Many online loan apps in Pakistan are scamming hundreds of people with millions of rupees daily. They lure people by offering easy loans and trap them in their fishy net.

SECP and FBR, have recently launched a probe against these companies and have started acting against these loan apps.

But, still, many innocent people are being trapped daily by these illegal loan apps and they end up losing their hard-earned money.

We consider it our duty to inform our readers of these illegitimate lenders and save their time and money along with mental fatigue.

Here is an overview of the online loan apps that are reportedly scamming people in Pakistan. This table includes the loan apps’ names, the type of scam they are involved in, and any known consequences of using these apps.

| S.No | Loan App Name | Type of Scam | Known Consequences |

|---|---|---|---|

| 01 | Barwaqt | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 02 | PK Loan | Unauthorized Charges | Financial loss, data misuse |

| 03 | AiCash | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 04 | Asan Qarz | Unauthorized Charges | Financial loss, data misuse |

| 05 | Udhar Paisa | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 06 | RoboCash | Unauthorized Charges | Financial loss, data misuse |

| 07 | ZetaLoan | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 08 | Fast Loan | Unauthorized Charges | Financial loss, data misuse |

| 09 | Easy Money | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 10 | B Cash | Unauthorized Charges | Financial loss, data misuse |

| 11 | Credit Cat | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 12 | Easy Loan | Unauthorized Charges | Financial loss, data misuse |

| 13 | Kredit | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 14 | Bonga | Unauthorized Charges | Financial loss, data misuse |

| 15 | CashBeam | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 16 | CashMate | Unauthorized Charges | Financial loss, data misuse |

| 17 | CashIt | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 18 | Plati Loans | Unauthorized Charges | Financial loss, data misuse |

| 19 | Mrloan | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 20 | Swift Loans | Unauthorized Charges | Financial loss, data misuse |

| 21 | Fori Qarz Online Personal Loan | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 22 | CashPro-Immediate Approval | Unauthorized Charges | Financial loss, data misuse |

| 23 | Loanclub | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 24 | HamdardLoan | Unauthorized Charges | Financial loss, data misuse |

| 25 | QuickCash | High-Interest Rates, Hidden Fees | Debt trap, harassment |

| 26 | 567 Speed Loan | Unauthorized Charges | Financial loss, data misuse |

| 27 | MyCash | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 28 | Zenn Park -Easy Instant Help | Unauthorized Charges | Financial loss, data misuse |

| 29 | Bee Cash | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 30 | Asaan Qarza- credit loans | Unauthorized Charges | Financial loss, data misuse |

| 31 | Superb Loans | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 32 | Galaxy Loan | Unauthorized Charges | Financial loss, data misuse |

| 33 | TiCash | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 34 | LendHome | Unauthorized Charges | Financial loss, data misuse |

| 35 | Rico Box – Easy Apply Online | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 36 | Easy Mobile Loans | Unauthorized Charges | Financial loss, data misuse |

| 37 | Yocash | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 38 | Harsha Tube – Quick Money | Unauthorized Charges | Financial loss, data misuse |

| 39 | Fair Loans | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 40 | Loan Credit Cash | Unauthorized Charges | Financial loss, data misuse |

| 41 | Aasan Lab – Easy Apply for Money | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 42 | Rose Cash – Loan Cash | Unauthorized Charges | Financial loss, data misuse |

| 43 | FinMore- Online Credit Loans | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 44 | BG Loan | Unauthorized Charges | Financial loss, data misuse |

| 45 | Get Welfare | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 46 | Tazza Centre – Get Money Soon | Unauthorized Charges | Financial loss, data misuse |

| 47 | UrCash | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 48 | Whale | Unauthorized Charges | Financial loss, data misuse |

| 49 | Fori Instant Loans | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 50 | Little Cash- Mobile Loans | Unauthorized Charges | Financial loss, data misuse |

| 51 | Debit Campsite | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 52 | Apple Qist Qarz | Unauthorized Charges | Financial loss, data misuse |

| 53 | Easy Loans Credit Fast Pay | High-Interest Rates, Hidden Fees | Financial loss, harassment |

| 54 | Sallam Loan – Online Loan App | Unauthorized Charges | Financial loss, data misuse |

| 55 | CashCredit-Online Loan money bee | High-Interest Rates, Hidden Fees | Financial loss, debt trap |

| 56 | Qarza Pocket -Personal Funds | Unauthorized Charges | Financial loss, data misuse |

That being said, let’s look at the names of remaining fake apps and if you need money online then which options are safe for you.

Lastly, if you fell victim to any of these loan sharks how can you you still save yourself? Here we go!

Recommended Reading: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

List Of Online Loan Apps That Are Scamming | Fake Loan Apps List

Table Of Contents

- List Of Online Loan Apps That Are Scamming | Fake Loan Apps List

- How Online Loan Apps Trap People In Their Scams?

- List Of Online Loan Apps That Are Involved In This Scam

How Online Loan Apps Trap People In Their Scams?

These online loan apps trap people by offering them easy money or easy loans of up to PKR 10,000 to PKR 100,000 by simply installing their apps on mobiles.

They transfer money to their Easypaisa/jazz cash accounts or directly to their bank accounts within a few minutes, for a time duration of a few weeks or a month.

They have hidden fees and conditions which are unacceptable to poor ones who apply for these online loans to meet their urgent needs.

Along with their other terms and conditions, they charge up to 200% of interest rates which are applicable for a weekly loan.

People end up buying more loans from similar or different apps to pay their loan amounts and end up losing their money, and assets to these scammers.

That’s why we have compiled a comprehensive list of these apps to save people from this fraud. So, let’s start our list!

Recommended Reading: SmartQarza Loan App-25,000 Online Urgent Loan In Pakistan (SECP Verified)

List Of Online Loan Apps That Are Involved In This Scam

Online Loan App Scam: Following is the list of top loan apps that are scamming people in Pakistan. So, beware of these apps and inform your loved ones to save their hard-earned money.

- Barwaqt

- PK Loan

- AiCash

- Asan Qarz

- Udhar Paisa

- RoboCash

- ZetaLoan

- RoboCash

- Fast Loan

- Easy Money

- B Cash

- Credit Cat

- Easy Loan

- Kredit

- Bonga

- CashBeam

- CashMate

- CashIt

Fake Loan Apps List 2024 | Online Loan Apps Banned List

Following is a complete list of 40+ loan apps blocked by the Ministry of Finance Pakistan:

- Plati Loans

- Mrloan

- Swift Loans

- Fori Qarz Online Personal Loan

- CashPro-Immediate Approval

- Loanclub

- HamdardLoan

- QuickCash

- 567 Speed Loan

- MyCash

- Zenn Park -Easy Instant Help

- Bee Cash

- Asaan Qarza- credit loans

- Superb Loans

- Galaxy Loan

- TiCash

- ZetaLoan- Easy Credit Wallet

- LendHome

- Rico Box – Easy Apply Online

- Easy Mobile Loans

- Yocash

- Harsha Tube – Quick Money

- Fair Loans

- Loan Credit Cash

- Aasan Lab – Easy Apply for Money

- Rose Cash – Loan Cash

- FinMore- Online Credit Loans

- BG Loan

- Get Welfare

- Tazza Centre – Get Money Soon

- UrCash

- Whale

- Fori Instant Loans

- Little Cash- Mobile Loans

- Debit Campsite

- Apple Qist Qarz

- Easy Loans Credit Fast Pay

- Sallam Loan – Online Loan App

- CashCredit-Online Loan money bee

- Qarza Pocket -Personal Funds

Recommended Reading: Get 25,000 Personal Loan Via Mobile | Paisayaar Urgent Cash Loan App

Here is a list of the government-approved online loan apps in Pakistan, along with other approved lending services categorized by their companies and services:

| S.No | Company Name | Service Type | App Name |

|---|---|---|---|

| 01 | JingleCred Digital Financial Services Limited | Loan App | Paisayaar |

| 02 | Seedcred Financial Services Limited | Loan App | Barwaqt |

| 03 | 4Sight Finance Services (Pvt) Limited | Loan App | Aitemaad |

| 04 | Walee Financial Services (Pvt) Limited | Loan App | Hakeem |

| 05 | Pakisnova Microfinance Company (Pvt) Limited | Loan App | Fauri Cash |

| 06 | Goldlion Financial Private Limited | Loan App | SmartQarza |

| 07 | Abhi Private LTD | Earned Wage Access (EWA) | Abhi – Your Salary Now! |

| 08 | Tez Financial Services Limited | Buy Now Pay Later (BNPL) | ZoodPay & ZoodMall |

| 09 | Cashew Financial Services Limited | B2B Financing | Muawin |

| 10 | QistBazaar Pvt Limited | Buy Now Pay Later (BNPL) | QistBazaar |

| 11 | CreditBook Financial Services Limited | B2B Financing | Tijara |

How Can We Save Ourselves from Online Loan Scams

Online Loan App Scam: Loan scams can be very convincing and it’s important to take steps to protect yourself and your money. Here are some tips to avoid loan scams and protect your finances:

- Do your research: Before applying for a loan, research the lender or loan app thoroughly. Check if the lender is registered with the relevant authorities and has a good reputation. You can also read reviews and ratings from other customers to get an idea of their experience.

- Beware of upfront fees: If a lender or loan app asks for upfront fees or charges, it’s a red flag. Legitimate lenders usually deduct fees from the loan amount, and you should never have to pay any fees before receiving the loan.

- Don’t share personal or financial information: Never share your personal or financial information, such as your social security number, bank account number, or credit card details, unless you’re sure that the lender is legitimate.

- Read the terms and conditions: Before accepting a loan offer, carefully read the terms and conditions to understand the interest rates, fees, and repayment terms. If anything is unclear, ask the lender for clarification.

- Trust your instincts: If something seems too good to be true, it probably is. Trust your instincts and be cautious if a lender or loan app is making unrealistic promises or pressuring you to accept a loan.

- Seek professional advice: If you’re unsure about a loan offer or if you’re experiencing financial difficulties, it’s recommended to seek professional advice from a financial advisor or credit counselor.

By following these tips, you can protect yourself from loan scams and ensure that your finances are safe. It’s important to be vigilant and cautious when applying for loans to avoid falling victim to fraud.

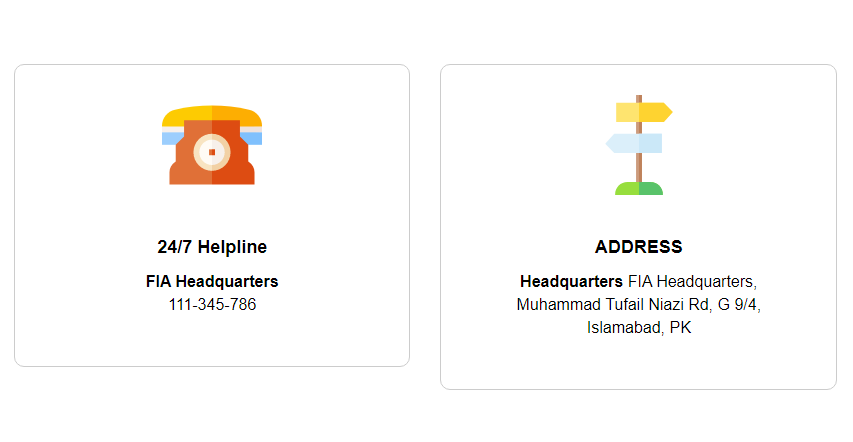

How to Report An Online Loan Scam in Pakistan?

Online Loan App Scam: If you believe you have been the victim of a loan fraud or scam in Pakistan, you should report it immediately to the relevant authorities. Here are the steps you can take to report a loan fraud or scam:

- Contact the lender or loan app: If you suspect that a lender or loan app has engaged in fraudulent activity, you should first contact them to report the issue and request a refund if necessary.

- Contact the State Bank of Pakistan: If you are unable to resolve the issue with the lender or loan app, you can contact the State Bank of Pakistan (SBP) to report the fraud. You can do this by calling the SBP’s toll-free helpline at 0800-77000 or by submitting a complaint online through the SBP’s complaint management system.

- File a complaint with the Federal Investigation Agency: If you believe that a loan fraud or scam is criminal in nature, you can file a complaint with the Federal Investigation Agency (FIA). You can do this by visiting your nearest FIA office and submitting a written complaint or by submitting an online complaint through the FIA’s website.

- Contact the relevant consumer protection agency: If you believe that your rights as a consumer have been violated, you can contact the relevant consumer protection agency to report the issue. In Pakistan, the main consumer protection agency is the Pakistan Consumer Protection Council.

By reporting loan fraud or scams, you can help protect yourself and others from financial harm.

It’s important to take action quickly if you believe that you have been the victim of a fraud or scam to minimize the damage and increase the chances of recovering your money.

Recommended Reading: Online Loan Apps {New List} | Fori Loan App In Pakistan

Online Loan Apps | FAQs

How do loan apps work?

Loan apps typically require users to download the online loan app and create an account. Users can then apply for a loan online by providing personal and financial information.

The loan app then uses algorithms and machine learning to assess the user’s creditworthiness and approve the loan. Once approved, the funds are transferred to the user’s bank account.

What are the risks associated with online loan apps and online loans?

The main risks associated with online loan apps and online loans include high-interest rates, hidden fees, and the potential for scams and fraud.

What should I consider when choosing an online loan app or online lender?

When choosing an online loan app or online lender, it’s important to consider factors such as interest rates, fees, repayment terms, and customer service.

You should also research the lender or loan app thoroughly and read reviews from other customers to get an idea of their experience.

Top institutions in Pakistan that give interest-free loans?

Several institutions in Pakistan offer interest-free loans to eligible individuals or groups. Here are some of the top institutions:

Akhuwat

Pakistan Poverty Alleviation Fund (PPAF)

Islamic Relief Pakistan

Alkhidmat Foundation Pakistan

National Bank of Pakistan.

Top 3 Online Loan Scamming Apps that are Banned in Pakistan?

Following are the name of the Top 3 Currently Online Loan Apps that are banned in Pakistan.

Fair Loans

Fori Instant Loans

Easy Mobile Loans

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment