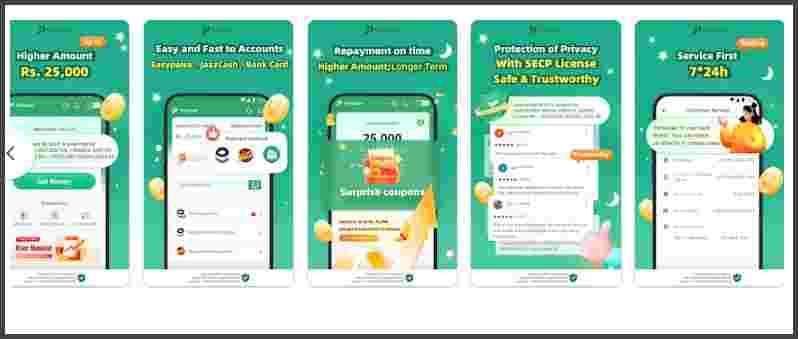

Paisayaar Loan App gives your desired personal loan via mobile only, ranging from Rs. 5,000-Rs. 25,000 24/7.

The following is an overview table of the Paisayaar app for online loans:

| Feature/Aspect | Details |

|---|---|

| Loan Amount Range | PKR 5,000 to PKR 25,000 |

| Eligibility Criteria | – Age: 18+ – Pakistani citizen – Registered mobile number linked to ID card |

| Loan Disbursement Channels | – Easy Paisa – Jazz Cash – Bank account |

| Repayment Duration | 30 to 90 days |

| Application Process | 1. Download the Paisayaar app from the Google Play Store 2. Sign up with the registered mobile number 3. Select your desired amount, and your selected amount will be instantly transferred into your Easy Paisa, or Jazz Cash account, or directly into your bank account number. |

| Verification | Complete identity verification using CNIC |

| Approval Time | Typically within 5 minutes |

| Repayment Terms | – Full repayment within 60-90 days – Accidental application repayment within 24 hours |

| Interest Rate | 0.6% per day |

| Penalty Rate | 2.3% per day (after repayment due date) |

| Loan Calculator | Available on the official website to estimate repayment, markup, and overdue charges |

| Customer Support | – Primary Hotline: 051-111-883-883 – Secondary Hotline: 051-884-127-0 |

| Email Support | support@paisayaar.pk |

| Company Ownership | JingleCred Digital Finance Services Ltd |

| User Base | Over 10 million users |

| Related Loan Apps | – SmartQarza Loan App – Qarza Loan App – Top 3 Loan Apps in Pakistan |

| App Download Options | – Google Play Store search for “Paisayaar” – Direct download link from the official website |

Maximum loan limits, repayment duration, and terms & conditions of getting a personal loan via mobile from the Paisayaar loan app are as follows:

- You can only get loan amounts ranging from PKR 5,000 to PKR 25,000 if you apply for the first time.

- Once, you receive the loan amount you have to repay it within 60-90 days.

- If you applied for your loan accidentally, you can return the principal amount i.e. same amount within 24 hours.

- After successful repayments loan amount and repayment duration could be increased depending upon your credit score.

Recommended Amount: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

How To Get A 25,000 Personal Loan Via Mobile | Paisayaar-Personal Loan App

Table of Contents

Who Can Get 25K Personal Loan Via Mobile From Paisayaar

Here are the eligibility criteria for individuals looking to obtain a 25K personal loan via mobile from Paisayaar:

- Age Requirement: Applicants must be 18 years of age or older to qualify for the loan.

- Citizenship and Mobile Registration: The loan is accessible to any citizen of Pakistan who possesses a registered mobile number linked to their ID card.

- Clean Loan Record: To be eligible for the loan, applicants should not have defaulted on previous loans from Paisayaar or any other loan app. A good repayment history is essential for loan approval.

- Banking Facilities: Applicants are required to have either a bank account or a mobile wallet to receive the loan amount. This ensures the seamless transfer of funds and facilitates repayment through the preferred financial channels.

Recommended Amount: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

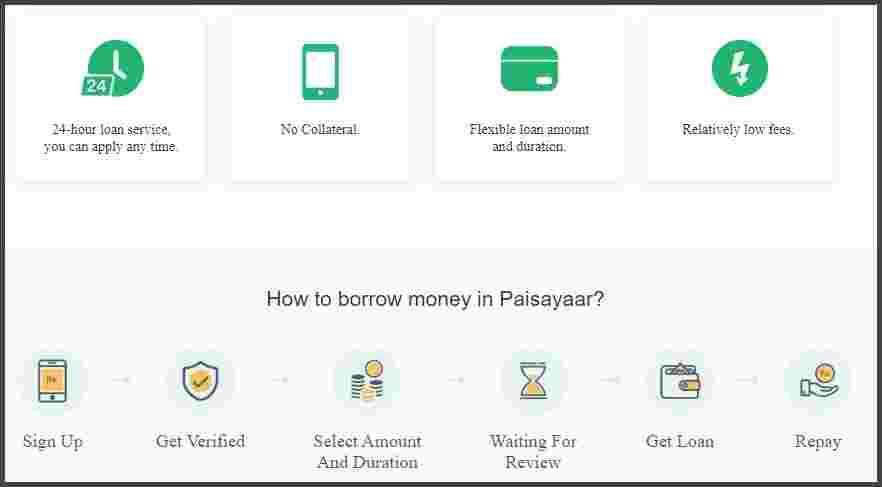

How To Get 25K From Paisayaar Loan App Via Mobile

Here’s a breakdown of the process of getting a Personal Loan Via Mobile ranging from Rs. 2K to Rs. 25K loan from Paisayaar via their mobile app:

- Download the Paisayaar App: Access the Paisayaar loan app through the Google Play Store on your mobile device.

- Sign Up Using Registered Phone Number: Register by using the phone number linked to your CNIC (Computerized National Identity Card).

- Complete Verification: Fill in the necessary personal information to verify your identity.

- Amount and Duration Selection: Choose the desired loan amount within the range of Rs. 5,000 to Rs. 25,000 and select the repayment duration.

- Await Review Approval: After submission, the loan application undergoes a review process which, once approved, allows for the loan to be granted.

- Receive Approved Loan: Upon approval, the loan amount will be swiftly transferred into your Easypaisa, Jazz Cash account, or directly into your designated bank account, typically within 5 minutes.

- Repayment Terms: After receiving the loan, the repayment period ranges between 30 to 90 days. The borrowed sum needs to be repaid within this specified timeframe.

Recommended Amount: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

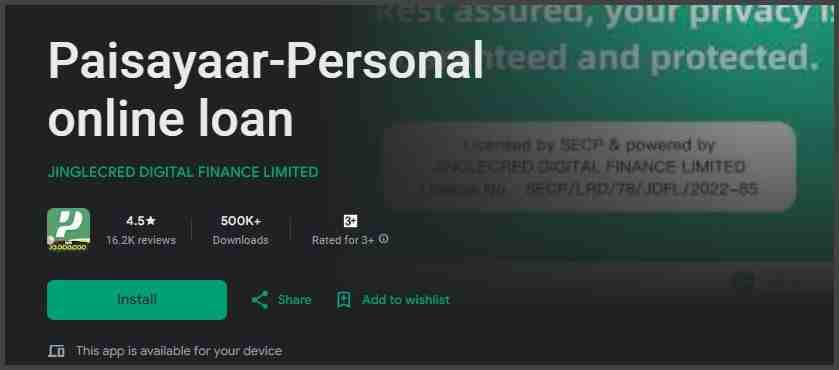

Paisayaar Loan App Download

You can download the Paisayaar loan app by following one of the following methods:

- Accessing Google Play Store: Open the Google Play Store on your mobile device.

- Search for “Paisayaar”: Within the Google Play Store, search for “Paisayaar” in the search bar to locate the app.

- Download the App: Click on the app and initiate the download process to acquire the Paisayaar loan app swiftly.

- Quick Access to Required Loan: Once the app is downloaded, you’ll have immediate access to the loan application process, allowing you to apply for the required loan within seconds.

Alternatively, you can also obtain the official Paisayaar app instantly by using the provided link:

Paisayaar Download Link: Paisayaar App – Google Play Store

By clicking on the provided link, you’ll be redirected to the official app page on the Google Play Store, enabling a rapid and direct download of the Paisayaar loan app.

Recommended Amount: Top 5 Apps To Get Urgent Loan In Pakistan {10K-2Lakh} {Updated}

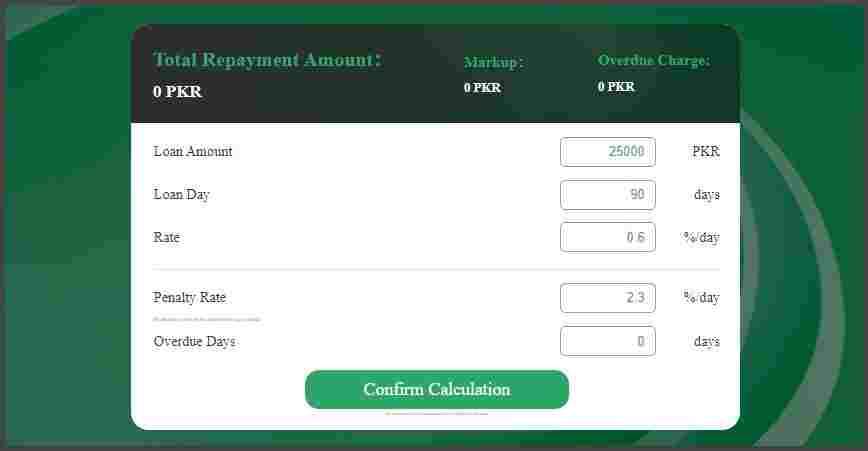

Paisayaar Loan Calculator

The Paisayaar loan app’s official website offers a loan calculator tool available for users.

- Calculations and Estimations: The loan calculator provides the ability to compute and estimate various factors associated with the loan, including:

- Total Repayment Amount: Users can determine the overall repayment amount, considering the principal loan amount, interest, and any applicable charges.

- Markup Calculation: The tool facilitates the calculation of the interest or markup associated with the loan.

- Overdue Charges Estimation: Users can estimate the charges that might apply in case of overdue payments.

For example, if you get a 25K Personal Loan Via Mobile for 90 days then loan calculator estimations are as follows:

- Loan Details for Calculation:

- Loan Amount: 25,000 PKR

- Loan Duration: 90 days

- Interest Rate: 0.6% per day

- Penalty Rate: 2.3% per day (only applied after the repayment due date)

Users can input these details into the loan calculator on the Paisayaar loan app’s website to obtain estimations for the total repayment amount, markup, and potential overdue charges based on their specific loan parameters.

Recommended Amount: SmartQarza Loan App- 25,000 Online Urgent Loan In Pakistan (SECP Verified)

Paisayaar Loan Helpline Number

- Office Location: The headquarters of Paisayaar is at Fortune Residency, Ground Floor, Street no. 26, in the National Police Foundation area, specifically at E11/4, Islamabad.

- Contact Email: Individuals can reach out via email at support@paisayaar.pk for any support inquiries or assistance.

- Service Hotline Numbers:

- Primary Service Hotline: Dial 051-111-883-883 for customer service support and general inquiries.

- Secondary Service Hotline: An additional contact number available for customer service assistance is 051-884-127-0.

- Grievance Redressal Officer: The Grievance Redressal Officer can be contacted at 03088888260 for specific grievances or escalation matters.

Recommended Amount: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

Paisayaar Loan App Owner

- Company Ownership: The Paisayaar Loan App is under the ownership and operation of JingleCred Digital Finance Services Ltd.

- Employee Demographics: Approximately 99% of the workforce within the company comprises Pakistani individuals.

- User Base: The app serves a vast user base, extending its financial services to more than 10 million individuals.

Recommended Amount: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

FAQs | Paisayaar Loan App

Which is the best app to borrow a loan?

SECP has allowed 3 nano loan apps in Pakistan to provide loan services. You can choose any one of the following loan apps:

1. Paisayaar_Personal Loan Via Mobile.

2. SmartQarza_Personal Loan Via Mobile.

3. Abhi – Your Salary Now!_Personal Loan Via Mobile.

Which app can I borrow loan?

You can choose any of the following loan apps to get an instant Personal Loan Via Mobile between Rs. 2,000 to Rs. 50,000:

1. Paisayaar_ Provides Rs. 2,000 to Rs. 25,000 Personal Loan Via Mobile.

2. SmartQarza_ Provides Rs. 5,000 to Rs. 30,000 Personal Loan Via Mobile.

3. Abhi – Your Salary Now!_ Provides Rs. 10,000 to Rs. 50,000 Personal Loan Via Mobile.

Who owns and operates the Paisayaar Loan App?

The Paisayaar Loan App is owned and operated by JingleCred Digital Finance Services Ltd.

How many users does Paisayaar serve?

Paisayaar provides Personal Loan Via Mobile to a user base exceeding 10 million individuals till now.

What are the eligibility criteria for obtaining a 25K personal loan via the Paisayaar Loan App?

To qualify for a 25K Personal Loan Via Mobile, you should be 18 years or older, be a Pakistani citizen with a registered mobile number against your CNIC, have a clean loan repayment history with no defaults, and possess a bank account or mobile wallet.

How do I apply for a loan using the Paisayaar Loan App?

You can apply for Personal Loan Via Mobile by downloading the app, signing up with your registered mobile number, filling in the required personal information, selecting the desired loan amount and duration, waiting for the review process, and upon approval, the loan amount will be transferred to your designated account.

How long do I have to repay the loan I receive from the Paisayaar Loan App?

After receiving your funds, you have a repayment window of 30 to 90 days to return the loan amount.

How can I contact Paisayaar’s customer support?

You can contact Paisayaar’s customer support to get a PKR 25,000 Personal Loan Via Mobile at 051-111-883-883 or 051-884-127-0.

For complaints, you can reach the designated officer at 03088888260.

Additionally, you can send an email to support@paisayaar.pk for inquiries and assistance.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment