Akhuwat Islamic Microfinance is a non-profit organization based in Pakistan that provides interest-free loans to low-income households and small businesses.

Akhuwat aims to alleviate poverty and promote social justice by providing financial assistance and support to those who need it most.

The organization operates on the principles of Islamic finance, which prohibit the charging of interest on loans and instead emphasize the sharing of risk and profits between lenders and borrowers.

With its unique model of interest-free lending, Akhuwat has become a popular choice for borrowers who may not have access to traditional financial institutions or who cannot afford high-interest rates.

In this article, we will take a closer look at Akhuwat Islamic Microfinance, its lending methodologies, eligibility criteria, and the pros and cons of its services.

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

Akhuwat Islamic Microfinance | Akhuwat Micro Loans

Table of Contents

Akhuwat Islamic Microfinance Eligibility Criteria

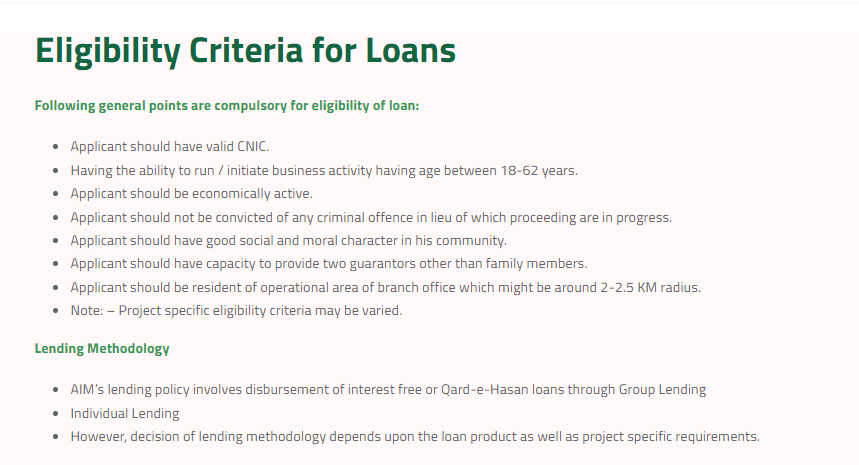

To be eligible for Akhuwat Islamic Microfinance, individuals or businesses must meet certain criteria, which may vary depending on the type of loan or service they are seeking.

Generally, the eligibility criteria for Akhuwat Islamic Microfinance include:

- Low-income status: Akhuwat primarily serves low-income individuals and families, so applicants must demonstrate a need for financial assistance.

- Good character: Applicants must demonstrate good character, honesty, and integrity.

- Ability to repay: Applicants must have a viable source of income and demonstrate the ability to repay the loan or service.

- Resident of Pakistan: Applicants must be a resident of Pakistan and have a valid CNIC (Computerized National Identity Card).

- Adherence to Islamic values: As an Islamic microfinance institution, Akhuwat requires its clients to adhere to Islamic values and principles.

Recommended Reading: Akhuwat Foundation Emergency Loan (10K-50K) {Interest-free}

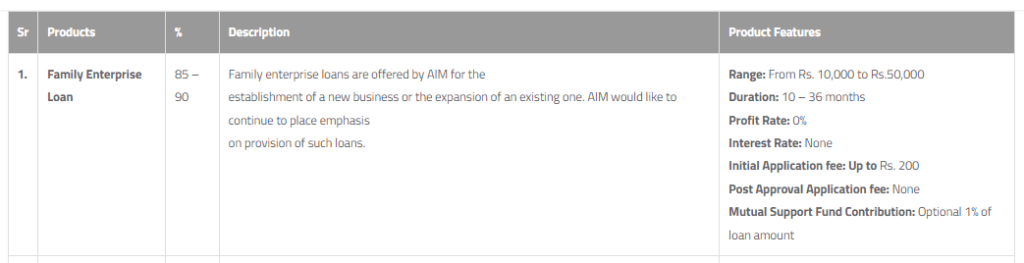

Akhuwat Islamic Microfinance Lending Types

Akhuwat Islamic Microfinance offers both individual lending and group lending methodologies to provide financial services to low-income households and small businesses in Pakistan.

Here is a brief overview of each methodology:

- Individual Lending: Individual lending is a method where Akhuwat provides loans to individuals based on their creditworthiness and ability to repay the loan. The loan is typically used for personal or business needs. The loan is repaid on a set schedule, usually in monthly installments over a period of six to twelve months. Akhuwat does not require any collateral for individual loans but may ask for a guarantor.

- Group Lending: Group lending is a method where Akhuwat provides loans to groups of individuals who come together to form a group, called a “Gharib-e-Mustahiq” group. The group members are jointly responsible for repaying the loan, which is typically used for income-generating activities. The group members receive training on financial management and business skills to ensure the success of their businesses. The loan is repaid on a set schedule, usually in weekly or bi-weekly installments over a period of six to twelve months.

Recommended Reading: Akhuwat Student Loans In Pakistan (10K-50K) {Interest-free}

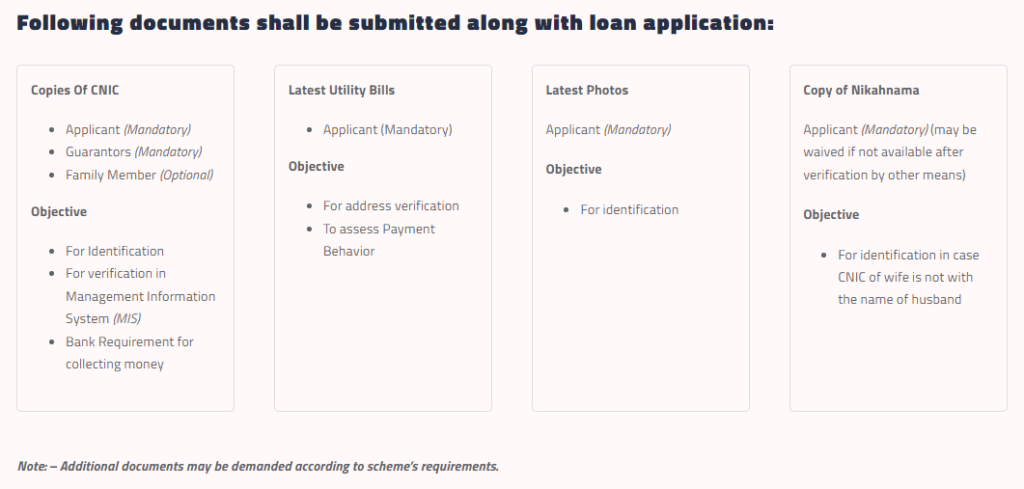

Akhuwat Islamic Microfinance Documents Required

To apply for a loan or service with Akhuwat Islamic Microfinance, applicants will need to provide certain documents, which may vary depending on the type of loan or service they are seeking.

Generally, the required documents for Akhuwat Islamic Microfinance include:

- CNIC (Computerized National Identity Card): All applicants must have a valid CNIC.

- Proof of income: Applicants must provide proof of income, such as pay stubs, bank statements, or income tax returns.

- Proof of residence: Applicants must provide proof of residence, such as a utility bill or rental agreement.

- Business registration documents: If applying for a small business loan, applicants must provide business registration documents, such as a business license or registration certificate.

- Guarantor information: Akhuwat may require applicants to provide information about a guarantor, such as their CNIC and proof of income.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

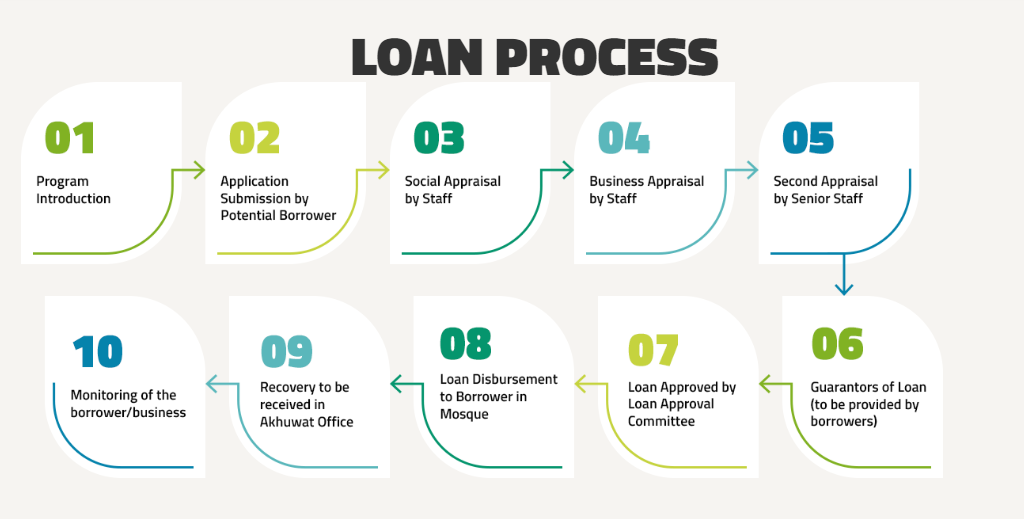

Akhuwat Islamic Microfinance Loan Application Process

The loan application process with Akhuwat Islamic Microfinance typically involves the following steps:

- Visit the nearest Akhuwat center: To apply for a loan or service, individuals or businesses should visit the nearest Akhuwat center. The center staff will provide information about the available loan or service options, eligibility criteria, and required documents.

- Fill out the application form: After selecting a loan or service, applicants will need to fill out an application form. The staff at the center will assist with filling out the form and verifying the required documents.

- Interview with the staff: After submitting the application form and required documents, applicants will need to attend an interview with the Akhuwat staff. During the interview, the staff will assess the applicant’s eligibility, financial needs, and repayment capacity.

- Loan approval: After the interview, if the loan is approved, the staff will inform the applicant of the loan terms and conditions. This includes the loan amount, repayment schedule, and any other relevant details.

- Disbursement of funds: Once the loan terms are agreed upon, the loan amount will be disbursed to the applicant. The staff will also provide information on how to repay the loan and any other required steps.

Recommended Reading: Akhuwat Foundation Emergency Loan (10K-50K) {Interest-free}

Akhuwat Islamic Microfinance Pros And Cons

Akhuwat Islamic Microfinance has several pros and cons, which are outlined below:

Pros:

- Interest-free loans: Akhuwat Islamic Microfinance offers interest-free loans, which makes them more accessible to low-income households and small businesses that cannot afford high-interest rates.

- Flexible loan terms: Akhuwat offers flexible loan terms, including repayment schedules that are customized to the needs of the borrower.

- Quick loan processing: Akhuwat has a streamlined loan application process, which means that loans can be approved and disbursed quickly.

- Focus on social development: Akhuwat places a strong emphasis on social development, providing training and support to borrowers to ensure their success in their businesses or other endeavors.

- Group lending: Akhuwat’s group lending methodology promotes social cohesion and collective responsibility, which can be beneficial in communities where traditional collateral-based lending is not available.

Cons:

- Limited geographic coverage: Akhuwat has limited geographic coverage, with branches primarily located in urban areas of Pakistan.

- Limited loan sizes: Akhuwat’s loan sizes are typically small, which may not be suitable for larger businesses or higher-income individuals.

- Limited range of financial products: Akhuwat’s range of financial products is limited to loans, which may not meet the needs of all potential customers.

- Eligibility criteria: Akhuwat has strict eligibility criteria, which may make it difficult for some borrowers to access their services.

- Guarantor requirements: Akhuwat may require a guarantor for some loans, which can be challenging for borrowers who do not have a guarantor.

Overall, while there are some limitations to Akhuwat’s services, the organization provides a valuable service to low-income households and small businesses in Pakistan, helping them access affordable financial services and support for their businesses or other needs.

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

Akhuwat Islamic Microfinance FAQs

What is Akhuwat Islamic Microfinance?

Akhuwat Islamic Microfinance is a non-profit organization that provides interest-free loans to low-income households and small businesses in Pakistan.

Who is eligible for Akhuwat Islamic Microfinance loans?

To be eligible for Akhuwat loans, borrowers must meet certain criteria, including being a Pakistani citizen, having a verifiable source of income, and meeting other criteria depending on the type of loan.

What types of loans does Akhuwat Islamic Microfinance offer?

Akhuwat offers a range of loans, including personal loans, business loans, agriculture loans, and housing loans.

How does Akhuwat Islamic Microfinance determine loan amounts?

Loan amounts are determined based on the borrower’s creditworthiness, repayment capacity, and other factors.

How long does it take to process a loan application with Akhuwat Islamic Microfinance?

The loan application process typically takes between one and two weeks, depending on the type of loan and other factors.

How does Akhuwat Islamic Microfinance ensure loan repayment?

Akhuwat ensures loan repayment by conducting credit checks, requiring collateral or a guarantor, and using other methods to ensure that borrowers are able to repay their loans.

Can borrowers apply for more than one loan with Akhuwat Islamic Microfinance?

Yes, borrowers can apply for multiple loans with Akhuwat, subject to their repayment history and other criteria.

Is Akhuwat Islamic Microfinance affiliated with any religious or political organizations?

Akhuwat is a non-profit organization and is not affiliated with any religious or political organizations. However, its operations are guided by Islamic principles and values.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment