With the proliferation of online shopping, having a virtual credit card with you is becoming increasingly important, especially in today’s digitalized world.

While many online vendors and stores will allow you to use your debit card or Visa Card, others don’t accept this form of payment, forcing you to find an alternative solution.

Fortunately, several platforms will allow you to create virtual credit cards in a matter of seconds, making it easy to shop online while keeping your real credit information secure and protected.

Virtual credit cards make it easier to use your computer or phone to shop online, but there are hundreds of virtual card vendors out there, so how can you make sure you choose the best one?

This guide gives you the five best platforms to create virtual credit cards online and use them anywhere in the world for business transactions and for online shopping.

Recommended Reading: Free! How To Get A Credit Card In Pakistan (Beginners Guide)

Best Platforms To Create Virtual Credit Cards

Table of Contents

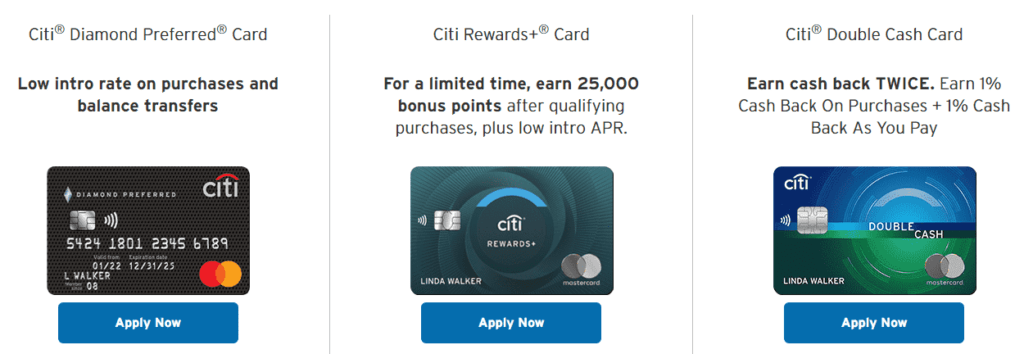

Citi Credit Card

Citi is one of the best platforms to create virtual credit cards online. It offers a lot of flexibility and functionality when it comes to managing your account.

You can compare and create virtual credit cards online for free, which is a great way to test out whether a particular card suits your needs before committing to something more expensive.

To set up an account, you’ll need to provide your personal information like address and phone number, as well as your email address.

You’ll also need to enter the name on the card (which defaults to Citi) but you can change that if you want.

After inputting this information, click ‘Create Account. You’ll receive confirmation that your account was created, and then you can log in to begin creating your first card.

Your first step will be to select a country where the card will be available, followed by entering the person’s first name, last name, and date of birth.

Then you’ll create their CVV code by entering both their security questions (choose two different answers) and their answers into text fields.

Finally, add the billing address – just enter the physical street address – followed by clicking ‘Create Card’.

You’ll then see a screen with details about your new virtual credit card – such as what it’s called and where it is available- as well as any features associated with it.

Recommended Reading: 7 Easy Steps To Get A Loan On Credit Card In Pakistan (Complete Guide)

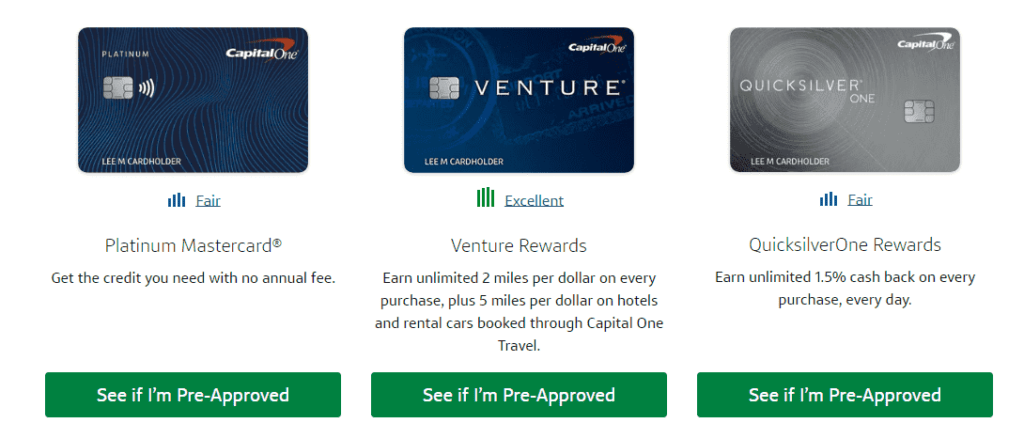

Capital One Credit Card

If you’re looking to create a virtual credit card online Capital One offers a variety of benefits that make it one of the best platforms to create virtual credit cards on.

Capital One also allows customers to use their cards for on-hand transactions as opposed to just online transactions, which is a great feature.

If you are interested in creating an online virtual card with them, follow these steps:

Visit the Capital One website and click Open an Account.

Click Get Started and then select your type of account from the drop-down menu – personal or business accounts are available.

Create your password, choose your security questions, enter your social security number, and provide other information before clicking Create My Account.

You will need to set up two different passwords. One will be used when logging into your account and the other will be used for verification purposes when using your virtual credit card online or making any purchase using it.

After clicking Create My Account, verify your email address by following the instructions sent to you by Capital One.

Next, open up the email from Capital One titled We have some more work to do that was sent to you after creating your account (note this email may be named something different).

Scroll down until you see Getting ready for fraud protection. Select Continue Reading below this title. Capital One also provides an app that makes it easy to create virtual cards on the go.

Once installed, users can create virtual cards directly from their phones without having to go through the entire process outlined above each time.

To install the app go to Settings > General > Software Update and then search for Capital One Mobile Wallet App on the App Store or Google Play Store.

The last step is configuring your card settings so you can start creating a new virtual card online at Capital One’s site if you need one!

Recommended Reading: List Of 11+ Best Credit Cards In Pakistan (Ultimate Guide)

Discover Virtual Credit Card

Virtual credit card services are a great alternative to carrying around physical credit cards.

Especially when you’re traveling abroad, having a virtual credit card is much more convenient and safer than carrying around your actual card.

Plus, these days, many online stores don’t accept physical credit cards anymore.

Luckily, there are a few platforms like Discover, that allow you to create virtual credit cards for free so that you can shop at sites that don’t take regular plastic.

The process to create virtual credit cards online is easy; here’s how:

Firstly, add your basic information for creating virtual credit cards (e.g., name, address, date of birth) at their official website.

Create a unique password and PIN number.

Proceed through the steps to create your virtual credit card by entering payment information including an expiration date and CVV code which is typically located on the back of your physical card.

Once complete, save this file onto a flash drive or email it to yourself as a backup just in case something happens to it.

You should now be able to make purchases wherever Visa debit cards are accepted!

Recommended Reading: Free! How To Get A Credit Card In Pakistan (Beginners Guide)

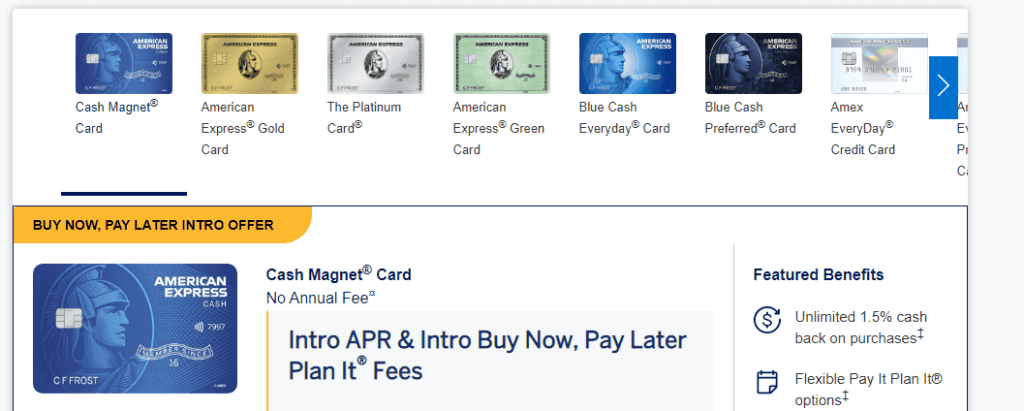

American Express Virtual Credit Card

Step-by-Step Process to Create an American Express Virtual Credit Card Online:

Visit the American Express website.

Click on Log In in the top-right corner of the screen and enter your email address and password in order to log into your account if you already have one or click Sign Up to create a new account.

Once logged in, click on the drop-down menu under My Account in the upper right-hand corner of the webpage and select Virtual Accounts from the list that appears.

You’ll then be taken to a page where you can create virtual credit cards for free with no obligation for now. Choose between Visa, MasterCard, Amex or Diners Club credit cards to get started.

You can also get instant access by signing up for Gold Delta SkyMiles, American Express Card ($95 annual fee) with 35,000 bonus miles after $1,000 spent in 90 days.

The application will then walk you through various aspects of your card such as the name and billing information as well as card number, CVV code, and expiration date before it gets sent off to be approved.

There is a box below the last step which asks if you want to create another virtual credit card. If so, simply check this box and repeat steps two through five until finished creating all desired cards.

When finished, click Create My Cards and confirm the process. Then simply close out of the window to create virtual credit cards for free.

Now you are ready to go online shopping and make online payments using your newly created virtual credit card!

Recommended Reading: How To Apply For A Credit Card In Pakistan (Guide+Tips+FAQs)

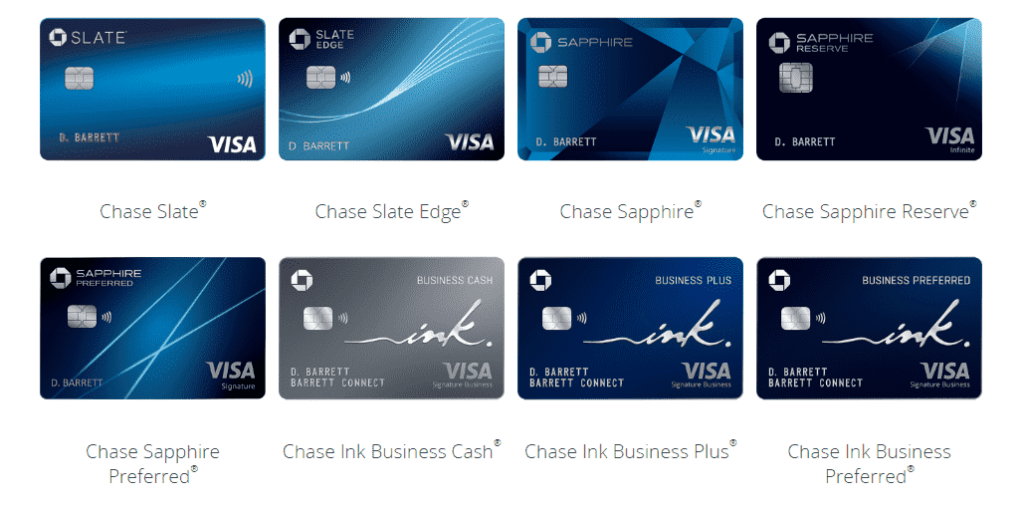

Chase Virtual Credit Card

A virtual credit card is a credit card number assigned to a user that can be used to make purchases online. These cards are generally safer than physical cards and can be easily created with an online platform.

There are many platforms out there that offer services to create virtual credit cards for free, but Chase offers one of the most secure platforms.

There is no cost for creating virtual Chase credit cards and you will need to enter your personal information in order to get started.

When you first enter the site, you will want to click on Create Your Account and then Virtual Card under the Products tab at the top of the page.

Fill in all of the required fields with your personal information and then click submit when finished. You’ll have to agree to their Terms & Conditions before proceeding any further.

Once this step is completed, it’s time to create your first virtual Chase credit card!

Select Create A New Virtual Card under Account Management on the left sidebar and then add your payment information so you can link it to your account.

That’s all there is to it! Creating a virtual credit card with this site is extremely simple and only takes a few minutes– so what are you waiting for?

Recommended Reading: 7 Easy Steps To Get A Loan On Credit Card In Pakistan (Complete Guide)

Pros And Cons Of Virtual Credit Cards

Virtual credit cards (VCCs) are digital versions of physical credit cards that can be used for online purchases. Here are some potential pros and cons of using virtual credit cards:

Pros Of Virtual Credit Card:

- Enhanced security: VCCs are designed to offer a higher level of security compared to physical credit cards. They typically have a unique number and expiration date, which reduces the risk of fraud and unauthorized access to your account.

- Convenient: Since VCCs can be generated and used online, they can be more convenient than physical credit cards, especially when it comes to making online purchases.

- Control over spending: With VCCs, you can set limits on the amount of money that can be spent, and the duration of the card’s validity. This helps you to manage your spending better and avoid overspending.

- No need for physical cards: You don’t have to carry around physical cards, which can be lost or stolen. This also means that you don’t have to worry about your physical card details being skimmed or copied.

Cons Of Virtual Credit Card:

- Limited use: VCCs can only be used for online transactions, and not in physical stores. This can be inconvenient if you need to make purchases in person.

- Restricted merchants: Not all merchants accept VCCs. This can limit your purchasing options and force you to use physical cards in certain situations.

- Fees: Some VCC providers charge fees for generating and using virtual cards. This can add to the overall cost of using VCCs, especially if you use them frequently.

- No rewards: Some VCCs do not offer rewards, such as cashback or points, which can be a disadvantage if you use your credit card for purchases on which you want to earn rewards.

Overall, virtual credit cards can be a useful tool for managing online purchases and protecting yourself from fraud.

However, they may not be suitable for everyone, depending on your spending habits and the type of rewards or benefits you are looking for.

Recommended Reading: List Of 11+ Best Credit Cards In Pakistan (Ultimate Guide)

Virtual Credit Cards FAQs

What are the top 5 virtual credit card companies in the world?

Citi, Capital One, Discover, Chase, and American Express are the top 5 virtual credit card companies in the world

What is the annual fee for an American Express Credit Card?

The annual fee for American Express Credit Cards is 95$ for users with personal credit cards.

What is the annual fee for an American Express Business Credit Card?

The annual fee for American Express Business cards is 695$ per annum.

Minimum Credit score required to get an American Express credit card?

A credit score of about 670 is mandatory to get an American Express Credit card.

What is a virtual credit card?

A virtual credit card is a digital version of a physical credit card that can be used for online transactions. It has a unique number and expiration date, which can be used to make purchases online without revealing your actual credit card details.

How do I get a virtual credit card?

You can get a virtual credit card from your credit card provider or through third-party payment providers that offer VCC services. Some banks offer virtual credit cards as an option for online transactions.

Are virtual credit cards safe?

Virtual credit cards offer enhanced security compared to physical credit cards. Since they are used only for online transactions, they reduce the risk of fraud and unauthorized access to your account.

Additionally, you can set limits on the amount of money that can be spent and the validity of the card.

Can I use a virtual credit card for in-store purchases?

No, virtual credit cards can only be used for online transactions.

Are there any fees for using a virtual credit card?

Some virtual credit card providers may charge fees for generating and using virtual cards. Make sure to check with your provider for any associated fees.

Do virtual credit cards offer rewards?

Not all virtual credit cards offer rewards such as cashback or points. However, some providers may offer rewards for using their virtual credit card services. Make sure to check with your provider for any associated rewards or benefits.

Can I use a virtual credit card for recurring payments?

Yes, you can use a virtual credit card for recurring payments as long as the merchant accepts virtual credit card payments. Just make sure to set the appropriate limits on the card’s validity and the amount that can be charged.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment