Are you in the market for a new or pre-owned (used) car on installment, but unsure of where to get the required financing? Look no further!

In this article, we have listed the top showrooms and banks in Pakistan that offer installment plans for new and used cars, often requiring only a minimal down payment.

Our list comprises showrooms of the top car manufacturers and dealers in Pakistan, such as:

- Pak Suzuki

- Toyota

- Pakwheels & many more.

Additionally, we’ve outlined the top five banks in Pakistan that offer Car On Installment loans with favorable terms, along with their eligibility criteria and interest rates.

The banks we’ve identified as top choices for Car On Installment loans include:

- Meezan Bank

- HBL

- Dubai Islamic Bank

- Bank Alfalah

- NBP

Without further delay, let’s start our guide!

Recommended Reading: List Of Top 100+ Car Leasing Companies In Pakistan (Updated City-Wise)

Car On Installment From Showroom | Second-Hand Cars Installments

Table of Contents

Getting a Car on Installment from a Pak Suzuki Showroom

Pak Suzuki offers a Car On Installment program, simplifying purchasing Suzuki vehicles in Pakistan. The company ensures the quality of its used cars through a rigorous 130-point inspection, providing customers with peace of mind.

Pak Suzuki’s exchange program allows customers to trade in their old vehicles for a new Suzuki or a certified used Suzuki, streamlining the car buying process.

Services Offered By Pak Suzuki Showroom

| Service | Details |

|---|---|

| Certified Used Cars | Pak Suzuki ensures reliable used Car On Installment with a 130-point inspection, genuine documents, and up to a 1-year warranty for peace of mind. |

| Exchange Program | Upgrade your vehicle easily with Suzuki’s exchange program. Get the best price for your old car, 3 free services, quick payment, and priority delivery. |

| Used Car Finance | Finance your Suzuki used car with competitive rates, no extra charges, clear terms, and low down payments at Pak Suzuki dealerships. |

Recommended Reading: How To Get A Used Car On Installments In Pakistan (Complete Guide)

Car On Installment From Pak Suzuki Showroom Details

| Suzuki RV Financing Solution | Details |

|---|---|

| One Window Solution: | Upgrade your vehicle every 2-3 years with lower monthly installments (30-35% less than traditional methods) and a Residual Value (RV) payment at the end. |

| Lower Monthly Installments: | Monthly payments are about 30-35% less because you pay up to 50% of the car financing amount as an RV at the end of the term. |

| Upgrade Assistance: | After 2-3 years, return your car and get the guaranteed right market value, helping you upgrade to a new vehicle. |

| BUYBACK GUARANTEE: | For up to 3 years, the dealership pays the RV amount to the bank, allowing you to use the remaining amount as a down payment for a new car. |

| Advantages of RV Financing: | |

| Excellent Resale Value: | Get a great resale value for your used car at Pak Suzuki dealerships. |

| Discounted Rates: | Avail discounted markup rates (up to K + 3%) and insurance rates (1.5 – 1.99%). |

| Preferred Delivery: | Enjoy priority delivery for your new car through the financing program. |

| No Early Settlement Charges: | Settle the loan early without charges and get a new car with low monthly installments again. |

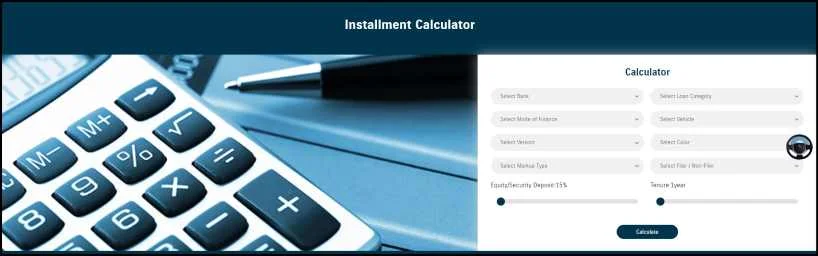

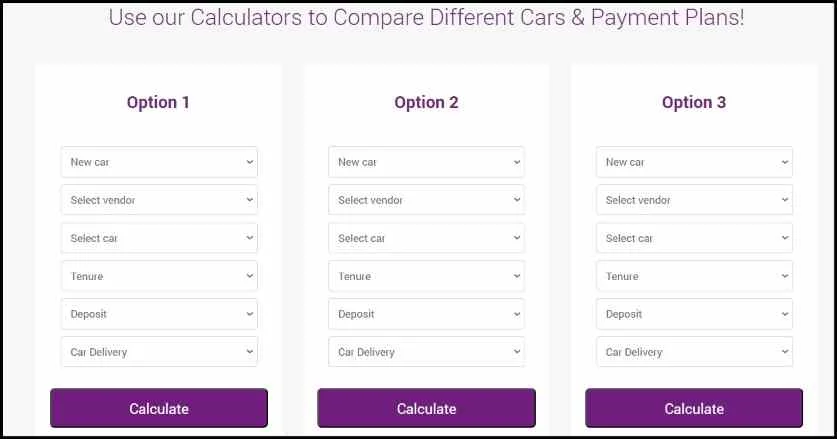

Suzuki Showroom Installment Calculator

Recommended Reading: Top 15 Car Leasing Companies In Pakistan (Tested+Reviewed)

Car On Installment From Toyota Showroom

Toyota offers a convenient installment purchasing option directly from their showroom through Toyota Smart Finance. With Toyota Smart Finance, financing your preferred Toyota vehicle is simple. Just apply online, and your Toyota will be prepared for you at the dealership upon its arrival.

Why Choose Toyota Smart Finance?

| Toyota Smart Finance | Details |

|---|---|

| Tailored Installments | Use the installment calculator to customize your monthly payments to fit your preferences. |

| Compare Options | Compare different installment or rental plans to find the best one for your needs. |

| Easy Application | Submit your financing application from home or office conveniently. |

| Best Rates | Access the best markup and insurance rates available. |

| Application Tracking | Monitor your application status for added convenience and peace of mind. |

| Transparent Processing | Enjoy clear and transparent processing at every stage of the financing process. |

| Prompt Delivery | Get your Toyota car quickly after your financing application is approved. |

How To Get Car On Installment From Toyota Showroom?

Acquiring a Car On Installment from the Toyota Showroom:

- Choose Your Toyota: Browse through our extensive selection of Toyota models to find the one that fits your preferences and budget, bringing you closer to owning your dream car through installments.

- Select Your Financing Mode: Whether you opt for conventional financing, Islamic financing, or RV financing, we have options tailored to your requirements.

- Complete Your Application: Upload all necessary information and documents to complete your financing application, streamlining your process.

- Track Your Application: Monitor the progress of your application using your CNIC and case ID, allowing you to stay informed as your Toyota makes its way to you.

Toyota Financing Option

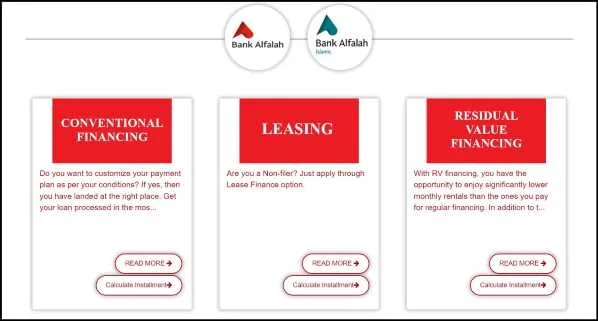

Bank Alfalah Financing

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan

| Financing Option | Details |

|---|---|

| Conventional Financing | Customize your payment plan with flexible loan processing. Benefit from competitive markup rates, easy documentation, and exclusive insurance rates. Choose tenure options from 1 to 7 years. |

| Leasing | Non-filers can apply for Lease Finance. Vehicles are registered under the bank’s name, with the bank handling withholding tax. Enjoy zero charges for car replacement and a balloon payment option. Financing available for new and imported vehicles for personal use. |

| Residual Value Financing | Pay lower monthly rentals with Residual Value (RV) financing. Choose tenure options from 1 to 5 years, with a maximum RV of up to 50%. At the end of the term, make a lump sum balloon payment to own the vehicle. |

Bank Alfalah Islamic Financing

| Financing Option | Details |

|---|---|

| Car Ijarah | Opt for interest-free, Shari’ah-compliant financing with minimal documentation. Choose tenure options from 1 to 7 years. No insurance or registration charges; rentals start before vehicle delivery. Enjoy competitive pricing and fast processing. |

| Residual Value Financing | Toyota Finance offers RV Financing with the option to make a lump sum payment (up to 50% of the total financed amount) at the end of the term. This option makes payments more affordable and convenient. |

Toyota Car Financing Calculator

Recommended Reading: 3 Easy Steps To Get A Car On Installments In Pakistan (Guide+Tips)

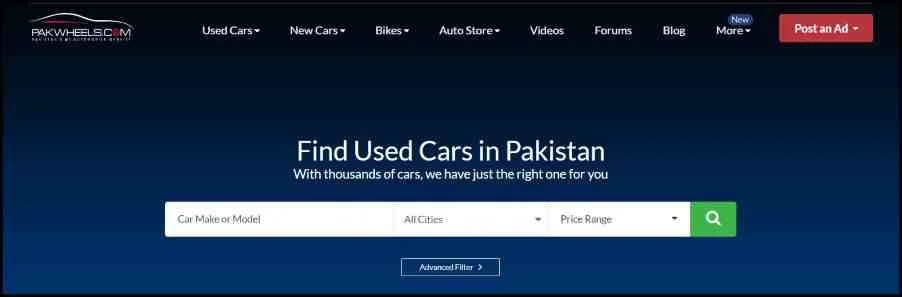

Car On Installment From Pakwheels Car Financing

Pak Wheels offers a reliable option for acquiring cars through installment plans or upgrading your current vehicle. Easily find your dream car within your budget through PakWheels’ platform.

PakWheels has conducted extensive research on car financing procedures with various banks to simplify the process for customers. Utilize the user-friendly car financing calculator provided by PakWheels to confidently plan your payments for new or used vehicles.

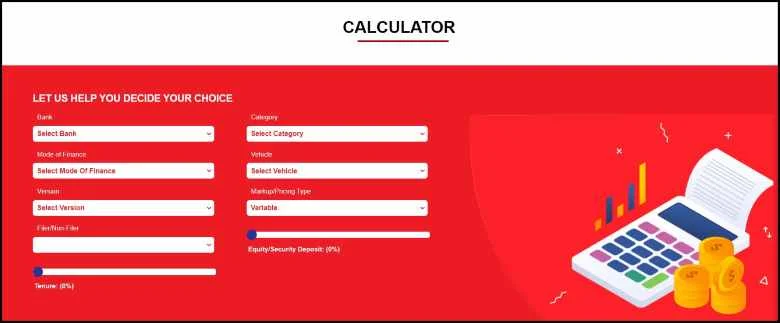

Pakwheels Car Financing Calculator

Why Choose PakWheels For Car Finance In Pakistan?

- Expert Assistance: Our team of skilled representatives is dedicated to ensuring a seamless process, making your experience with us effortless and smooth.

- Best Rates: We provide access to the lowest competitive rates from our partner banks, guaranteeing that you receive the best possible deal for your financing needs.

- Coverage Plans: Benefit from customized coverage plans our partner banks offer, tailored to meet your specific requirements and ensure comprehensive protection.

- Rate Comparison: Effortlessly compare rates from Pakistan’s top financing banks and secure the best deal that aligns with your preferences and financial goals.

Recommended Reading: List Of Top 100+ Car Leasing Companies In Pakistan (Updated City-Wise)

Services Offered PakWheels

| Sell It for Me | We manage the selling process of your vehicle, ensuring a hassle-free experience for you. |

| Auction Sheet Verification | We verify auction sheets to ensure the quality and authenticity of the vehicle. |

| Car Inspection | Our experts conduct thorough inspections to guarantee the quality and reliability of our cars. |

| Partner Workshop | Access our network of trusted partner workshops for all your car maintenance and repair needs. |

| Car Insurance | Benefit from comprehensive car insurance coverage through PakWheels. |

| Car Registration | Let us assist you with the easy and seamless registration process for your vehicle. |

| Ownership Transfer | Transfer car ownership smoothly with our assistance. |

Pakwheels Car Financing Details

- Minimum Down Payment Requirement: To secure a car through installment, a minimum down payment of 35% of the car’s value is necessary.

- Car Loan Calculator: Use our convenient car loan calculator to explore various installment options available in Pakistan.

- Eligibility Criteria: Applicants must be between 22 and 65 years old at loan maturity. Salaried individuals should have a maximum monthly income of RS 80,000, while self-employed individuals should earn at least RS 1,00,000 per month. For pensioners or those with remittance income, the minimum age should be 65 or less, with a monthly income of RS 1,00,000.

- Maximum Financing Tenure: Banks typically offer car financing with a maximum tenure ranging from 3 to 9 years.

Recommended Reading: How To Get A Used Car On Installments In Pakistan (Complete Guide)

List Of Top 5 Best Car Financing Banks in Pakistan

Here are the top 5 banks for acquiring cars through installment plans in Pakistan:

- Meezan Bank Car Loan

- HBL Car Loan

- Dubai Islamic Bank Car Loan

- Bank Alfalah Car Loan

- NBP Car Loan

Meezan Bank Car Loan

- Car Ijarah: Meezan Bank’s innovative car financing solution offers Pakistan’s first interest-free car installment plan, operating on the Islamic principle of Ijarah, or car leasing. This product is ideal for individuals seeking interest-free locally manufactured or assembled vehicles.

- How it Works: With Car Ijarah, the bank purchases the car and leases it to the customer for 1 to 5 years, as per the agreed-upon contract. At the end of the lease period, the vehicle can be sold to the customer at a nominal amount or gifted to them.

Meezan Bank Car Financing Features

- Lowest Upfront Payment: Enjoy the benefit of the lowest initial payment required to start your car installment plan.

- Rental Payment Starts After Vehicle Delivery: Begin paying rentals only after you have received the vehicle, ensuring your payments align with your usage.

- Quick Processing Time: Experience fast processing times for your convenience, allowing you to start enjoying your new vehicle sooner.

- Minimum Security Deposit: Benefit from a low-security deposit requirement, starting from as low as 30%* of the vehicle’s value.

- WHT Coverage: Meezan Bank covers the Withholding Tax (WHT) on the vehicle purchase, relieving you of this financial burden.

Recommended Reading: Top 15 Car Leasing Companies In Pakistan (Tested+Reviewed)

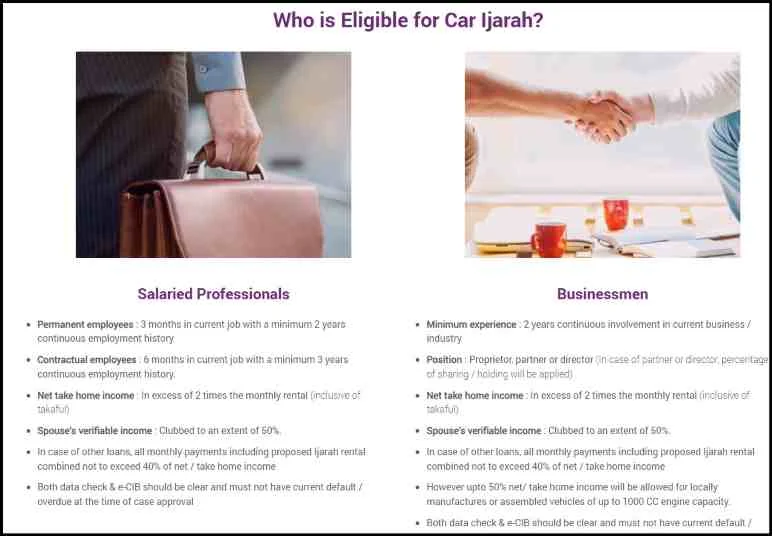

Who is Eligible for Car Ijarah? + Documents Required

| Eligibility Criteria | Salaried Professionals | Self-Employed Professionals / Businessmen |

|---|---|---|

| Employment History | Permanent: 3 months in current job, 2 years total employment. Contractual: 6 months in current job, 3 years total employment. | 2 years of continuous involvement in current business or industry. |

| Position | Not applicable | Must be a proprietor, partner, or director with applicable sharing/holding percentage. |

| Net Take Home Income | Must be double the monthly rental, including takaful. | Must be double the monthly rental, including takaful. |

| Spouse’s Income | Up to 50% of verifiable income can be added to the applicant’s income. | Up to 50% of verifiable income can be added to the applicant’s income. |

| Debt-to-Income Ratio | Monthly payments, including the proposed Ijarah rental, should not exceed 40% of net/take-home income. | Monthly payments, including proposed Ijarah rental, should not exceed 40% of net/take-home income (up to 50% for vehicles up to 1000 CC engine capacity). |

| Data Check | Data check and e-CIB must be clear, with no current default or overdue accounts at the time of case approval. | Data check and e-CIB must be clear, with no current default or overdue accounts at the time of case approval. |

Required Documents

- Application Form: A completed and signed application form by the applicant.

- Salaried Individuals: Copy of recent pay slip/certificate.

- Businessmen: Business Proof:

- Bank certificate confirming proprietorship.

- NTN (National Tax Number).

- Business Association letter or tax return, etc.

- Copy of last six months’ bank statements.

- One recent photograph.

- Specimen Signature Card: Preferably in the bank’s prescribed format.

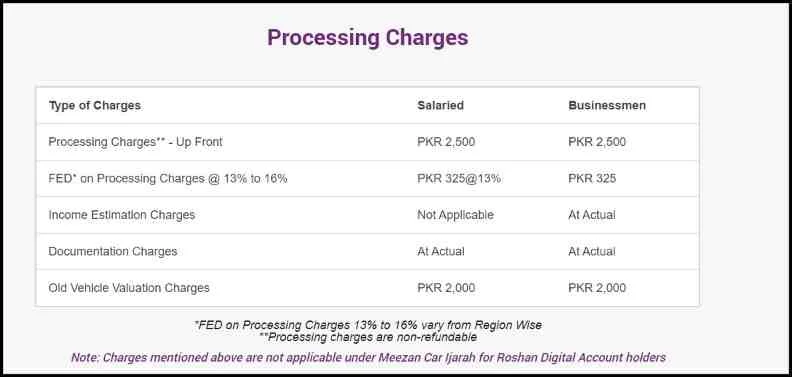

Meezan Bank Car Loan Processing Charges

| Up-Front Processing Charges | PKR 2,500 | PKR 2,500 |

| FED on Processing Charges @ 13%* | PKR 325 | PKR 325 |

| Income Estimation Charges | Not Applicable | Charged at Actual |

| Documentation Charges | Charged at Actual | Charged at Actual |

| Old Vehicle Valuation Charges | PKR 2,000 | PKR 2,000 |

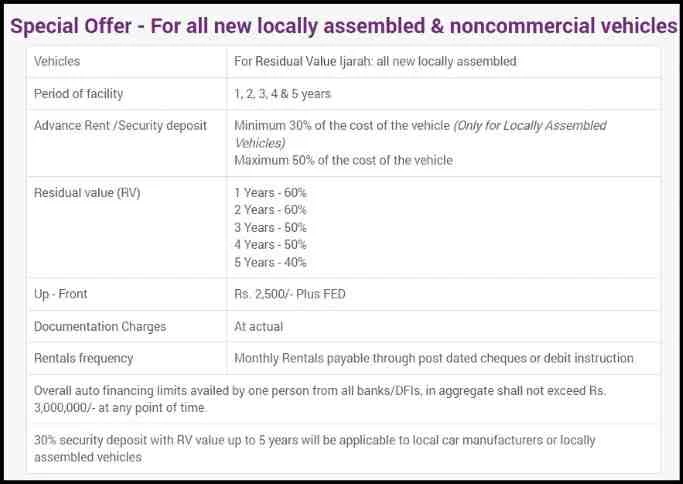

Meezan Bank Car Loan Interest Rate

Meezan Bank Car On Installment Loan Details:

| Aspect | Details |

|---|---|

| Eligible Vehicles | Residual Value Ijarah applies to all new locally assembled vehicles. |

| Period of Facility | Options available for 1, 2, 3, 4, & 5 years. |

| Advance Rent/Security Deposit | Minimum: 30% of the vehicle cost (only for locally assembled vehicles). <br> Maximum: 50% of the vehicle cost. |

| Residual Value (RV) | 1 Year: 60% 2 Years: 60% 3 Years: 50% 4 Years: 50% 5 Years: 40% |

| Up-Front Payment | Rs. 2,500/- Plus FED |

| Documentation Charges | Charged at actual cost |

| Rentals Frequency | Monthly rentals payable through post-dated cheques or debit instructions |

| Overall Auto Financing Limit | Aggregate financing limit across all banks/DFIs not to exceed Rs. 3,000,000/- at any point in time. |

| Security Deposit | A 30% security deposit with an RV value of up to 5 years applies to local car manufacturers or locally assembled vehicles. |

Meezan Bank Car Loan Calculator

Easily compare different cars and payment plans using our calculators.

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan

HBL Easy Car Loan

HBL offers the HBL Easy Car On Installment Loan, simplifying the process of purchasing your dream car through installment plans. With this financing facility, HBL provides funding up to 70% of your desired car’s value, allowing you to choose any vehicle you desire.

Enjoy a fixed markup rate tailored to your specific needs, making it easier to turn your dream of owning a car into reality with HBL’s car on the installment plan.

HBL Car Loan Requirements

Documents Required for Salaried Person:

- Verified copy of CNIC.

- Two recent passport-size photographs.

- Latest original salary slip.

- Personal bank statement for the last three months.

Documents Required for Self-Employed Business Persons/Professionals:

- Verified copy of CNIC.

- Two recent passport-size photographs.

- Bank statement for the last 6 months.

- Bank letter confirming account details.

- Proof of occupation/business.

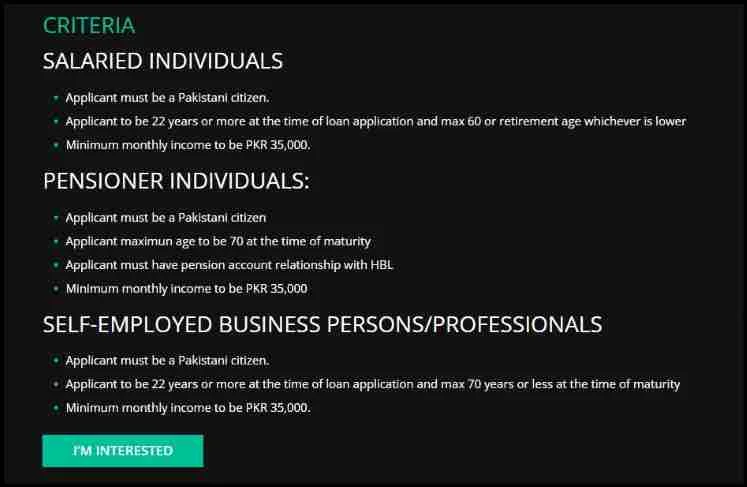

HBL Easy Car Loan Eligibility Criteria

Criteria for Salaried Person:

- Pakistani citizenship is required for the applicant.

- The applicant must be at least 22 years old at the time of loan application, with a maximum age of 60 or retirement age, whichever is lower.

- A minimum monthly income of PKR 35,000 is required.

Criteria for Pensioner Person:

- The applicant must be a Pakistani citizen.

- The maximum age limit at the time of maturity is 70 years.

- The applicant must have an existing pension account relationship with HBL.

- A minimum monthly income of PKR 35,000 is required.

HBL Easy Car Loan Features

- Loan Amount: The car on Installment loan amount ranges from PKR 200,000 to PKR 3,000,000.

- Repayment Period: Enjoy a repayment period of up to 5 years.

- Vehicle Options: Choose any locally manufactured vehicle, whether new or used.

- Financing: Finance up to 70% of your preferred car’s value.

- Secured Insurance: Enjoy secured insurance with a tracker facility for peace of mind.

- Payment Options: Multiple payment options are available for your convenience.

- Dealer Network: Benefit from a wide network of over 150 eligible dealers offering various brands and cars.

- Application Process: Easily access the application process through HBL’s 1600+ branches.

- Customer Support: Receive round-the-clock support through HBL Phone Banking.

HBL Easy Car Loan Calculator

Use the HBL Easy car on installment Loan Calculator to choose a car that fits your budget.

Recommended Reading: 3 Easy Steps To Get A Car On Installments In Pakistan (Guide+Tips)

HBL Islamic Car Finance

HBL Islamic Car on Installment offers a Musharakah-based solution, allowing you to own a car on installment. This facility operates on the concept of Musharakah, where both the bank and the customer become joint owners of the vehicle based on an agreed investment ratio.

The customer gradually purchases units of the bank’s share over time until they become the sole owner of the vehicle. During this period, the customer pays agreed rentals for using the bank’s share until complete ownership is achieved.

HBL Islamic Car Features

- Finance Available: Both new and used vehicles intended for personal use are eligible for financing.

- Flexible Payment Tenure:

- 1 to 5 years for vehicles up to 1000cc.

- 1 to 3 years for cars above 1000cc.

- Takaful Coverage: Provided through business partners on the HBL panel.

- Rental Payments: Begin only after the delivery of the vehicle to the customer.

- Quick Processing: Minimal documentation requirements ensure quick processing.

- Partial Payments: Option for partial payments to ease the burden.

- Early Termination: Option for early termination of the facility if needed.

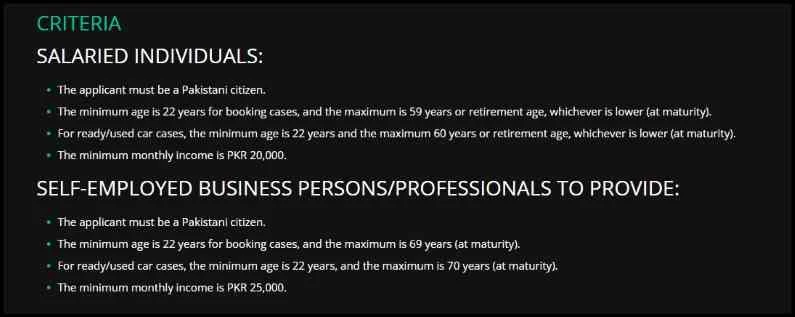

HBL Islamic Car Eligibility Criteria

Criteria for Salaried Person:

- Pakistani citizenship is required.

- The minimum age requirement is 22 years at the time of booking, with a maximum of 59 years or retirement age, whichever is lower, at maturity.

- For cases involving ready/used cars, the minimum age is 22, and the maximum is 60 years or retirement age, whichever is lower, at maturity.

- The minimum monthly income should be PKR 20,000.

Criteria for Self-Employed Business Persons/Professionals:

- Pakistani citizenship is required.

- The minimum age requirement is 22 years at the time of booking, with a maximum of 69 years at maturity.

- For cases involving ready/used cars, the minimum age is 22 years, and the maximum is 70 years at maturity.

- The minimum monthly income should be PKR 25,000.

Recommended Reading: List Of Top 100+ Car Leasing Companies In Pakistan (Updated City-Wise)

Dubai Islamic Bank Car Loan

Dubai Islamic Bank’s car on installment service offers an easy way to drive your dream car with a fully Sharia-compliant process. The Musharaka cum Ijara model allows you to get a car on Installment quickly.

Requirements for Dubai Islamic Bank Car Loan:

Eligibility Criteria:

- Salaried individuals must be at least 21 years old at the time of application, not exceeding 60 years at the time of car on installment finance maturity.

- Self-employed professionals and businessmen must also be at least 21 years old at the time of application, with a maximum age limit of 65 years at the time of car on installment finance maturity.

- A minimum monthly net income of Rs. 25,000 is required.

- Salaried individuals should have a work tenure of at least 3 months, while self-employed professionals and businessmen should have a work tenure of 6 months and 12 months, respectively.

Documents Required:

- Copy of the primary applicant’s CNIC.

- Copy of the co-applicants CNIC.

- Two passport-size photographs.

- Latest salary slip.

- Six months bank statement.

- Bank certificate.

Dubai Islamic Bank Car Loan Interest Rate

Key Features:

- Low Takaful Rates: Benefit from Takaful rates lower than those offered by other banks, ensuring cost-effectiveness.

- Payment in Advance Booking Cases: Customers in Advance Booking cases are not required to make monthly rental payments until they receive the car.

- Competitive Monthly Rentals: Enjoy competitive and affordable monthly rental rates that meet industry standards.

- Flexible Financing Amount: DIBPL offers car on installment financing ranging from 70% to 85% of the car’s value, with a minimum financing amount of Rs. 100,000 and a maximum of Rs. 3,000,000.

- Shari’a Compliance: Our car on installment products adhere to Islamic principles and are Shari’a-compliant, ensuring interest-free transactions.

- Flexibility: Choose from financing options for both new and used cars, with payment plans ranging from 1 to 5 years. Additionally, customers can club income and finance vehicles up to 9 years old.

Recommended Reading: How To Get A Used Car On Installments In Pakistan (Complete Guide)

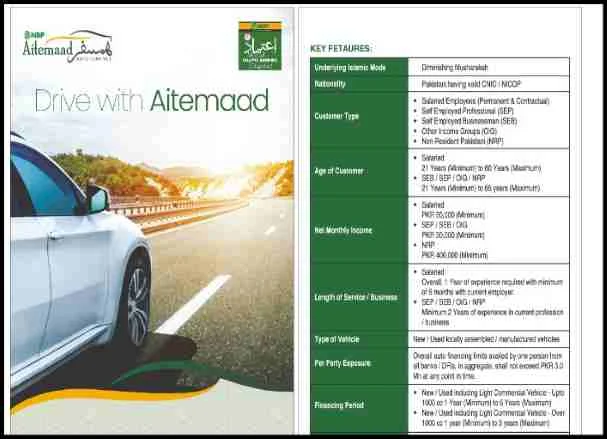

NBP Car Loan

NBP car on installment offers competitive financing rates linked to SBP 01 Year KIBOR plus a spread, making it affordable for customers. Women customers can benefit from special discounts on the financing rates, encouraging female ownership of vehicles.

car on installment payments are made through your NBP Aitemaad Islamic Banking account, providing a convenient and hassle-free payment process. Repayment is structured in equal monthly installments, including rental payments, Musharakah units, and Takaful payments, ensuring clarity and transparency in the repayment process.

After one year, customers can make partial payments with a 5% charge on the buyout unit price, not exceeding 50% of the outstanding balance. Early payments are allowed with a 5% charge on the outstanding balance. All charges are clearly defined in the NBP Aitemaad Schedule of Charges (SOC).

NBP Car Loan Requirements

Eligibility Criteria:

| Eligibility Criteria | Details |

|---|---|

| Nationality | Pakistani citizen with a valid CNIC or NICOP. |

| Gender | Open to males, females, and others (X). |

| Customer Types | Available for various customer types including salaried employees (permanent & contractual), self-employed professionals (SEP), self-employed businessmen (SEB), and other income groups (OIG) like pensioners, remittance earners, etc. Non-resident Pakistanis (NRP) are also eligible but require a resident Pakistani co-customer. |

| Age | Salaried: Minimum 21 to maximum 60 years at maturity. SEP/SEB/OIG/NRP: Minimum 21 to 65 years at maturity. |

| Net Monthly Income | Salaried/SEP/SEB/OIG: Minimum PKR 50,000. NRP: Minimum PKR 400,000. |

| Length of Service/Business | Salaried: Minimum 1-year experience with at least 6 months at the current employer (6 months for NBP employees). SEP/SEB/OIG/NRP: Minimum 2 years experience in the current profession/business. |

Required Documents:

- Copy of valid CNIC/NICOP.

- Two recent passport-size colored photographs.

- Attested salary slips/income proof for the last three months.

- Original/stamped & signed bank statement for the last six months (showing salary/income).

- Copy of the latest paid utility bill.

- Additional documents for NBP Employees:

- Liability Statement.

- Verification of Educational Documents.

- Non-Involvement Certificate.

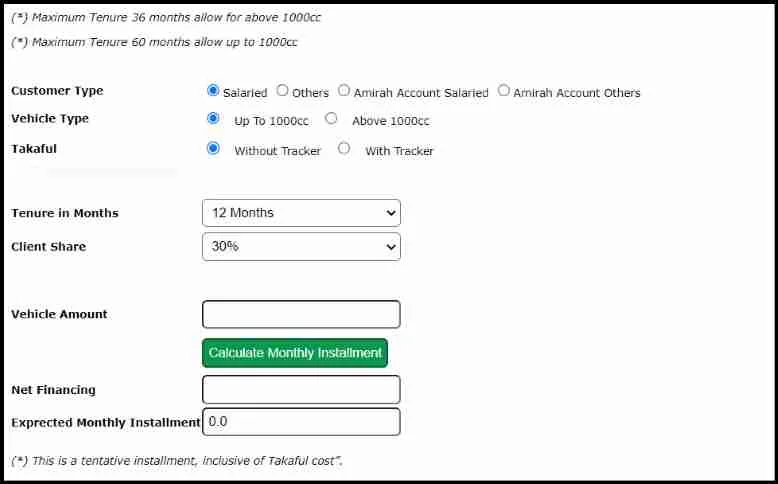

NBP Car Loan Calculator

Recommended Reading: Top 15 Car Leasing Companies In Pakistan (Tested+Reviewed)

Comparing Car Financing Options: Showroom vs. Banks

Sure, here’s a comparison of car financing options from showrooms versus banks:

| Aspect | Showrooms | Banks |

|---|---|---|

| Financing Availability | Limited to specific brands and models offered by the showroom. | Offers flexibility to finance a wide range of car brands and models. |

| Interest Rates | Usually higher interest rates compared to banks. | Typically offers lower interest rates, making it more cost-effective in the long run. |

| Down Payment | May require a lower down payment, but could result in higher overall costs due to higher interest rates. | Often requires a higher down payment, but leads to lower overall costs due to lower interest rates. |

| Vehicle Inspection | Showrooms may offer certified used cars with thorough inspections. | Banks may not conduct vehicle inspections, leaving it to the buyer’s discretion. |

| Financing Process | Often has a simpler and quicker financing process. | May involve more paperwork and longer processing times. |

| Special Promotions and Deals | Showrooms may offer special promotions or deals on financing options. | Banks may offer promotional rates or deals on car loans. |

| Flexibility in Terms | Showrooms may have less flexibility in terms of loan duration and repayment options. | Banks usually offer more flexibility in terms of loan duration and repayment options. |

| After-Sales Services | Showrooms may provide after-sales services such as warranty coverage and maintenance packages. | Banks typically do not offer after-sales services related to the vehicle. |

| Customer Service and Support | Showrooms provide dedicated customer service and support throughout the financing process. | Banks offer customer service, but may not be as specialized in car financing. |

FAQs | Car On Installment

What minimum down payment is required for getting a car on installment from the Pak Suzuki showroom?

The minimum down payment required is 35% of the car’s value.

What are the benefits of Pak Suzuki’s certified used car on installment services?

Enjoy peace of mind with genuine documents and up to a 1-year warranty.

Get 3 free services and the best price, with quick payment and priority delivery when you exchange your old vehicle.

How does Pak Suzuki’s exchange program work?

Upgrade your car easily with Suzuki’s exchange program, offering the best price for your used car on installment and priority delivery.

What is Suzuki RV Financing and how does it work?

Suzuki RV Financing offers car on installment, approximately 30-35% less compared to traditional financing. Customers can pay up to 50% of the car financing amount at the end of the tenure, known as the Residual Value (RV) amount.

What are the benefits of Suzuki car on installment RV Financing?

Enjoy good resale value for your used car through Pak Suzuki dealerships.

Avail discounted markup rates (up to K + 3%) and insurance rates (1.5 – 1.99%).

What services does Toyota Smart Finance offer for buying cars on installment from their showroom?

Toyota Smart Finance offers easy financing for your favorite Toyota car with an online application and dealership pickup.

What are the key features of Toyota Smart Finance?

Customize your monthly installments or rentals according to your preferences by using the installment calculator.

Compare various installment or rental options to find the one that suits you best.

Easily submit your financing application from the comfort of your home or office.

What are the requirements for getting a car on installment from PakWheels?

The minimum down payment requirement is 35%.

Applicants must be at least 22 years old and not exceed 65 years at the time of loan maturity.

Salaried individuals should have a maximum monthly income of RS 80,000, while self-employed individuals should earn at least RS 1,00,000 per month.

What are the benefits of getting a car on installment from PakWheels?

Expert Assistance: Skilled representatives ensure an easy process, making your experience smooth.

Best Rates: We share the lowest competitive rates from our partner banks, ensuring you get the best deal.

Coverage Plans: Customized coverage plans from partner banks cater to your specific requirements, ensuring protection.

What are the minimum requirements for getting a car on installment from HBL?

The minimum requirements for getting a car on installment from HBL:

Applicants must hold Pakistani citizenship.

Salaried individuals must be at least 22 years old with a maximum age of 60 or retirement age, whichever is lower, at maturity.

Self-employed individuals must be at least 22 years old with a maximum age of 70 or less at maturity.

The minimum monthly income requirement is PKR 35,000.

Recommended Reading: How To Get A Car On Installment Without Bank In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions, contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment