Akhuwat offers 8 types of interest-free loans including; agriculture loans, business loans, education loans, health loans, marriage loans, emergency loans, orphan support loans, and house loans, etc.

In this article, we will discuss the types of Akhuwat loans and how they are helping to transform lives in Pakistan.

Akhuwat Foundation provides the following loans:

- Akhuwat Loan For Business

- Akhuwat Loan For Agriculture

- Akhuwat Loan For Liberation

- Akhuwat Loan For House

- Akhuwat Loan For Education

- Akhuwat Loan For Health

- Akhuwat Loan For Marriage

- Akhuwat Loan For Emergency

Recommended Reading: Akhuwat Foundation Emergency Loan (10K-50K) {Interest-free}

Akhuwat Foundation Loans | 8 Types Of Akhuwat Loans

Table of Contents

Recommended Reading: Akhuwat Student Loans In Pakistan (10K-50K) {Interest-free}

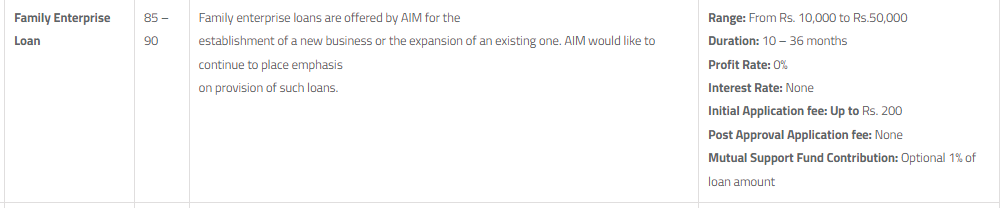

Akhuwat Loan For Business

Akhuwat provides interest-free loans to individuals and groups for a variety of purposes, including for small businesses.

The Akhuwat loan for business is designed to help entrepreneurs start or grow their businesses, providing them with the necessary funds to invest in equipment, inventory, marketing, and other business-related expenses.

Here are some key features and the maximum limit of the Akhuwat loan for business:

Key Features:

- Interest-free loan: Akhuwat loans for businesses are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat loans for business is PKR 10,000 to PKR 50,000, which can be used to start a new business or expand an existing one.

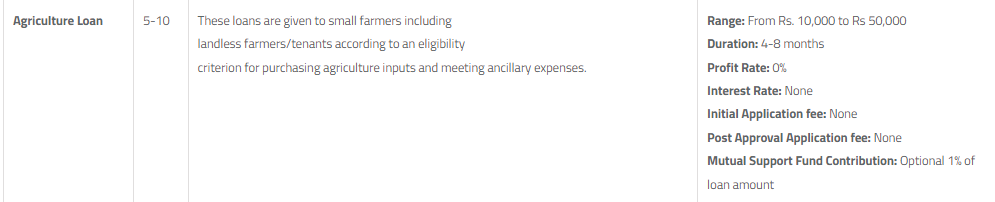

Akhuwat Loan For Agriculture

Akhuwat provides interest-free loans to individuals and groups for a variety of purposes, including for agriculture.

The Akhuwat Foundation loan for agriculture is designed to help farmers and agriculturalists purchase necessary equipment, seeds, and fertilizers, and support other farming-related expenses.

Here are some key features and the maximum limit of the Akhuwat Foundation loan for agriculture:

Key Features:

- Interest-free loan: loans for agriculture are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat for agriculture is PKR 10,000 to PKR 50,000, which can be used to purchase equipment, seeds, and fertilizers, and support other farming-related expenses.

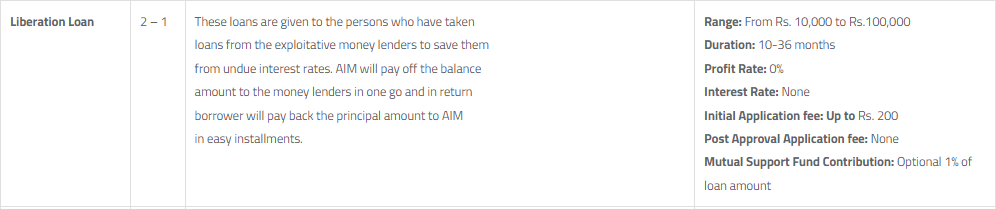

Akhuwat Loan For Liberation

Akhuwat provides interest-free loans to individuals and groups for a variety of purposes, including liberation loans.

The Akhuwat loan for liberation is designed to help individuals and families who have been subjected to the traps of high-interest rates loans, providing them with the necessary funds to set them free from the trap of these nasty lenders.

Here are some key features and the maximum loan limit of the Akhuwat for liberation:

Key Features:

- Interest-free loan: Loans for liberation are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for liberation is PKR 10,000 to PKR 100,000, which can be used to pay off debts and provide the necessary funds to break free from bonded labor.

Recommended Reading: Akhuwat Islamic Microfinance {10K-5OK} Akhuwat Interest-free Loans

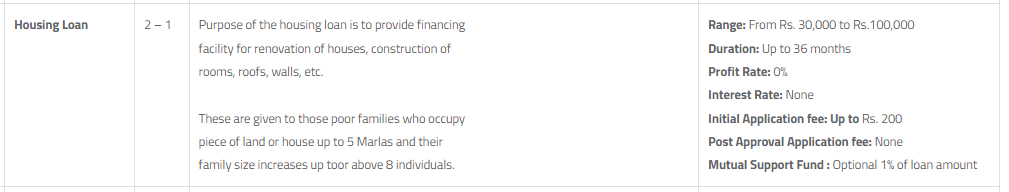

Akhuwat Loan For House

Akhuwat Foundation provides interest-free loans to individuals and groups for a variety of purposes, including for building or improving homes.

The Akhuwat loan for houses is designed to help people build or improve their homes, providing them with the necessary funds to make their living conditions better.

Here are some key features and the maximum limit of the Akhuwat loan for the house:

Key Features:

- Interest-free loan: Akhuwat loans for houses are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat loans for houses is PKR 10,000 to PKR 100,000, which can be used for the construction, renovation, or improvement of a house.

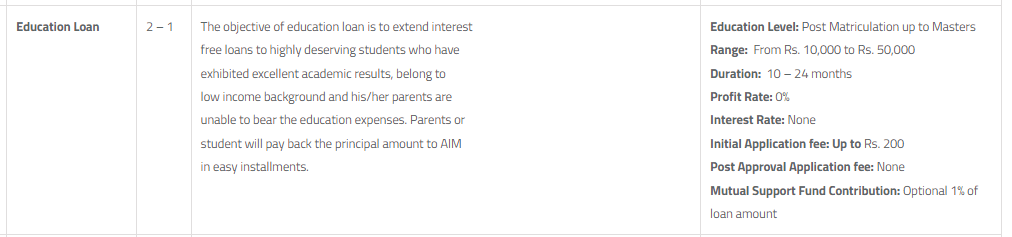

Akhuwat Loan For Education

Akhuwat Foundation provides interest-free loans to individuals and groups for a variety of purposes, including for education.

The Akhuwat loan for education is designed to help students who are unable to afford the high cost of education, providing them with the necessary funds to pursue their academic goals.

Here are some key features and the maximum limit of the Akhuwat loan for education:

Key Features:

- Interest-free loan: Akhuwat loans for education are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for students with limited documentation to apply for loans.

- Maximum loan amount: The maximum loan amount for Akhuwat loans for education is PKR 10,000 to PKR 50,000, which can be used for tuition fees, books, and other educational expenses.

- Support network: Akhuwat provides support networks for borrowers, which can help them to build relationships with others in their community and provide additional support in repaying the loan.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

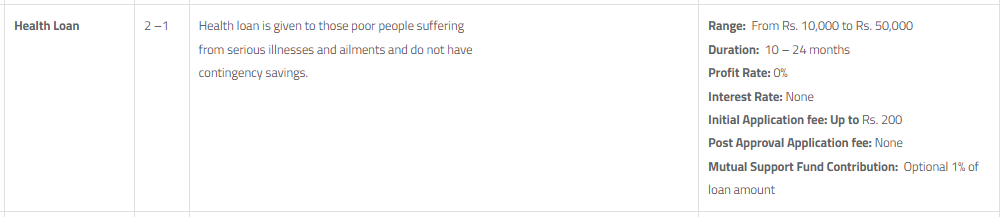

Akhuwat Loan For Health

Akhuwat Foundation provides interest-free loans to individuals and groups for various purposes, including health-related expenses.

The Akhuwat loan for health is designed to help individuals who are facing financial constraints and cannot afford expensive medical treatments or surgeries.

Here are some key features and the maximum limit of the Akhuwat loan for health:

Key Features:

- Interest-free loan: Akhuwat loans for health are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat loans for health is PKR 10,000 to PKR 50,000, which can be used for medical treatments, surgeries, and other health-related expenses.

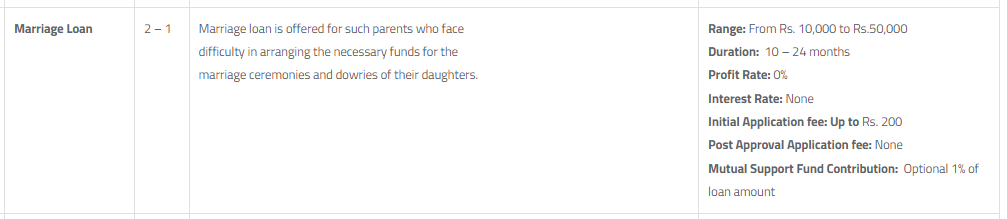

Akhuwat Loan For Marriage

Akhuwat Foundation provides interest-free loans to individuals and groups for various purposes, including for marriage-related expenses.

The Akhuwat loan for marriage is designed to help families who are facing financial constraints and cannot afford the high cost of wedding ceremonies.

Here are some key features and the maximum limit of the Akhuwat loan for marriage:

Key Features:

- Interest-free loan: Akhuwat loans for marriage are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat loans for marriage is PKR 10,000 to PKR 50,000, which can be used for wedding-related expenses such as food, decorations, clothing, and other related expenses.

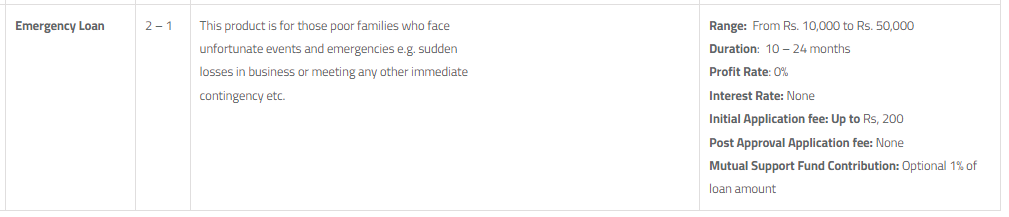

Akhuwat Loan For Emergency

Akhuwat Foundation provides interest-free loans to individuals and groups for various purposes, including emergency-related expenses.

The Akhuwat loan for emergencies is designed to help individuals who are facing unexpected financial emergencies and need immediate financial assistance.

Here are some key features and the maximum limit of the Akhuwat loan for emergencies:

Key Features:

- Interest-free loan: Loans for emergencies are interest-free, which means that borrowers do not have to worry about paying any interest on the loan amount.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, making it easier for individuals with limited documentation to apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Maximum loan amount: The maximum loan amount for Akhuwat for emergencies is PKR 10,000 to PKR 50,000, which can be used for medical emergencies, accidents, home repairs, or other unexpected expenses.

Recommended Reading: Akhuwat Islamic Microfinance {10K-50K} Akhuwat Interest-free Loans

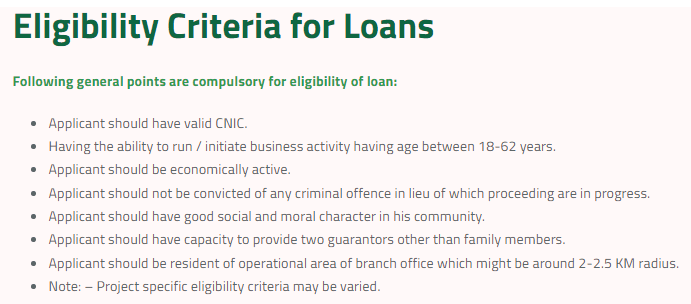

Akhuwat Loan Eligibility Criteria

Akhuwat’s program is designed to help low-income individuals and families in Pakistan who are unable to access traditional banking services.

- Income: Applicants must have a monthly income of less than PKR 25,000.

- Residence: Applicants must be residents of the area where Akhuwat operates its loan program.

- Credit history: Akhuwat does not require applicants to have a credit history or collateral to secure a loan. However, the organization may consider any previous history with Akhuwat or other microfinance institutions.

- Purpose of the loan: Akhuwat offers different types of loans for specific purposes, such as business loans, education loans, and agriculture loans. Applicants must demonstrate that the loan will be used for the intended purpose.

- Guarantor: Applicants must provide a guarantor who can vouch for their character and ability to repay the loan. The guarantor must be a permanent resident of the area and have a monthly income of at least PKR 30,000 (approximately USD 180).

- Repayment capacity: Applicants must demonstrate that they have the capacity to repay the loan. Akhuwat assesses repayment capacity by analyzing the applicant’s income and expenses.

- Age: Applicants must be at least 18 years old.

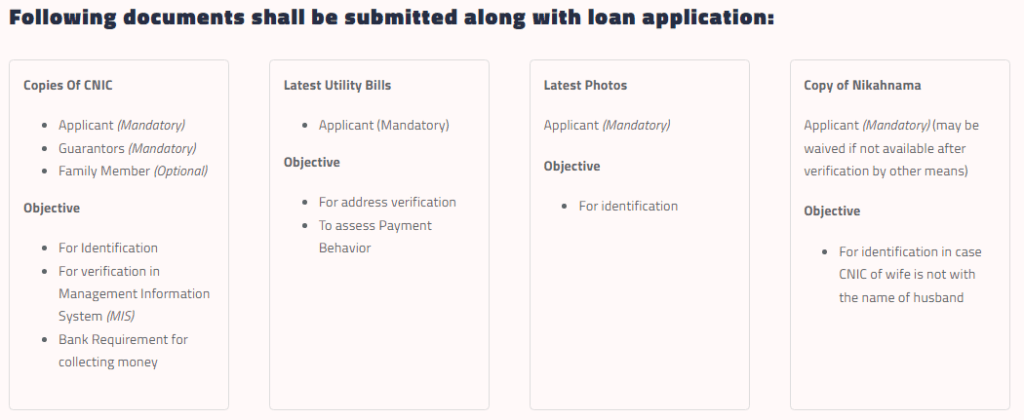

Akhuwat Loan Documents Required

o apply for a loan with Akhuwat, applicants must provide the following documents:

- National Identity Card (NIC): A valid NIC is required for all applicants and guarantors.

- Proof of residence: Applicants must provide a recent utility bill or rent agreement to demonstrate their place of residence.

- Income proof: Applicants must provide proof of their monthly income, such as a salary slip or a letter from their employer. If the applicant is self-employed, they must provide documentation that demonstrates their income, such as bank statements or tax returns.

- Business registration documents: If the applicant is applying for a business loan, they must provide proof of their business registration.

- Educational certificates: If the applicant is applying for an education loan, they must provide proof of their enrollment in an educational institution and relevant educational certificates.

- Other relevant documents: Depending on the type of loan, applicants may be required to provide additional documents, such as land registration documents for agriculture loans.

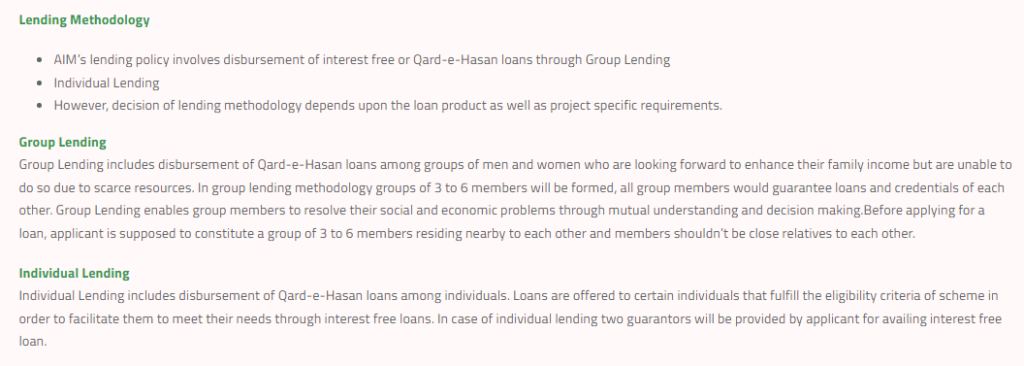

Akhuwat Loan Lending Methods

Akhuwat offers two main lending methods for its loan program: individual lending and group lending.

Individual lending

This method involves lending to individuals who apply for loans on their own. The applicant provides the necessary documentation and a guarantor, and Akhuwat assesses their eligibility based on their repayment capacity and other criteria.

Once the loan is approved, the borrower is responsible for repaying the loan on their own. Individual lending is ideal for those who have a clear business plan or project in mind and have the capacity to repay the loan independently.

Group lending

This method involves lending to a group of individuals who apply for loans together. The group consists of between five and ten members who are jointly responsible for repaying the loan.

Each member of the group provides a guarantor and is assessed based on their repayment capacity.

If the loan is approved, the group receives the funds collected and is responsible for repaying the loan together.

Group lending is ideal for those who may not have a clear business plan or project in mind but are part of a community or social group that can support each other in repaying the loan.

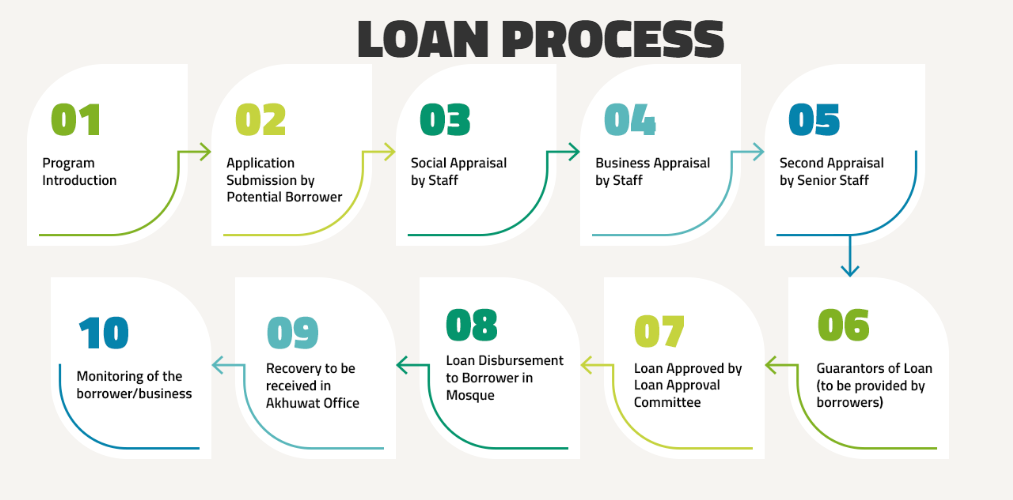

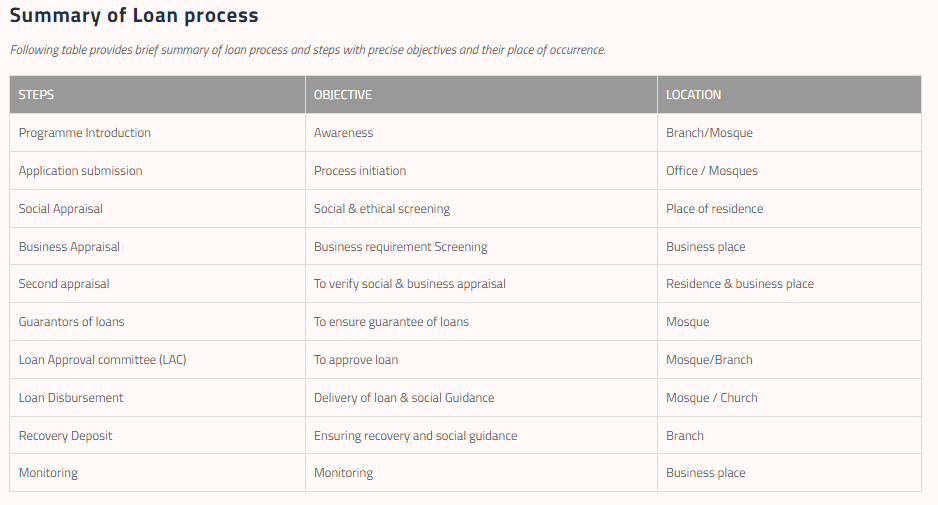

Akhuwat Loan Application Process

To apply for a loan with Akhuwat, applicants can follow these steps by visiting the nearest Akhuwat center:

- Find your nearest Akhuwat center: Akhuwat operates across Pakistan and has numerous centers throughout the country. You can find your nearest center on the Akhuwat website or by calling the Akhuwat helpline.

- Visit the Akhuwat center: Once you have identified your nearest center, visit it in person during its opening hours. You will need to bring the necessary documents with you, such as your NIC, proof of residence, and income proof.

- Meet with an Akhuwat representative: When you arrive at the center, you will be assigned an Akhuwat representative who will guide you through the application process. The representative will ask you questions about your financial situation and the purpose of the loan.

- Submit your application: Once you have completed the application form and provided all the necessary documentation, you will need to submit your application to the representative. The representative will review your application and determine your eligibility for a loan.

- Wait for approval: If your loan is approved, you will be notified by Akhuwat within a few days. If there are any issues with your application, the representative will inform you of the reasons for the rejection.

- Sign the loan agreement: If your loan is approved, you will need to sign a loan agreement with Akhuwat. This agreement outlines the terms and conditions of the loan, including the repayment schedule and any applicable fees.

- Receive your loan: Once you have signed the loan agreement, Akhuwat will disburse the loan amount to you either in cash or through a bank transfer.

Akhuwat Foundation Contact Number

The contact number for the Akhuwat Foundation varies depending on the location and specific department you are trying to reach.

However, you can find the main contact information for Akhuwat Foundation’s head office below:

- Phone: +92-42-111-448-464

- Email: info@akhuwat.org.pk

- Address: 19 Civic Center, Township, Lahore, Pakistan

You can also visit their website at www.akhuwat.org.pk for more information and contact details of their regional offices.

Akhuwat Loans Pros And Cons

Akhuwat have several advantages and disadvantages that should be considered before applying for one:

Pros:

- Interest-free loans: Akhuwat offers interest-free loans to individuals and groups, which can be a significant advantage for those who may not have access to traditional banking services or who cannot afford the high-interest rates charged by other lenders.

- Easy eligibility criteria: Akhuwat does not require collateral or credit history for loan applications, which means that those who may not have extensive documentation can still apply for loans.

- Flexible repayment options: Akhuwat offers flexible repayment schedules, allowing borrowers to repay the loan over a longer period, which can be beneficial for those who have irregular income streams.

- Community support: For group lending, Akhuwat provides support networks for borrowers, which can help them build relationships with others in their community and provide additional support in repaying the loan.

Cons:

- Limited loan amounts: Loan amounts may not be sufficient for some borrowers, especially those who require large sums of money for their businesses or projects.

- Geographical limitations: Akhuwat has limited coverage in certain areas of Pakistan, which may make it difficult for some individuals to access their services.

- Strict repayment schedules: While Akhuwat does offer flexible repayment options, they also enforce strict repayment schedules, which can be challenging for those who have difficulty repaying the loan on time.

- Guarantor requirement: All Akhuwat require a guarantor, which can be a challenge for some borrowers who may not have someone willing to guarantee their loans.

Recommended Reading: Akhuwat Islamic Microfinance {10K-50K} Akhuwat Interest-free Loans

Akhuwat Loans FAQs

What is the Akhuwat Foundation?

Akhuwat Foundation is a non-profit organization based in Pakistan that provides interest-free loans to individuals and groups in need.

What types of loans does Akhuwat offer?

Akhuwat offers a range of loan products, including individual loans, group loans, education loans, healthcare loans, and more.

Who is eligible for Akhuwat loans?

To be eligible for an Akhuwat loan, applicants must be Pakistani citizens, have a valid national identity card, and meet other specific eligibility criteria depending on the type of loan.

How much can I borrow from Akhuwat?

The loan amount available from Akhuwat depends on the type of loan, the borrower’s income, and other factors. However, the maximum loan amount for individual loans is currently PKR 100,000.

What is the interest rate for Akhuwat loans?

Akhuwat loans are interest-free, which means that borrowers do not have to pay any interest on the loan amount.

What documents do I need to apply for an Akhuwat loan?

The documents required to apply for an Akhuwat loan depend on the type of loan, but typically include a valid national identity card, proof of residence, income proof, and other relevant documentation.

How do I apply for an Akhuwat loan?

To apply for an Akhuwat loan, applicants can visit their nearest Akhuwat center and complete the application process with the help of an Akhuwat representative.

How long does it take to get an Akhuwat loan?

The time it takes to get an Akhuwat loan varies depending on the type of loan and other factors. However, borrowers can typically expect to receive a decision on their loan application within a few days.

What is the repayment schedule for Akhuwat loans?

The repayment schedule for Akhuwat loans varies depending on the type of loan, but borrowers are typically required to repay the loan amount within 6 to 24 months.

Can I apply for an Akhuwat loan if I have bad credit?

Yes, Akhuwat loans do not require a credit history or collateral, which means that individuals with bad credit can still apply for a loan.

However, the loan approval will depend on other factors, such as income and repayment capacity.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment