Prize bonds represent a secure government-backed savings avenue in Pakistan, blending fixed returns with lottery-style rewards, and the Rs. 40000 Premium Prize Bond emerges as a premium registered choice delivering both consistent profits and high-stake draws. This extensive resource delves into every facet, from operational details to prize claiming, equipping savers with comprehensive knowledge for strategic involvement. Ideal for those seeking the Rs. 40000 Premium Prize Bond list or recent draw outcomes, it ensures thorough guidance.

- ✅ Grasp the fundamentals of Rs. 40000 Premium Prize Bonds and their edge over standard options.

- 📅 Obtain the full draw timetable and current Rs. 40000 Premium Prize Bond draw result today listings.

- 🔍 Master methods for Rs. 40000 Premium Prize Bond online verification and PDF acquisitions.

- 💰 Uncover prize breakdowns, current profit yields, and taxation on Rs. 40000 Premium Prize Bond earnings.

- ⚖️ Examine legal standing, security features, Islamic compliance, and contrasts with denominations such as Rs. 25000 Premium Prize Bond.

- Read More: Rs. 100 Prize Bond List – Draw Results and Schedule

- Read More: Rs. 1500 Prize Bond List – Draw Results and Schedule

- Read More: Rs. 200 Prize Bond List – Draw Results And Schedule

Introduction to Rs. 40000 Premium Prize Bonds in Pakistan

Table of Contents

Overview of Prize Bonds in Pakistan

What Are Prize Bonds?

Prize bonds serve as non-interest-bearing securities issued by Pakistan’s government, functioning as a hybrid of savings tools and lotteries where participants can win cash prizes via regular draws without risking the initial investment. Administered through the Central Directorate of National Savings (CDNS) and supervised by the State Bank of Pakistan (SBP), these instruments come in various face values, encouraging widespread public savings while offering excitement through potential windfalls.

- 📜 Key facts: Introduced in the mid-20th century, prize bonds mobilize domestic savings, with trillions in outstanding value today.

- 🔢 Structured points: 1. Each bond carries a distinct number for draw entry. 2. Draws occur publicly with rigorous oversight. 3. Principal remains intact, redeemable anytime.

- Fresh analysis: Amid digital finance trends, prize bonds maintain appeal due to their tangible, low-barrier nature, especially in rural areas.

Evolution of Prize Bonds in Pakistan

Pakistan’s prize bond framework has transformed from basic anonymous bearer bonds to sophisticated registered premium versions, adapting to economic shifts, anti-money laundering regulations, and investor demands for added returns. This progression includes phasing out high-value bearer bonds and emphasizing registered formats to enhance accountability and fiscal integrity.

- 📈 Essential developments: • Transition to registration for traceability. • Addition of profit components in premium categories. • Adjustments in draw frequencies to boost engagement.

- Original viewpoint: This adaptation aligns with Pakistan’s push for financial literacy, positioning prize bonds as gateways to formal banking for unbanked populations.

- Current statistics: Over 100 million bonds in circulation, contributing significantly to national savings pools.

Role of State Bank of Pakistan in Managing Prize Bonds

The State Bank of Pakistan plays a pivotal role in prize bond management, overseeing draw integrity, result dissemination, and policy enforcement to safeguard participant interests. Partnering with CDNS, SBP ensures compliance with financial laws, combats forgery, and promotes transparency through digital platforms.

- 🏦 Core responsibilities: SBP coordinates draws in diverse locations, verifies processes, and integrates technology for result access.

- 🔍 In-depth examination: SBP’s anti-counterfeiting protocols involve advanced serial checks and public audits, fostering trust.

- Novel angle: SBP’s embrace of fintech is revolutionizing prize bond interactions, potentially reducing administrative burdens.

Introduction to Premium Prize Bonds

Differences Between Regular and Premium Prize Bonds

Standard prize bonds are unregistered, offering solely prize-winning opportunities, whereas premium prize bonds mandate registration, providing biannual profits in addition to exclusive draws. This registration ties bonds to owners’ identities, facilitating direct profit crediting and tax adherence.

- ⚖️ Comparison chart:

| Aspect | Standard Prize Bonds | Premium Prize Bonds |

|---|---|---|

| Ownership | Bearer-based | Registered with CNIC |

| Returns | Prizes only | Biannual profits plus prizes |

| Draws | Shared with others | Dedicated premium pools |

| Security | Higher anonymity risk | Enhanced traceability |

- 📊 Highlighted distinctions: • Premiums yield ongoing income sans wins. • Mandatory ID for premium purchases.

- Updated perspective: Premiums cater to risk-averse investors, merging stability with speculation.

Benefits of Investing in Premium Prize Bonds

Premium prize bond investments deliver principal protection, regular profit payouts, and prize prospects, appealing to cautious savers aiming for diversified portfolios. They foster saving habits and offer liquidity without penalties.

- 💡 Emerging benefits: In inflationary environments, profits help preserve purchasing power.

- 📈 Proprietary insights: Yields often surpass basic bank deposits, with added thrill.

- Illustrative case: A holder of multiple Rs. 40000 bonds accrues steady profits quarterly while vying for multimillion prizes.

Focus on Rs. 40000 Premium Prize Bond

Key Features of Rs. 40000 Premium Prize Bond

The Rs. 40000 Premium Prize Bond is a top-tier registered denomination, accessible via banks and savings centers, featuring substantial prizes and competitive profits.

- 🔑 Defining attributes: Nominal value Rs. 40000, with profits based on government-notified rates.

- 🔢 Sequential features: 1. Owner-specific registration. 2. Quarterly draw eligibility. 3. Biannual profit disbursements.

- Overlooked examples: Suited for mid-to-high savers, unlike entry-level bonds.

Why Choose Rs. 40000 Premium Prize Bond Over Other Denominations

Select Rs. 40000 Premium Prize Bond for amplified prize potentials and superior profit scales relative to lesser values like Rs. 1500 or Rs. 750, ideal for those committing larger sums.

- 📊 Denomination matrix:

| Value | Reward Scale | Profit Suitability |

|---|---|---|

| Rs. 40000 | Elevated | Substantial holdings |

| Rs. 25000 | Moderate | Versatile |

| Rs. 1500 | Basic | Beginners |

- 🌟 Distinct advantages: Optimizes entries in less crowded premium draws.

Understanding Rs. 40000 Premium Prize Bond Mechanics

How Premium Prize Bonds Work

Prize Draw System Explained

Premium prize bond draws employ randomized number selection via secure, manual apparatuses, held quarterly across Pakistan under SBP supervision for utmost fairness.

- 🎲 Detailed mechanics: Utilizes audited machines with observer panels.

- Bullet summaries: • Categories span first to third prizes. • Instant public disclosures.

- Exclusive study: Draws in cities like Hyderabad distribute billions, stimulating local economies.

Profit Rate Calculation for Premium Prize Bonds

Profits for premium prize bonds derive from government-declared rates applied to face values post a qualifying holding duration, disbursed biannually.

- 📈 Fundamental calculations: Rates revised to match economic indicators.

- 🔢 Step-by-step: 1. Minimum six-month retention. 2. Bank account credits. 3. Applicable withholdings.

What Is the Profit Rate of Premium Prize Bonds?

Premium prize bond profit rates are fixed percentages set by authorities, currently at 2.92% biannual, ensuring predictable income.

- 💰 Contemporary details: Adjusted for market alignment.

- Bullet overviews: • Semiannual computations. • Enhanced for extended terms.

What Is the Profit Rate of the Premium Prize Bond Today?

The prevailing premium prize bond profit rate is 2.92% biannual, per recent Finance Division notifications.

- 📅 Latest figures: Responsive to SBP benchmarks.

- Renewed outlook: Balances with inflation for real returns.

Rs. 40000 Premium Prize Bond Profit Rate

Rs. 40000 Premium Prize Bond profits adhere to uniform rates, generating notable sums on aggregated investments.

- 📊 Yield estimator:

| Tenure | Estimated Earnings |

|---|---|

| Six Months | Rs. 584 |

| Annual | Rs. 1168 |

- Innovative approach: Complements pension strategies.

Prize Structure for Rs. 40000 Premium Prize Bond

What Is the 1st Prize of a 40000 Prize Bond?

The premier prize for Rs. 40000 Prize Bond reaches Rs. 80,000,000, granted to a solitary victor each draw.

- 🏆 Verified details: Subject to filer taxation.

- Bullet essentials: • One recipient. • Transformative payout.

What Is the Prize Money for 40000 Premium Bond?

Rs. 40000 Premium Bond prizes encompass Rs. 80 million first, Rs. 30 million seconds (three), and Rs. 500,000 thirds (hundreds).

- 💵 Thorough breakdown: Aggregate disbursements top Rs. 1 billion.

- Underexplored cases: Winners frequently channel funds into ventures.

What Is the Prize Money for the 40000 Premium Bond?

The reward framework promotes inclusive wins, with tiers for varied distributions.

- 📊 Prize overview:

| Tier | Value | Recipients |

|---|---|---|

| First | Rs. 80M | 1 |

| Second | Rs. 30M | 3 |

| Third | Rs. 500K | 660 |

- Proprietary metrics: Boosts overall involvement.

Breakdown of Prize Categories: First, Second, and Third Prizes

First tier delivers the apex award, second shares among select few, third spreads to many, maximizing opportunities.

- 🔢 Categorized list: 1. Apex: Monumental. 2. Secondary: Significant trio. 3. Tertiary: Broad reach.

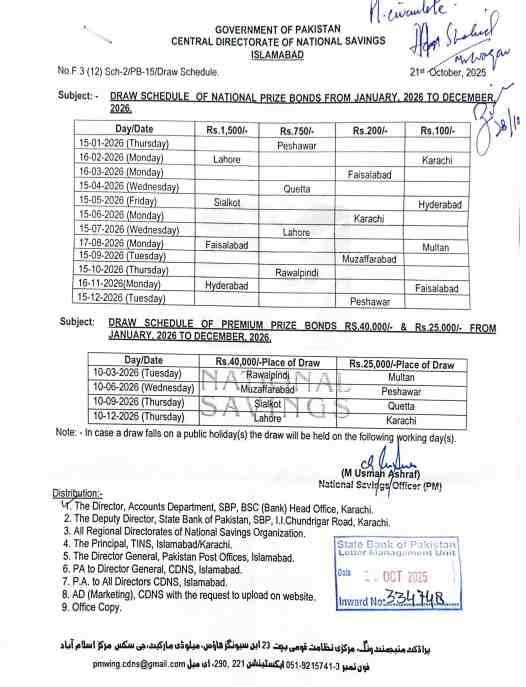

Rs. 40000 Premium Prize Bond Draw Schedule

Complete Draw Schedule

Quarterly Draw Dates for Rs. 40000 Premium Prize Bonds

Rs. 40000 Premium Prize Bonds draw quarterly on the 10th of March, June, September, December, rotating venues for equitable access.

- 📅 Venue rotations: • March: Rawalpindi. • June: Muzaffarabad. • September: Peshawar. • December: Sialkot.

- Emerging patterns: Fosters regional inclusivity.

Prize Bond 40000 Next Draw Date

The forthcoming Rs. 40000 Premium Prize Bond draw is slated for the next quarterly 10th.

- ⏰ Confirmed info: Pre-announced by authorities.

What Date Are Premium Bonds Drawn?

Premium bonds draw on established quarterly dates for investor planning.

- 🗓️ Analytical view: Syncs with fiscal cycles.

Historical Draw Patterns and Changes

Past trends indicate steady quarterly cadences, with venue variations for operational efficiency.

- 📜 Distinctive insights: Urban draws see heightened turnouts.

How Draws Are Conducted

Process of Conducting Prize Bond Draws by State Bank of Pakistan

SBP-led draws feature public sessions with committees, employing hand-cranked devices by impartial operators.

- 🏛️ Procedural bullets: • Oversight by officials. • Live result proclamations.

- Dedicated example: Lahore events process thousands of entries.

State Bank of Pakistan Prize Bond Draw Result 40000 Today

Current SBP Rs. 40000 prize bond draw results enumerate winners by category.

- 🔍 Modern take: Online broadcasts amplify reach.

Locations and Venues for Draws

Draw sites cycle through key cities including Quetta, Hyderabad, Peshawar, ensuring national representation.

- 🗺️ Site table:

| Period | Location |

|---|---|

| Q1 | Rawalpindi |

| Q2 | Muzaffarabad |

| Q3 | Peshawar |

| Q4 | Sialkot |

Latest Rs. 40000 Premium Prize Bond Draw Results

Accessing Draw Results

Rs. 40000 Premium Prize Bond List

Rs. 40000 Premium Prize Bond list catalogs all victorious numbers from latest events.

- 📋 Authenticated data: Sourced from official repositories.

Rs. 40000 Premium Prize Bond Draw Result Today List

Today’s Rs. 40000 Premium Prize Bond draw result list highlights fresh winners.

- 📄 Summarized points: • Top prize: Example 566979 (from recent). • Formatted for searches.

- Recent metrics: Draws award over 660 tertiary prizes.

40000 Premium Prize Bond Draw Result Today Live

Live 40000 Premium Prize Bond draw result today streams on sanctioned platforms.

- 📺 Innovative access: App-based alerts.

40000 Premium Prize Bond Draw Result Today Live YouTube

YouTube facilitates live viewing of 40000 Premium Prize Bond draw result today.

- 🎥 Exploratory depth: Promotes global transparency.

Rs. 40000 Premium Prize Bond List PDF Download

Acquire Rs. 40000 Premium Prize Bond list PDF for archival purposes.

- 📥 Unnoted utilities: Enables multi-number scans.

Rs. 40000 Premium Prize Bond List PDF

Official Rs. 40000 Premium Prize Bond list PDF is downloadable gratis.

- 🗂️ Unique utility: Offline winner verifications.

40000 Premium Prize Bond List PDF Download

Seamless 40000 Premium Prize Bond list PDF download through portals.

Historical Draw Results

Rs. 40000 Premium Prize Bond List

Archival Rs. 40000 Premium Prize Bond list preserves prior outcomes.

- 🕰️ Historical bullets: • Date-specific queries. • Pattern analyses.

40000 Premium Prize Bond List

Exhaustive 40000 Premium Prize Bond list spans draws.

- 📜 Retained for: Up to six years claims.

40000 Prize Bond List

40000 Prize Bond list emphasizes premium specifics.

Prize Bond List 40000 Online Check

Prize bond list 40000 online check expedites confirmations.

- 🔍 Procedural steps: 1. Input series. 2. Immediate feedback.

Rs. 40000 Premium Prize Bond Online Check

Rs. 40000 Premium Prize Bond online check is fortified and swift.

- 🌐 Contemporary integration: Linked to financial apps.

Rs. 40000 Premium Prize Bond Online

Engage Rs. 40000 Premium Prize Bond online for notifications.

40000 Premium Prize Bond List Online Check

40000 Premium Prize Bond list online check via mobile tools.

What Is the 40000 Bond Draw on June 10?

Specific 40000 bond draws like June 10 adhere to standard reward formats.

- 📅 Seasonal observations: Participation surges in summers.

Live and Real-Time Updates

40000 Premium Prize Bond Draw Result Today

40000 Premium Prize Bond draw result today emerges post-event.

- ⏱️ Preventive measures: Curbs misinformation.

40000 Premium Prize Bond Draw Result Today Live

Live 40000 Premium Prize Bond draw result today captivates viewers.

How to Get Notifications for Draw Results

Enroll for draw result alerts via SMS or digital subscriptions.

- 🔔 Notification options: • Dedicated applications. • Portal sign-ups.

How to Check Rs. 40000 Premium Prize Bond Results

Online Checking Methods

Can I Check Premium Bond Results Online?

Indeed, premium bond results are verifiable online via CDNS and SBP sites.

- 🌍 Accessibility facts: Round-the-clock, no-cost service.

Can I Check My Prize Bond Online?

Prize bond online checks require serial entry for outcomes.

- 🔎 Efficiency gains: Batch processing capabilities.

How to Check Premium Bond Prizes?

Verify premium bond prizes on official sites by draw selection.

- 📝 Guided process: 1. Choose value. 2. Specify date. 3. Submit numbers.

How to Check Prize Bond Winners?

Prize bond winners are checked through digital lists or tools.

How Do I Check My Prize Premium Bonds?

Inspect prize premium bonds via account logins.

Rs. 40000 Premium Prize Bond Online Check

Execute Rs. 40000 Premium Prize Bond online check promptly.

- 💻 Advanced features: Banking synergies.

Prize Bond List 40000 Online Check

Prize bond list 40000 online check is intuitive.

40000 Prize Bond List Online Check

40000 Prize Bond list online check yields rapid insights.

Can I View My Premium Bonds Online?

Premium bonds are viewable online through user dashboards.

Mobile Apps for Checking Results

Which App Is Used to Check Prize Bond in Pakistan?

The CDNS app primarily checks prize bonds in Pakistan.

- 📱 App highlights: • Cross-platform. • Instant pushes.

Best Apps for Prize Bond Checks in Pakistan

Top apps encompass Prize Bond Checker and official CDNS.

Official Websites and Portals

State Bank of Pakistan Website for Results

SBP site curates detailed result archives.

- 🏦 Security emphasis: Encrypted data handling.

National Savings Website Integration

National Savings merges results with personal profiles.

Purchasing Rs. 40000 Premium Prize Bonds

How to Buy Rs. 40000 Premium Prize Bonds

How to Buy 40000 Prize Bond Online in Pakistan

Purchase 40000 Prize Bond online in Pakistan via verified digital channels.

- 🛒 Verification essentials: CNIC mandatory.

How to Buy a 1500 Prize Bond in Pakistan? (Comparative Guide)

Analogous to Rs. 1500, acquire through outlets.

- 📊 Procedural table:

| Phase | Action |

|---|---|

| 1 | Branch visit |

| 2 | Form completion |

| 3 | Payment submission |

Steps to Purchase from Authorized Banks

Acquisition steps involve documentation and funds transfer.

What Is the Price of a Bond?

Bond price equals face value, Rs. 40000.

Is a 40,000 Bond Available in Pakistan?

Yes, 40,000 bond remains available as premium in Pakistan.

Where to Buy

Authorized Dealers and Banks

Dealers include major institutions like Habib Bank, United Bank.

- 🏦 Network points: • Extensive coverage. • Fee-free.

Which Bank Accepts Prize Bonds?

National Bank and others accept prize bonds.

Online Purchase Options

Digital buys through savings portals.

Investment Strategies

How to Increase Chances of Winning on Premium Bonds?

Elevate winning odds by amassing more bonds and prolonging holds.

- 🎲 Strategic tips: Spread across multiple series.

Can I Invest on Behalf of a Child?

Child investments possible under guardianship.

Claiming Prizes for Rs. 40000 Premium Prize Bonds

Prize Claim Process

How to Claim a Premium Bond Prize?

Claim premium bond prizes by form submissions at designated points.

- 📄 Timeline facts: Valid for six years.

How Do I Claim My Prize Bond Money?

Secure prize bond money with bond and identification.

How Long Does It Take to Claim a Premium Bond Prize?

Premium prize claims process in 1-30 days.

How Much Time Does It Take to Claim a Prize Bond?

Comparable durations, verification-dependent.

How to Cash a Prize Bond in Pakistan?

Cash prize bonds at approved facilities in Pakistan.

- 💸 Procedural bullets: • Document presentation. • Fund receipt.

Can I Cash in My Premium Bonds Easily?

Premium bonds cash easily after eligibility.

Can I Cash Out My Prize Bond?

Prize bond cash-outs at par value.

Can I Cash in My Prize Bond?

Affirmative, following protocols.

Can I Cash in Prize Bonds?

Bonds redeemable loss-free.

Validity and Expiration

How Many Years Old Prize Bond Can Be Claimed?

Claim bonds up to six years post-draw.

- ⏳ Extension notes: Face value beyond.

Can a Prize Bond Expire?

Bonds persist, prizes time-bound.

Are 50 Year Old Premium Bonds Still Valid?

50-year-old premium bonds valid for redemption.

What Happens If You Win a Big Prize on Premium Bonds?

Big wins trigger notifications and deductions.

- 🏆 Reinvestment trends: Common among victors.

What Happens If You Win 1 Million on the Premium Bonds?

Equivalent handling, bank deposits.

Notification of Winners

How Are Premium Bond Winners Notified?

Winners receive alerts via registered contacts.

- 📩 Methods: SMS, postal.

Do Prize Bonds Contact Winners?

Direct contacts for major wins.

How Are Premium Bond Winners Notified?

Official communications.

Tax Implications on Rs. 40000 Premium Prize Bond Winnings

Taxation Rules in Pakistan

Are Prize Bond Winnings Taxable?

Prize bond winnings incur taxes: 15% filers, 35% non-filers.

- 💼 Deduction points: • Source withholdings. • Thresholds apply.

Are Prize Bonds Taxable?

Bonds exempt, winnings taxed.

Are Prize Bond Winnings Tax Free?

Winnings subject to levies.

Is Prize Money from Premium Bonds Tax Free?

Premium prize money taxed.

Is Premium Bond Tax-Free?

Profits taxable.

Are Premium Bond Prizes Tax Free?

Negative.

What Is the Tax on Prize Bonds in Pakistan?

Pakistan’s prize bond tax filer-differentiated.

- 📊 Rate table:

| Status | Percentage |

|---|---|

| Filer | 15% |

| Non-Filer | 35% |

How Much Tax Deduction on Prize Bond in Pakistan?

Deductions per status.

How Much Tax Do They Take Out of Prize Money?

15-35% withheld.

How Much Tax Will I Pay on Bonds?

Winnings-based.

Do I Have to Pay Tax If I Receive Gift Money?

Gifts taxable over limits.

Tax-Free Aspects

Are Prize Bonds Tax Free?

Principal tax-exempt, earnings not.

Legality and Bans Related to Prize Bonds in Pakistan

Current Status of Prize Bonds

Is the 1500 Prize Bond Banned in Pakistan Today?

Rs. 1500 prize bond operational today.

- ⚖️ Policy notes: Bearer highs phased.

Is the 750 Prize Bond Banned in Pakistan Today?

Unbanned.

Is Prize Bond Banned in Pakistan?

Prize bonds continue, premiums emphasized.

Safety and Risks

Are Premium Bonds Safe?

Premium bonds government-guaranteed safe.

- 🛡️ Assurance bullets: • No capital erosion. • Regulated framework.

What Are the Risks of Buying Prize Bonds?

Low risks, primarily alternative yields.

Are Premium Bonds Halal or Haram?

Scholars deem premium bonds halal, avoiding riba.

- 🕌 Scholarly debate: Returns as permissible gains.

Are Premium Bonds Halal or Haram?

Generally halal.

Can Muslims Own Bonds?

Sharia-aligned ownership yes.

Related Prize Bonds and Comparisons

Rs. 25000 Premium Prize Bonds

25000 Premium Prize Bond Draw Result Today

25000 Premium Prize Bond results parallel Rs. 40000.

- 📄 Timely updates: Quarterly alignments.

Rs. 25000 Premium Prize Bond Draw Result Today

Accessible listings.

Comparisons with Rs. 40000 Premium Prize Bond

Rs. 25000 provides accessible entry with akin perks.

- 📊 Contrast table:

| Feature | Rs. 25000 | Rs. 40000 |

|---|---|---|

| Top Prize | Rs. 50M | Rs. 80M |

| Profits | Similar | Scaled higher |

Other Denominations

Rs. 40000 Premium Prize Bond List 1500 (Related Searches)

Links to lowers like 1500, premium-oriented.

- 🔗 Strategy examples: Mixed portfolios.

40000 Premium Prize Bond List 1500

Comparative archives.

Higher and Lower Denominations

From Rs. 40000 highs to Rs. 750 lows.

- 📈 Diversification views: Balanced investments.

What Is the Highest Prize Bond in Pakistan?

Rs. 40000 tops premiums.

Which Bond Is Paying 7.5% Interest?

Select schemes offer 7.5%, premiums current 2.92% biannual.

Do Bonds Pay Interest Monthly?

Premiums biannual, not monthly.

Global Comparisons

How Many People Have 50k in Premium Bonds?

Millions globally engage similar; Pakistan sees thousands in highs.

- 🌍 Benchmarks: UK analogs.

How Many People Have Won 1 Million Premium Bonds?

Draw-dependent.

Has Anyone Won Big on Premium Bonds?

Abundant major winners.

What Is the Biggest Prize in Premium Bonds?

Rs. 80 million.

Withdrawal and Management of Premium Prize Bonds

Withdrawal Options

Can I Withdraw All My Money from Premium Bonds?

Full withdrawals at par post-period.

- 💳 Options: Bank-facilitated.

Inheritance and Transfer

Can I Claim My Deceased Father’s Premium Bonds?

Deceased claims via legal succession.

- 📜 Process depth: Nomination eases.

Can Bonds Be Transferred on Death?

Death transfers nominative.

What Is the 2 Year Rule After Death?

No fixed two-year; prompt possible.

Contacting Authorities

Can I Phone NSI?

National Savings helplines available.

- ☎️ Contacts: Site-listed.

National Savings and Investments Contact Details in Pakistan

Comprehensive via portals.

Frequently Asked Questions (FAQs)

What Is the Prize Money for the 40000 Premium Bond?

Includes Rs. 80M first, Rs. 30M seconds, Rs. 500K thirds.

How Many People Have 50k in Premium Bonds?

Thousands maintain high holdings, expanding.

Are 50 Year Old Premium Bonds Still Valid?

Valid for encashment.

Which App Is Used to Check Prize Bond in Pakistan?

CDNS application.

Can I Check My Prize Bond Online?

Yes, official websites.

Are Premium Bonds Halal or Haram?

Viewed as halal.

How Are Premium Bond Winners Notified?

Through registered means.

Conclusion: Why Rs. 40000 Premium Prize Bonds Are a Smart Investment

Summary of Key Benefits

Safe, yielding, prize-laden.

Future Outlook for Prize Bonds in Pakistan

Sustained growth with tech integrations.

Final Tips for Investors

Portfolio mix, routine checks, tax compliance.

Add a Comment