The integration of Shopify and WooCommerce has become a common practice among entrepreneurs to establish their online presence. However, ensuring smooth transactions and compliance with local regulatory frameworks remains a challenge.

This article delves into the realm of the top five payment gateways in Pakistan that meet the specific needs of Shopify and WooCommerce users.

For Shopify and WooCommerce payments in Pakistan, we have identified and short-listed the following payment solutions:

- PayPak

- Safepay

- bSecure

- GoPayFast

- SadaPay

In case you are in a hurry, here is a brief overview table of the top 5 payment gateways recommended for Shopify and WooCommerce users:

| Payment Gateway | Key Features | Supported Platforms | Contact Information |

|---|---|---|---|

| PayPak | – Domestic payment scheme – Inter Bank Fund Transfer – Bill payments – Secure connectivity | Shopify, WooCommerce | Phone: +92 21 11 11 1LINK (15465) Address: 1LINK 1HQ LG 11 / 11-A, Lower floor Park Towers, Clifton Block 5, Karachi, Pakistan |

| Safepay | – Accepts various payment methods – Hassle-free and instant payments – Secure transaction experience – API Integration | Shopify, WooCommerce | Email: support@getsafepay.com Address: 42-c, South Park Avenue, Phase II Ext, DHA, Karachi, Pakistan – 75500 |

| bSecure | – One-click checkout solution – Phone number authentication – Shipping and billing address management – Payment flexibility | Shopify, WooCommerce | Official website contact form |

| GoPayFast | – Streamlined registration process – PCI-DSS compliance – Payment links solution – Invoice generation | Shopify, WooCommerce | Email: info@gopayfast.com Phone: +92 21 37132793 Head Office: National Aerospace Science and Technology Park (NASTP), Faisal Cantonment, Karachi, Karachi City, Sindh |

| SadaPay | – Simplified tasks such as sending money, paying bills – Instant fund access – Global accessibility – Enhanced security | Shopify, WooCommerce | Official website contact form Head Office: Ufone Tower, 9th Floor, Jinnah Avenue, Block F-7/1, Blue Area, Islamabad |

Now, let’s explore the details of each of these payment gateways!

Recommended Reading: Shopify Payment Methods In Pakistan (Shopify+Woocommerce)

Best Online Payment Gateways In Pakistan | International Payment Gateways In Pakistan

Table of Contents

PayPak

PayPak: Driving Local Transactions:

PayPak has emerged as a trailblazer in Pakistan’s payment gateway sector, being the country’s first and only domestic payment scheme. This initiative places Pakistan among the 28 countries globally with a similar domestic payment scheme.

As part of the 1LINK network, PayPak operates with the support of the State Bank of Pakistan, aiming to promote financial inclusivity and digitalization nationwide by offering robust payment gateway solutions.

PayPak’s debit card provides users with convenient access to their funds at any time and from any location. The card allows for transactions at all ATMs across the country, as well as at various dining establishments, retail outlets, shopping malls, and online platforms.

PayPak’s Offerings

PayPak’s Offerings Include:

- Inter Bank Fund Transfer (1IBFT): Facilitates seamless fund transfers between different banks.

- 1BILL: Enables users to pay their bills conveniently through the PayPak platform.

- Shared ATM Services: Provides access to a network of ATMs for convenient cash withdrawals and other transactions.

- IPS Connectivity: Offers secure connectivity for processing transactions.

- Fraud Risk Management Services (FRMS): Provides tools and services to help mitigate fraud risks.

- 1LINK Open APIs: Allows developers to integrate PayPak’s services into their applications.

- Fraudulent Transaction Dispute Handling (FTDH): Offers a mechanism to address disputed transactions.

- Cyber Threat Intelligence Platform (1TIP): Provides insights and tools to combat cyber threats.

- Switch Dispute Resolution System (SDRS): A system for resolving disputes related to payment switches.

- 1LINK Hosted Services Platform: Hosted services for banks and financial institutions.

- Tokenization Service: Enhances security by replacing sensitive card information with a token.

- 1QR: A quick response (QR) code-based payment solution.

- 1ID: A unique identifier for PayPak transactions.

- Perso Bureau: Provides personalized card issuance services.

Contact Details

- Phone: +92 21 11 11 1LINK (15465)

- Address: 1LINK 1HQ LG 11 / 11-A, Lower floor Park Towers, Clifton Block 5, Karachi, Pakistan.

Safepay

Safepay: Streamlining Secure Payments:

VSafepay offers a seamless transaction experience by accepting payments from various sources, including credit cards, debit cards, bank accounts, and mobile wallets. This ensures convenience for both businesses and customers, providing a comprehensive payment gateway solution.

Supported by industry-leading endorsements, Safepay offers a hassle-free and instant payment experience, supported by robust security measures to protect sensitive financial information.

Safepay enables businesses to securely accept customer payments through digital payment channels, creating growth opportunities while providing hassle-free, instant, and secure payment gateway transactions.

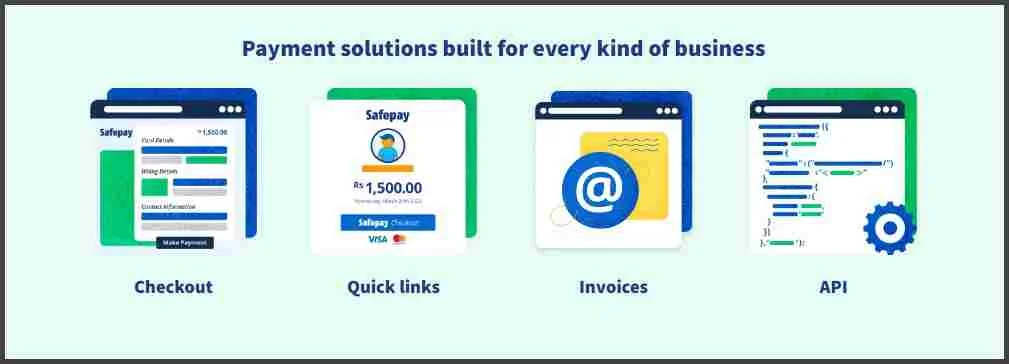

Safepay’s Offerings:

Safepay’s Offerings Include:

- Tailored Payment Solutions:

- Checkout Options

- Quick Link Generation

- Invoicing Capabilities

- API Integration

Safepay’s Process:

- Customer Payment Initiation: Customers start the payment process by using Safepay for their transactions.

- Secure Fund Handling: Safepay promptly captures and securely holds funds with the help of its trusted financial partners.

- Disbursement Process: Safepay disburses funds to the linked bank account based on its settlement schedule, ensuring timely and reliable payments.

Key Features of Safepay Services:

Streamlined Payment Management Tools:

- Access detailed information on every payment transaction.

- Initiate refunds and reversals effortlessly, providing a seamless customer experience.

- Stay informed about newly released features and functionalities.

- Enjoy a developer and business-friendly interface that allows you to explore various use cases, catering to freelancers, entrepreneurs, organizations, and non-profits alike.

Contact Details:

- Email: support@getsafepay.com

- Address: 42-c, South Park Avenue, Phase II Ext, DHA, Karachi, Pakistan – 75500

Recommended Reading: International Payment Gateways In Pakistan (Shopify+Woocommerce)

bSecure

bSecure: Innovating Online Checkout Experiences:

Efficient Checkout Solution:bSecure provides a streamlined one-click checkout solution aimed at simplifying product sales globally, ensuring swift transactions and seamless management of the purchasing process. With a strong focus on security, each transaction is encrypted, prioritizing user transparency and satisfaction, thereby enhancing trust and confidence in the platform.

bSecure’s Process

- Phone Number Authentication: Users can easily log in without the need for passwords by verifying their identity through a one-time password (OTP) sent to their registered phone number.

- Address Management: Shipping and billing addresses are conveniently mapped geographically, with the option for live location sharing to ensure accuracy.

- Shipment Options: bSecure provides location-based shipment methods, offering estimated shipping times and costs to optimize the delivery experience.

- Payment Flexibility: Users have access to a wide range of local and international payment options, including Cash on Delivery, ensuring convenience and accessibility.

- Efficient Checkout: Custom invoices are generated for each transaction, along with follow-up details, to further streamline the purchase process.

Key Features of bSecure Services:

- Sales Enhancement

- Effortless Payment Acceptance

- Instant Shopping

- BIN-Based Discounts

- Reduced Rejection Rates

- Multi-Store Management

- Language Customization

- Area-Based Shipments

- Transaction Management

- Website Accessibility

- Customer Retention

bSecure’s Target Audience:

- eCommerce & Retail Businesses: bSecure caters to the needs of eCommerce and retail businesses, providing them with secure and efficient payment solutions.

- Software as a Service (SaaS) Providers: SaaS providers can benefit from bSecure’s services, integrating secure payment options into their software offerings.

- Freelancers: Freelancers can utilize bSecure to manage their payment transactions securely.

Contact Details:

For any questions, please visit our official website and make use of the contact form available there.

GoPayFast

GoPayFast: Driving Digital Business Growth:

- GoPayFast offers a streamlined registration process through a self-sign-up portal, allowing for paperless and contact-free registration from any location.

- Integration with GoPayFast accelerates payment acceptance, optimizing revenue streams and fostering business expansion.

- GoPayFast prioritizes transaction security, adhering to PCI-DSS compliance standards and employing robust fraud monitoring solutions, transaction monitoring systems, and a dedicated team to protect your business.

- With GoPayFast’s Payment Links solution, customers can make payments using a variety of methods, including bank accounts, card transactions, and mobile wallets, ensuring convenience and accessibility for all users.

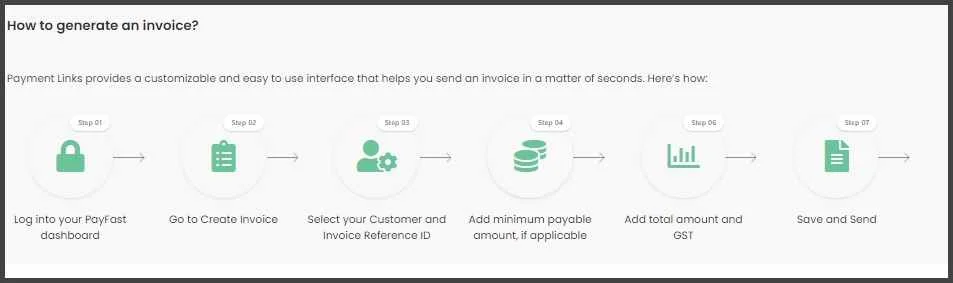

Generating Invoices with GoPayFast

- Access your PayFast dashboard.

- Go to “Create Invoice.”

- Choose your customer and invoice reference ID.

- Specify the minimum payable amount, if needed.

- Enter the total amount and GST.

- Save and send the invoice effortlessly.

How Customers Can Make Payments Through PayFast?

Paying Bills with PayFast Billing: A Step-by-Step Guide to Streamlined Payments

- Access Internet Banking or Mobile App: Begin by securely logging in to your bank’s internet banking website or mobile application.

- Locate Bill Payments: Once logged in, navigate to the bill payments section within the banking interface.

- Choose PayFast as Biller: Select PayFast from the list of available billers as the recipient for your payment.

- Enter Invoice Details: Provide the necessary details for your invoice, including the invoice number and the amount owed.

- Confirm Payment: Review the provided information for accuracy, then proceed to confirm the payment. Upon confirmation, your payment will be securely processed through PayFast Billing.

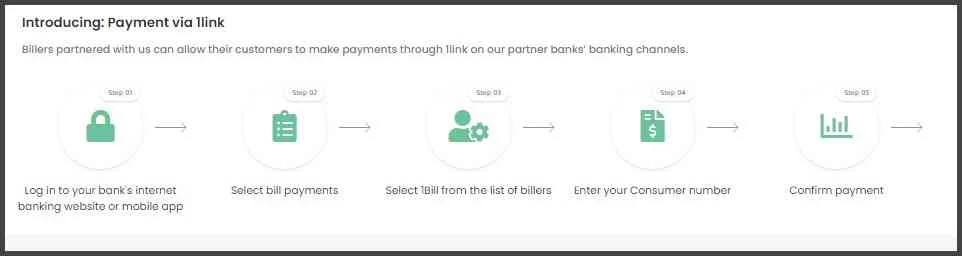

Making Payments through 1Link

- Access Banking Channels: Start by securely logging in to your bank’s internet banking website or mobile application to access your account.

- Locate Bill Payments: Once logged in, find the section dedicated to bill payments within the banking interface.

- Choose 1Bill as the Biller: Select 1Bill from the list of available billers as the recipient for your payment.

- Enter Consumer Number: Input your unique consumer number associated with the bill or service you are paying for.

- Confirm Payment: Review the provided details for accuracy, then proceed to confirm the payment. Upon confirmation, your payment will be securely processed through 1Link’s payment gateways, ensuring seamless transactions for both billers and customers.

Contact Details:

- Email: info@gopayfast.com

- Phone: +92 21 37132793

- Head Office: National Aerospace Science and Technology Park (NASTP), V4P99G3, Faisal Cantonment, Karachi, Karachi City, Sindh

SadaPay

SadaPay: Revolutionizing Financial Independence

- Effortless Transactions: SadaPay simplifies tasks such as sending money, paying bills, requesting funds, and topping up mobile balances, providing users with unmatched convenience in payment processing.

- Instant Fund Access: Experience the convenience of instant remittance arrivals, ensuring quick access to your funds whenever and wherever needed.

- Global Accessibility: Whether you are in Pakistan or abroad, SadaPay offers tailored account sign-up options to cater to the diverse needs of freelancers and individuals worldwide.

- Enhanced Security: SadaPay prioritizes the security of your funds with features such as biometric access, AI fraud detection, and robust encryption protocols, ensuring your peace of mind.

- International Payment Acceptance: Simplified acceptance of international payments is made possible through SadaPay’s platform, which offers easy generation and sharing of payment links for swift and secure transactions.

How to Accept International Payments with SadaPay?

- Generate Payment Link: Easily create a payment link using the SadaPay platform.

- Share the Link: Share the generated payment link with the payer.

- Receive Payments: Swiftly receive payments directly into your SadaBiz account.

Store in USD, Spend in PKR

- Direct Payment Processing: SadaPay allows for direct payment processing, bypassing intermediaries and avoiding excessive platform fees that could reduce earnings.

- Higher Transaction Limits: Enjoy higher transaction limits of up to Rs. 500,000 per month, directly credited to your SadaBiz account.

- Lowest Fees: Benefit from the lowest fees available in the market, maximizing the value of your transactions.

Accepted Invoice Payment Methods with SadaPay

Invoices can be paid using various methods such as Apple Pay, G Pay, and Mastercard or VISA cards (credit/debit). These payment options simplify the payment process for customers, eliminating the need for SWIFT codes.

Contact Details:

- For inquiries, please visit the official website and use the contact form available.

- Head Office: Ufone Tower, 9th Floor, Jinnah Avenue, Block F-7/1, Blue Area, Islamabad.

Best International Payment Gateways That Operate Globally

The following payment gateways work on a global scale and if you are in search of payment solutions on a global scale then the following table might be useful for you:

| International Payment Gateway | Working | Charges | Additional Information |

|---|---|---|---|

| PayPal | – Intermediary for secure transactions between buyers and sellers. | – Transaction fees: 2.9% + $0.30 USD to 4.4% + fixed fee per transaction. – Additional fees for currency conversion and cross-border transactions. | – Widely accepted globally – Supports multiple currencies – Offers buyer and seller protection |

| Stripe | – Online platform for secure payment processing. | – Transaction fees: around 2.9% + USD 0.30 per successful transaction. – Additional fees for international cards and currency conversion. | – Supports over 135 currencies – Offers subscription billing and recurring payments – Advanced fraud protection tools |

| 2Checkout | – Global payment platform for businesses. | – Transaction fees: range from 3.5% + $0.35 USD to 6% + fixed fee per transaction. – Additional fees for currency conversion and cross-border transactions. | – Multi-language support – PCI-DSS compliant – Integrates with popular e-commerce platforms |

| Payoneer | – Facilitates cross-border payments for businesses. | – Fees vary based on payment type, withdrawal method, and currency conversion. – Transaction fees may range from 0% to 3% of the total amount. | – Offers virtual receiving accounts – Secure online platform – Supports mass payouts |

| Worldpay | – Provides global payment solutions for businesses. | – Transaction fees vary based on location, sales volume, and payment methods accepted. – Additional fees for currency conversion and cross-border transactions. | – Supports over 120 currencies and 200 payment methods – Customizable solutions and reporting tools – Dedicated support for merchants |

Best Online Payment Methods in Pakistan (Industry-Wise)

If you are looking for payment solutions specific to your needs. Then you may find our following recommendations useful for your particular business needs.

Payment Gateway Options for Shopify in Pakistan

- PayPak

- Safepay

- bSecure

- GoPayFast

- SadaPay

Payment Gateway Solutions for WordPress in Pakistan

- PayPak

- Safepay

- bSecure

- GoPayFast

- SadaPay

Best Payment Gateway for Your E-commerce Business in Pakistan

- PayPak

- Safepay

- bSecure

- GoPayFast

- SadaPay

Recommended Reading: How To Create Skrill Account In Pakistan | How To Make Skrill Account

FAQs | Payment Gateways In Pakistan

What is PayPak’s role in Pakistan’s payment gateway landscape?

PayPak is Pakistan’s inaugural and sole domestic payment scheme (DPS), marking Pakistan’s entry into the league of 28 countries worldwide with such a scheme.

How does Safepay simplify online transactions?

Safepay simplifies online transactions by offering a one-click checkout solution and providing industry-leading support for a hassle-free and instant payment experience.

What are the key features of bSecure’s payment solutions?

bSecure’s payment solutions include versatile payment acceptance, endorsement by industry leaders, flexible payment options, streamlined payment processes, and efficient payment management tools.

How does GoPayFast revolutionize online checkouts?

GoPayFast innovates online checkouts by providing a streamlined checkout experience, instant payment acceptance, and robust security measures.

What are the steps to generate an invoice with SadaPay?

To generate an invoice with SadaPay, log in to your SadaPay dashboard, navigate to create an invoice, select your customer and invoice reference ID, add the minimum payable amount if applicable, include the total amount and GST, and save and send the invoice seamlessly.

How can customers pay via SadaPay?

Customers can pay via SadaPay by accessing their SadaPay dashboard, selecting the pay option, entering the recipient’s details, and confirming the payment.

What are the benefits of using SadaPay for international payments?

Using SadaPay for international payments allows you to save in USD and spend in PKR, bypass intermediaries, enjoy higher transaction limits, and benefit from the lowest fees available on the market.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions, contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment