Meezan Bank, a leading Islamic bank in Pakistan, offers a convenient and hassle-free online as well as on-branch account opening service for individuals and business entities.

Meezan Bank Account Opening provides Riba-free banking solutions to individuals, sole proprietorships, partnerships, limited companies, and even freelancers (with income proof) to open accounts that align with their financial needs.

With the flexibility to choose from multiple currencies including the Pakistani Rupee, Euro, GBP, and Dollar, Meezan Bank ensures a diverse range of options to cater to its customer’s preferences.

We will explore eligibility criteria, account opening documents, benefits, and the Meezan Bank Account Opening process online as well as by visiting the nearest branch. So, let’s start our guide!

Recommended Reading: NBP Asaan Digital Account (CNIC+PKR 100){Benefits+Limit+Charges}

Meezan Bank Account Opening Online | How To Open Meezan Bank Account Online

Table of Contents

Recommended Reading: Solar Panel On Installment Meezan Bank | Interest-Free Loan For Solar Panels

Meezan Bank Current Account Types

Meezan Bank Account Opening: Meezan Bank provides a range of current account options to cater to diverse customer needs.

Here are the different types of current accounts offered by Meezan Bank, along with brief explanations for each:

- Rupee Account: Meezan Bank’s Rupee Account allows customers to conveniently manage their finances in Pakistani Rupees.

- Dollar Account: Meezan Bank’s Dollar Account enables customers to hold and transact in US Dollars.

- Euro Account: Meezan Bank’s Euro Account allows customers to manage their finances in Euros.

- GBP Account: Meezan Bank’s GBP Account is tailored for customers who prefer to manage their funds in British Pounds.

Recommended Reading: FREE! Bank Alfalah Asaan Current Account Opening Online {Benefits+Limit}

Meezan Bank Current Account Benefits

Meezan Bank Account Opening: Meezan Bank’s current account offers a host of benefits to its customers. Here are the key benefits provided by Meezan Bank Account Opening (current) along with explanations for each:

| Feature | Details |

|---|---|

| Free Chequebook: | Obtain a checkbook at no cost |

| Free Pay Orders: | Request Pay Orders without any charges |

| Free Internet Banking: | Access Internet Banking services without any fees |

| Minimum Investment: | Start your Rupee Current Account with a minimum investment of Rs. 1000 |

| Online Branch Banking: | Enjoy online branch banking services from anywhere in Pakistan |

| Priority Desk: | Access priority assistance at designated desks |

| No Restriction: | No limits on withdrawals or transactions |

| Unlimited Withdrawals: | Withdraw funds as many times as needed within a single day |

| No Deductions: | No deductions will be made on low balances, ensuring your funds remain intact |

Recommended Reading: Bank Alfalah Digital Account Opening | Bank Alfalah Digital Lifestyle Branch

Meezan Bank Account Opening Requirements

Meezan Bank Current Account Opening Eligibility Criteria

Meezan Bank Account Opening: To open a current account with Meezan Bank, individuals, and entities are required to meet certain eligibility criteria.

Here are the key requirements for a current account opening with Meezan Bank:

- Individuals: Individuals who wish to open a current account with Meezan Bank should be at least 18 years old and have a valid identification document such as a national identity card or passport.

- Sole-Proprietorships: Sole-proprietorships, which are businesses owned and operated by a single individual, are eligible for Meezan Bank Account Opening.

- Partnerships: Partnerships, that involve two or more individuals jointly operating a business, are eligible for current account opening with Meezan Bank.

- Limited Companies: Limited companies, both private and public, can open a current account with Meezan Bank.

- Freelancers: Freelancers can also open a current account with Meezan Bank, subject to providing proof of income.

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

Documents Required For Account Opening In Meezan Bank

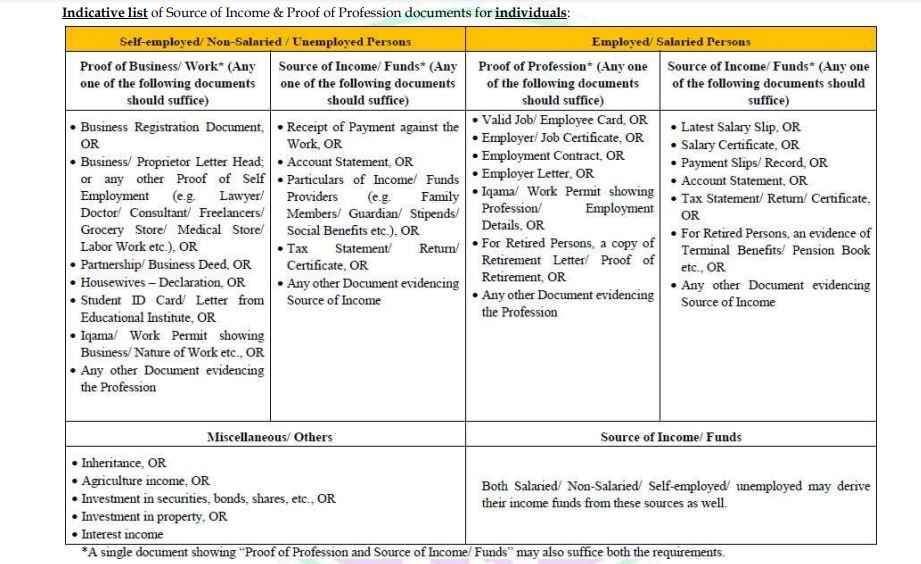

Meezan Bank Account Opening: When opening an account with Meezan Bank, customers are required to submit specific documents to fulfill the account opening requirements.

Here are the documents needed for different categories of individuals:

| Employment Status | Proof of Profession | Source of Income/Funds |

|---|---|---|

| Employed/Salaried: | Valid Job/Employee Card Employer/Job Certificate Employment Contract Employer Letter Iqama/Work Permit showing Profession/Details Retirement Letter (for retired persons) | Latest Salary Slip Salary Certificate Payment Slips/Record Account Statement Tax Statement/Return/Certificate Evidence of Terminal Benefits/Pension Book (for retired persons) |

| Self-employed/Non-Salaried/Unemployed: | Business Registration Document Business/Proprietor Letterhead Partnership/Business Deed Housewives Declaration Student ID Card/Letter from Educational Institute Iqama/Work Permit showing Business/Nature of Work Any other Document evidencing the Profession | Receipt of Payment against the Work Account Statement Details of Income/Funds Providers (e.g., Family Members/Guardian/Stipends/Social Benefits) Tax Statement/Certificate Any other Document evidencing the Source of Income |

You can download this list and prepare all the necessary documents before starting the Meezan Bank Account Opening process online or on-branch.

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Meezan Bank Account Opening Process

How To Open Meezan Bank Account Online | Meezan Bank Internet Banking App

Meezan Bank Account Opening: Opening a Meezan Bank account online is a convenient and straightforward process. Here are the steps to open a Meezan Bank account online, along with explanations for each:

- Download the Meezan Bank Internet Banking App: Begin the process by downloading the Meezan Bank Internet Banking app. You can find the app on the Google Play Store by searching for “Meezan Bank Internet Banking”.

- Verify Mobile Number: After installing the app, open it and follow the on-screen instructions to register your mobile number. A One-Time Password (OTP) will be sent to your registered mobile number for verification.

- Input Your CNIC: Provide your CNIC number for verification. This step ensures that you are a valid Pakistani citizen and eligible to open an account with Meezan Bank.

- Provide Your Professional Details: Enter your professional details, including your occupation, employer information, and source of income.

- Biometric Verification: Undergo biometric verification using your registered fingerprints. This step adds an extra layer of security to ensure that the account is being opened by the authorized individual.

- Live Selfie: Take a live selfie using the app’s camera feature. This is another security measure to verify your identity and prevent fraudulent activities.

- Review And Submit: Review all the information you have provided and make sure it is accurate.

- All Done: Congratulations! You have successfully opened a Meezan Bank account online.

Recommended Reading: How To Open Joint Account In Standard Chartered Bank {Charges+Working}

Meezan Bank Account Opening By Visiting Nearest Branch

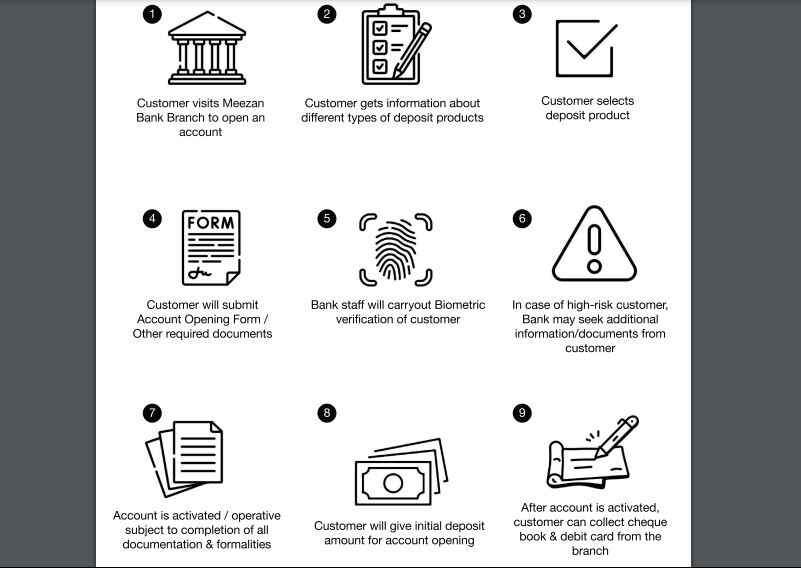

Meezan Bank Account Opening: To open a Meezan Bank account by visiting the nearest branch, follow these steps:

| Step | Details |

|---|---|

| 1 | Customers visit the Meezan Bank Branch to open an account. |

| 2 | The customer gets information about different types of deposit products offered by the bank. |

| 3 | Customer selects a deposit product based on their preferences and requirements. |

| 4 | Bank staff will carry out Biometric verification of the customer for identity confirmation. |

| 5 | The customer will submit the Account Opening Form along with any other required documents. |

| 6 | In the case of a high-risk customer, the bank may request additional information or documents. |

| 7 | The account is activated/operative subject to completion of all documentation and formalities. |

| 8 | The customer will give the initial deposit amount required for account opening. |

| 9 | After the account is activated, the customer can collect their checkbook and debit card from the branch. |

Recommended Reading: How To Open A Bank Account In Pakistan | Bank Account Opening Requirements

Meezan Bank Internet Banking Registration

Meezan Bank Account Opening: To register for Meezan Bank Internet Banking, follow these steps:

- Visit the Official Website: Go to the official Meezan Bank website at https://ebanking.meezanbank.com/AmbitRetailFrontEnd/mblOnlineRegistration.

- Enter CNIC and Account Number: On the registration page, you will be prompted to enter your CNIC and Account Number.

- Complete the Verification Process: Once you have entered the required details, follow the on-screen instructions to complete the verification process.

- Create Login Credentials: After successful verification, you will be prompted to create your login credentials.

- Set Security Measures: Meezan Bank may also require you to set up additional security measures, such as security questions or a two-factor authentication method

- Agree to Terms and Conditions: Read and accept the terms and conditions of Meezan Bank’s Internet Banking services.

- Complete the Registration: After reviewing the information and ensuring its accuracy, submit the registration form to complete the process.

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Meezan Bank Account Opening FAQs

What is Meezan Bank Account Opening Charges?

Whether you are living in Pakistan or living abroad. Meezan Bank Account Opening Charges are only PKR 1,000.

Meezan Bank Account Opening Benefits?

The following are the key benefits of Meezan Bank Account Opening:

Free Chequebook

Free Pay Orders

Free Internet Banking

Account Opening In PKR 1000O-Only

Online Branch Banking

Unlimited Withdrawal

No Deductions (On Low Balenc Only).

How can I open a Meezan Bank account online?

For Meezan Bank Account Opening online, you can download the Meezan Bank Internet Banking app from the Google Play Store and follow the account opening process outlined in the app.

You will need to provide your personal information, undergo verification, and submit the necessary documents as per the bank’s requirements.

What documents are required for opening a Meezan Bank account at a branch?

While starting Meezan Bank Account Opening at a branch, you will need to provide valid identification documents, such as CNIC, passport, POC, ARC, or POR Card, depending on your citizenship or residency status.

Additionally, you will need to provide proof of profession or source of income, along with other supporting documents requested by the bank.

What is the minimum initial deposit required to open a Meezan Bank account?

The minimum initial deposit required to open a Meezan Bank account is usually PKR 1000.

However, this may vary depending on the type of account you are opening and any specific promotions or offers available at the time.

How long does it take to activate a Meezan Bank account?

The account activation process typically takes 24 to 48 hours, depending on the type of account (individual or entity) and the completion of the necessary verification procedures by the bank.

You will be notified once your account is activated and ready for use.

Can I open a joint account with Meezan Bank?

Yes, Meezan Bank allows customers to open joint accounts. Joint accounts can be opened by individuals, partnerships, or companies, as per the bank’s account opening policies and requirements.

Can I choose the currency for my Meezan Bank account?

Yes, Meezan Bank offers account openings in multiple currencies. You can choose to open your account in Pakistani Rupee (PKR), US Dollar (USD), Euro (EUR), or British Pound (GBP), depending on your preference and needs.

What are the benefits of Meezan Bank’s current account?

Meezan Bank’s current account offers various benefits, including a free Chequebook, free pay orders, free internet banking, account opening with a low minimum deposit, online branch banking, unlimited withdrawals, and no deductions on low balances.

Can I open a Meezan Bank account if I am a non-resident Pakistani?

Yes, Meezan Bank allows non-resident Pakistanis to open accounts. You can provide the required documents, such as a valid passport and proof of Pakistani origin, to fulfill the account opening criteria.

Can I open a Meezan Bank account as a sole proprietor or freelancer?

Yes, Meezan Bank facilitates account openings for sole proprietors and freelancers. You will need to provide the necessary documents, including proof of profession or source of income, to meet the account opening requirements.

What are the available account types for businesses at Meezan Bank?

Meezan Bank offers current accounts for different types of businesses, including sole proprietorships, partnerships, and limited companies.

Can I open multiple accounts with Meezan Bank?

Yes, you can open multiple accounts with Meezan Bank. Whether it’s for different purposes or currencies, you can maintain multiple accounts to manage your finances efficiently.

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment