There are hundreds of online loan apps on Google Play Store that provide digital lending services in Pakistan and other countries around the world.

Unfortunately, most of these “Fori Loan Apps” are spammy and fake. They blackmail their customers by accessing their contact details and by spamming their data e.g. family and personal pics and videos etc.

To guide our audience and to save them from potential scams, we have listed a list of the top 5 online loan apps in Pakistan that are registered and approved by SECP for online loan services.

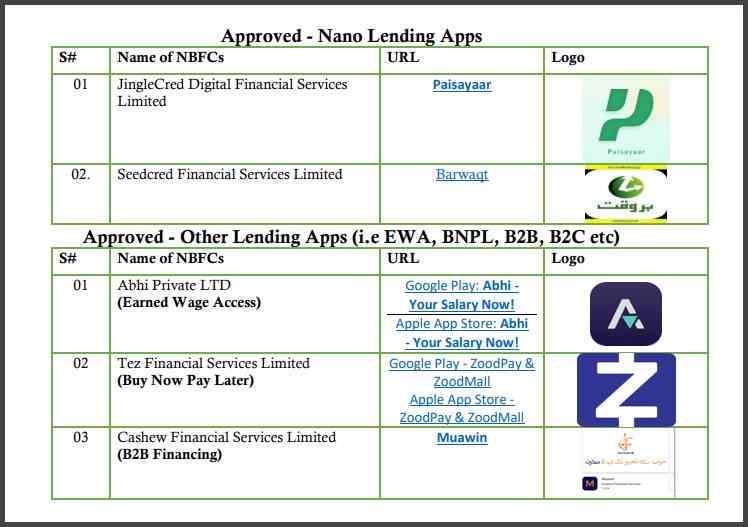

The following nano loan apps are approved by SECP for 2024 and onward:

- Barwaqt

- Paisayaar

- Abhi-Your Salary Now!

- Zoodpay

- Muawin.

Here is a brief overview table of SECP Pakistan registered loan apps:

| Loan App | Loan Amount | Repayment Terms | Key Features |

|---|---|---|---|

| Barwaqt | Up to PKR 25,000 | 30 to 90 days | 24/7 service, no collateral required, flexible disbursement options |

| Paisayaar | PKR 5,000 to PKR 25,000 | 60 to 90 days | Easy sign-up, direct transfer to Easy Paisa, Jazz Cash, or bank |

| Abhi-Your Salary Now! | PKR 25,000 to PKR 100,000 | 30 to 90 days | Quick salary advances, user-friendly app, flexible loan amounts |

| Zoodpay | Varies (Buy Now Pay Later model) | Flexible installment options | Access to millions of products, international presence |

| Muawin | Based on business needs | 3 to 6 months (Islamic financing) | B2B focus, Sharia-compliant, choice of lenders |

We strictly advise/forbid our readers from getting online loans from other loan apps except the above listed by us, to avoid any sort of scam/blackmailing.

Having said that! Now, let’s discuss eligibility criteria, requirements, terms and conditions, and a step-by-step guide on how to get loans from above listed online loan apps in Pakistan in detail. Here we go!

Recommended Readings: Get 25,000 Personal Loan Via Mobile | Paisayaar Urgent Cash Loan App

Online Loan Apps Approved By SECP | Registered Loan Apps In Pakistan

![Online Loan Apps (For 2026) {New List} [Fori Loan App In Pakistan] 1 loan-apps-in-pakistan](https://personalloan.pk/wp-content/uploads/2024/05/loan-apps-in-pakistan.jpg)

Table of Contents

What Are Online Loan Apps And How Do They Work?

Online loan apps serve as a modern financial solution crafted to deliver accessible funds to individuals through digital platforms swiftly. These innovative tools streamline the conventional loan application journey, utilizing technology to create a smooth and efficient borrowing experience.

Digital Accessibility: Unlike conventional lending institutions, Online Loan Apps prioritize user accessibility. Users can initiate the entire loan application process directly from their smartphones or computers, eliminating the need for time-consuming visits to physical branches.

Application Process: The application process for Online Loan Apps is designed to be user-friendly, typically involving a series of straightforward steps. Applicants need to complete digital forms, providing essential personal and financial information. The submission process is often accompanied by minimal documentation.

Credit Assessment: Online Loan Apps leverage advanced algorithms and data analytics to swiftly evaluate the creditworthiness of applicants. The automated credit assessment process enables quick decision-making, reducing the time users need to wait for approval or denial of their loan requests.

Quick Disbursement: Upon approval, Online Loan Apps expedite the disbursement of funds. The digital nature of these platforms facilitates swift financial transactions, ensuring that the approved funds reach the borrower’s account promptly, addressing urgent financial needs.

Repayment Flexibility: Online Loan Apps commonly present borrowers with a range of flexible repayment options. Borrowers can select from various repayment plans, including monthly installments, tailored to suit their financial capabilities. This adaptability enriches the borrower’s experience and aligns with diverse financial preferences.

Security Measures: To protect user data and financial information, reputable Online Loan Apps implement robust security measures. Encryption technologies and secure servers are commonly deployed to preserve users’ sensitive data’s confidentiality and integrity throughout the borrowing process.

Customer Support: Online Loan Apps consistently offer accessible customer support services. Borrowers can seek assistance or clarification on any aspect of the loan application or repayment process through in-app communication channels, emails, or helplines. This contributes to an overall user-friendly experience.

Recommended Readings: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

List Of Approved Nano Loan Apps | Digital Lending Apps White List By SECP

Barwaqt-Nano Loan App

- Barwaqt Online Loan App extends loan amounts of up to PKR 25,000 with user-friendly terms and conditions for 30 to 90 days at maximum repayment time.

- A round-the-clock loan service ensures that applicants can submit their requests at any time, offering unparalleled accessibility.

- No collateral is required, providing a hassle-free and straightforward application process.

- Barwaqt offers a diverse range of methods for disbursing funds, allowing borrowers to choose the most convenient option for receiving their money.

- Flexibility in choosing the loan amount and duration, tailoring the financial assistance to meet individual needs.

- Experience the advantage of relatively low fees, making Barwaqt a cost-effective solution for those seeking financial support.

Recommended Readings: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

Paisayaar-Online Loan App

- Paisayaar Online Loan App provides a convenient avenue for securing personal loans exclusively through mobile applications, offering a range from Rs. 5,000 to Rs. 25,000, accessible round the clock.

- Begin your journey by signing up with your registered mobile number, whereupon you can effortlessly select your preferred loan amount. The chosen sum is promptly transferred to your Easy Paisa, Jazz Cash account, or directly into your designated bank account.

- Repayment terms are designed for flexibility, requiring borrowers to settle the loan amount within 60 to 90 days.

Recommended Readings: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

Abhi-Your Salary Now!-Digital Lending App

![Online Loan Apps (For 2026) {New List} [Fori Loan App In Pakistan] 2 Abhi-Your-Salary-Now-Digital-Lending-App](https://personalloan.pk/wp-content/uploads/2023/11/Abhi-Your-Salary-Now-Digital-Lending-App.jpg)

- Abhi-Your Salary Now! introduces a digital lending platform offering online salary advances ranging from Rs. 25,000 to Rs. 100,000, with a requirement to settle the borrowed amount within 30 days.

- Access the loan application by visiting the Google Play Store on your mobile device.

- Install the Abhi-Your Salary Now! loan app to kickstart the straightforward application process.

- Registration is simple; provide your mobile number and CNIC details to create your account.

- Choose your desired loan amount, ranging from Rs. 25,000 to Rs. 100,000 (Select Rs. 50,000, if you are applying for the first time), by completing a user-friendly form within the app.

- Upon submission of your application, expect the loan amount to be swiftly transferred within 5 minutes to your specified Easypaisa, Jazz Cash, or designated bank account.

- With the funds in hand, you’re all set! Remember, the repayment window spans 30 to 90 days, allowing flexibility in settling the borrowed amount.

Recommended Readings: Top 5 Apps To Get Urgent Loan In Pakistan {10K-2Lakh} {Updated}

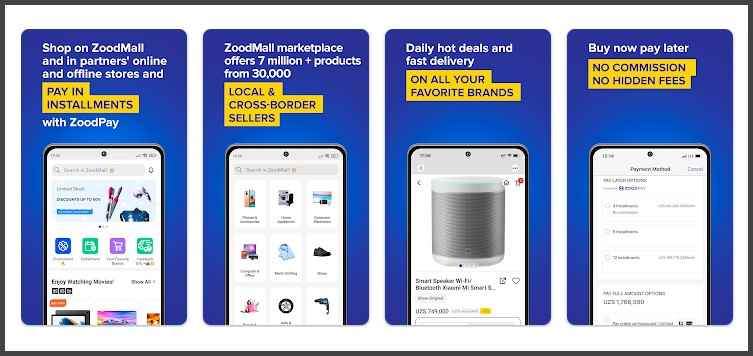

Zoodpay-Buy Now Pay Later

- Zoodpay operates on the “Buy Now Pay Later” model, providing users with convenient installment options for their purchases.

- With access to a vast array of choices, Zoodpay users can explore and shop among 7+ million products available in over 30,000 stores, both locally and internationally.

- Zoodpay has established a presence in multiple countries, actively serving customers in Pakistan, Uzbekistan, and Lebanon.

- While Zoodpay offers flexibility in payment methods, reviews suggest that the delivered services may fall short of user expectations, impacting the overall satisfaction of its user base.

- It’s essential to note that Zoodpay, in its operations, collects personal data, including contact details and payment information. This data is shared with third parties, raising considerations regarding privacy and data handling practices.

Recommended Readings: Get 25,000 Personal Loan Via Mobile | Paisayaar Urgent Cash Loan App

Muawin-Buy Now Pay Later App In Pakistan

- Muawin emerges as Pakistan’s pioneering Business to Business (B2B) “Buy Now Pay Later App,” introducing a unique approach to financial assistance.

- The platform empowers users to choose from different lenders, facilitating the acquisition of the desired credit or online loan for initiating or sustaining business endeavors.

- Setting itself apart, Muawin operates on Islamic financing principles, ensuring compliance with Sharia guidelines in its financial practices.

- The flexibility offered by Muawin is evident in the preparation of loan amounts, allowing for easy installment plans spanning 3 to 6 months. The duration is determined by the credibility of applicants and the specific nature of their business ventures, tailoring the repayment structure to individual needs.

Recommended Readings: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

FAQs | Online Loan Apps In Pakistan

Which Online loan apps were approved by SECP?

The following online loan apps are approved by SECP for loan services across Pakistan:

Barwaqt

Paisayaar

Abhi-Your Salary Now!

Zoodpay

Muawin.

What loan amounts does Barwaqt offer, and under what terms?

Barwaqt provides loan amounts ranging up to PKR 25,000 with user-friendly terms.

How accessible is Barwaqt’s loan service, and when can one apply?

Barwaqt offers a 24-hour loan service, allowing applicants to apply at any time.

Is collateral required when applying for a loan through Barwaqt?

No, Barwaqt’s loan service does not require any collateral.

What methods are available for receiving the loan amount from Barwaqt?

Barwaqt offers a variety of methods for receiving money, providing flexibility for borrowers.

Are there relatively low fees associated with Barwaqt’s loan service?

Yes, like other Online Loan Apps Barwaqt offers relatively low fees, enhancing its cost-effectiveness for borrowers.

What loan amounts are offered by Paisayaar, and what is the repayment duration?

Paisayaar provides online loans ranging from Rs. 5,000 to Rs. 25,000, with a repayment period of 60-90 days. Unlike other Online Loan Apps its terms and conditions are user-friendly to facilitate common people.

What steps are involved in applying for a loan through Paisayaar?

Users can sign up using their registered mobile number, select the desired amount, and receive instant transfers to their Easy Paisa, Jazz Cash, or bank account.

What loan amounts are available through Abhi-Your Salary Now?

Abhi-Your Salary Now! offers online salary advances ranging from Rs. 25,000 to Rs. 100,000, with a 30-day repayment window.

How can one apply for a loan through Abhi-Your Salary Now!?

Applicants can install the app, register with their mobile number and CNIC details, and select their desired loan amount through a simple form.

What model does Zoodpay operate on, and where does it function?

Zoodpay operates on the “Buy Now Pay Later” model and is actively working in Pakistan, Uzbekistan, and Lebanon.

How extensive is the product range available to Zoodpay users?

Zoodpay users can shop from 7+ million products in more than 30,000 stores locally and internationally.

What are the concerns raised in reviews about Zoodpay’s services?

Reviews suggest that Zoodpay’s services may not meet user expectations, impacting overall satisfaction.

What data does Zoodpay collect and share with third parties?

Zoodpay collects personal data such as contact details and payment information, sharing it with third parties.

What distinguishes Muawin as Pakistan’s first B2B “Buy Now Pay Later App”?

Muawin stands out as Pakistan’s first Business to Business (B2B) “Buy Now Pay Later App.”

How does Muawin operate regarding credit for business ventures?

Muawin allows users to select any lender for the desired credit (online loan) to start or support business ventures.

What financing principles does Muawin adhere to in its operations?

Unlike other Online Loan Apps, Muawin operates on Islamic financing principles, ensuring Sharia compliance in its financial practices.

What is the range of loan amounts and installment durations offered by Muawin?

Muawin offers loan amounts of Rs. 25,000 to Rs. 100,000, with easy installments spanning 3 to 6 months based on applicant credibility and business nature.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment