In recent years, the concept of online lending has gained immense popularity in Pakistan, it offers a hassle-free way to obtain personal or business loans without having to visit a traditional bank.

The good news is that there are many a govt. sponsored institutions that provide online loans in Pakistan that are totally interest-free loans ranging from 10,000 to 500,000 PKR.

In this article, we will explore the top 3 online loans in Pakistan, that offer interest-free loans, and discuss the eligibility criteria and application process for these loans.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

Online Loan In Pakistan Without Interest | Interest-Free Loan In Pakistan

Table of Contents

Recommended Reading: Kashf Foundation Loan Apply Online (15K-3Lakh) {Interest-Free}

Pakistan Poverty Alleviation Fund (PPAF)

Online Loan In Pakistan: Pakistan Poverty Alleviation Fund (PPAF) is a non-profit organization that was established in 2000 to help alleviate poverty and promote sustainable development in Pakistan.

The PPAF operates through a network of community organizations, microfinance institutions, and other partners to identify and support the needs of the poorest and most vulnerable populations.

Its programs aim to build the capacity of communities to become self-sufficient and to promote economic growth and social development.

PPAF Online Applicaion Process

Here is a step-by-step guide on how to apply for an Online Loan In Pakistan through PPAF:

| Steps | Details |

|---|---|

| Identify Partner Organization: | Visit the PPAF App or website or contact the local government/community center to find a PPAF partner organization in your area. |

| Meet Eligibility Criteria: | Ensure you meet income, residency, and other criteria set by the partner organization. |

| Submit Application: | Submit an application form provided by the partner organization. |

| Attend Orientation Session: | Learn about loan terms, repayment schedules, and requirements. |

| Receive Loan Disbursement: | Upon approval, receive your loan for starting or expanding your business, or for other financial needs. |

| Repay the Loan: | Repay the principal amount according to the agreed repayment schedule. |

Recommended Reading: How To Get An Interest-free Loan Online [20K-75K]

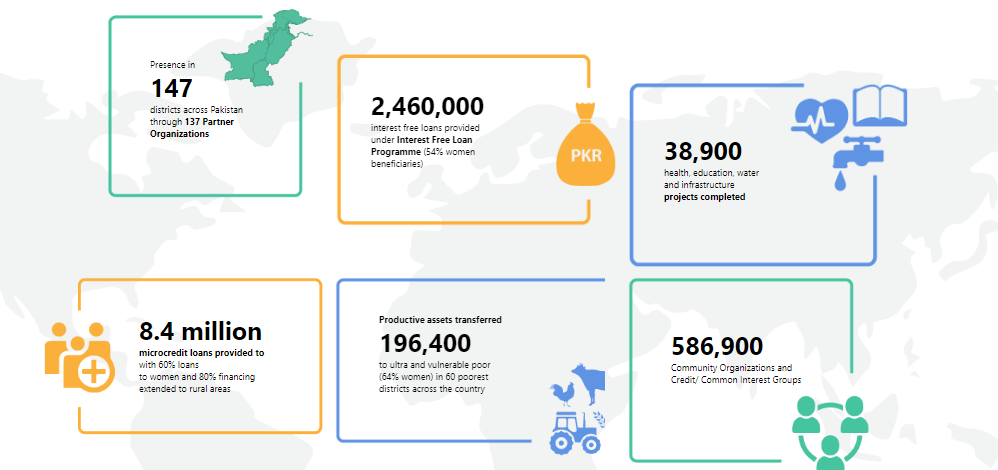

PPAF Achievement

| Category | Details |

|---|---|

| Districts Covered: | 147 districts |

| Partner Organizations: | 137 |

| Microcredit Loans Provided: | 8.4 million (60% to women, 80% in rural areas) |

| Interest-Free Loans Provided: | 2,460,000 (54% to women beneficiaries) |

| Productive Assets Transferred: | 196,400 (64% of women in the 60 poorest districts) |

| Health, Education, Water, and Infrastructure Projects: | 38,900 projects completed |

| Community Organizations and Groups: | 586,900 Community Organizations and Credit/Common Interest Groups |

Pakistan Poverty Alleviation Fund (PPAF) Contact Number

Here are the contact details for getting an Online Loan In Pakistan through the Pakistan Poverty Alleviation Fund (PPAF):

- Website: www.ppaf.org.pk

- Helpline: +92-51-844-444-1

- Email: info@ppaf.org.pk

- Address: Pakistan Poverty Alleviation Fund (PPAF), F-7 Markaz, Islamabad, Pakistan.

PPAF also has regional offices and centers located across Pakistan, which you can find on their website or by contacting their helpline.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

Kashf Foundation Personal And Business Loan

Online Loan In Pakistan: Kashf Foundation is a non-profit microfinance organization that was established in 1996 in Lahore, Pakistan.

Its primary aim is to provide financial services to low-income households, especially women, to help them become financially independent and empower them to make a positive impact on their communities.

Kashf Foundation offers microfinance services, such as microcredit, micro-savings, and microinsurance, to its clients, along with entrepreneurship and financial education training. The organization has won numerous awards for its innovative approach and success in promoting financial inclusion in Pakistan.

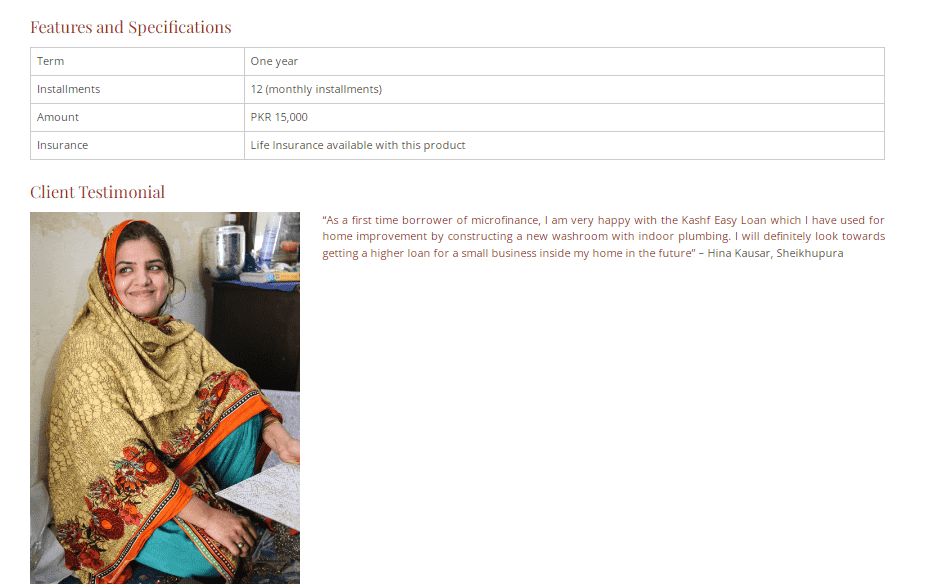

Kashf Foundation Kashf Easy Loan

Kashf Foundation offers the Kashf Easy Loan which is an Online Loan In Pakistan, which is a microcredit product designed to provide financial assistance to low-income individuals in Pakistan.

This loan product comes with a range of features and specifications that make it an ideal choice for those who need quick access to funds without the hassle of complex application procedures.

Here are the key features and specifications of Online Loan In Pakistan under the umbrella of Kashf Easy Loan:

| Feature | Details |

|---|---|

| Term | One year (12 months) |

| Installments | 12 monthly installments |

| Loan Amount | PKR 15,000 |

| Insurance | Life Insurance available with this product |

| Client Testimonial | “As a first-time borrower of microfinance, I am very happy with the Kashf Easy Loan which I have used for home improvement by constructing a new washroom with indoor plumbing. I will definitely look towards getting a higher loan for a small business inside my home in the future.” – Hina Kausar, Sheikhupura |

| Loan Term | The Kashf Easy Loan has a term of one year, requiring repayment within 12 months. |

| Monthly Installments | The loan is repaid in 12 monthly installments, making it easier for borrowers to manage their cash flows. |

| Quick Disbursement | The loan application process is simple and streamlined, ensuring quick disbursement of funds. |

| Minimal Documentation | Requires minimal documentation, making it easy for borrowers to apply. |

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

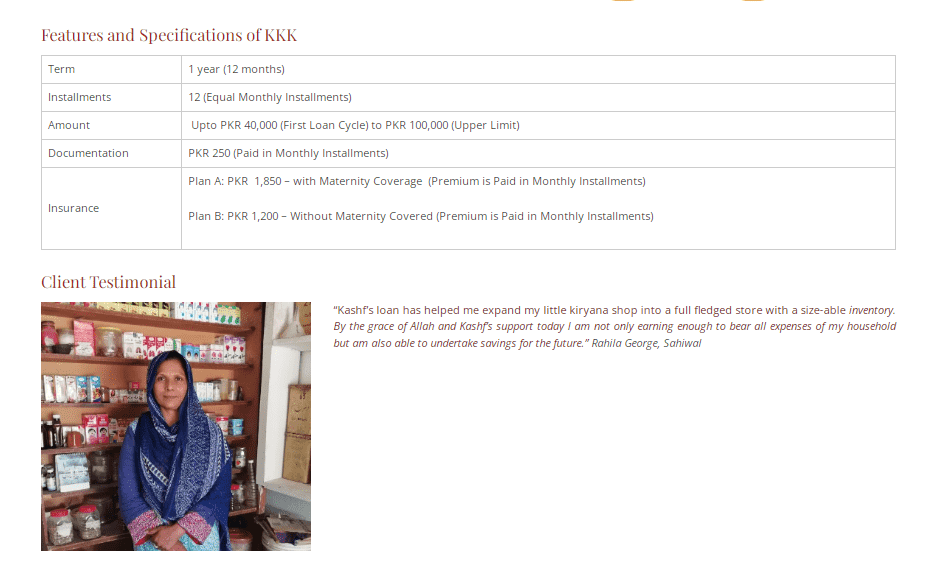

Kashf Foundation Kashf Business Loan

Kashf Foundation provides the Kashf Business Loan, a microfinance product designed to support low-income entrepreneurs in Pakistan.

Online Loan In Pakistan product offers a range of features and specifications that make it a popular choice among small business owners who need financial assistance.

Here are the key features and specifications of the Kashf Business Loan:

| Feature | Details |

|---|---|

| Term | 1 year (12 months) |

| Installments | 12 equal monthly installments |

| Loan Amount | Up to PKR 40,000 (First Loan Cycle) to PKR 100,000 (Upper Limit) |

| Documentation Fee | PKR 250 (Paid in monthly installments) |

| Insurance | Plan A: PKR 1,850 with Maternity Coverage (Premium paid in monthly installments) Plan B: PKR 1,200 without Maternity Coverage (Premium paid monthly) |

| Client Testimonial | “Kashi’s loan has helped me expand my little kiryana shop into a full-fledged store with a sizeable inventory. By the grace of Allah and kashf’s support today, I am not only earning enough to bear all expenses of my household but am also able to undertake savings for the future.” – Rahila George, Sahiwal |

| Collateral | Collateral-free loan |

Kashaf Foundation Contact Number

Here is the contact information for Kashaf Foundation:

- Website: https://www.kashaffoundation.org/

- Email: info@kashaf.org

- Address: Kashaf Foundation, House No. 22, Street No. 62, F-7/4, Islamabad, Pakistan

- Helpline Number: +92-51-111-111-875

Please note that the helpline is available from Monday to Friday, from 9:00 AM to 5:00 PM. Additionally, you can also visit one of their branches located in various cities throughout Pakistan to get more information about their services and Online Loan In Pakistan products.

Recommended Reading: Kashf Foundation Loan Apply Online (15K-3Lakh) {Interest-Free}

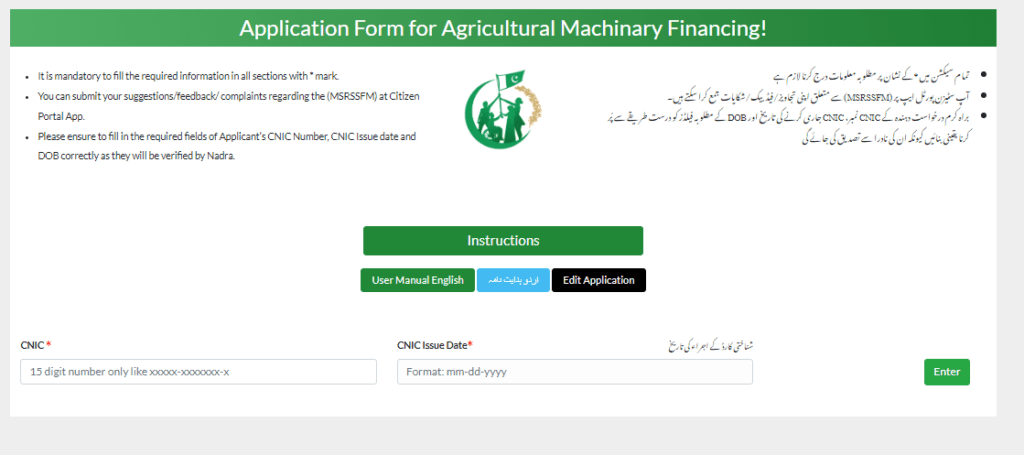

Prime Minister Youth Loan Scheme

Online Loan In Pakistan: The “Prime Minister Youth Loan Scheme” is a government initiative launched to provide financial assistance to the youth of Pakistan for starting their own businesses or expanding existing ones.

Online Loan In Pakistan scheme aims to encourage entrepreneurship among young people and create job opportunities for the country’s growing population.

Maximum limit:

Under the Prime Minister Youth Loan Scheme, eligible individuals can avail of online loan in Pakistan ranging from Rs. 100,000 to Rs. 5,000,000, depending on the nature of their business proposal and their financial requirements.

Prime Minister Youth Loan Scheme Application Process

The application process for getting online loan in Pakistan through PM Youth Loan Scheme:

| Step | Details |

|---|---|

| Eligibility Criteria | Open to Pakistanis aged 21 to 45 years with a viable business plan |

| Business Plan | Prepare a comprehensive business plan outlining the proposed business idea, feasibility, financial projections, and marketing strategies |

| Submission of Application | Submit the Online Loan In Pakistan application online through the official Prime Minister Youth Loan Scheme website or visit designated National Bank of Pakistan (NBP) branches |

| Verification and Approval | The application undergoes verification process including a credit check, assessment of the business plan, and evaluation of collateral (if any) |

| Disbursement of Loan | Upon approval, the loan amount is disbursed to a designated account; applicants attend training sessions organized by NAVTTC to enhance business management skills |

| Repayment | Loan repayment in easy installments over 8 years, including a one-year grace period; offered at a low-interest rate of 6% per annum |

Prime Minister Youth Loan Scheme Contact Number

Here is the contact information for the Prime Minister Youth Online Loan In Pakistan:

- Website: https://www.kamyabjawan.gov.pk

- Email: info@kamyabjawan.gov.pk

- Address: National Information Technology Board (NITB), 3rd Floor, Evacuee Trust Complex, F-5, Islamabad, Pakistan

- Helpline Number: 0800-77000

Please note that the helpline is available from Monday to Friday, from 9:00 AM to 5:00 PM. Additionally, you can also visit designated National Bank of Pakistan (NBP) branches across the country for more information and assistance with the loan application process.

Recommended Reading: How To Get An Interest-free Loan Online [20K-75K]

FAQs | Online Loan In Pakistan

What is the Prime Minister Youth Loan Scheme?

The Prime Minister Youth Loan Scheme is a government initiative launched to provide financial assistance to the youth of Pakistan for starting their own businesses or expanding existing ones.

How can I apply for a loan under the Prime Minister Youth Loan Scheme?

You can apply for an Online Loan In Pakistan under this scheme by submitting a business plan online through the official Prime Minister Youth Loan Scheme website or by visiting designated National Bank of Pakistan (NBP) branches across the country.

Recommended Reading: How To Get Urgent Cash Loan In Pakistan Without Interest {10K-3Lakh}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment