Kashf Foundation Loan is a microfinance program designed to provide financial assistance and support to poor women, entrepreneurs, and small business owners especially women in Pakistan.

In this article, we will explain the different types of Kashf Foundation Loan Schemes, the key features of every scheme, and the application process to get an interest-free loan from Kashf Foundation.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

Kashf Foundation Loan Apply Online | Interest-Free Loan In Pakistan

Table of Contents

Recommended Reading: How To Get An Interest-free Loan Online [20K-75K]

Kashf Foundation Loan Schemes

Kashf Foundation offers various loan schemes to support women entrepreneurs and small business owners in Pakistan.

| Product Name | Details |

|---|---|

| Kashf Karobar Karza: | A credit-appraisal-backed individual loan for expanding an existing business or setting up a new business. |

| Kashf School Sarmaya: | A unique and innovative product that aims to improve the quality of education in the country by providing financial access to low-cost private schools as well as capacity-building training. |

| Kashf Easy Loan: | A relatively new product introduced to meet the urgent needs of clients who require small loan amounts for any purpose. |

| Kashf Mahweshi Karza: | A new and unique lending product that is customized to meet the needs of female rural managers involved in dairy and meat production. |

| Kashf Marhaba Product: | Offered in Khyber Pakhtoonkhawa, Kashf offers this customized product designed in accordance with Islamic law and Sharia. |

| Kashf Sahulat Karza: | Provided to our repeat clients in order to meet their emergency needs and expenditures. |

These loan schemes have been designed to cater to the specific financial needs of borrowers and to help them achieve their goals. Some of the loan schemes offered by the Kashf Foundation are:

Kashf Easy Loan Scheme

Kashf Easy Loan is a microfinance loan product offered by Kashf Foundation to support women entrepreneurs and small business owners in Pakistan.

It is a convenient and accessible loan option designed to provide quick financial assistance to those who need it.

Recommended Reading: Online Loan In Pakistan Without Interest {10K-5Lakh} (Personal+Business)

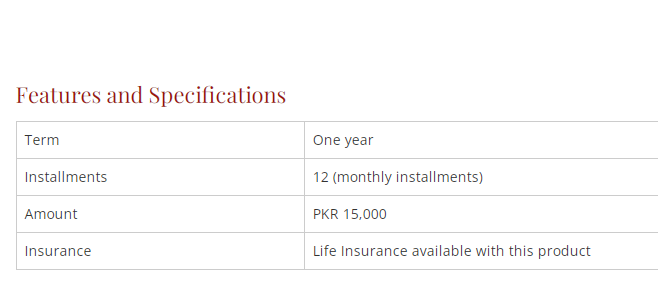

Key Features Of Kashf Easy Loan Scheme

| Feature | Description |

|---|---|

| Term | One year |

| Installments | 12 monthly installments |

| Amount | Up to PKR 15,000 |

| Insurance | Life insurance available with this product |

Kashf Karobar Karza Scheme

“Kashf Karobar Karza” is a loan product offered by Kashf Foundation, a microfinance organization in Pakistan.

The product is designed to cater to the financial needs of small business owners and entrepreneurs who need capital to start or grow their businesses.

Key Features of Kashf Karobar Karza Scheme

| Feature | Description |

|---|---|

| Term: | 1 year (12 months) |

| Installments: | 12 equal monthly installments |

| Amount: | Up to PKR 40,000 (first loan cycle) to PKR 100,000 (upper limit) |

| Documentation Fee: | PKR 250 (paid in monthly installments) |

| Insurance: | Plan A: PKR 1,850 with maternity coverage (paid in monthly installments) Plan B: PKR 1,200 without maternity coverage (paid in monthly installments) |

| Collateral-free: | No security or guarantor required |

| Quick Disbursement: | Loan disbursed quickly after approval, usually within a few days |

| Flexible Repayment: | Early repayments are allowed without penalties |

| Business Development Services: | Access to training and mentoring services to help grow businesses |

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Kashf School Sarmaya Scheme

Kashf Foundation is a microfinance institution that aims to empower women and families in Pakistan by providing them with financial and social services.

One of the financial products offered by the Kashf Foundation is the Kashf School Sarmaya, which is designed to provide affordable financing to parents who want to send their children to school.

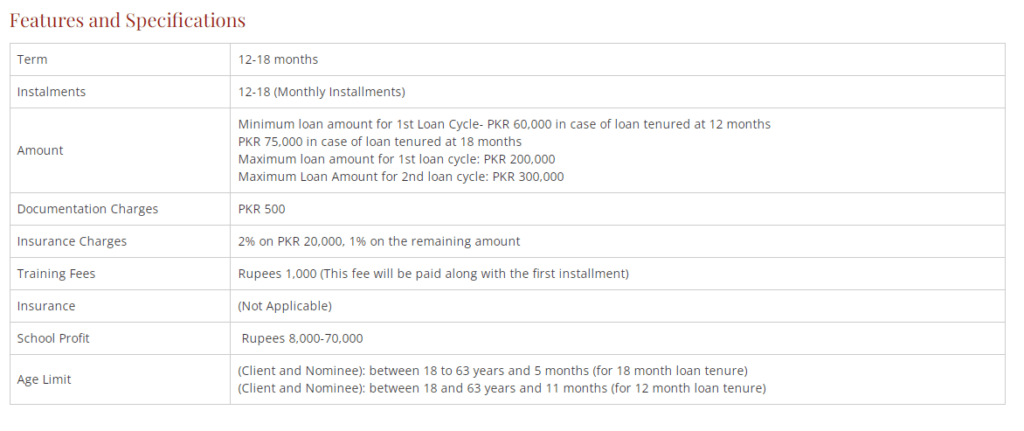

Key Features Kashf School Sarmaya Loan Scheme

| Feature | Details |

|---|---|

| Term: | 12-18 months |

| Installments: | 12-18 monthly installments |

| Amount: | Minimum for 1st cycle: PKR 60,000 (12 months) / PKR 75,000 (18 months) Maximum for 1st cycle: PKR 200,000 Maximum for 2nd cycle: PKR 300,000 |

| Documentation Charges: | PKR 500 |

| Insurance Charges: | 2% on PKR 20,000 and 1% on the remaining amount |

| Training Fees: | PKR 1,000 (paid with the first installment) |

| Insurance: | Not applicable |

| School Profit: | PKR 8,000 – 70,000 |

| Age Limit: | 18 to 63 years and 5 months (for an 18-month loan)<br>18 to 63 years and 11 months (for a 12-month loan) |

Kashf Mahweshi Karza Scheme

One of the financial products offered by the Kashf Foundation is the Kashf Mahweshi Karza, which is designed to provide affordable financing to women who want to purchase livestock.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

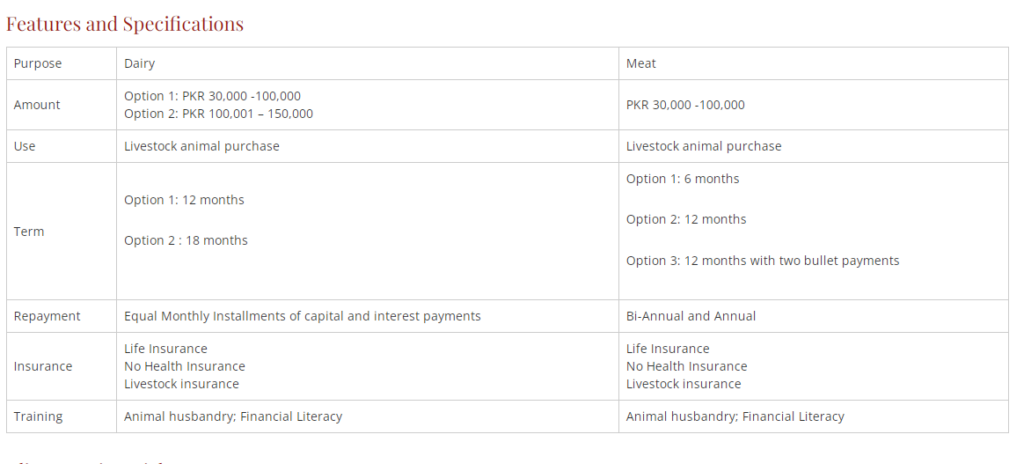

Key Features Kashf Mahweshi Karza Scheme

| Feature | Details |

|---|---|

| Purpose: | Dairy, Meat |

| Amount: | Option 1: PKR 30,000 – 100,000 Option 2: PKR 100,001 – 150,000 |

| Use: | Livestock animal purchase |

| Term: | Dairy Option 1: 12 months Dairy Option 2: 18 months Meat Option 1: 6 months Meat Option 2: 12 months Meat Option 3: 12 months with two bullet payments |

| Repayment: | Equal monthly installments of capital and interest payments Meat Option 3: Bi-Annual and Annual |

| Insurance: | Life insurance No health insurance Livestock insurance |

| Training: | Animal husbandry, Financial literacy |

Recommended Reading: How To Get An Interest-free Loan Online [20K-75K]

Kashf Marhaba Loan Scheme

One of their flagship products is the Kashf Marhaba Loan Scheme, which is designed to provide easy and affordable access to credit for small businesses and individuals.

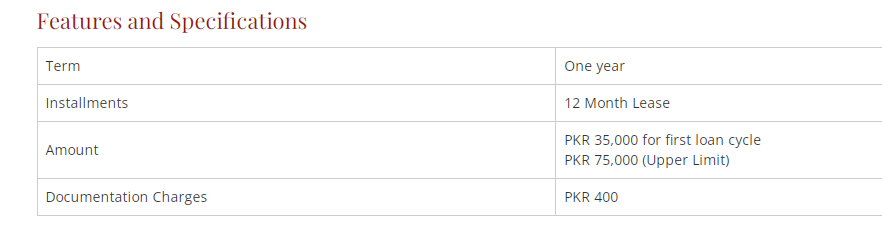

Key Features Of Kashf Marhaba Loan Scheme

| Feature | Details |

|---|---|

| Term: | One year |

| Installments: | 12 monthly installments |

| Loan Amount: | PKR 35,000 for the first loan cycle Upper Limit: PKR 75,000 |

| Documentation Charges: | PKR 400 |

| Collateral-free: | No collateral required |

| Fast Processing: | Quick loan processing to meet urgent needs |

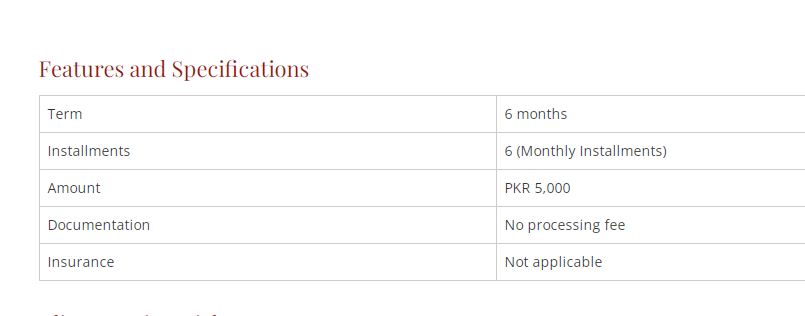

Kashf Sahulat Karza Scheme

Kashf Sahulat Karza Scheme is a microfinance initiative launched in Pakistan to provide easy access to credit for low-income individuals and micro-entrepreneurs.

This scheme aims to help the financially marginalized population to overcome their financial challenges and fulfill their basic needs.

Key Features Of Kashf Sahulat Karza Scheme

| Feature | Details |

|---|---|

| Term: | 6 months |

| Installments: | 6 monthly installments |

| Loan Amount: | PKR 5,000 |

| Documentation: | No processing fee |

| Insurance: | Not applicable |

Recommended Reading: Online Loan In Pakistan Without Interest {10K-5Lakh} (Personal+Business)

Kashf Foundation Loan Application Process

Kashf Foundation is a Pakistani microfinance institution that provides microcredit loans to low-income women entrepreneurs.

If you want to apply for a loan at Kashf Foundation, you can follow these steps:

| Step | Details |

|---|---|

| Find Your Nearest Kashf Center: | Visit the Kashf Foundation website, click “Find a Kashf Center,” enter your location, and note the center’s address and phone number. |

| Visit The Kashf Center: | Go to the nearest Kashf center during working hours (9 a.m. to 5 p.m.). |

| Attend the Information Session: | Attend a session where a staff member explains loan details and provides an application form. |

| Submit The Application Form: | Fill out and submit the application form with personal info, income details, and references. |

| Provide Required Documents: | Submit documents such as CNIC, photos, proof of income, and business registration (if applicable). |

| Interview With Kashf Staff: | Attend an interview to discuss your business plan and assess your creditworthiness. |

| Loan Approval: | If approved, you will be notified and attend a loan disbursement ceremony to receive the loan. |

| Loan Repayment: | Repay the loan in monthly installments as per the agreed schedule. Payments can be made at the Kashf center or via mobile banking. |

Kashf Foundation Contact Number

Here is the contact information for the Kashf Foundation:

- Website: https://kashf.org

- Email: info@kashf.org

- Helpline: +92 42 111 527 423

- Address: Kashf Foundation, Head Office, 49-A, Block XX, Phase III, DHA, Lahore, Pakistan.

You can also find the contact information for the nearest Kashf center by visiting their website or calling the helpline number.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Kashf Foundation Loan Pros And Cons

Pros Of Kashf Foundation Loan

- Easy Access to Finance: Kashf Foundation provides easy access to finance for low-income women entrepreneurs who do not have access to traditional banking services.

- Women Empowerment: Kashf Foundation focuses on empowering women entrepreneurs by providing them with financial resources, training, and support to start and grow their businesses.

- Interesr-free: Kashf Foundation offers interest-free microcredit loans for women entrepreneurs to borrow money.

- Flexible Repayment Terms: Kashf Foundation offers flexible repayment terms, allowing borrowers to repay their loans in installments that suit their cash flow and income.

- Non-Collateralized Loans: Kashf Foundation does not require collateral for microcredit loans, making it easier for women entrepreneurs to access finance.

Cons Of Kashf Foundation Loan

- Limited Loan Amount: Kashf Foundation provides small loans ranging from PKR 20,000 to PKR 200,000.

- Stringent Loan Application Process: The loan application process at Kashf Foundation may be lengthy and require extensive documentation, making it challenging for some women entrepreneurs to access finance.

- High Risk of Default: Since the Kashf Foundation provides loans to low-income women entrepreneurs who may not have a steady income source, there is a higher risk of default compared to traditional lenders.

- Focus on Women Borrowers Only: Kashf Foundation only provides loans to women borrowers.

- Limited Geographical Coverage: Kashf Foundation has limited geographical coverage and may not be available in all areas of Pakistan.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

FAQs | Kashf Foundation Loan

What is the Kashf Foundation?

Kashf Foundation is a Pakistani microfinance institution that provides microcredit loans to low-income women entrepreneurs.

The foundation was established in 1996 and has since helped thousands of women entrepreneurs in Pakistan to start and grow their businesses.

Who is eligible to apply for a Kashf Foundation loan?

Kashf loans are available to low-income women entrepreneurs in Pakistan. The borrower must have a viable business idea and be able to demonstrate the ability to repay the loan.

How much can I borrow from the Kashf Foundation?

Kashf Foundation provides microcredit loans ranging from PKR 15,000 to PKR 300,000.

How do I apply for a Kashf Foundation loan?

To apply for a Kashf loan, you need to visit the nearest Kashf center, attend the information session, fill out the loan application form, provide the required documents, and undergo an interview with Kashf staff.

What documents are required to apply for a Kashf Foundation loan?

The documents required to apply for a Kashf loan include CNIC (Computerized National Identity Card), two passport-size photographs, proof of income, and business registration documents (if applicable).

How long does it take to process a Kashf Foundation loan application?

The loan application process at Kashf Foundation can take a few weeks to a few months, depending on the borrower’s application and the loan amount.

How do I repay my Kashf Foundation loan?

Kashf loans are repaid in monthly installments as per the repayment schedule agreed upon at the time of loan approval. Borrowers can make their monthly loan payments at the Kashf center or through mobile banking.

Can I apply for a second loan from the Kashf Foundation if I have already repaid my first loan?

Yes, you can apply for a second loan from the Kashf Foundation if you have already repaid your first loan. However, you must have a good repayment history and a viable business idea to be eligible for another loan.

What happens if I am unable to repay my Kashf Foundation loan?

If you are unable to repay your Kashf Foundation loan, you should contact the foundation as soon as possible to discuss your situation.

The foundation may work with you to develop a repayment plan or offer other solutions to help you repay the loan.

How much loan can I get through the Kashf Sahulat Karza scheme?

Kashf Sahulat Karza provides existing clients with quick access to cash for emergency expenses or needs.

The loan amount for Kashf Sahulat Karza is typically PKR 5,000.

The loan term for Kashf Sahulat Karza is six months.

Recommended Reading: Online Loan In Pakistan Without Interest {10K-5Lakh} (Personal+Business)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment