Kisan Loan Scheme | PM Kisan Package of Rs 1,800 bn (now Rs 1.22 trillion under the PM Kissan Package) has been announced by PM Shehbaz Sharif to assist farmers who have suffered crop losses due to the extreme weather conditions (floods) of the past year.

The PML-N leader had earlier promised to introduce this package to ease the debt burden of farmers in his party’s election manifesto.

Prime Minister has finally announced Rs 1,800 billion (now Rs 1.22 trillion under the PM Kissan Package) worth of relief for the farmers in the form of tax exemptions, direct cash transfers, and tractor schemes.

| Program | Description |

|---|---|

| Kisan Loan Scheme: | A special loan program for farmers to help them recover from crop losses due to floods and extreme weather. |

| PM Kisan Package: | A relief package of Rs 1.22 trillion will help farmers affected by floods. |

| Support Provided: | 1. Tax exemptions 2. Direct cash transfers 3. Tractor schemes |

| Purpose: | To support agriculture and rural development by providing financial assistance to farmers. |

| Implementing Bank: | National Bank of Pakistan (NBP) |

| Announced By: | Prime Minister Shehbaz Sharif |

Here’s everything you need to know about the Prime Minister Kisan Loan Scheme for the agricultural sector and how it will affect the lives of all farmers across the country, especially in flood-affected areas in Pakistan

Recommended Reading: NBP Al-Ghazi Tractor Loan Scheme | Tractor Loan Scheme In Pakistan Online Apply

Kisan Loan Scheme 2024 | Government Of Pakistan Kisan Package

Table of Contents

- Kisan Loan Scheme 2024 | Government Of Pakistan Kisan Package

- PM Kisan Package For Flood-Affected Farmers 2024 (New Addition)

Recommended Reading: Free! Sewing Machine Scheme Online Apply | Silai Machine Scheme

What Is Kisan Package?

Prime Minister Kisan Loan Scheme: Prime Minister Shehbaz Sharif announced on Saturday that the Kisan Package/Kisan Loan Scheme will be distributed among the farmers by the Government of Pakistan.

The Kisan Package is a relief package for the farmers. The price support and input subsidies are part of this package which will help in reducing the input costs for crops such as wheat and sugarcane.

It also includes a government-funded crop insurance program with coverage up to 100% in case of unforeseen circumstances like drought or floods.

Recommended Reading: Shaukat Khanum Hospital Free Treatment Process | Free Cancer Treatment

What’s Included In The Kissan Package?

Prime Minister Kisan Loan Scheme: The Kisan Package by the government of Pakistan is a much-needed relief for the agricultural sector that has been suffering due to recent floods.

The government announced its intention to spend approximately Rs. 18 billion in this regard to provide an impetus for the agricultural economy. It includes several incentives like a reduction in taxes on fertilizers and pesticides and a subsidy on electricity bills for farmers.

Kisan Loan Scheme 2024

Prime Minister Kisan Loan Scheme: The “Kisan Loan Scheme 2024” has been launched by the Government of Pakistan to provide financial assistance to farmers across the country.

As part of this initiative, the government has disbursed a massive amount of Rs 1.22 trillion under the PM Kissan Package to support agriculture and rural development. This scheme aims to alleviate poverty, improve the livelihoods of farmers, and boost the agricultural sector’s growth by providing affordable credit facilities and other resources to farmers.

The government hopes that this initiative will lead to increased agricultural productivity, better crop yields, and ultimately, greater food security for the people of Pakistan.

Recommended Reading: Cost Of Cancer Treatment In Shaukat Khanum (Ultimate Guide)

Implementation Of Kissan Package

Prime Minister Kisan Loan Scheme: The Kisan Package will be implemented in two phases. First, the government will implement an urgent relief package in order to help struggling farmers.

The government will provide a subsidy per acre for wheat and rice crops and a subsidy on the purchase of fertilizers by small and medium-sized producers. After the initial round of subsidies is completed, the government will implement various initiatives in order to make farming more sustainable for farmers over time.

The Kisan Package aims to make agriculture profitable again by introducing agricultural insurance schemes for crops, increasing training opportunities for farmers, and promoting research and development projects in the field.

Recommended Reading: Interest-free Loans For Electric Bikes And Rickshaws Scheme 2024 {Updated}

PM Kisan Package For Flood-Affected Farmers 2024 (New Addition)

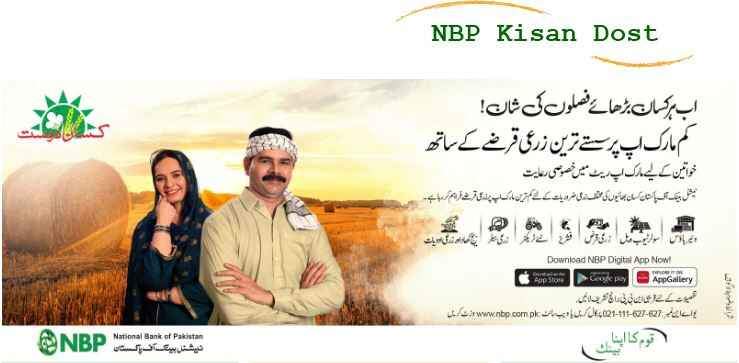

Prime Minister Kisan Loan Scheme: The National Bank of Pakistan (NBP) has recently launched a special initiative called the Prime Minister Kisan Package to support farmers affected by floods.

The NBP has taken the initiative to address the financial challenges faced by farmers who have been impacted by floods. This package offers interest-free loans to farmers, enabling them to purchase essential agricultural inputs such as seeds and fertilizers.

Key features of the Prime Minster Kisan Package are:

| Loan Type | Purpose | Loan Amount | Tenure | Details |

|---|---|---|---|---|

| Interest-Free Loan for Seed and Fertilizer: | Buy seeds and fertilizers | Up to PKR 2 Lakhs | Up to 6 months | For flood-affected farmers |

| Interest-Free Loan for Land-Owning Farmers: | Agricultural recovery and rehabilitation | Up to PKR 5 Lakhs | Up to 3 years | For farmers with flood-affected agricultural land |

Conclusion

Prime Minister Kisan Loan Scheme: Kisan Package supports objectives laid out in Vision 2025 which aims to double exports and quadruple industrial output while reducing poverty rates from 31% now to 20% within 10 years.

Furthermore, there is provision for new technology in crop cultivation such as drones and artificial intelligence along with new machinery like rice huskers or a paddy thresher that can cut down on labor costs by 30%.

Overall, it is a get step toward a way forward for revamping the agricultural sector in Pakistan. Especially, in the flood-ridden areas of Sindh, Balochistan, and South Punjab.

Recommended Reading: Governor Sindh IT Courses Registration [Website] {$5K/M+Free Courses}

Which Bank Is Best For Agriculture Loan In Pakistan (Additional Guide)

There are several banks in Pakistan that offer agriculture loans to farmers and individuals involved in agriculture-related activities. Here are the top five banks for agriculture loans in Pakistan and the reasons why they are considered the best:

| Bank | Types of Loans | Features |

|---|---|---|

| Zarai Taraqiati Bank Limited (ZTBL) | Crop loans, livestock loans, farm mechanization loans | Flexible repayment options, competitive interest rates |

| National Bank of Pakistan (NBP) | Crop loans, livestock loans, farm mechanization loans | Flexible repayment options, competitive interest rates |

| Habib Bank Limited (HBL) | Crop loans, livestock loans, farm mechanization loans | Flexible repayment options, competitive interest rates |

| MCB Bank Limited | Crop loans, livestock loans, farm mechanization loans | Flexible repayment options, competitive interest rates |

| Allied Bank Limited | Crop loans, livestock loans, farm mechanization loans | Flexible repayment options, competitive interest rates |

Recommended Reading: NBP Kisan Tractor Scheme 2024

FAQs | Kisan Package

What is PM Shehbaz Sharif Kisan Loan Scheme?

Prime Minister Kisan Loan Scheme of Rs 1,800 bn (now Rs 1.22 trillion under the PM Kissan Package) by the government of Pakistan. It would assist in purchasing fertilizers, subsidies for electricity bills, and overall agriculture sector support and subsidies.

How much money would be given to young farmers in Pakistan by the Kissan Package?

Young farmers would be given about 50 billion by the government of Pakistan to modernize and improve the agriculture sector.

What is the Prime Minister Kisan Loan Scheme for Flood-Affected Farmers?

The Prime Minister Kisan Loan Scheme (interest-free) for Flood-Affected Farmers is an initiative introduced by the National Bank of Pakistan (NBP) to provide interest-free loans to farmers who have been affected by floods.

It aims to support them in purchasing essential agricultural inputs and facilitating the recovery of their farming activities.

What is the loan tenure for the PKR 2 Lakh loan under the PM Kisan Loan Scheme?

Under Prime Minister Kisan Loan Scheme tenure for the PKR 2 Lakh loan, which is designated for seed and fertilizer purchasing, is up to 6 months.

This timeframe allows farmers to utilize the loan effectively and repay it within a reasonable period, without the additional burden of interest payments.

What is the loan tenure for the PKR 5 Lakh loan under the Prime Minister Kisan Loan Scheme?

Prime Minister Kisan Loan Scheme tenure for the PKR 5 Lakh loan, available to farmers with agricultural land, extends up to 3 years.

This longer duration offers farmers flexibility in managing their finances, allowing them to gradually repay the loan while focusing on the recovery and sustainability of their agricultural activities.

Recommended Reading: Free! Sewing Machine Scheme Online Apply | Silai Machine Scheme

If you like this article, please share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment