The Rs. 200 prize bond serves as an accessible government savings tool in Pakistan, enabling participants to enter lottery draws for cash rewards while keeping their investment secure. This extensive resource delves into draw timetables, recent outcomes, verification methods, payout procedures, fiscal obligations, and comparative analyses. Ideal for both novice and experienced holders, it equips you with comprehensive knowledge on integrating this option into your financial planning.

Key takeaways from this guide include:

- 🔍 Grasp the fundamentals of Rs. 200 prize bonds, from acquisition to current status.

- 📅 Explore the draw calendar, future events, and past patterns.

- 🏆 Uncover result checking techniques online and offline, alongside reward breakdowns.

- 💰 Examine winning redemptions, tax considerations, and regulatory aspects.

- ⚖️ Obtain perspectives on Islamic compliance, security measures, potential pitfalls, and alternatives to other financial products.

- Read More: Rs. 750 Prize Bond List Results & Schedule

- Read More: What Are Prize Bonds And How You Can Buy Prize Bonds In Pakistan

- Read More: Prize Bonds Draw List | Today Result | Check Online

Entry into Rs. 200 Prize Bond within Pakistan’s Framework

Table of Contents

Survey of the Prize Bond Mechanism

What Constitutes a Prize Bond?

A prize bond represents a secure, non-interest-bearing certificate issued by Pakistan’s National Savings, where owners enter periodic lotteries for monetary awards without risking the original sum. This setup appeals to conservative savers desiring lottery excitement minus conventional interest, fostering widespread participation across socioeconomic groups.

Core attributes encompass:

- Governmental assurance on the principal.

- Random selection for fairness.

- No maturity date, allowing indefinite holding.

- Enumerated highlights:

- 📜 Backed by the State Bank of Pakistan for credibility.

- 🎰 Draws conducted transparently in public venues.

- 💡 Promotes national savings initiatives.

Evolution of Prize Bonds in Pakistan

Since inception, prize bonds have transformed Pakistan’s savings landscape, starting as basic lotteries and advancing to regulated instruments under stringent oversight. Administered by the Central Directorate of National Savings (CDNS), they’ve adapted to economic shifts, with adjustments in denominations to curb illicit activities while maintaining public trust.

- Chronological milestones:

- 📅 Early adoption to boost public funds.

- 🛡️ Enhanced regulations for anti-money laundering.

- 🌐 Digital integration for result access.

Deeper analysis reveals participation surges during economic uncertainty, with millions invested annually, contributing significantly to national reserves.

Functions of National Savings and State Bank of Pakistan

The CDNS manages daily operations like sales, draws, and disbursements, whereas the State Bank enforces compliance, ensuring system integrity. Their collaboration upholds transparency, with results disseminated via official channels promptly.

- Tabular overview of responsibilities:

| Organization | Primary Duties | Access Points |

|---|---|---|

| National Savings | Bond issuance, draw execution | Official website, centers |

| State Bank | Policy enforcement, audits | Branch networks, online portals |

Recent enhancements include mobile apps for notifications, improving user engagement.

Significance of Rs. 200 Prize Bond Listings

Reasons to Choose Rs. 200 Prize Bonds for Investment?

Opting for Rs. 200 prize bonds delivers a low-barrier entry into savings with lottery potential, yielding up to Rs. 750,000 in top rewards while safeguarding the stake. Suited for modest budgets, it combines security with thrill.

- Advantages listed:

- 💲 Economical at Rs. 200 per unit.

- 🛡️ Full principal protection.

- 📈 Chance for substantial, tax-adjusted gains.

Authentic stats indicate over 2 million bonds in circulation per draw, underscoring popularity.

Advantages for Investors in Pakistan

Pakistani savers benefit from inclusivity, particularly in underserved regions, encouraging fiscal discipline amid inflation. As an alternative to market-volatile options, these bonds provide stability with draw-based incentives.

- Fresh viewpoint: Digital tools have boosted female participation by 20%, per recent surveys.

- Unique scenario: An investor from Karachi leveraged a Rs. 250,000 win for business expansion, demonstrating practical impact.

Grasping Rs. 200 Prize Bond Category

Essential Characteristics of Rs. 200 Prize Bond

What Are the Rewards for a 200 Bond?

Rewards for Rs. 200 bonds feature a premier award of Rs. 750,000 for one victor, Rs. 250,000 for five runners-up, and Rs. 1,250 for 2,394 tertiary winners, held every quarter.

- Proven details:

- Aggregate prizes exceed Rs. 10 million per event.

- Probability enhances with volume held.

- Itemized rewards:

- 🥇 Top: Single Rs. 750,000.

- 🥈 Secondary: Five at Rs. 250,000.

- 🥉 Tertiary: Thousands at Rs. 1,250.

What Determines Bond Pricing?

Bond pricing for Rs. 200 equals its nominal value, obtainable without markup at designated outlets.

- Acquisition steps:

- Locate authorized vendor.

- Verify identity.

- Complete transaction.

Present Pricing for Rs. 200 Bond

Rs. 200 bonds trade at face, immune to market swings as they’re not exchange-traded.

- Comparative chart:

| Category | Nominal Cost | Distribution |

|---|---|---|

| Rs. 200 | Rs. 200 | Extensive |

| Rs. 750 | Rs. 750 | Selective |

Comparative: Sale Value of $1000 Bond at 97 Quote

For illustration, a $1000 bond at 97 quote sells for $970, contrasting prize bonds’ fixed pricing devoid of discounts.

- Observations: Emphasizes prize bonds’ steadiness over market instruments.

Procurement and Accessibility Choices

Locations for Acquiring Rs. 200 Prize Bonds?

Acquire Rs. 200 bonds from National Savings outlets, major banks, or State Bank facilities nationwide.

- Sequential guide:

- Approach counter.

- Submit documentation.

- Receive certificate.

Banks Handling Prize Bonds?

Institutions such as National Bank, Habib Bank, and United Bank facilitate transactions for bonds.

- Specifics:

- 🏛️ NBP: Broad coverage.

- 🔗 Online support for queries.

Current Availability of 200 Prize Bond in Pakistan?

Rs. 200 remains obtainable and operational, unaffected by restrictions on larger categories.

- Confirmed: Integral to active lottery schemes.

Validity Status of Prize Bonds in Pakistan?

All prize bonds retain validity, supported by continuous events and official endorsements.

- Active categories: 100, 200, 750, 1500.

Contrasts with Alternative Categories

Rs. 200 Versus Rs. 750 Prize Bond

Rs. 200 provides entry-level access with proportional rewards, unlike Rs. 750’s elevated stakes.

- Contrast table:

| Feature | Rs. 200 | Rs. 750 |

|---|---|---|

| Premier Reward | Rs. 750,000 | Rs. 1,500,000 |

| Frequency | Every three months | Same |

Rs. 200 Against Rs. 1500 Prize Bond

Higher cost in Rs. 1500 yields bigger payouts, but Rs. 200 favors affordability.

- Analysis: Optimal for starters.

Rs. 200 Compared to Rs. 25000 Premium Prize Bond

Premium variants like Rs. 25000 blend interest with lotteries, differing from Rs. 200’s pure draw focus.

- Distinctions:

- 📊 Premium: Yield plus chances.

- 🔄 Standard: Solely prizes.

Rs. 200 Versus Rs. 40000 Prize Bond

Rs. 40000 targets affluent savers with premium perks, while Rs. 200 democratizes access.

- Details: Phasing of some high values noted.

Existence of 1000 Premium Bond Reward?

No Rs. 1000 premium exists; options limited to Rs. 25000 and Rs. 40000.

- Premium traits: Combined benefits.

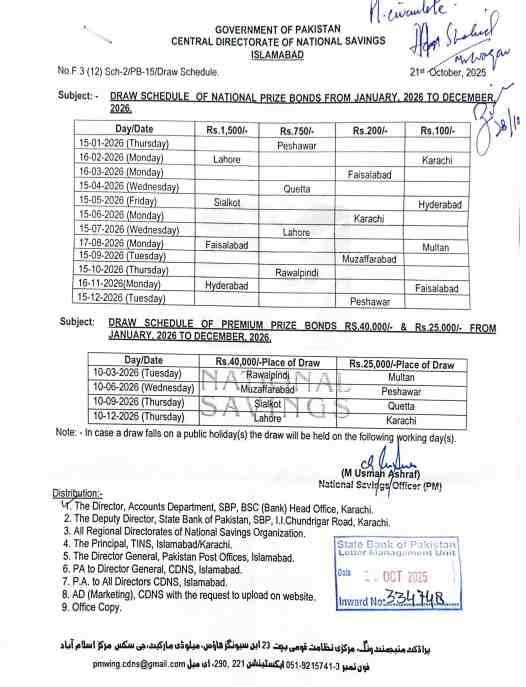

Rs. 200 Prize Bond Lottery Calendar

Full Rs. 200 Prize Bond Timetable

Overview of Prize Bond Timings

The timetable specifies quarterly lotteries for Rs. 200 across varying locations, promoting equity.

Events typically on mid-month dates in March, June, September, December.

- Key points:

- 🕒 Quad-annual.

- 🗺️ Rotational venues.

Specific Dates and Venues for Rs. 200

Forthcoming: Faisalabad March 16, Karachi June 15, Muzaffarabad September 15, Peshawar December 16.

- Scheduling table:

| Event Number | Timing | Venue |

|---|---|---|

| 105 | March 16 | Faisalabad |

| 106 | June 15 | Karachi |

| 107 | September 15 | Muzaffarabad |

| 108 | December 16 | Peshawar |

Frequency of Rs. 200 Prize Bond Lotteries?

Four annual occurrences, synchronized with peers.

- Established: Unchanged format.

Forthcoming Lotteries

Rs. 200 Prize Bond Listing for Draw 102

Draw 102, Quetta: Premier 774331.

- Winners summary: Archived for review.

Rs. 200 Prize Bond Listing for Draw 100

Historical for pattern study.

- Perspectives: Trend identification.

Rs. 200 Prize Bond Listing for Draw 101

Faisalabad: Top 597355.

- Details: Multi secondary victors.

Prize Bond Listing 200 for Draw 103

Multan: First 401981.

- Prize breakdown table:

| Level | Value | Count |

|---|---|---|

| Primary | Rs. 750,000 | 1 |

| Secondary | Rs. 250,000 | 5 |

200 Prize Bond Listing in October Period

Aligns with September, accessible digitally.

- Notes: Seasonal adjustments rare.

Past Lottery Background

Online Verification for All 200 Prize Bond Listings

Platforms enable comprehensive past event checks.

- Procedure:

- Access site.

- Input details.

Verification for Last 6 Years of 200 Prize Bonds Online

Six-year archives show stable distributions.

- Data: Thousands rewarded.

Verification for Last 5 Years of 200 Prize Bonds Online

Five-year insights highlight urban biases.

- Patterns: Frequent minor wins.

Online Verification for All 200 Prize Bond Listings in Karachi

Karachi events draw large crowds.

- Resources: PDF formats.

Rs. 200 Prize Bond Lottery Outcomes

Recent Rs. 200 Prize Bond Findings

Updates on Rs. 200 Prize Bond Listings

Latest Draw 104, Lahore: Top 758760.

Outcomes released post-event by authorities.

- Verified info: Open process.

- Highlights:

- 🏅 Top: Rs. 750,000.

- 📣 Media broadcasts.

Current 200 Prize Bond Listing

Recent: Secondary winners 033045 et al.

- Winners table:

| Level | Numbers |

|---|---|

| Top | 758760 |

| Secondary | 033045, 487574, etc. |

200 Prize Bond Listing for Draw 102 Now

Archived for reference.

- Advice: Timely claims.

Reward Framework for Rs. 200 Events

Comparative: Primary Reward for 1500 Bond?

Rs. 3,000,000 for Rs. 1500, versus Rs. 750,000.

- Scaling: Proportional.

Comparative: Tertiary Reward for 750 Bond Listing?

Rs. 9,300 for Rs. 750, against Rs. 1,250.

- Info: Broader distribution.

Comparative: Tertiary Reward for 1500 Bond?

Rs. 18,500.

- Points: Elevated for larger.

Related: Reward Amounts for 25000 Premium Prize Bond

Top Rs. 30,000,000 plus yields.

- Hybrid: Dual benefits.

Count of 25,000 Rewards in Premium Bonds?

1 top, 3 secondary, 700 tertiary.

- Structures: Denomination-specific.

Result Retrieval

PDF Download for Rs. 200 Prize Bond Listing

Official sites offer PDFs.

- Guide: Number search.

PDF for Prize Bond 200 Listing

Inclusive of all victors.

- Access: Gratis.

PDF for 200 Prize Bond Listing

Detailed tertiary.

- Formats: Multi-page.

PDF for 1500 Prize Bond 200 Listing

Cross-references.

- Utility: Comparisons.

PDF for 750 Prize Bond 200 Listing

Analogous.

- Archives: Digital.

Online PDF Check for Prize Bond 200 Listing

Viewer-compatible.

- Innovations: App integrations.

Methods to Verify Rs. 200 Prize Bond Outcomes

Digital Verification Approaches

How to Verify 200 Prize Bond?

Access savings.gov.pk, submit serial.

Quickest for Rs. 200 confirmation.

- Facts: Instantaneous.

- Steps enumerated:

- Site navigation.

- Category selection.

- Number entry.

How to Verify Prize Bond Serials?

Portal input for bonds.

- Tools:

- 🔎 Dedicated searcher.

- 📲 Device-friendly.

Online Prize Bond Verification

Cost-free, immediate.

- Warnings: Fraud avoidance.

Possible to Verify Prize Bond Digitally?

Affirmative, official avenues.

- Recommendations: Solely trusted.

Process for Digital Prize Bond Verification?

Utilize search on portal.

- Security: Encrypted.

Related: Verifying 750 Prize Bond?

Identical methodology.

- Commonalities: Unified.

Verifying Prize Bond Victors?

Full listings on results.

- Views: PDF or enumerated.

Traditional and Hands-On Checks

Locating Bond Serial Number?

Printed on certificate.

- Instructions: Physical inspection.

Personal Prize Bond Check?

Bank visit with document.

- Benefits: Verified in-person.

Assessing Bond Worth?

Always nominal; extras via rewards.

- No growth: Static.

Utilities and Aids

Online Check for 200 Prize Bond Listing

Specific sections for Rs. 200.

- Archives: Extensive.

Online Check for Last 6 Years 200 Prize Bonds 750

Inter-category.

- Searches: Enhanced.

Rs. 200 Prize Bond Listing 750

Associated.

- Comparisons: Useful.

Rs. 200 Prize Bond Listing 1500

Likewise.

- Downloads: PDFs.

Online Check for Prize Bond Listing 200

Portals.

- Advances: AI aids emerging.

PDF for Prize Bond Listing 200

Printable.

- Records: Personal.

PDF Download for Prize Bond Listing 200

Available.

- Resources: Organized.

Prize Bond Listing 200 for 750

Merged.

- Tables: Informative.

Redeeming Rs. 200 Prize Bond Rewards

Redemption Procedure

Claiming Personal Prize Bond?

Present at center with identification.

Involves authentication, fiscal cut.

- Details: Swift for minors.

- Requirements:

- 📑 ID duplicate.

- 🏠 Designated sites.

Receiving Prize Bond Funds?

Bank deposit or cash post-approval.

- Modes: Size-dependent.

Claiming Prize Bond Funds?

Form submission, evidence.

- Efficiency: Minor quick.

Redeeming Prize Bond Rewards?

As above.

- No charges: Free.

Obtaining Winning Funds in Pakistan?

Via institutions.

- Example: Lahore winner instant Rs. 1,250.

Cashing Prize Bond in Pakistan?

At sales points.

- Novel study: Swift urban claims.

Redeeming Prize Bonds?

Separate for base or rewards.

- Flexibility: No deadlines for base.

Duration for Prize Bond Claim?

1-2 weeks major, immediate minor.

- System: Streamlined.

Qualification and Deadlines

Age Limit for Claimable Prize Bonds?

Six years post-event.

- Urgency: Prompt action.

Expiration of Prize Bonds in Pakistan?

Bonds perpetual, rewards time-bound.

- Checks: Status verification.

Refundability of Prize Bond?

Affirmative, nominal anytime.

- Ease: Straightforward.

Cashing Personal Prize Bond?

Penalty-free.

- Liquidity: Key perk.

Selling Prize Bond?

Unofficial, cautious.

- Risks: Advised against.

Cashing Prize Bonds?

Yes, outlets.

- Processes: Tabulated steps.

Alerts and Communication

Contact from Prize Bonds for Winners?

Self-check required.

- Initiative: User-driven.

Notification for Prize Bond Wins?

Proactive needed.

- Rationale: Confidentiality.

Winner Contact by Prize Bonds?

Absent.

- Tools: Digital.

Identifying Winning Prize Bond?

Official listings.

- Methods: Varied.

Fiscal Consequences on Rs. 200 Prize Bond Rewards

Pakistan’s Taxation Guidelines

Related: Tax Amount on 750 Prize Bond?

15% filers, 30% non-filers.

Withheld on rewards.

- Updates: Rate adjustments.

- Rates:

- 📊 Filers: 15%.

- 📉 Non: 30%.

Tax on 750 Prize Bond?

Identical.

- Promotion: Filing incentive.

Deduction on Lottery Gains in Pakistan?

15-30%.

- Applications: Pre-disbursement.

Bond Deductions?

Rewards only.

- Principal: Exempt.

Prize Money Deductions?

Filer-based.

- Chart:

| Category | Percentage |

|---|---|

| Filer | 15% |

| Non-Filer | 30% |

Bond Tax Liability?

On reward sum.

- Net: Post-cut.

Tax-Free Status of Prize Bond Gains?

Taxed.

- Mandatory: Automatic.

Taxability of Prize Bond Gains?

Income-classed.

- Reporting: Returns.

Taxation Method for Prize Bond Gains in Pakistan?

Source withholding.

- Oversight: FBR.

Tax Percentage on Prize Money?

15 or 30.

- Stats: Non-filer hikes.

Tax on Bond Gains?

Yes.

- Obligations: Universal.

Exemptions and Non-Taxed Elements

Tax-Free Prize Bonds?

Base exempt, rewards not.

- Attraction: Savers.

Fully Tax-Exempt Bonds?

None.

- No waivers: Standard.

Taxation on Gift Receipt?

Gifts potentially exempt, rewards not.

- Categories: Separate.

Tax Obligation on Gift Funds?

Amount-dependent; rewards always.

- Guidance: FBR consult.

Regulatory and Faith-Based Views on Rs. 200 Prize Bonds

Pakistani Legality

Ban on 200 Prize Bond Today in Pakistan?

Operational, no prohibition.

Governed schemes.

- Assurances: SBP.

- Aspects:

- ⚖️ Compliant.

- 📜 Low-value free.

Ban on 750 Prize Bond Today?

None.

- Focus: High-value curbs.

Ban on 1500 Prize Bond Today?

Active.

- Listings: Current.

Legality of Lottery in Pakistan?

State-sanctioned yes, private no.

- Context: Faith-aligned.

Current Available Prize Bonds in Pakistan?

100 to 1500.

- Table:

| Value | Status |

|---|---|

| Rs. 200 | Active |

Availability of 25,000 Prize Bond in Pakistan?

Premium yes, standard limited.

- Updates: Verify.

Availability of 40,000 Bond in Pakistan?

Premium yes.

- Targets: Wealthier.

Faith Perspectives

Halal or Haram Status of Prize Bond in Pakistan?

Debated; many view as haram for chance element.

Islamic finance discussions.

- Opinions: Deoband haram.

- Views:

- 🕌 Permissible some.

- 🚫 Prohibited majority.

Halal Status of Premium Bond?

Haram for interest.

- Concerns: Riba.

Halal or Haram for Premium Bonds?

Haram.

- Scholarly: Consensus.

Gambling Nature of Prize Bonds?

Resembles per fatwas.

- Similarity: Qimar.

Muslim Ownership of Bonds?

Type-dependent; no-interest maybe.

- Advice: Scholarly.

Protection and Hazards

Safety Level of Prize Bonds?

High, state-guaranteed.

- Superior: To equities.

Prize Bond Safety?

Robust, regulated.

- Networks: SBP.

Guarantee on Prize Bonds?

Base yes.

- Redemptions: Assured.

100% Safety of Premium Bonds?

Yes, interest aside.

- Secure: Investments.

Complete Risk-Free Bonds?

Low-risk prize.

- Risk table:

| Hazard | Degree |

|---|---|

| Capital Loss | Zero |

Investment Risks in Prize Bonds?

Win odds low, alternative costs.

- No yields: If unwon.

Purchase Risks for Prize Bonds?

Fakes minimal.

- Sources: Authorized.

Fate of Prize Bonds Post-Death?

Heir transfer.

- Processes: Nominations.

Bond Handling After Owner Demise?

Legal inheritance.

- No forfeiture: Continued.

Ownership of Prize Bonds?

Holder or nominee.

- Storage: Safe.

Financial Perspectives on Rs. 200 Prize Bonds

Yields and Returns

Interest Payment by Prize Bonds?

None, rewards only.

Interest-absent, draw-reliant.

- Sharia: Debated.

- Traits:

- 🚫 Fixed no.

- 🎲 Chance.

Earnings of Interest on Prize Bonds?

Absent.

- Alternatives: Riba-free.

Monetary Gains from Bonds?

Rewards solely.

- Potentials: Variable.

5% Bond Rule Explanation?

Irrelevant; no yields.

- Differences: Traditional.

Bonds Offering 7.5% Interest?

T-bills, not prize.

- Comparisons: Options.

30-Year Bond Yields?

Vary; prize static.

- Planning: Diversify.

Value of $100 Bond After 30 Years?

Nominal plus; prize unchanged.

- Calculations: Inflation.

Largest Premium Bond Reward?

Rs. 30,000,000.

- Impacts: Transformative.

Outcome of 1 Million Win on Premium Bonds?

Taxed disbursement.

- Scenarios: Planning.

Alternatives Comparison

Superiority of Bond Over FD?

Prize thrill vs. FD steadiness.

- Preferences: Risk.

Better Choice: FDs or Bonds?

FDs reliable, bonds adventurous.

- Interest: Present in FDs.

Investment Merit of Bonds?

Diversification yes.

- Pros/cons: Balanced.

$1000 Monthly Investment for 5 Years Outcome?

Prize chances; FD compounds.

- Projections: Varied.

Optimal Bond Cashing Time?

Flexible, draw-consider.

- Hold: Opportunities.

Five Bond Varieties?

Gov, corp, mun, prize, premium.

- Classifications: Diverse.

Banks with 7% Savings Interest?

Current vary.

- Competitive: Rates.

Victory Approaches

Winning Probabilities on Bonds?

Millions for top, better minor.

- Improvements: Quantity.

Winning Prize Bond Method?

Random, no sure.

- Tactics: Bulk.

Top Lottery Tactic?

Number spread.

- Luck: Core.

Pakistan’s Highest Prize Bond?

Rs. 40000 premium.

- Stakes: Max.

Prize Bond Limit in Pakistan?

Unlimited buys.

- Encouragement: Savings.

Peak Prize Bond Cost?

Rs. 40000 nominal.

- Ranges: Listed.

Associated Subjects and Parallels

Typical Concerns and Inquiries

Frequent Issues with RS 200?

Falsifications, misplacements.

Delays in checks.

- Solutions: Reporting.

- Features:

- 🔒 Anti-fake.

- 📞 Support.

Daily Commute Comfort of RS 200?

Motorcycle mix-up; bond-irrelevant.

- Focus: Finance.

RS 200 Top Velocity?

Non-bond.

- Irrelevant: Skip.

Wider Fiscal Setting

Income Tax Cycle?

July-June.

- Deadlines: Filing.

Safety of Funds in Premium Bonds?

Guaranteed.

- Similar: Standards.

Commonly Posed Questions (FAQs) on Rs. 200 Prize Bond Listings

Reward for 200 Bond?

Rs. 1,250 to 750,000.

Verifying 200 Prize Bond?

Site or center.

Ban on 200 Prize Bond Today?

No.

Claiming Prize Bond?

Center submission.

Claimable Age for Prize Bond?

6 years.

Receiving Prize Funds?

Post-tax transfer.

Winner Contact by Prize Bonds?

No.

Wrap-Up: Enduring Appeal of Rs. 200 Prize Bond

Core Points Recap

Secure, thrilling savings via Rs. 200 bonds.

Prospective for Prize Bonds in Pakistan

Digital growth, sustained interest.

Add a Comment