How To Open A Joint Account In Meezan Bank: Meezan Bank, a leading financial institution, offers a wide range/types of accounts to deal with the financial needs of its customers.

Among these options is the joint account, an excellent choice for individuals who wish to share financial responsibilities with a partner or family member.

In this article, we will guide you on how to open a joint account with Meezan Bank, both through their user-friendly online platform and by visiting the nearest branch.

Moreover, we will outline the applicable charges and the essential requirements (documents, etc.), to open a joint account in Meezan Bank.

Recommended Reading: How To Open Joint Account In Standard Chartered Bank {Charges+Working}

How To Open A Joint Account In Meezan Bank | Meezan Bank Account Opening Online

Table of Contents

Recommended Reading: Solar Panel On Installment Meezan Bank | Interest-Free Loan For Solar Panels

Meezan Bank Current Account Types

Meezan Bank offers a variety of current account types to cater to the diverse needs of its customers. Each account type comes with its own features and benefits, providing flexibility and convenience for different individuals and businesses.

Here are the different current account types offered by Meezan Bank, along with a brief explanation of their key attributes:

Recommended Reading: Meezan Bank Account Opening Online {Local+Overseas}

| Account Type | Details |

|---|---|

| Individual Account: | For managing personal finances, with online banking, checkbook, and debit card for easy spending. |

| Joint Account: | For sharing finances with a partner or family, giving joint access to funds and ownership. |

| Sole Proprietorship Account: | For sole business owners to separate personal and business finances, with business checks and online banking. |

| Freelancer Account: | For freelancers to manage payments and expenses efficiently, with options for international transactions and dedicated support. |

| Corporate Account: | For businesses, offering tailored solutions for managing cash flow, payments, and corporate services like payroll. |

Recommended Reading: NBP Asaan Digital Account (CNIC+PKR 100){Benefits+Limit+Charges}

Current Account Types (Currency-Wise)

Here are the four types of current accounts that you can open with Meezan Bank, available in both local and foreign currencies:

| Account Type | Details |

|---|---|

| Rupee Account: | Meezan Current Account lets you keep your money in a Riba-free account and access it without any withdrawal restrictions. It offers professional from Meezan Bank and is available for Individuals, Sole Proprietorships, Partnerships, and Limited Companies. Freelancers can also open this account. |

| Dollar Account: | Meezan Dollar Current Account operates on a Qard contract, ensuring the bank pays back your money on demand. Your funds may be used for investment, but not in activities against Shariah principles. It’s a secure option for individuals and corporate clients to meet business needs and diversify currency investments, protecting against currency fluctuations. |

| Euro Account: | Meezan Euro Current Account follows a Qard contract, assuring the bank returns your money when requested. Funds may be invested but not in Shariah-prohibited activities. This account is suitable for individuals, sole proprietorships, partnerships, and limited companies. |

| GBP Account: | Meezan Pound Current Account operates on a Qard basis, ensuring the bank repays your money on demand. Funds may be invested, excluding activities against Shariah principles. It’s a reliable choice for individuals and corporate clients to meet business requirements and diversify investments, safeguarding against currency fluctuations. |

Recommended Reading: FREE! Bank Alfalah Asaan Current Account Opening Online {Benefits+Limit}

Joint Account Opening Requirements | Meezan Bank Account Opening Requirements

Joint Account Opening Eligibility Criteria

To open a account with Meezan Bank, certain eligibility criteria must be met. Here are the requirements for opening a account:

| Basic Documents Required for Account Opening |

|---|

| Type of Customer | Documents Required |

|---|---|

| Individual: | A. General Requirements: |

| 1. Copy of valid identity document: | |

| Pakistani citizens: Valid CNIC/SNIC/NICOP/SNICOP. | |

| Foreign citizens: Valid Passport. | |

| Persons of Pakistani origin: Valid POC. | |

| Registered Aliens in Pakistan: Valid ARC. | |

| Afghan refugees in Pakistan: Valid POR Card. | |

| Minors (Pakistani citizens): Valid Form-B/Juvenile Card. | |

| B. Proof of profession / Source of income: | |

| See enclosed indicative list for acceptable documents. |

Recommended Reading: Bank Alfalah Digital Account Opening | Bank Alfalah Digital Lifestyle Branch

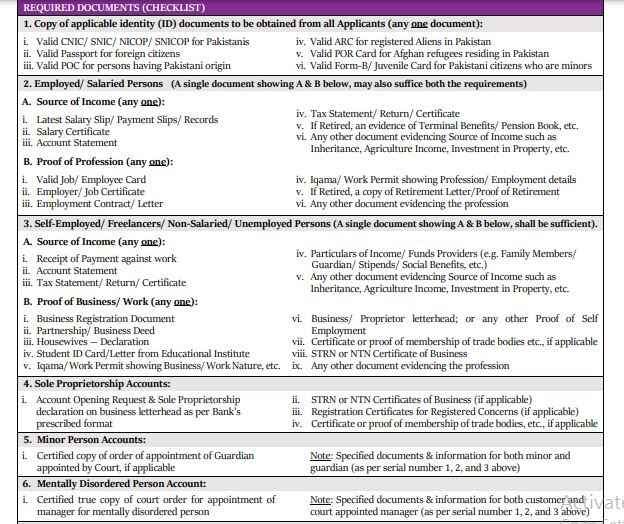

Documents Required To Open A Joint Account

When opening a account, certain documents are required to verify the identity of the applicants and ensure compliance with regulatory standards.

Here are the documents typically requested by Meezan Bank to open a joint account:

| Serial No. | Type of Applicant: | Documents Required |

|---|---|---|

| 1. | All Applicants: | Copy of valid identity document: |

| i. Pakistani citizens: CNIC/SNIC/NICOP/SNICOP. | ||

| ii. Foreign citizens: Passport. | ||

| iii. Persons of Pakistani origin: POC. | ||

| iv. Registered Aliens in Pakistan: ARC. | ||

| v. Afghan refugees in Pakistan: POR Card. | ||

| vi. Minors (Pakistani citizens): Form-B/Juvenile Card. | ||

| 2. | Employed/Salaried Persons: | A. Source of Income (any one): |

| 1. Latest Salary Slip/Payment Slips/Records. | ||

| 2. Salary Certificate. | ||

| 3. Account Statement. | ||

| B. Proof of Profession (any one): | ||

| i. Valid Job/Employee Card. | ||

| ii. Employer/Job Certificate. | ||

| iii. Employment Contract/Letter. | ||

| iv. Tax Statement/Return/Certificate. | ||

| v. Proof of Retirement (if retired). | ||

| 3. | Self-Employed/Freelancers/Non-Salaried/Unemployed Persons: | A. Source of Income (any one): |

| 1. Receipt of Payment against work. | ||

| 2. Account Statement. | ||

| 3. Tax Statement/Return/Certificate. | ||

| B. Proof of Business/Work (any one): | ||

| i. Business Registration Document. | ||

| ii. Partnership/Business Deed. | ||

| iii. Housewives Declaration. | ||

| iv. Student ID Card/Letter from Educational Institute. | ||

| v. Business Proprietor letterhead/Proof of Self-Employment. | ||

| vi. STRN or NTN Certificate of Business. | ||

| vii. Certificate/proof of membership of trade bodies, if applicable. | ||

| viii. Iqama/Work Permit showing Business/Work Nature. | ||

| 4. | Sole Proprietorship: | Account Opening Request & Sole Proprietorship declaration on business letterhead as per Bank’s prescribed format. |

| 5. | Minor Person: | Certified copy of order of appointment of Guardian appointed by Court, if applicable. |

| 6. | Mentally Disordered Person: | 1. Certified true copy of court order for appointment of manager for mentally disordered person. |

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

Meezan Bank Joint Account Opening | Meezan Bank Current Account Opening

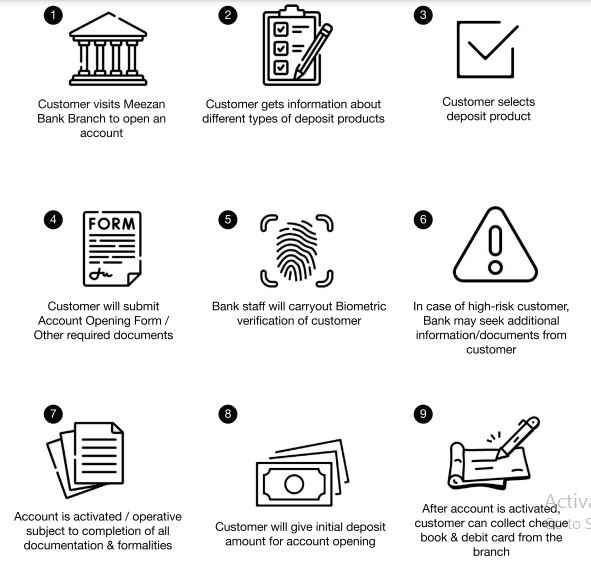

Opening a joint account with Meezan Bank involves a straightforward process that can be completed by following these steps:

Visit the Nearest Meezan Bank Branch

- Locate the nearest Meezan Bank app or branch and visit it in person to initiate the account opening process.

- The bank’s customer service representatives will guide you through the necessary steps and provide any assistance required.

Obtain Initial Information about Joint Account

- Gather relevant information about the joint account, such as the features, benefits, and terms and conditions.

- The bank staff will provide you with a comprehensive overview of the joint account services and answer any queries you may have.

Submit a Duly Filled Account Opening Form with the Required Documents:

- Obtain the account opening form from the bank and fill it out accurately and completely.

- Attach the necessary documents, such as identification proof, proof of address, and any other specific documents required by the bank.

- Ensure that all the provided information is correct and up to date.

Biometric Verification

- Undergo biometric verification at the bank branch to verify your identity.

- This step helps maintain the security and authenticity of the account opening process.

Initial Deposit

- Make the initial deposit required to activate the joint account.

- The bank will inform you about the minimum deposit amount and acceptable methods of deposit.

Collect Checkbook and Debit/Credit Card

- Once the account is successfully opened, collect the checkbook and debit/credit card associated with the joint account.

- These essential banking tools will enable you to manage and access your funds conveniently.

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Meezan Bank Joint Account Opening Online | Meezan Bank Digital Account Opening

Opening a joint account with Meezan Bank can be conveniently done online through their mobile app. Here are the step-by-step instructions for opening a account digitally:

| Features | Details |

|---|---|

| Branches: | Access state-of-the-art branch banking services for in-person assistance and transactions. |

| ATMs: | Enjoy round-the-clock banking services at our ATMs for quick and convenient transactions. |

| Internet Banking: | Bank hassle-free anytime, anywhere with our simple online banking platform. |

| Mobile Banking: | Now available for added convenience, enjoy banking services at your fingertips with our mobile app. |

| Debit Cards: | Explore our range of debit cards to find the one that suits your needs for easy and secure transactions. |

| Call Centre: | Our bank’s call centre is available 24/7 to assist you with any queries or banking needs, providing continuous support. |

Pros Of Joint Account Opening

Pros:

- Shared Financial Responsibilities: Opening a joint account allows for the pooling of financial resources and sharing of expenses.

- Convenient Access to Funds: With a joint account, both account holders have equal access to the funds.

- Enhanced Financial Planning and Budgeting: Joint account holders can collectively plan and budget their finances, making it easier to track expenses, set financial goals, and work towards shared objectives.

Recommended Reading: How To Open A Bank Account In Pakistan | Bank Account Opening Requirements

Joint Account FAQs

What is a joint account?

A joint account is a bank account that is opened and owned by two or more individuals. All account holders have equal rights and access to the funds within the account.

It is commonly used by couples, family members, or business partners who want to share financial responsibilities and have joint control over the account.

How do I open a joint account?

To open a joint account, you typically need to visit the bank branch with all the account holders. Fill out the necessary forms, provide identification documents for each account holder, and complete any required paperwork.

The bank may also require signatures and other verification processes. It is advisable to check with your specific bank for their account opening procedures.

Who can open a joint account?

Joint accounts can be opened by individuals who wish to share ownership and financial responsibilities. This may include spouses, family members, business partners, or any other individuals mutually agreed upon.

What are the benefits of opening a joint account?

Some benefits of opening a joint account include shared financial responsibilities, convenient access to funds for both account holders, and enhanced financial planning and budgeting capabilities.

What are the potential drawbacks of joint account opening?

Drawbacks of joint accounts may include loss of individual control over funds, the potential for mismanagement or misuse of funds by one account holder, and shared legal and financial liability for debts or obligations incurred by either account holder.

How do I open a joint account?

To open a joint account, visit the nearest branch of the bank and provide the required documents, such as identity proof and address verification.

Fill out the account opening form and complete any necessary biometric verification. Additionally, an initial deposit may be required to activate the account.

What documents are needed to open a joint account?

Typically, valid identification documents such as national identity cards, passports, or other officially recognized identification documents are required for each account holder. Proof of address and proof of profession or source of income may also be necessary.

Can one joint account holder withdraw funds without the consent of others?

In most cases, joint account holders have equal rights to access and withdraw funds from the account. However, specific account agreements or bank policies may impose restrictions or require the consent of all account holders for certain transactions.

How is the liability shared in a joint account?

Joint account holders are usually jointly and severally liable for any debts or obligations associated with the account. This means that each account holder is individually responsible for the entire account balance and can be held liable for any defaults or liabilities.

Can I remove a joint account holder from the account?

Removing a joint account holder typically requires the consent and cooperation of all account holders. It may involve formal processes and documentation as per the bank’s policies and procedures.

What happens to a joint account in the event of the death of one account holder?

In the event of the death of one account holder, the funds in the joint account usually pass to the surviving account holder(s) by right of survivorship. Proper documentation, such as a death certificate, may be required to update the account accordingly.

Can I have different ownership ratios in a joint account?

Yes, it is possible to have different ownership ratios in a joint account. For example, account holders may agree to have unequal shares in the account based on their contributions or financial arrangements.

It is essential to discuss and clarify ownership ratios with the bank during the account opening process.

Can I convert my individual account into a joint account?

Yes, it is generally possible to convert an individual account into a joint account. You would need to visit the bank, provide the necessary documents, and fill out the required forms to request the conversion. The bank will guide you through the process and provide any additional information or documentation needed.

Can I set spending limits or restrictions on a joint account?

Spending limits or restrictions on a joint account is typically not available directly through the bank. However, account holders can mutually agree upon spending limits or establish guidelines for managing the account to ensure responsible financial management.

Can I convert a joint account into an individual account?

In most cases, converting a joint account into an individual account requires the consent of all account holders.

The bank will have specific procedures and requirements for such conversions, which may include providing identification documents and completing necessary paperwork.

Recommended Reading: Bank Alfalah Digital Account Opening | Bank Alfalah Digital Lifestyle Branch

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment