Akhuwat Foundation is a non-profit organization that is dedicated to providing interest-free loans to underprivileged communities in Pakistan, and one of the key services it offers is the Emergency Loan program.

The program aims to provide quick and easy access to interest-free loans for individuals and families in crisis, allowing them to meet urgent expenses without having to resort to costly loans with high interest rates.

In this article, we will explore the Akhuwat Foundation Emergency Loan program and its impact on the lives of those it serves.

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

Akhuwat Foundation Emergency Loan | How To Get A 50,000 Loan In Pakistan

Table of Contents

Recommended Reading: Akhuwat Student Loans In Pakistan (10K-50K) {Interest-free}

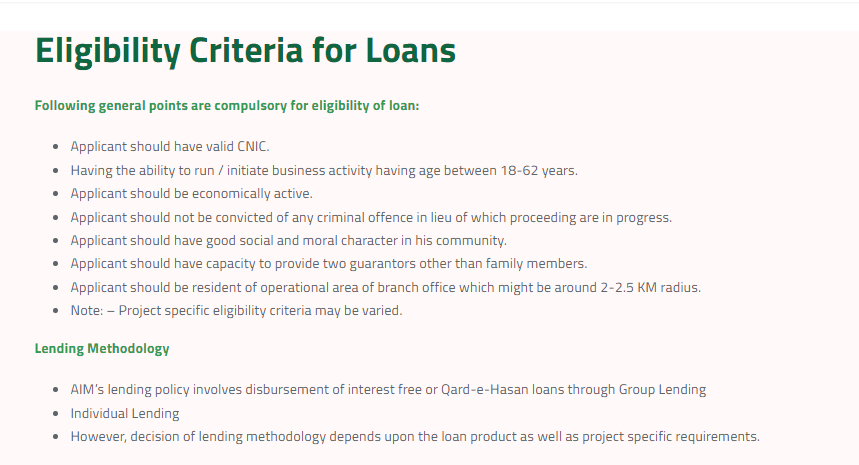

Akhuwat Foundation Emergency Loan Eligibility Criteria

The Akhuwat Foundation Emergency Loan program is designed to provide Islamic microfinance to individuals and families facing unforeseen financial crises in Pakistan.

To be eligible for the program, applicants must meet certain criteria, which are as follows:

- Residency: The applicant must be a resident of Pakistan and provide proof of their current address.

- Age: The applicant must be at least 18 years old.

- Income: The applicant’s monthly income must be less than or equal to the poverty line established by the government of Pakistan.

- Purpose of loan: The loan must be used for a genuine emergency, such as medical treatment, education expenses, or urgent repairs to the applicant’s home.

- Repayment capacity: The applicant must demonstrate that they have the capacity to repay the loan within the stipulated time frame.

- Collateral: The Akhuwat Foundation Emergency Loan program does not require any collateral or security.

- Guarantor: The applicant must provide a guarantor who can vouch for their character and ability to repay the loan.

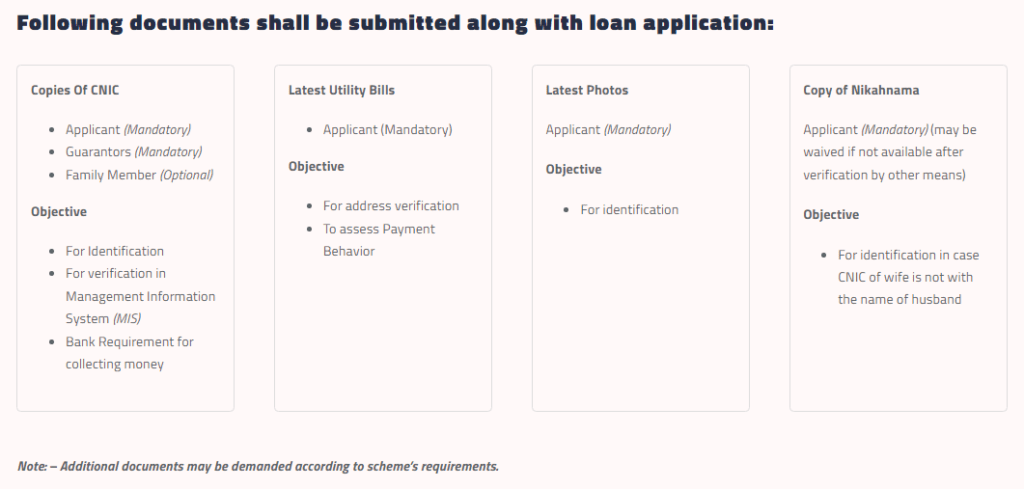

Akhuwat Foundation Emergency Loan Documents Required

To apply for an Akhuwat Foundation Emergency Loan, applicants must provide the following documents:

- National Identity Card (NIC): A valid and up-to-date NIC is required to prove the applicant’s identity and residency in Pakistan.

- Proof of Address: The applicant must provide a utility bill or any other official document that verifies their current address.

- Income Proof: The applicant must provide proof of their monthly income, such as a salary slip or bank statement.

- Emergency Details: The applicant must provide details of the emergency for which they are seeking the loan, such as medical bills, education expenses, or urgent repairs.

- Guarantor’s NIC: The applicant must provide the National Identity Card of their guarantor, who is responsible for ensuring that the loan is repaid on time.

- Guarantor’s Proof of Income: The guarantor must also provide proof of their income to demonstrate their ability to repay the loan in case the applicant is unable to do so.

Recommended Reading: Akhuwat Islamic Microfinance {10K-50K} Akhuwat Interest-free Loans

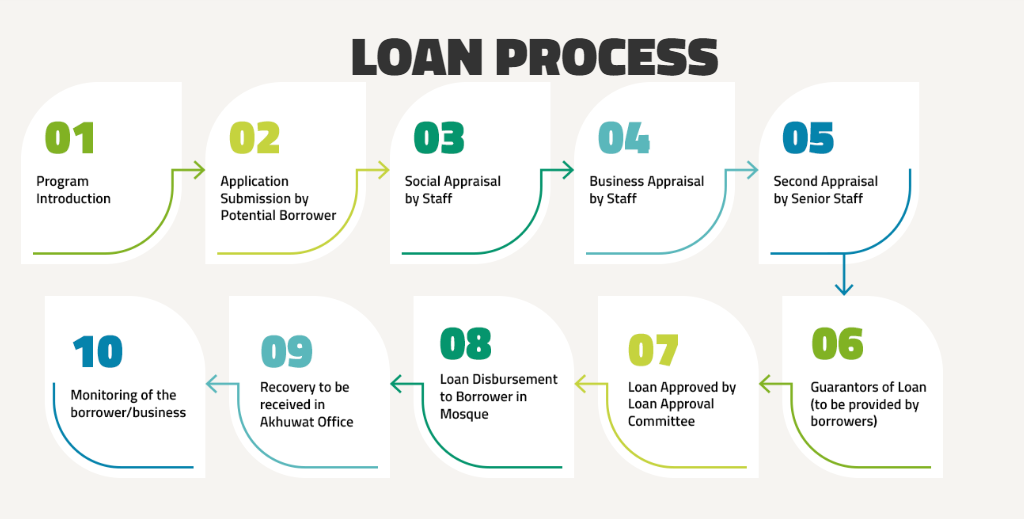

Akhuwat Foundation Emergency Loan Application Process

To apply for an Akhuwat Foundation Emergency Loan, individuals can visit their nearest Akhuwat center and follow the application process outlined below:

- Visit the nearest Akhuwat center: The first step is to locate the nearest Akhuwat center, which can be found on the organization’s website or by calling their helpline. Once identified, the applicant should visit the center and request an application form.

- Fill out the application form: The application form will require the applicant to provide personal details such as their name, address, and contact information, as well as details about their emergency and income.

- Provide necessary documents: Along with the application form, the applicant must provide the necessary documents such as their NIC, proof of address, income proof, and guarantor’s information.

- Apply: After filling out the application form and providing the necessary documents, the applicant should apply to the Akhuwat center.

- Wait for approval: The Akhuwat Foundation will review the application and verify the information provided by the applicant. If the application is approved, the applicant will be notified and asked to sign a loan agreement.

- Receive the loan: Once the loan agreement is signed, the loan amount will be disbursed to the applicant’s bank account or given in cash, depending on the applicant’s preference.

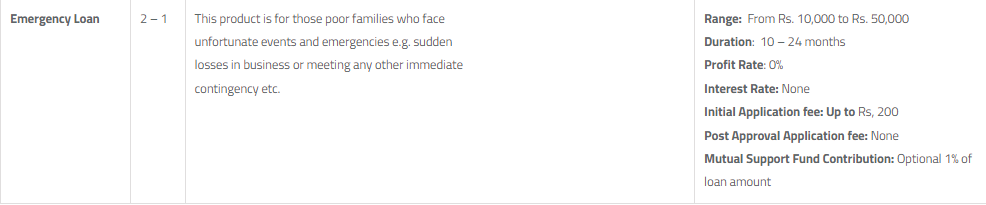

Akhuwat Foundation Emergency Loan Maximum Limit

The maximum limit for an Akhuwat Foundation Emergency Loan varies depending on the applicant’s financial situation and the nature of the emergency for which the loan is being sought. Typically, the loan amount ranges from PKR 10,000 to PKR 50,000.

However, the Akhuwat Foundation Emergency Loan program is designed to provide interest-free microfinance services to individuals and families in crisis, to promote financial inclusion and reduce poverty in Pakistan.

Therefore, the loan amount is determined based on the applicant’s need and their ability to repay the loan within the stipulated time frame.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

Akhuwat Foundation Emergency Loan Pros And Cons

Pros:

- Interest-Free Loans: One of the most significant advantages of the Akhuwat Foundation Emergency Loan program is that it provides interest-free loans to individuals in need. This means that borrowers are not burdened with the additional cost of interest payments, which can often be a significant financial burden.

- Quick Processing: The application process for an Akhuwat Foundation Emergency Loan is quick and straightforward. Borrowers can receive the funds within a few days of submitting their application, which can be particularly helpful in times of financial crisis.

- No Collateral Required: The Akhuwat Foundation Emergency Loan program does not require borrowers to provide collateral or security, which can be especially beneficial for those who do not have valuable assets to use as collateral.

- Flexible Repayment Terms: The repayment terms for Akhuwat Foundation Emergency Loans are flexible, and borrowers can choose a repayment plan that suits their financial situation.

Cons:

- Limited Loan Amount: The loan amount provided by the Akhuwat Foundation Emergency Loan program is limited, which may not be sufficient to cover the entire cost of some emergencies.

- Eligibility Criteria: The eligibility criteria for the Akhuwat Foundation Emergency Loan program are strict, which means that not everyone may qualify for a loan. This can be particularly challenging for those who are facing financial hardship but do not meet the program’s requirements.

- Guarantor Requirement: The Akhuwat Foundation Emergency Loan program requires borrowers to provide a guarantor who can vouch for their ability to repay the loan. This can be a challenge for those who do not have someone who can serve as a guarantor.

- Limited Geographic Coverage: The Akhuwat Foundation Emergency Loan program is currently available only in select cities and towns in Pakistan, which means that not everyone in need may have access to the program.

Recommended Reading: Akhuwat Student Loans In Pakistan (10K-50K) {Interest-free}

Akhuwat Foundation Emergency Loan FAQs

Who is eligible for an Akhuwat Foundation Emergency Loan?

Individuals who are Pakistani citizens and facing an unexpected emergency can apply for an Akhuwat Foundation Emergency Loan.

Applicants must meet the eligibility criteria, including having a reliable source of income, a guarantor, and providing the necessary documents.

What is the maximum loan amount I can get through the Akhuwat Foundation Emergency Loan program?

The maximum loan amount varies depending on the applicant’s financial situation and the nature of the emergency.

Typically, the loan amount ranges from PKR 10,000 to PKR 50,000.

Is there any interest charged on Akhuwat Foundation Emergency Loans?

No, there is no interest charged on Akhuwat Foundation Emergency Loans. The loan is provided interest-free to individuals in need.

What is the repayment period for Akhuwat Foundation Emergency Loans?

The repayment period for Akhuwat Foundation Emergency Loans varies depending on the loan amount and the borrower’s financial situation. However, the repayment period typically ranges from three to twelve months.

How can I apply for an Akhuwat Foundation Emergency Loan?

Individuals can apply for an Akhuwat Foundation Emergency Loan by visiting their nearest Akhuwat center, filling out the application form, and providing the necessary documents.

Once the loan is approved, the borrower will be asked to sign a loan agreement, and the loan amount will be disbursed to their bank account or given in cash.

Can I apply for an Akhuwat Foundation Emergency Loan online?

No, the Akhuwat Foundation Emergency Loan program does not offer an online application process. Individuals must visit their nearest Akhuwat center to apply for a loan.

What happens if I am unable to repay the loan on time?

If a borrower cannot repay the loan on time, they should contact the Akhuwat Foundation immediately to discuss their options. Failure to repay the loan can result in legal action and damage the borrower’s credit score.

Can I apply for another loan after repaying my previous Akhuwat Foundation Emergency Loan?

Yes, borrowers can apply for another loan after repaying their previous loan, provided they meet the eligibility criteria and have a valid reason for seeking another loan.

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment