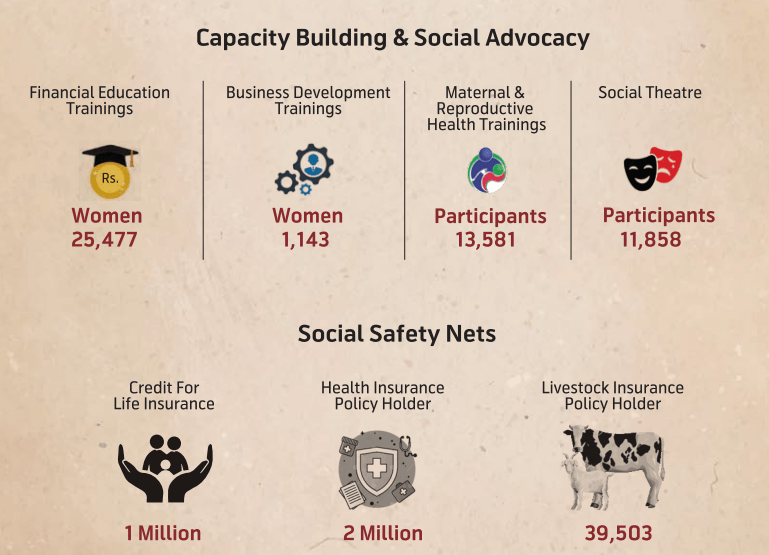

Kashf Foundation Insurance is a non-profit program that offers a range of insurance products designed to cater to the specific needs of low-income individuals and families in Pakistan.

The organization’s flagship programs include Kashf Life Insurance, Kashf Health Insurance, and Kashf Animal Insurance, each of which provides much-needed protection to vulnerable communities.

In this article, we will explore each Kashf Foundation insurance program in more detail, and highlight the impact that they have had on the lives of low-income individuals and families in Pakistan.

Recommended Reading: List Of Government Insurance Companies In Pakistan (Approved+Certified)

Micro-Insurance: 3 Types Of Kashf Foundation Insurance

Table of Contents

- Micro-Insurance: 3 Types Of Kashf Foundation Insurance

Recommended Reading: List Of Top 10 Insurance Companies In Pakistan (Secure+Certified)

What Is the Kashf Foundation?

Kashf Foundation is a non-profit organization that provides microfinance services to low-income households, especially women, in Pakistan. Kashf Foundation was founded in 1996 and has since provided loans and other financial services to over 3 million clients across the country.

Types Of Loans Offered By Kashf Foundation

| Product | Details |

|---|---|

| Kashf Kaboor Karza: | A credit-appraisal-backed individual loan for expanding an existing business or setting up a new business. |

| KASHF SCHOOL SARMAYA: | A unique product aiming to improve education quality by providing financial access to low-cost private schools and capacity-building training. |

| KASHF EASY LOAN: | A new product was introduced to meet the urgent needs of clients who require small loan amounts for any purpose. |

| KASHF MAHWESHI KARZA: | A lending product customized to meet the needs of female rural managers involved in dairy and meat production. |

| KASHF MARHABA PRODUCT: | Offered in Khyber Pakhtunkhwa, this product is designed in accordance with Islamic law and Sharia. |

| Kashf Saulat Karza: | Provided to repeat clients to meet their emergency needs and expenditures. |

Insurance Offered By Kashf Foundation

| Insurance Product | Details |

|---|---|

| BIMA in Kashf Sehatmand Zindagi: | A comprehensive health insurance program for the entire family. It is easy to use and understand. |

| Kashf Credit for Life Insurance: | Insurance coverage for the death or disability of the client or her major breadwinner. It covers the outstanding loan amount and provides a small burial payout to help with funeral expenses. |

| Discovery Animal Insurance: | Insurance coverage for cattle purchased in case of theft or death of the cattle. |

Kashf Foundation Insurance

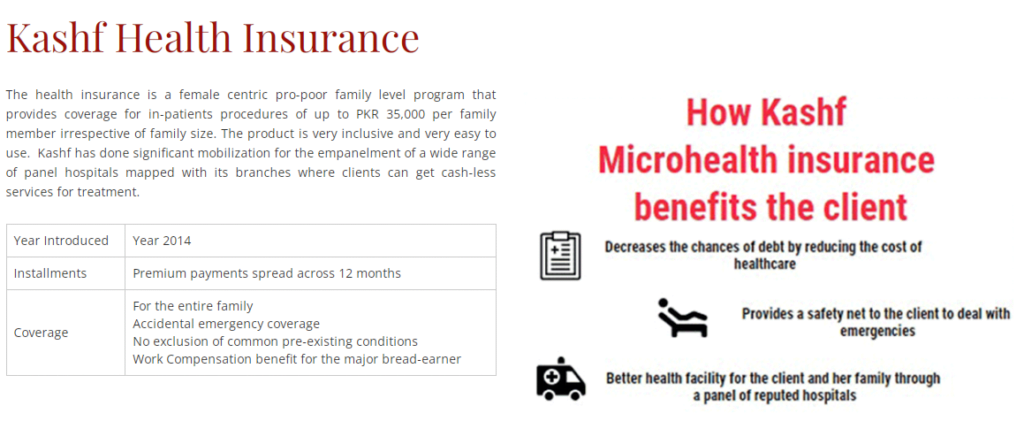

Kashaf Health Insurance

Kashf Health Insurance is a comprehensive health insurance product that was introduced by Kashaf Foundation Insurance in 2014.

Here are some of the key features of Kashaf Health Insurance:

| Feature | Details |

|---|---|

| Product Name: | Kashf Health Insurance |

| Description: | A female-centric pro-poor family program providing coverage for in-patient procedures up to PKR 35,000 per family member. |

| Year Introduced: | 2014 |

| Installments: | Premium payments spread across 12 months |

| Benefits: | Decreases chances of debt by reducing healthcare costs |

| Provides coverage for the entire family | |

| Includes accidental emergency coverage | |

| No exclusion of common pre-existing conditions | |

| Work compensation benefit for the major bread-earner | |

| Coverage: | Provides a safety net for emergencies |

| Better health facilities through a panel of reputed hospitals | |

| Empanelment: | A wide range of panel hospitals mapped with Kashf branches offering cashless treatment services |

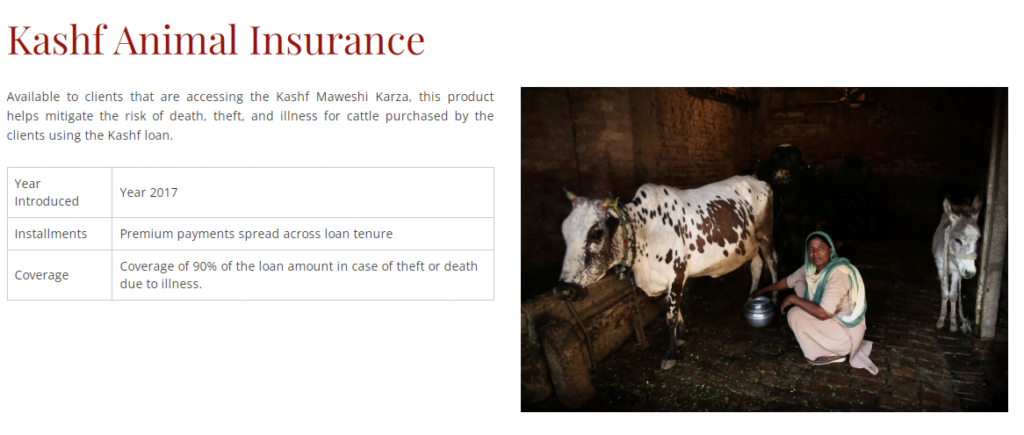

Kashf Animal Insurance | Pet Insurance

Kashf Animal Insurance, also known as Pet Insurance, is a unique insurance product offered by Kashaf Foundation Insurance that provides financial protection to farmers and livestock owners in the event of an animal’s illness, injury, theft, or death.

Here are some of the key features of Kashf Animal Insurance:

- Year Introduced: Kashf Animal Insurance was introduced in 2017.

- Premium Payments: Premium payments can be spread across the loan tenure, making it easier for farmers and livestock owners to manage their payments.

- Coverage: The policy covers 90% of the loan amount in the event of theft or death due to illness, providing much-needed financial protection to farmers and livestock owners.

- Illness Coverage: The policy also covers illness-related expenses, ensuring that policyholders can receive the necessary medical care for their animals.

- Theft Coverage: The policy covers theft, ensuring that policyholders are financially protected in case of animal theft.

Kashaf Life Insurance

Kashaf Life Insurance is a unique insurance product offered by Kashaf Foundation Insurance to provide life insurance coverage to individuals who may not have access to traditional insurance products.

Here are some of the key features of Kashaf Life Insurance:

- Accessibility: The program is specifically designed to cater to the needs of low-income individuals who may not be eligible for conventional insurance policies.

- Affordability: Kashaf Life Insurance offers coverage at affordable rates, making it accessible to a larger segment of the population.

- Customization: The insurance policy can be customized to meet the specific needs of the individual, including the sum assured, the term of the policy, and premium payments.

- Coverage: Kashaf Life Insurance provides life insurance coverage for natural or accidental death, with an option to add disability coverage as well.

- Premiums: The premiums for the policy can be paid on a weekly, monthly, or quarterly basis, making it easier for individuals to manage their payments.

- Claim settlement: The claim settlement process is straightforward and transparent, with the policyholder’s beneficiaries receiving the sum assured in the event of the policyholder’s death.

- Additional benefits: In addition to life insurance coverage, the policy also offers additional benefits such as accidental death and disability coverage, which can provide additional financial support to the policyholder and their family.

How To Apply For Kashaf Foundation Insurance

Here are the steps to apply for Kashaf Foundation Insurance by visiting the nearest Kashaf Center:

| Step | Details |

|---|---|

| 1. Locate the Nearest Center: | Visit the Kashaf Foundation website and use the “Contact Us” page to find the nearest Kashaf Center to your location. |

| 2. Visit the Center: | Identify the nearest Kashaf Center and visit it during working hours. Check the hours on the website or call their helpline. |

| 3. Speak to the Representative: | Talk to a representative at the center about the insurance product you are interested in. They will give you detailed information. |

| 4. Provide Documentation: | Provide the required documents like your ID card, proof of income, and other relevant documents. |

| 5. Fill out the Application Form: | Carefully fill out the application form provided by the representative with accurate information about yourself and your family. |

| 6. Submit Application: | Submit the completed application form and required documents to the representative. They will review your application. |

| 7. Wait for Approval: | The approval process may take some time. You will be notified by the Kashaf Foundation once your application is approved. |

Kashf Foundation Contact Number

If you need to get in touch with Kashf Foundation, here are the contact details you can use:

- Website: www.kashf.org/insurance

- Email: insurance@kashf.org

- Helpline: 0800-000-55

- Address: Kashf Foundation Head Office, 10-C, Lane 1, Shahbaz Commercial Area, Phase VI, DHA, Karachi, Pakistan.

Kashaf Foundation Insurance Pros And Cons

Pros:

- Affordable premiums: Kashaf Foundation Insurance offers insurance products that are affordable and accessible to low-income families.

- Comprehensive coverage: Kashf Foundation insurance products offered by Kashaf Foundation Insurance provide comprehensive coverage for various aspects of life, including health, life, and animal insurance.

- Spread-out payments: Premium payments for Kashaf Foundation Insurance products can be spread out over an extended period, making it easier for policyholders to manage their finances.

- Work compensation benefits: Kashf Foundation health insurance products offered by Kashaf Foundation Insurance also provide work compensation benefits to the major breadwinner in the family, ensuring financial protection in case of work-related accidents or injuries.

Cons:

- Limited coverage: Kashf Foundation insurance products offered by Kashaf Foundation Insurance have limited coverage and may not cover all medical expenses.

- Limited geographic coverage: Kashaf Foundation Insurance is currently only available in Pakistan, limiting its accessibility to people in other countries.

- Limited product offerings: Kashaf Foundation Insurance only offers a limited number of insurance products, which may not cater to the needs of all individuals.

- Limited accessibility: Some people may have difficulty accessing Kashaf Foundation Insurance products due to geographical or logistical barriers.

Recommended Reading: Top Government Insurance Companies In Pakistan

FAQs | Kashaf Foundation Insurance

What is Kashaf Foundation Insurance?

Kashaf Foundation is a non-profit micro-insurance provider in Pakistan that offers affordable insurance products to low-income families, including health insurance, life insurance, and animal insurance.

Who can apply for Kashaf Foundation Insurance?

Kashaf Foundation Insurance is available to individuals and families who meet the eligibility criteria, which may vary depending on the specific insurance product.

How can I apply for Kashaf Foundation Insurance?

You can apply for Kashaf Foundation Insurance by visiting their website, calling their helpline number, or visiting their head office in Karachi.

What types of insurance products does Kashaf Foundation Insurance offer?

Kashaf Foundation Insurance offers health, life, and animal insurance products.

What is the coverage period for Kashaf Foundation Insurance products?

The coverage period for Kashaf Foundation Insurance products varies depending on the specific insurance product and the policy terms and conditions.

What is the claims process for Kashaf Foundation Insurance products?

The claims process for Kashaf Foundation Insurance products varies depending on the specific insurance product and the policy terms and conditions.

You can contact the Kashf Foundation customer support team for more information on the claims process.

Is Kashaf Foundation Insurance available in all parts of Pakistan?

Kashaf Foundation Insurance is currently available in selected regions of Pakistan. You can visit their website or contact Kashf Foundation customer support team for more information on their geographic coverage.

Recommended Reading: Top 10 Insurance Companies In Pakistan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment