Solar Panel On Installment Meezan Bank: Welcome to our guide on Interest-Free Loan For Solar Panels by Meezan Bank, offering a Shariah-compliant solar panel scheme that paves the way for a sustainable and eco-friendly future.

By installing solar panels under this scheme, customers can benefit from a net metering system, allowing them to sell surplus electricity back to the national grid, effectively becoming environmentally responsible energy producers.

What sets this program apart is its flexibility, allowing participants to opt for installment plans spread over an extended 5-year period.

With capacity options ranging from 1KW to an impressive 1000KW and financing limits spanning from 1 Lakh to 25 Lakh, Meezan Bank ensures that sustainable energy solutions are within everyone’s reach.

Depending on the applicant’s status and the program’s nature, down payment requirements vary from 15% to 50%, making it even more accessible to embark on this eco-friendly journey.

In this article, we will explore Solar Panel On Installment by Meezan Bank:

- Requirements To Get Solar Panel On Installment Meezan Bank

- Eligibility Criteria

- Documents Required To Get Interest-Free Loan For Solar Panels

- How To Apply For Solar Panel On Installment By Meezan Bank

- Meezan Bank Solar Energy Partners

- Meezan Bank Solar Panel Calculator

- Meezan Bank Solar Financing Contact Number

Avail Shariah-compliant financing for Solar Panel with Meezan Solar.

— Meezan Bank (@MeezanBankLtd) January 15, 2022

For more details, please call at (021) 111-331-331 (332) or visit https://t.co/JXmIPk3X02#MeezanBank #IslamicBank #SolarEnergy #ConsumerEase pic.twitter.com/vo2ooiLR3b

Recommended Reading: How To Open A Joint Account In Meezan Bank {Charges+Requirements}

Solar Panel On Installment Meezan Bank | Interest-Free Loan For Solar Panels

Table of Contents

- Solar Panel On Installment Meezan Bank | Interest-Free Loan For Solar Panels

Recommended Reading: How To Open Joint Account In Standard Chartered Bank {Charges+Working}

Requirements To Get Solar Panel On Installment Meezan Bank

Eligibility Criteria

Eligibility Criteria for Solar Panel On Installment from Meezan Bank:

| Requirement | Description |

|---|---|

| Residency and Age | Must be a Pakistani resident with a valid CNIC. Primary applicant aged 20-60; Co-applicant below 75 years old. |

| Minimum Income | Primary applicant: PKR 100,000/month. Contractual employees (5+ years): PKR 200,000/month. Businessmen: PKR 500,000/month. Pensioners: PKR 100,000/month. |

| Employment Stability | Minimum two years of continuous employment history. |

| Tax Payer Status | Must be an active taxpayer with a valid NTN. |

| Guarantors | Two guarantors are required with clean financial records and valid IDs. |

| Mandatory Account with Meezan Bank | An account will be opened if the applicant doesn’t have one with Meezan Bank. |

Recommended Reading: Meezan Bank Account Opening Online {Local+Overseas}

Documents Required To Get Interest-Free Loan For Solar Panels

Documents Required for Interest-Free Loan for Solar Panel On Installment:

| Required Documents | Salaried Person | Entrepreneur | Pensioners |

|---|---|---|---|

| 1. Current pay slip (original, stamped, or attested) | 1. For Sole Proprietorship: | 1. Last six months’ pension bank statements showing net pension credited (photocopy, signed, and stamped by the issuing bank) | |

| 2. Employment letter from employer (including start date, position, and nature of employment) | a) NTN certificate and tax return | ||

| 3. Six months’ bank statement of the employer (original, stamped, or certified) | b) Bank letter confirming proprietorship | ||

| 4. Audited financial statements of the company and letter of undertaking from the employer (if applicable) | c) Six months’ bank statement (original or certified) | ||

| 2. For Partnership: | 2. For applicants retiring during the financing period: | ||

| a) Partnership deed (latest and previous, if any) | Financing is allowed if a minimum of 75% of installments are paid during employment and 25% after retirement | ||

| b) Certificate from the registrar of firms (if registered) | |||

| c) Six months’ bank statement (of the firm or the applicant partner) | |||

| 3. For Company Directors: | |||

| a) Six months’ bank statement of the company or the director (original or certified) | |||

| b) Memorandum of association | |||

| c) Articles of association | |||

| d) Certificate of incorporation | |||

| e) Latest Form-A & Form-29 | |||

| f) Audited financial statements |

Recommended Reading: NBP Asaan Digital Account (CNIC+PKR 100){Benefits+Limit+Charges}

How To Apply For Solar Panel On Installment By Meezan Bank

How to Apply for Solar Panel on Installment by Meezan Bank:

- Visit Meezan Bank Branch or Call: To initiate the application process, you can either visit your nearest Meezan Bank branch in person or contact their helpline at 111-331-331 or 111-331-331.

- Obtain Quotation from Registered Meezan Solar Energy Partner: Get a detailed quotation for the solar panels from a registered Meezan Solar Energy Partner.

- Obtain and Fill Application Form: Obtain the application form either from the Meezan Bank branch or their website. These documents may include a signed copy of your CNIC, recent electricity bills, and other supporting documents.

- Submit Application with Necessary Documents: Attach all the necessary documents along with the filled application form. The bank will require these documents for verification and processing purposes.

- Wait for Approval: Once your application and documents are submitted, the bank will review and process your request.

Recommended Reading: FREE! Bank Alfalah Asaan Current Account Opening Online {Benefits+Limit}

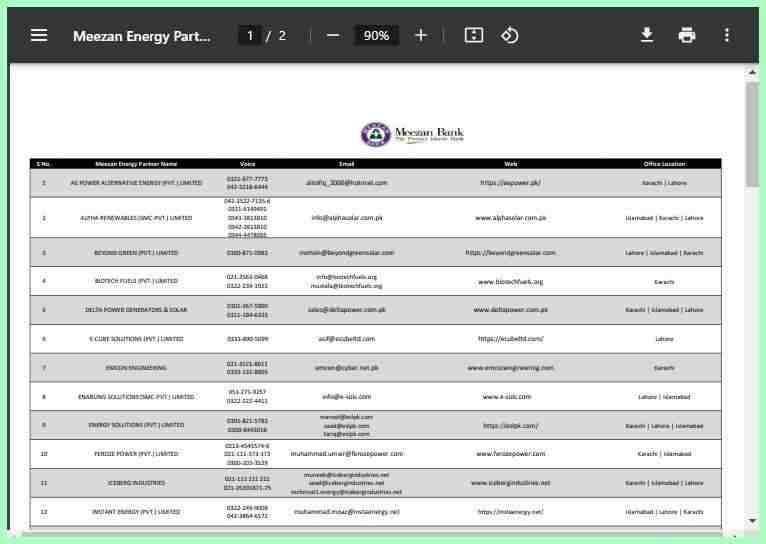

Meezan Bank Solar Energy Partners

| Company Name | Contact Number | Email Address | Website | Locations |

|---|---|---|---|---|

| AE Power Alternative Energy: | 0300-7882356, 0304-11104767 | info@aepower.pk, raheel.yaqub@aepower.pk | https://aepower.pk | Karachi, Lahore |

| Sky Electric Pvt. Limited: | 0300-0458534 | muhammad.saad@skyelectric.com | https://skyelectric.com | Islamabad, Karachi, Lahore |

| Shahzad Solar Pvt. Limited: | 041-2656244, 0342-2334444 | shahzadsolar.director@gmail.com | https://shahzadsolar.com | Faisalabad |

| True Solar Pvt. Limited: | 0313-4360311, 0304-4386355, 0300-4600373 | zeeshan.malik@truesolar.pk | https://truesolar.pk | Karachi, Lahore |

| Sustainable Solar Energy Solutions: | 0337-7001106 | info.sustainablesolar@gmail.com | https://sses.pk | Karachi |

| Alpha Renewables (SMC-Pvt.) Limited: | 042-3522-7135, 0321-6149491, 0343-3813810, 0342-3813810, 0344-4478065 | info@alphasolar.com.pk | https://alphasolar.com.pk | Islamabad, Karachi, Lahore |

| Modular Energy (SMC-Private) Limited: | 0317-6527111 | customers@solarcitizen.pk | https://solarcitizen.com.pk | Islamabad, Karachi, Lahore |

| Reliance Energy Solution: | 0309-5558192 | hr@res.com.pk | https://res.com.pk | Lahore |

Recommended Reading: Bank Alfalah Digital Account Opening | Bank Alfalah Digital Lifestyle Branch

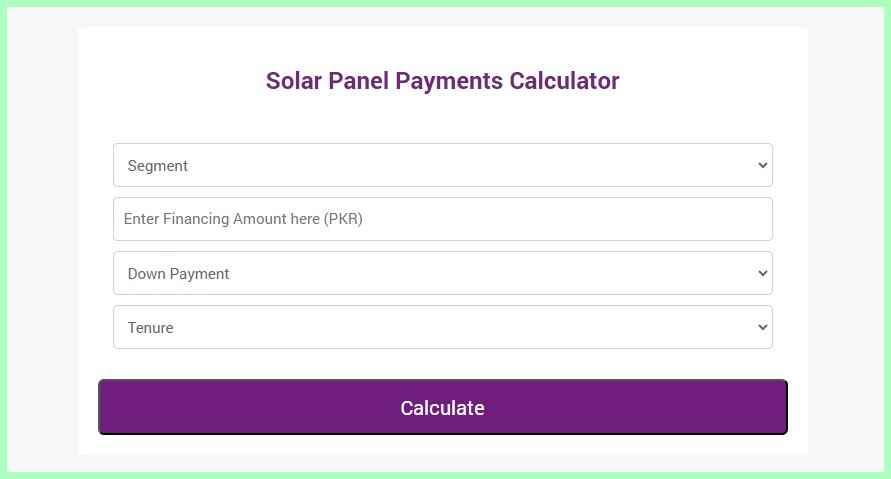

Meezan Bank Solar Panel Calculator

Meezan Bank Solar Panel Calculator:

- Accessible Online Tool: The Meezan Bank Solar Panel On Installment Calculator is available online at the following link: https://www.meezanbank.com/solar-panel-calculator/.

- Segment Selection: Users are required to select their segment, which could be a salaried person, business individual, or pensioner.

- Financing Limit Input: To get an accurate estimate, users need to input their desired financing limit. This is the maximum amount they intend to finance for their solar panel installation.

- Down Payment Information: Users are prompted to enter the down payment they are willing to make for the solar panel plant.

- Tenure Selection: Users can choose the preferred tenure for repaying the solar panel financing.

- Calculate Button: After entering all the necessary information, users can click the “Calculate” button to generate an exact estimate for the solar panel plant financing.

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

Meezan Bank Solar Financing Contact Number

For general inquiries and information about Solar Panel On Installment financing, you can reach out to Meezan Bank through the following channels:

- Meezan Bank Website: Visit the official website at https://www.meezanbank.com/solar-panel-financing/ to access relevant details and resources regarding solar panel financing.

- Meezan Bank Helpline: Contact the Meezan Bank helpline at +92 21 111 331 331 or +92 21 111 331 332 for any queries or assistance related to solar financing.

- Meezan Bank Email: Send your inquiries or complaints via email to the bank at info@meezanbank.com or complaints@meezanbank.com.

For personalized assistance and guidance specific to solar financing, you can get in touch with the dedicated representatives in various regions:

- Karachi Representative: Mr. Azeem Ullah Cell No: 0331 2592705

- Islamabad Representative: Mr. Asad M. Khan Cell No: 0301 1189153

- Islamabad Representative: Mr. Shahzad Mehmood Cell No: 0304 1927401

- Lahore Representative: Mr. Rana Asif Altaf Cell No: 0300 6362042

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Solar Panel On Installment FAQs

How can I apply for the Solar Panel On Installment scheme offered by Meezan Bank?

You can apply for the Solar Panel On Installment by visiting your nearest Meezan Bank branch or by calling their helpline at 111-331-331 or 111-331-332. The bank representatives will guide you through the application process.

What documents are required to apply for the Solar Panel On Installment?

To apply for Solar Panel On Installment, you need two sets of ID card copies for the applicant, co-applicant, and guarantors, proof of tax returns with NTN number, income/salary slips, and bank statements for the last 6 months, residency ownership documents, and a bank account in Meezan Bank. Additionally, Takaful proof is required after the sale.

What is the financing limit for the Solar Panel On Installment?

The financing limit for the scheme ranges from 1 Lakh to 25 Lakh, depending on your eligibility and requirements.

Can I choose the tenure for repayment?

Yes, you can choose the tenure for repayment, and the installment plans can be extended up to a maximum 5-year term.

Is the solar panel scheme available for businesses as well?

Yes, the solar panel scheme is available for both individuals (salary persons, businessmen, and pensioners) and businesses (business individuals).

Are there any age restrictions for applicants?

Yes, the primary applicant should be between 20 to 60 years of age, while the co-applicant’s age should not exceed 75 years.

How long does it take for the application to get approved or rejected?

The acceptance or rejection of the application usually takes place within 2 weeks from the submission date.

Can I sell excess electricity back to the national grid with this scheme?

Yes, through a net metering system, participants can sell excess electricity back to the national grid, contributing to the national energy supply.

Are there any specific requirements for a down payment?

The down payment ranges from 15% to 50%, depending on the applicant’s status and the nature of the program.

How can I calculate the estimate for my solar panel plant financing?

To calculate the estimate, you can use the Meezan Bank Solar Panel Calculator on their website (https://www.meezanbank.com/solar-panel-financing/). Provide necessary information such as segment (salary person, business individual, or pensioner), required financing limit, down payment, and tenure, and click “Calculate” to get an exact estimate for solar panel financing.

Is this scheme available for businesses as well?

Yes, the Solar Panel On Installment scheme is available for both individuals (salary persons, businessmen, and pensioners) and businesses (business individuals).

Are there any age restrictions for applicants?

Yes, the primary applicant should be between 20 to 60 years of age, and the co-applicant’s age should not exceed 75 years.

Can I sell excess electricity back to the national grid with this solar panel scheme?

Yes, participants can sell excess electricity back to the national grid through a net metering system, contributing to the national energy supply.

Recommended Reading: How To Open A Bank Account In Pakistan | Bank Account Opening Requirements

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment