 2Checkout | – Global coverage in 200+ countries – Support for 45+ payment methods – Multilingual support | Yes | Yes |

| Sage Pay | – Accept payments online – Real-time invoice payments – Secure payment processing | Yes | Yes |

| Square | – Diversified revenue streams – Efficient cash flow management – Advanced reporting and analytics | Yes | Yes |

| Billapay | – Customizable shopping cart experience – Top-tier PCI compliance – 24/7 customer support | Yes | Yes |

| DynaPay | – Tailored solutions for different industries – Secure and efficient payment processing – Global payment solutions | Yes | Yes |

| GoCardless | – Recurring payments – Instant bank pay – International payments | Yes | Yes |

| Payoneer | – Trusted global presence – Multi-currency support – Versatile platform | Yes | Yes |

Now, let’s discuss the details of these platforms so, you can decide which one of these best fits for your needs!

Recommended Reading: Shopify Payment Methods In Pakistan (Shopify+Woocommerce)

List Of Top International Payment Gateways In Pakistan

Table of Contents

PayPal

PayPal Overview: Ranked as the top international payment gateway for Shopify and WooCommerce.

- Founded:

- December 1998 (as Confinity)

- October 1999 (as X.com)

- March 2000 (as PayPal)

- Products:

- Credit cards

- Payment systems

PayPal for Personal Transactions

- Shop and Buy: Conveniently shop online and make purchases.

- Buy Now, Pay Later: Flexible payment options for purchases.

- Deals and Cash Back: Access exclusive deals and earn cash back on purchases.

- Pay with Rewards: Utilize rewards points for payments.

- Pay with QR Codes: Seamless payments via QR code scanning.

- Checkout with Crypto: Embrace cryptocurrency payments.

- PayPal Credit and Cards: Access credit and debit card services.

- Send and Receive: Easily send and receive money.

- Send Money: Transfer money securely to friends and family.

- Request Money: Request funds from contacts.

- Start Selling: Begin selling products or services online.

- Donate and Raise Funds: Support causes or raise funds for personal endeavors.

- Manage Your Money: Efficiently manage finances.

- Set up Direct Deposit: Facilitate direct deposit transactions.

- Deposit Checks: Conveniently deposit checks digitally.

- Add Cash: Add cash to your PayPal account.

- Savings and Goals: Set financial goals and save effectively.

- Buy and Sell Crypto: Engage in cryptocurrency trading.

- Pay Bills: Easily pay bills online.

PayPal: Leading International Payment Gateway for Shopify and WooCommerce

- Accept Payments

- Online Checkout

- Installment Payments

- Invoicing

- POS System

PayPal for Business Solutions

- PayPal Consumer Network: Gain access to a large consumer network for business growth.

- Pay Later Solutions: Provide customers with deferred payment options.

- Payment Methods: Support a variety of payment methods for customer convenience.

- Checkout Conversion: Improve checkout processes to increase conversion rates.

- Optimize & Protect Your Business: Utilize tools to optimize and protect your business operations.

- Global Payment Processing: Process international payments seamlessly.

- Fraud Protection: Benefit from advanced fraud protection measures.

- Payouts: Streamline payout processes for efficiency.

- Operations: Manage business operations effectively with PayPal’s tools.

Cryptocurrency Transactions: Buying, Selling, and Transferring

- Buying or Selling Cryptocurrency

- Converting between PYUSD and Another Cryptocurrency

- Transferring Cryptocurrency

Donation Processing

- Standard Rate for Receiving Domestic Donations

- Receiving International Donations

- Additional Percentage-Based Fee for International Donations

- Fixed Fee for Donations (Based on Currency Received)

Money Transfers

Easily send money domestically to friends and family. Transfer funds internationally for personal transactions.

Securely receive personal transactions. Fixed fee applied to personal transactions based on the received currency.

Recommended Reading: Top 5 Payment Gateways In Pakistan (Shopify+Woocommerce)

Stripe

- Startups: Tailored solutions to efficiently kickstart payment processes.

- Enterprises: Scalable and robust payment solutions for large enterprise needs.

- SaaS: Payment infrastructure for Software as a Service (SaaS) businesses, ensuring smooth transactions.

- Platforms: Versatile payment solutions for platform businesses, facilitating transactions between parties.

- E-commerce: Comprehensive tools for e-commerce businesses to manage online payments effortlessly.

- Marketplaces: Specialized solutions for marketplaces, enabling secure transactions between buyers and sellers.

- Crypto: Integration options for handling cryptocurrency payments within your business model.

- Creator Economy: Payment solutions tailored for creators, empowering effective monetization of content.

- Embedded Finance: Solutions to seamlessly integrate payment functionalities into various applications and services.

- Global Businesses: Optimized payment solutions for global businesses, supporting cross-border transactions.

- Finance Automation: Tools to streamline finance operations and optimize revenue management processes.

Stripe Product Features

- Accept and Optimize Payments, Globally: Improve authorization rates, enhance checkout conversion, and provide localized payment options worldwide.

- Capture Recurring Revenue: Support recurring business models, minimize churn, and automate financial operations.

- Start with Billing: Access tools for invoicing, recognizing revenue, and generating custom revenue reports.

- Set up Multiparty Payments and Payouts: Integrate payments into your platform or marketplace for seamless end-to-end payment experiences.

- Start with Connect: Utilize features such as Terminal for in-person payments, Instant Payouts for rapid payments, and Payment Elements for customizable user interfaces.

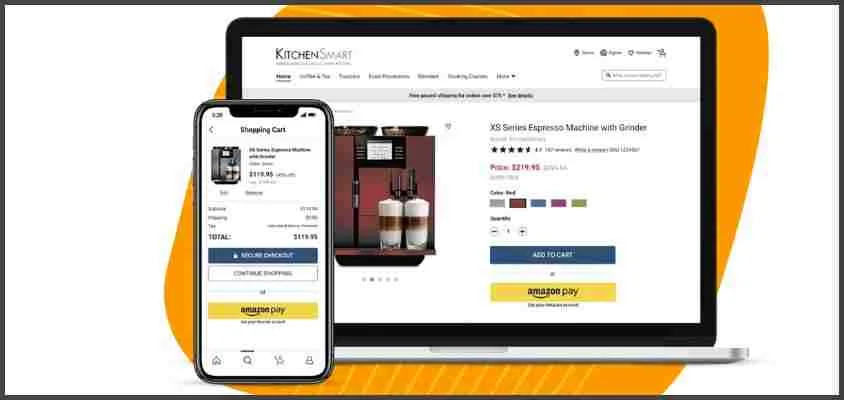

Amazon Pay

Amazon Pay provides the convenience and security of Amazon’s services for online shopping. It streamlines the checkout process across various online stores. Users can manage their payment methods on Amazon.com, enhancing convenience and security.

Versatile Solution for Various Business Models

- Instant payment for purchases, ensuring prompt transaction processing.

- Option to delay payment for a specified period, offering flexibility to customers.

- Ability to split payments between multiple methods, accommodating various payment preferences.

- Set up automatic payments for subscription services, ensuring seamless renewals.

- Combine a single purchase with a subscription service, offering convenience and flexibility.

- Easy refund process for eligible purchases, enhancing customer satisfaction.

- Quick Checkout: Easily complete purchases using stored payment and address information from your Amazon account.

- Convenient Payment Management: Manage payments on Amazon.com and checkout smoothly on other websites.

- Secure Shopping Experience: Enjoy a secure checkout process with eligible purchases protected by Amazon’s A-to-Z Guarantee.

How to Opening an Amazon Pay Account?

- No Additional Registration: If you have an Amazon account, there’s no need for additional registration.

- Use Amazon Pay Button: Simply use the Amazon Pay button where available and access the information stored in your Amazon account.

Amazon Pay Fees

There are no extra fees for using Amazon Pay for purchases. Your card issuer may charge foreign transaction fees if applicable. Refer to your card’s terms and conditions for any other potential fees.

Adyen

Comprehensive Financial Technology Platform

Adyen offers a complete solution for payments, data management, and financial operations on a single platform. It helps accelerate business ambitions by providing streamlined financial technology services.

Unified Platform for Payment Acceptance and Financial Management

- Accept Payments: Easily accept, process, and settle payments with a single provider.

- Protect Revenue: Ensure revenue protection and implement security measures for transactions.

- Control Finances: Efficiently manage and monitor financial operations within the platform.

Primary Payment Features

- Omni-Channel Payments: Allow customers to pay through their preferred channels and methods, managed by a single provider.

- Online Payment Acceptance: Accept payments online, including on websites and in applications.

- Enhanced In-Person Payments: Improve in-person payments with flexible point-of-sale setups and terminal options.

- Unified Commerce: Integrate online and in-store payment data into a single system for comprehensive insights.

Adyen’s Payment Charges

These fees include processing fees and payment method fees, which are charged at various stages of the payment process. Besides payment methods, other Adyen products are priced separately.

Adyen’s Payment Offerings

- Payment Acceptance: Businesses can accept, process, and settle payments using over 100 payment methods.

- Online and In-Person Payments: Receive payments through various channels, including web, in-app, and in-person transactions.

- Unified Commerce: Adyen supports omnichannel businesses by integrating online and in-person payment data.

- Risk Management Tools: The platform offers tools for managing risks, authentication, and revenue optimization.

Braintree

Founded by Bryan Johnson in October 2007, Braintree is a Chicago-based company that specializes in mobile and web payment systems for e-commerce businesses. Acquired by PayPal on September 26, 2013, Braintree has since become an integral part of PayPal’s suite of payment solutions.

Key Features of Braintree

- Global Commerce Tools: Braintree provides tools for global commerce, enabling businesses to operate and accept payments internationally.

- Support for Popular Payment Methods: It supports a wide range of popular payment methods to cater to diverse customer preferences.

- Level 1 PCI Compliance: Braintree ensures a high level of security compliance, meeting the stringent standards of PCI DSS (Payment Card Industry Data Security Standard) Level 1.

- Scalable Infrastructure: Its infrastructure is designed to scale, accommodating the growth and expansion of businesses.

- Easy Integration: Braintree offers a streamlined integration process for merchants to seamlessly incorporate its payment solutions into their platforms.

- Optimized for Web and Mobile: Braintree’s services are optimized for both web and mobile platforms, providing a smooth payment experience across devices.

- Buy Now, Pay Later Options: It offers flexible payment options, including buy now, and pay later, to enhance customer convenience and increase sales.

International Business Solutions

- Braintree supports merchants in over 45 countries/regions worldwide, providing them with the tools to build and grow their businesses.

- Accept, split, and enable payments in more than 130 currencies, allowing businesses to cater to a diverse global audience.

- Braintree offers stellar support, innovative concepts, and simplified processes to empower merchants in their journey toward success.

Worldpay

Customize a platform to prioritize your needs and those of your software customers. Expedited setup process to quickly start using payment solutions.

Seamlessly process both incoming and outgoing transactions. Manage funds efficiently and oversee financial operations. Ensure adherence to regulatory requirements with built-in compliance features.

For Business Owners: Global Payment Solutions for Shopify and WooCommerce

- Get immediate access to payment solutions to start generating revenue quickly.

- A comprehensive suite of tools for managing and optimizing e-commerce transactions.

- A flexible virtual terminal for accepting payments remotely.

- A secure hardware solution for processing card payments at physical locations.

- A portable device for accepting payments on the go.

Worldpay’s Offerings

- Make Payments

- Payouts: Simplify domestic and international payout processes.

- Online: Accept payments globally through secure online channels.

- Take Payments

- In-Person: Securely accept payments at physical retail locations.

- Omnichannel: Seamlessly integrate payment experiences across various channels.

- Marketplaces & Platforms: Power payments on your marketplace or platform.

- Check: Streamline item and lockbox processing.

- Digital Bill Pay: Support digital bill payments.

- Payment Optimization

- Payment Optimization: Increase revenue through smarter centralization, authorization, and validation.

- Manage Payments

- Fraud and Protect: Combat fraud and manage risk effectively.

- Payment Optimization: Enhance revenue through centralized, authorized, and validated transactions.

- Understand: Gain intelligent insights and reporting capabilities.

- Loyalty, Cards, and Offers: Boost loyalty and revenue generation through tailored card offers and incentives.

2Checkout (Now Verifone)

Utilize 2Checkout’s solution to sell products and services online and accept payments from customers worldwide. Reach customers across North & Central America, Europe, APAC, Africa & Middle East, and LATAM, spanning over 200 countries and territories.

Comprehensive Coverage and Features:

- Global Reach: Covering 200+ countries and territories, 2Checkout offers extensive global coverage to expand your business reach.

- Payment Diversity: With support for 45+ payment methods, 2Checkout provides diverse payment options to cater to varied customer preferences.

- Multilingual Support: Available in 30+ languages, 2Checkout offers multilingual support to enhance accessibility and customer experience.

- Currency Options: With support for 130+ display currencies, 2Checkout allows you to display prices in multiple currencies to accommodate international customers.

- Customer Assistance: 2Checkout provides 24/7 shopper support, offering round-the-clock assistance for customers regarding orders and payments.

Streamlining Global Payment Processing

- Enhance payment authorization rates through intelligent payment routing and support for multiple payment processors, ensuring seamless transactions across borders.

- Boost authorization rates by up to 25% with multi-currency management, reducing cart abandonment and improving the overall customer experience.

How Payments Work?

- Varied Payout Methods: Select from a range of payout options such as wire transfer, ACH, PayPal, and Payoneer.

- Currency Choices: Receive funds in your preferred currency, including USD, EUR, and GBP, ensuring convenience and flexibility for merchants.

Sage

Easily accept payments online and receive invoice payments in real time, enhancing cash flow. Ensure secure processing of payments, maintaining accuracy in accounts and inventory management. Sage solutions integrate with providers such as Stripe and PayPal, offering flexible payment options for customers.

Core Features of Sage Products

- Payment Acceptance

- Bank Reconciliation

- Payroll Management

- Quick Invoicing

Advantages of Sage

- Time Optimization: Streamline payment processes to free up time for core business activities.

- Cash Flow Management: Stay informed about cash flow status with real-time updates.

- Simplified Reconciliation: Easily reconcile financial data for accurate record-keeping.

- Financial Oversight: Gain better control over financial operations for improved decision-making.

- Faster Payments: Enhance productivity and efficiency by accelerating payment processing.

- Convenient Payment Options: Offer customers flexible payment methods for enhanced satisfaction.

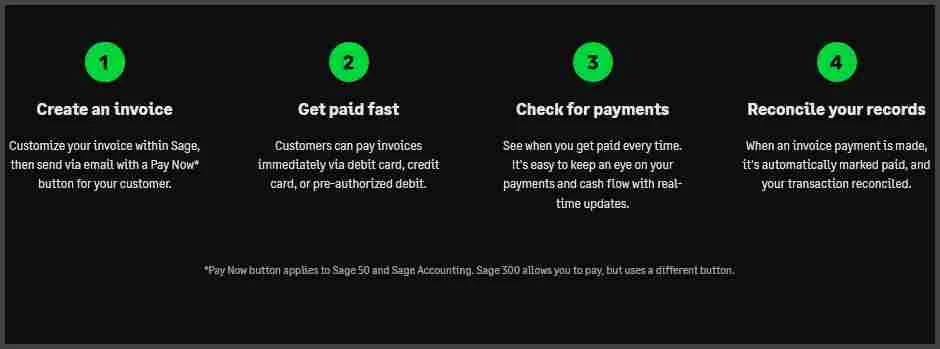

How to Accept Online Payments with Sage?

- Invoice Creation: Customize invoices in Sage and send them via email, including a Pay Now button.

- Fast Payment Processing: Customers can immediately pay invoices using a debit card, credit card, or pre-authorized debit.

- Payment Monitoring: Keep track of payments and cash flow with real-time updates.

- Automatic Reconciliation: Invoice payments are automatically marked as paid, simplifying transaction reconciliation.

Square

- Diversify Revenue:

- Explore opportunities to expand product offerings or introduce new services.

- Increase income by diversifying revenue streams.

- Manage Cash Flow:

- Ensure smooth financial operations by effectively managing cash flow.

- Keep track of income and expenses for financial stability.

- Reach Customers:

- Reach a broader customer base through various marketing channels.

- Utilize Square’s tools to engage with existing customers and attract new ones.

- Advanced Reporting:

- Access detailed reports and analytics to understand business performance.

- Make informed decisions based on comprehensive data analysis.

- Manage Your Team:

- Efficiently manage team schedules, tasks, and performance.

- Streamline communication and collaboration to enhance productivity.

- Retail Store and Photo Studio:

- Transform retail store and photo studio operations with Square’s solutions.

- Enhance customer experience and streamline workflows for improved efficiency.

- Restaurant Success Stories:

- Learn from restaurants leveraging Square’s tools for success.

- Optimize restaurant operations to deliver exceptional service and increase revenue.

- Retail Success Stories:

- Explore success stories from retail businesses using Square’s platform.

- Streamline operations and enhance customer experience to drive growth.

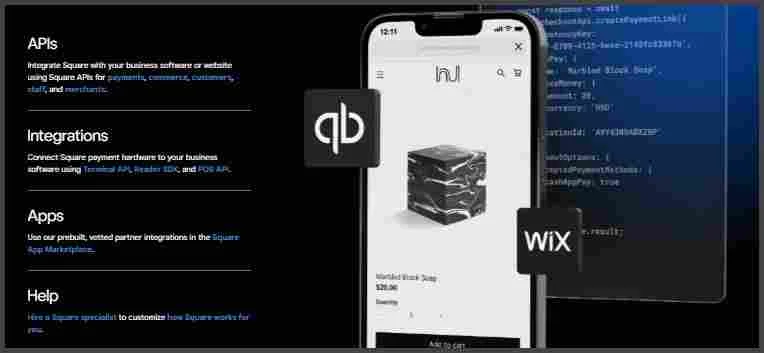

Square Integrations: Global Payment Solutions for Shopify and WooCommerce

APIs:

- Integrate Square’s payment functionalities seamlessly into your business software or website.

- Access Square’s commerce features to enhance your online storefront or e-commerce platform.

- Utilize Square’s customer management capabilities to personalize interactions and improve customer experience.

- Streamline staff management tasks by integrating Square’s staff API into your HR or scheduling software.

- Gain insights into merchant data and operations by integrating Square’s merchant API into your analytics or reporting tools.

- Integrations:

- Connect Square payment hardware to your existing business software infrastructure for streamlined operations.

- Integrate Square’s card reader functionalities into your mobile or web applications for in-person payments.

- Seamlessly integrate Square’s point-of-sale functionalities into your POS systems or software platforms.

Apps:

- Explore a curated selection of prebuilt and vetted partner integrations available in the Square App Marketplace.

- Choose from a variety of apps designed to enhance different aspects of your business operations, from accounting to marketing.

Help:

- Hire Square specialists to customize Square’s functionalities to meet the unique needs of your business.

- Receive personalized assistance in tailoring Square’s features and workflows to optimize your business processes.

Square International Payment Gateway Fees for Shopify and WooCommerce

- In-Person Transactions: 2.6% + 10¢ per transaction when customers tap, dip, or swipe their card.

- Online Purchases: 2.9% + 30¢ per transaction for purchases made through your online store.

- Manually Entered Card Details: 3.5% + 15¢ per transaction for manually entered card details.

- Invoice Payments: 3.3% + 30¢ per transaction for payments made through invoices.

Payment Processing Times for Leading International Payment Gateways on Shopify and WooCommerce

- Transfer funds to an external bank account within 1-2 business days for free or instantly for a fee.

- Access funds from Square sales instantly for free with Square Checking.

Billapay

Billapay’s team of e-commerce payment professionals is committed to assisting online merchants in quickly initiating transaction processing.

Integrate Billapay’s flexible and customizable solutions to effortlessly accept all major credit cards and begin transaction processing immediately.

Advantages of Billapay

- Revenue Growth: Enable seamless payment processing to drive revenue and increase sales.

- Customer Insights: Utilize advanced analytics to understand customer behavior and identify new marketing opportunities.

- Improved Customer Service: Offer 24/7 call center support to enhance customer satisfaction.

- Fraud Prevention: Effectively manage security risks and reduce instances of fraud.

- Cost Efficiency: Lower payment processing fees to optimize costs.

- Chargeback Management: Implement strategies to reduce chargeback occurrences and minimize financial impact.

Comprehensive Product Suite of Billapay for Shopify and WooCommerce

- Customize the shopping cart experience to align with your unique business requirements.

- Ensure secure transactions with top-tier PCI compliance.

- Access detailed, real-time reporting and transaction status through Chargeback Snapshot.

- Utilize tools for customer behavior analysis and preference tracking to make informed decisions.

- Benefit from round-the-clock customer and merchant support to address any inquiries or issues promptly.

Key Features of Billapay International Payment Gateway Solutions

- Bank Integration: Seamlessly integrate with leading foreign and domestic banks for smooth transactions.

- Affiliate Tracking Software Compatibility: Easily integrate with existing affiliate tracking software for improved functionality.

- International Currency Support: Conduct transactions in multiple international currencies to serve a global customer base.

- Credit Card Processing: Securely and efficiently accept credit card payments.

- Chargeback Monitoring and Dispute Resolution: Monitor chargebacks and resolve disputes promptly.

- Built-in Reporting and Analytics: Access comprehensive reporting and analytics tools to track performance and identify areas for improvement.

- 24/7/365 Customer Support: Receive continuous customer support for any assistance or troubleshooting needs.

DynaPay

DynaPay provides customized solutions for different electronic payment processing requirements, including retail, mobile, online, and ACH transactions.

Select from a variety of products for each type of solution to ensure you have the equipment that best fits your business needs.

DynaPay’s Specialized Offerings

- Industry Focus: DynaPay specializes in catering to diverse industries, such as:

- Landscapers

- Health Care Providers

- Veterinarians

- Law Firms

- Restaurants

- Electricians, HVAC, and Plumbing

DynaPay’s Global Payment Solutions

- DynaPay offers secure and efficient terminals for in-person transactions at retail locations.

- Portable solutions are available for on-the-go payments, ideal for businesses that require mobility.

- Online platforms are provided to facilitate secure electronic transactions for e-commerce businesses.

- Comprehensive systems combining hardware and software are offered for efficient transaction processing.

- Tailored solutions are available for businesses operating in the online marketplace.

- Specialized solutions are provided for businesses categorized as high-risk industries.

- Automated Clearing House solutions are offered for electronic funds transfer and payment processing.

- Customizable gift card programs are available to enhance customer engagement and loyalty.

- Secure and reliable processing solutions are provided for credit card transactions.

GoCardless

- Recurring Payments:

- Efficiently manage subscriptions and invoices with ease.

- Instant Bank Pay:

- Facilitates quick and hassle-free one-off payments for added convenience.

- International Payments:

- Collect payments from over 30 countries, broadening your global reach and customer base.

- GoCardless Success+:

- Minimize payment failures and ensure smoother transaction processing for enhanced reliability.

- GoCardless Protect+:

- Advanced fraud protection measures are implemented for secure recurring payments.

- Verified Mandates:

- Reliable payer authentication processes are in place to bolster security and trust.

- GoCardless Bank Account Data:

- Access comprehensive bank account data to make well-informed decisions swiftly.

International Payment Solutions for Shopify and WooCommerce

- Tailor integrations to meet unique business requirements.

- Connect with over 350 partner applications for expanded functionality.

- Integrate bank payments directly into your platform for a smoother user experience.

- Customize recurring payment schedules to fit varying amounts and dates.

Accepted Payment Options

- Enable instant, one-off payments: Customers can make quick payments from their bank accounts, avoiding high card fees.

- Schedule recurring payments: Automatically collect payments on due dates for subscriptions and installments.

- Access bank account data: Securely utilize customer bank account information, including balances and transactions, from over 2,300 banks in the UK and Europe.

Payment Processing Flow

- Quick Registration: Sign up for GoCardless in a matter of minutes.

- Customizable Options: Choose from a variety of payment methods and features to match your business needs.

- Immediate Payment Collection: Start collecting payments right away, ensuring a smooth transaction process for both you and your customers.

Payoneer

- Trusted Global Presence: Used and trusted by millions of customers worldwide.

- Multi-Currency Support: Process transactions in over 70 currencies, accommodating diverse customer preferences.

- Global Coverage: Available in over 190 countries, offering services to businesses worldwide.

- Multilingual Support: Accessible in more than 22 languages, ensuring inclusivity for a wide range of users.

Why Use Payoneer?

- Competitive Pricing: Take advantage of competitive pricing and fee structures to retain more of your earnings.

- Market Expansion: Tap into new business opportunities and broaden your market reach through Payoneer’s extensive network.

- Thriving Ecosystem: Join a vibrant community of businesses and professionals within the Payoneer network.

- Dedicated Support: Receive comprehensive support and guidance at every step of your global business journey.

- Versatile Platform: Utilize a flexible platform designed to cater to the demands of global commerce.

Customer Profile

- Businesses

- Marketplaces

- Freelancers or Online Professionals

- E-commerce Sellers

- BPO or Call Centers

- Wholesale Traders or B2B Sellers

- IT, Consulting, or Digital Services Providers

- Other Digital Businesses

Partnerships

- Integration Partnerships: Collaborate with Payoneer to seamlessly integrate its services into your business ecosystem.

- Bank Partnerships: Partner with leading banks to enhance financial services and accessibility.

- Accounting Software Integration: Integrate Payoneer with accounting software for streamlined financial management.

Payoneer Fees for International Payment Gateways Solutions for Shopify and WooCommerce

Payoneer offers competitive and transparent fee structures to help businesses keep more of their earnings. Strives to keep fees low and, whenever possible, offers free services to support business growth and success.

Additional Charges

- Annual Account Fee:

- Fee: USD 29.95

- Details: Waived as long as you actively use your Payoneer account. If 12 months pass and you’ve received less than USD 2,000.00 (or equivalent) in payments, this fee may be charged.

- Escheatment Fee:

- Fee: Variable per state

- Details: Charged if Payoneer is required to transfer ownership of your funds to an applicable state, with a processing fee deducted as permitted by that state’s regulations.

- Registration Fee:

- Fee: Variable

- Details: Charged when registering for a Payoneer account; the exact amount may vary.

Comparison Of International Payment Gateways For Shopify And WooCommerce

Here is nother comparison of international payment gateways for Shopify and WooCommerce based on specific criteria such as transaction fees, supported currencies, payment methods, and additional features.

Here is a comparison table of the above mentioned top payment solutions for Shopify And WooCommerce to help you choose best fit for your needs:

| Payment Gateway | Transaction Fees | Supported Currencies | Payment Methods | Additional Features |

|---|---|---|---|---|

| PayPal | Percentage + fixed fee per transaction | 100+ | Credit/debit cards, PayPal balance, bank transfers | Cryptocurrency transactions, buyer/seller protection |

| Stripe | Percentage + fixed fee per transaction | 135+ | Credit/debit cards, ACH payments, Apple Pay, Google Pay | Recurring billing, subscription management |

| Amazon Pay | Percentage + fixed fee per transaction | 12 | Credit/debit cards, Amazon Pay balance | Delayed payments, split payments, automatic payments |

| Adyen | Custom pricing based on business volume | 150+ | Credit/debit cards, bank transfers, eWallets | Risk management, revenue optimization, unified commerce |

| Braintree | Percentage + fixed fee per transaction | 130+ | Credit/debit cards, PayPal, Venmo, digital wallets | Fraud protection, data encryption, PCI compliance |

| Worldpay | Custom pricing based on business volume | 120+ | Credit/debit cards, eWallets, bank transfers | Omnichannel payments, global payment processing |

| 2Checkout | Percentage + fixed fee per transaction | 45+ | Credit/debit cards, PayPal, eWallets | Recurring billing, multilingual support, global coverage |

| Sage Pay | Custom pricing based on business volume | 25 | Credit/debit cards, eWallets, bank transfers | Invoice payments, secure tokenization, account management |

| Square | Percentage + fixed fee per transaction | 25 | Credit/debit cards, mobile payments, ACH transfers | POS integration, inventory management, payroll services |

| Billapay | Custom pricing based on business volume | N/A | Credit/debit cards, eChecks, ACH payments | Customizable shopping carts, 24/7 customer support |

| DynaPay | Custom pricing based on business volume | N/A | Credit/debit cards, mobile payments, eChecks | Tailored solutions for specific industries, fraud prevention |

| GoCardless | Custom pricing based on business volume | 30 | Direct debit, bank transfers | Recurring payments, subscription management, international expansion |

| Payoneer | Custom pricing based on business volume | 70+ | Bank transfers, eWallets, prepaid cards | Multicurrency support, global payments, affiliate partnerships |

Recommended Reading: How To Create Skrill Account In Pakistan | How To Make Skrill Account

FAQs | International Payment Gateways

What are the key features of PayPal’s payment gateway?

PayPal offers features such as global reach, payment processing, recurring payments, and secure checkout options.

How does Stripe’s payment gateway help businesses accept and optimize payments globally?

Stripe enhances authorization rates, optimizes checkout conversion, and offers localized payment methods worldwide.

What convenience and security does Amazon Pay offer for online shopping?

Amazon Pay simplifies the checkout process across various online stores and allows users to manage payment methods on Amazon.com.

How does Adyen provide a comprehensive solution for payments, data management, and financial operations?

Adyen accelerates business ambitions by offering streamlined financial technology services.

What are the key features of Braintree’s payment gateway?

Braintree provides global commerce tools, supports a wide range of payment methods, ensures PCI compliance, and is built to scale.

How does Worldpay facilitate payment acceptance and financial management?

Worldpay offers seamless payment acceptance, revenue protection, and efficient financial management within a single platform.

What global coverage and features does 2Checkout offer for online payments?

2Checkout provides extensive global coverage, supporting payments in over 200 countries and territories, and offers 45+ payment methods.

How does Sage Pay help businesses manage payments, invoices, and financial operations?

Sage Pay allows businesses to manage payments, invoices, and custom revenue reporting, making financial operations more efficient.

What key features does Square offer for payment acceptance and financial management?

Square provides tools for seamless payment acceptance, secure processing, efficient financial operations, and comprehensive insights.

How does Billapay support businesses in transaction processing and payment management?

Billapay offers specialized assistance and customizable solutions for transaction processing and payment management.

What are the benefits of using GoCardless for recurring payments and international transactions?

GoCardless offers benefits such as instant bank pay, chargeback reduction, fraud protection, and verified mandates for secure transactions.

How does Payoneer help businesses keep more of their earnings and expand their market reach?

Payoneer offers competitive pricing, and transparent fee structures, and opens marketplace opportunities to expand business reach.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions, contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment