The Ehsaas Interest-Free Loan Scheme is a poverty alleviation initiative launched by the Pakistan Poverty Alleviation Fund (PPAF), a non-profit organization established by the Government of Pakistan.

The scheme aims to provide Ehsaas interest-free loan to eligible individuals and households, particularly those living in poverty, to help them meet their financial needs and improve their standard of living.

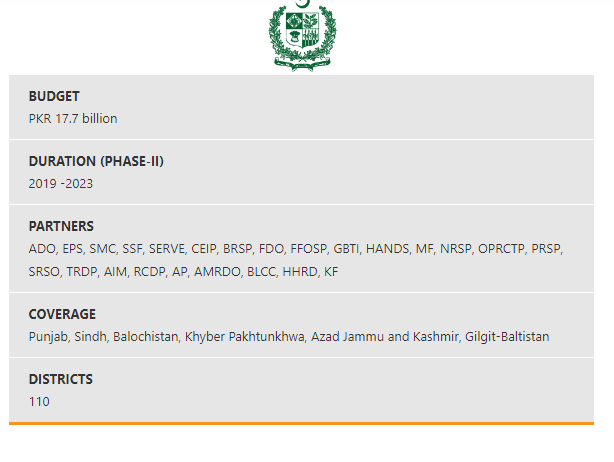

Ehsaas Interest-free Loan Scheme Details:

| Features | Details |

|---|---|

| Project: | Ehsaas Interest-free Loan Scheme |

| Loan Amount: | PKR 20,000 to PKR 100,000 |

| Interest: | No interest on the borrowed amount |

| Repayment Period: | 6 months to 2 years |

| Total Budget: | PKR 17.7 billion |

| Duration (Phase II): | 2019-2023 |

| Partners: | ADO, EPS, SMC, SSF, SERVE, CEIP, BRSP, FDO, FFOSP, GBTI, HANDS, MF, NRSP, OPRCTP, PRSP, SRSO, TRDP, AIM, RCDP, AP, AMRDO, BLCC, HHRD, KF |

| Coverage: | Punjab, Sindh, Balochistan, Khyber Pakhtunkhwa, Azad Jammu and Kashmir, Gilgit-Baltistan |

| Districts Covered: | 110 districts |

Under the scheme, eligible applicants can receive Ehsaas Interest-free Loans ranging from PKR 20,000 to PKR 100,000, depending on their financial needs and repayment capacity.

The loans are interest-free, which means that the borrowers do not have to pay any interest on the borrowed amount. However, they are required to repay the principal amount in easy installments within a specified period, which can range from six months to two years.

Recommended Reading: How To Register For Ehsaas Rashan Program (SMS-8123) {Updated}

Ehsaas Interest-free Loan Scheme | Ehsaas Program Loan

Table of Contents

Recommended Reading: Ehsaas Emergency Cash Program 12,000-25,000 (SMS-8171){Updated}

Ehsaas Interest-free Loan Scheme Key Features

Here are some key features of the Ehsaas Interest-Free Loan Scheme:

| Feature | Details |

|---|---|

| Interest-free Loans: | No interest is charged; repay only the principal amount. |

| Loan Amounts: | Range from PKR 20,000 to PKR 100,000, based on financial needs and repayment capacity. |

| Repayment Period: | Easy installments over 6 months to 2 years. |

| Eligibility Criteria: | – Pakistani citizens aged 18-65 years. – Household income below a certain threshold. – Viable business idea or plan for using the loan. |

| Business Development Support: | Provides training and technical assistance in business planning, financial management, and marketing. |

| No Collateral Required: | No collateral or security is needed for the loan. |

| Quick Processing: | Simple and fast application process, with a 2-3 weeks turnaround from application to disbursement. |

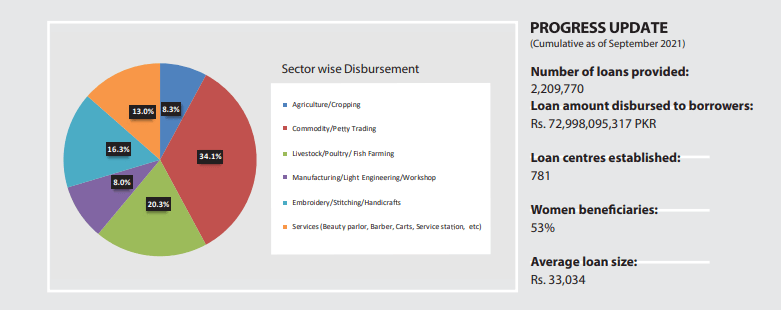

Ehsaas Interest-free Loan {Progress Update}

| Features | Details |

|---|---|

| Sector-wise Disbursement: | – Agriculture/Cropping: 13.0% – Commodity/Petty Trading: 8.3% – Livestock/Poultry/Fish Farming: 16.3% – Manufacturing/Light Engineering/Workshop: 8.0% – Embroidery/Stitching/Handicrafts: 20.3% – Services (Beauty parlor, Barber, Carts, Service station, etc): 34.1% |

| Number of Loans Provided: | 2,209,770 |

| Total Loan Amount Disbursed: | Rs. 72,998,095,317 PKR |

| Loan Centres Established: | 781 |

| Women Beneficiaries: | 53% |

| Average Loan Size: | Rs. 33,034 |

Recommended Reading: Ehsaas Bahimat Buzurg Program Registration-SMS-8171 (PKR 2000) {Updated}

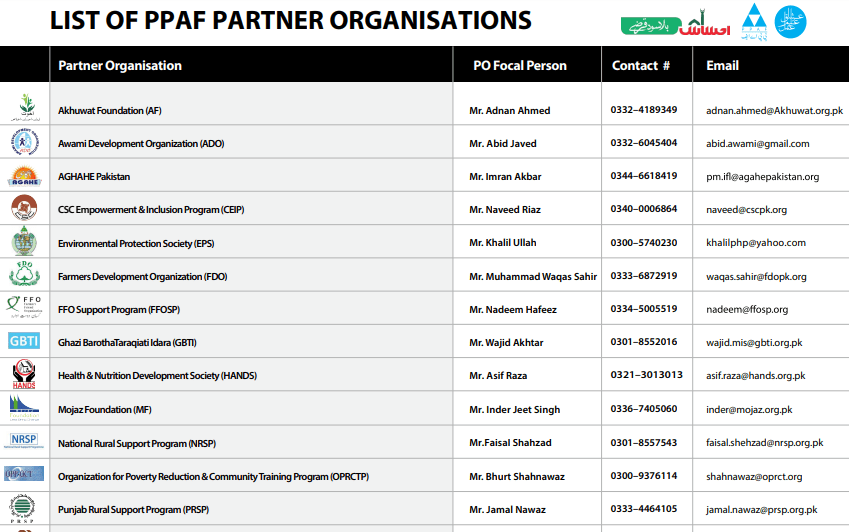

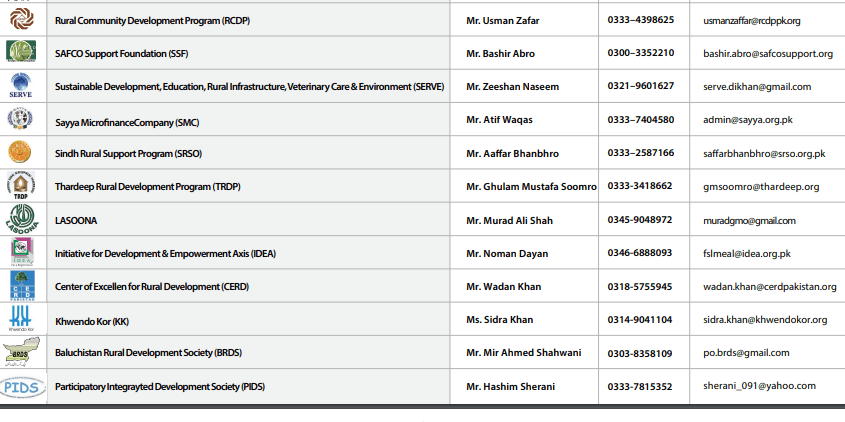

Partner Organizations Of Ehsaas Loan Program

The Ehsaas Interest-Free Loan Scheme is being implemented through partner organizations selected by the Poverty Alleviation and Social Safety Division (PASSD) in Pakistan.

These organizations are responsible for disbursing the loans to eligible borrowers, as well as for providing training and technical assistance to help borrowers manage their businesses and repay the loans.

Some of the partner organizations of the Ehsaas Interest-Free Loan Scheme include:

- Akhuwat

- Kashf Foundation

- NRSP Microfinance Bank

- First Women Bank

- Telenor Microfinance Bank

- FINCA Microfinance Bank

- The Punjab Provincial Cooperative Bank Ltd

- Khushhali Microfinance Bank

- Apna Microfinance Bank

- Jubilee Life Insurance Company Limited

The partner organizations are authorized by the government to disburse loans under the scheme, subject to eligibility criteria and other requirements.

Recommended Reading: Ehsaas Kafalat Program Registration PKR 12,000 (SMS CNIC 8171) {Updated}

Ehsaas Interest-free Loan Eligibility Criteria

To be eligible for the Ehsaas Interest-free Loan Scheme in Pakistan, applicants must meet the following criteria:

| Criteria | Details |

|---|---|

| Age: | 18 to 65 years |

| Nationality: | Must be a Pakistani citizen |

| Income: | Household income must be below a certain threshold (varies by location and household size). Assessed using the poverty scorecard. |

| Loan Purpose: | Must be used for productive purposes like starting or expanding a business, healthcare, education, or urgent financial needs. |

| Business Plan: | Must have a viable business idea or a clear plan for using the loan amount. |

| Repayment Capacity: | Must demonstrate the ability to repay the loan within 6 months to 2 years. |

| Credit History: | Preference for those with a good credit history, but applicants with no credit history will also be considered. |

| Other Factors: | Gender, disability status, and geographic location may also be considered in the selection process. |

Ehsaas Interest-free Loan Application Process

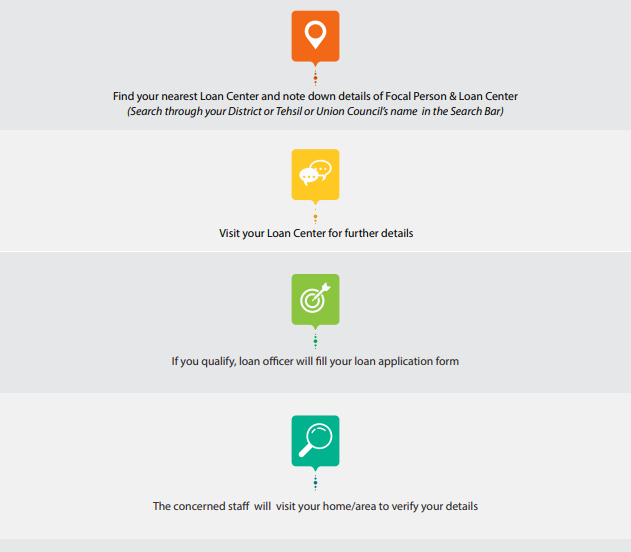

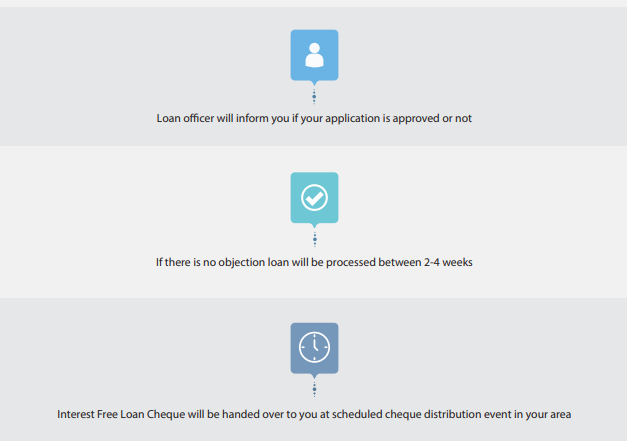

Here is a step-by-step guide to the loan application process for the Ehsaas Interest-Free Loan Scheme:

- Check your eligibility: Before applying for the loan, make sure you meet the eligibility criteria for the scheme, including age, income, loan purpose, and repayment capacity.

- Prepare your business plan: You will need to have a viable business idea or a clear plan for using the loan amount.

- Find a partner organization: The loan disbursement process is managed by partner organizations, such as microfinance institutions and banks.

- Apply for the loan: Once you have identified a partner organization, you can apply for the loan by filling out an application form.

- Attend the interview: After submitting your loan application, you will be invited for an interview with the partner organization.

- Receive loan approval: If your loan application is approved, you will receive a loan approval letter from the partner organization.

- Sign the loan agreement: Before receiving the loan amount, you will need to sign a loan agreement.

- Receive the loan amount: Once you have signed the loan agreement, the loan amount will be disbursed to your bank account or as cash.

- Repay the loan: You will need to repay the loan in easy installments within the specified period, which can range from six months to two years.

The outline of the loan application process is as follows:

Recommended Reading: Ehsaas Program Registration 8171 | اپنے گھرانے کی اہلیت کے بارے میں جانیۓ

Pros And Cons

Ehsaas-Interest-free-Loan-Program

Like any government program or policy, the Ehsaas Interest-Free Loan Scheme in Pakistan has both pros and cons.

Pros:

- Provides access to credit: The scheme provides interest-free loans to low-income households, which can help them start or expand their businesses or meet other urgent financial needs.

- Promotes financial inclusion: The scheme aims to promote financial inclusion by providing loans to those who may not have access to formal financial institutions.

- Alleviates poverty: By providing access to credit, the scheme can help reduce poverty and improve the economic well-being of low-income households.

Cons:

- Limited loan amount: The maximum loan amount is limited, which may not be sufficient for some borrowers to start or expand their businesses.

- Limited loan purposes: The loans can only be used for certain purposes, such as business startup or expansion, which may limit their usefulness for some borrowers.

- Limited repayment period: The repayment period is limited to two years, which may not be sufficient for some borrowers to repay the loan.

- Repayment risks: There is a risk that borrowers may default on their loans, which could lead to losses for the partner organizations and the government.

Recommended Reading: How To Register For Ehsaas Rashan Program (SMS-8123) {Updated}

Ehsaas Interest-free Loan Scheme FAQs

Who is eligible for the Ehsaas Interest-Free Loan Scheme?

The scheme is targeted toward low-income households with a monthly income of less than Rs. 30,000. Applicants must be between the ages of 18 and 65 and have a viable business plan or a clear purpose for using the loan amount.

What is the maximum loan amount that can be availed under the scheme?

The maximum loan amount that can be availed under the scheme is Rs. 100,000.

What are the documents required to apply for the loan?

The documents required to apply for the loan include a copy of the CNIC, proof of income, a business plan, and other documents specified by the partner organization.

What are the loan purposes for which the loan amount can be used?

The loan amount can be used for various purposes, such as business startup or expansion, education expenses, health expenses, or meeting other urgent financial needs.

How can I apply for the loan under the scheme?

To apply for the loan, you can contact the partner organizations authorized to disburse loans under the scheme in your area. You will need to fill out an application form and provide the required documents.

What is the interest rate on the loan under the scheme?

There is no interest charged on the loan under the scheme. However, a small administrative fee may be charged by the partner organization.

What happens if I default on the loan repayment?

If you default on the loan repayment, the partner organization may take legal action to recover the outstanding amount, which may include seizing assets or deducting the amount from your bank account.

What are the repayment terms for the loans obtained through the Ehsaas Interest-Free Loan Scheme?

Beneficiaries are typically required to repay the loan within a specified timeframe and in accordance with the repayment terms and conditions set by the scheme.

Failure to repay the loan on time may result in penalties and could affect future eligibility for financial assistance programs.

How can I apply for the Ehsaas Interest-Free Loan Scheme?

To apply for the scheme, you need to complete the application form accurately, attach the required documents, and submit them to the designated Ehsaas centers or specified submission channels.

It is important to review the latest guidelines provided by the government or relevant authorities for the specific application process in your region.

Can I apply for multiple loans under the Ehsaas scheme?

Applicants can only avail of one loan at a time under the Ehsaas Interest-Free Loan Scheme. Once a loan has been granted and repaid, individuals are eligible to apply for another loan if they meet the criteria.

Recommended Reading: Ehsaas Emergency Cash Program 12,000-25,000 (SMS-8171){Updated}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment