Akhuwat Student Loans Program, which provides financial assistance to students who are unable to afford their educational expenses.

This program provides interest-free loans to students who are unable to afford their educational expenses, ensuring that talented students are not held back by financial constraints.

In this article, we will explore the Akhuwat Student Loans Program in more detail, discussing its benefits, eligibility criteria, and impact on student’s lives.

We will also examine the role of microfinance in promoting education and alleviating poverty, and how Akhuwat’s initiatives are contributing to the development of a more equitable and inclusive society.

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

Akhuwat Student Loans In Pakistan | Student Loans In Pakistan Without Interest

Table of Contents

Recommended Reading: Akhuwat Foundation Emergency Loan (10K-50K) {Interest-free}

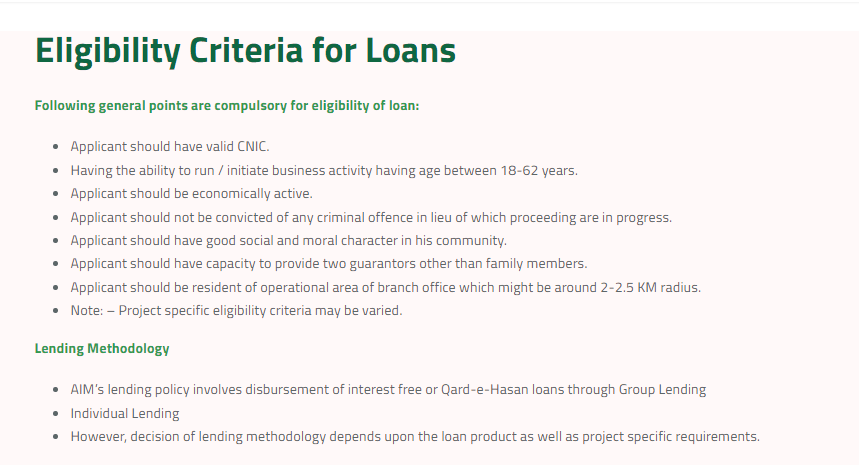

Akhuwat Student Loans Eligibility Criteria

The Akhuwat Student Loan Program aims to provide financial assistance to students who are unable to afford their educational expenses.

To be eligible for this program, applicants must meet the following criteria:

- Residency: The applicant must be a citizen of Pakistan and a resident of the area where Akhuwat operates its programs.

- Education Level: The applicant must be enrolled in a recognized educational institution at the intermediate, bachelor, master, or post-graduate level.

- Academic Performance: The applicant must have a good academic record, with a minimum GPA of 2.5 for intermediate and bachelor’s level students, and a minimum GPA of 3.0 for master’s and post-graduate level students.

- Financial Need: The applicant must demonstrate a genuine need for financial assistance, with a total family income not exceeding PKR 30,000 per month. The applicant’s family income will be verified through a household survey and documentation.

- Character References: The applicant must provide at least two character references from reputable individuals who can vouch for the applicant’s moral character, academic potential, and financial need.

- Co-Signer: The applicant must have a co-signer who is willing to guarantee the loan repayment. The co-signer must have a good credit history and be able to provide collateral if necessary.

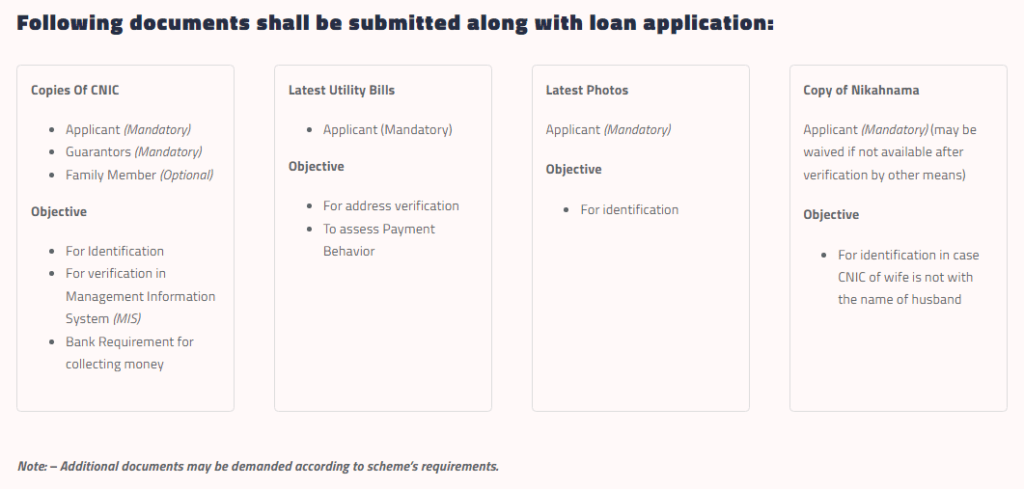

Akhuwat Student Loans Documents Required

To apply for an Akhuwat Student Loan, applicants must provide the following documents:

- Educational documents: Applicants must submit their educational certificates, transcripts, and enrollment proof from a recognized educational institution. The documents must be attested by the relevant authorities.

- Proof of residency: Applicants must provide proof of their permanent and current address, such as a utility bill, rent agreement, or domicile certificate.

- Income and family documentation: Applicants must submit their and their family’s income proof, including payslips, bank statements, tax returns, and other relevant documents. They may also need to provide proof of their family size and composition, such as a family registration certificate or national identity card.

- Character references: Applicants must provide at least two character references from reputable individuals who can vouch for the applicant’s moral character, academic potential, and financial need. The references must include the contact information of the reference person.

- Co-signer documentation: Applicants must provide the co-signers income and asset proof, such as payslips, bank statements, tax returns, and property documents. They may also need to provide the co-signers national identity card or passport copies.

- Photographs: Applicants must provide recent passport-size photographs of themselves and their co-signer.

Recommended Reading: Akhuwat Islamic Microfinance {10K-50K} Akhuwat Interest-free Loans

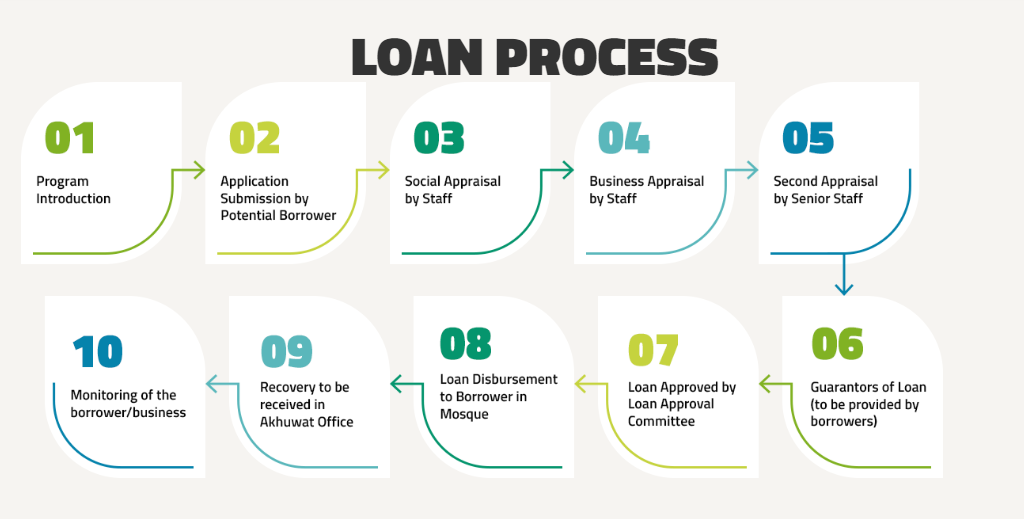

Akhuwat Student Loans Loan Application Process

If you are interested in applying for an Akhuwat Student Loan, you can follow these steps to complete the loan application process from the nearest Akhuwat center:

- Find your nearest Akhuwat center: Visit the Akhuwat website or contact the Akhuwat helpline to find the nearest Akhuwat center in your area.

- Collect the loan application form: Visit the Akhuwat center and collect the student loan application form. You may need to provide the necessary documents mentioned in the application form.

- Fill out the application form: Fill out the loan application form completely and accurately. Make sure to provide all the necessary information, including your personal and academic details, co-signer information, and income details.

- Submit the application form and documents: Once you have completed the loan application form, submit it along with the required documents to the Akhuwat center. The center staff will verify your information and documents, and may also conduct a household survey to assess your financial need.

- Wait for loan approval: After submitting your loan application, you will need to wait for the Akhuwat staff to review your application and make a decision on whether to approve your loan request. This may take several days or weeks, depending on the volume of loan applications received and the availability of funds.

- Receive loan disbursement: If your loan application is approved, you will receive the loan amount in your bank account or through a cheque. The Akhuwat staff will also provide you with details about the loan repayment process, including the repayment schedule and options.

It is important to note that the loan application process and requirements may vary depending on the specific guidelines and policies of Akhuwat.

Applicants should always check the latest guidelines and requirements before submitting their loan application.

Recommended Reading: Akhuwat Foundation Loan Online Apply | Akhuwat Loan Scheme 2024

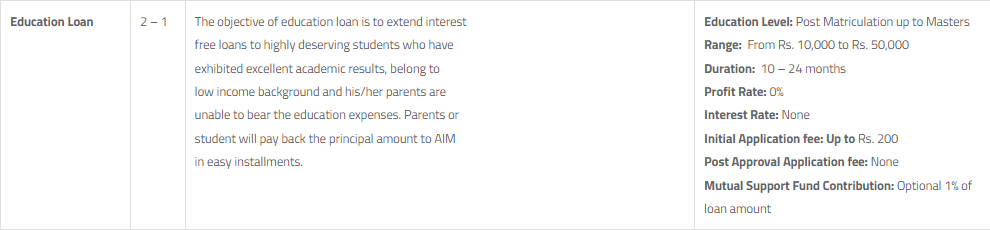

Akhuwat Foundation Student Loan Limit

The maximum loan limit for Akhuwat Student Loans varies depending on the level of education and the program in which the student is enrolled.

Here are the maximum loan limits for each level of education:

- Intermediate level: The maximum loan amount for intermediate-level students is PKR 10,000.

- Bachelor’s level: The maximum loan amount for bachelor’s level students is PKR 50,000.

- Master’s level: The maximum loan amount for master’s level students is also PKR 50,000.

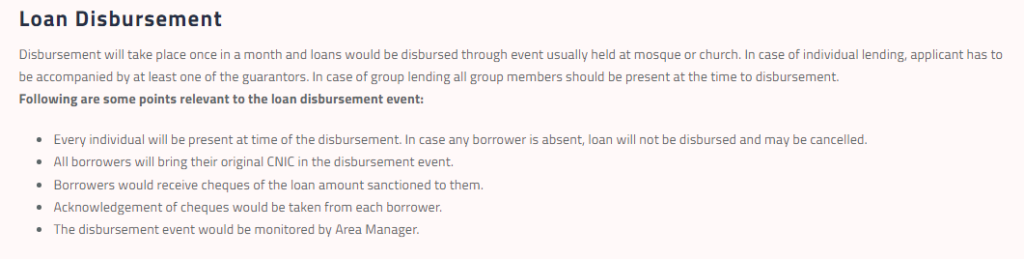

Akhuwat Foundation Loan Disbursement Process

After the loan application is approved, the loan disbursement process for Akhuwat Student Loans is typically held in a Mosque or a nearby church.

Note that the loan disbursement process may vary depending on the level of education and program in which the student is enrolled, and the policies and procedures of the Akhuwat Foundation. Students should consult with the Akhuwat Foundation

Recommended Reading: Akhuwat Foundation | 8 Types Of Akhuwat Loans (10K-1LAKH) {Interest-free}

Akhuwat Student Loans Pros And Cons

Pros:

- Interest-free loans: Akhuwat Student Loans are interest-free, which means that students can repay the loan amount without any additional interest charges. This makes the loan more affordable and accessible to students from low-income families who may struggle to pay high-interest rates on traditional loans.

- Flexible repayment terms: Akhuwat offers flexible repayment terms for its student loans, allowing students to repay the loan amount for several years. This reduces the financial burden on students and their families and allows them to focus on their studies.

- Easy application process: The loan application process for Akhuwat Student Loans is straightforward to follow. Students can visit the nearest Akhuwat center and fill out the loan application form, submit the required documents, and wait for the loan approval decision.

- No collateral required: Akhuwat Student Loans do not require any collateral or guarantor, which makes it easier for students to apply for the loan and get approval.

Cons:

- Limited loan amount: The maximum loan amount for Akhuwat Student Loans is relatively low compared to other student loan programs, which may not be sufficient to cover the full cost of education for some students.

- Eligibility criteria: The eligibility criteria for Akhuwat Student Loans may be stringent, and not all students may qualify for the loan. Students who do not meet the income or academic requirements may not be eligible for the loan.

- Limited availability: Akhuwat Student Loans may not be available in all areas or for all levels of education, which limits the accessibility of the loan for some students.

- Repayment requirements: While the repayment terms for Akhuwat Student Loans are flexible, students are still required to repay the loan amount over some time. Failure to do so may result in penalties and a negative credit rating.

Recommended Reading: Akhuwat Foundation Emergency Loan (10K-50K) {Interest-free}

Akhuwat Student Loans FAQs

What is the interest rate for Akhuwat Student Loans?

Akhuwat Student Loans are interest-free, which means that the loan amount will not accumulate any interest during the repayment period.

What are the eligibility criteria for Akhuwat Student Loans?

The eligibility criteria for Akhuwat Student Loans may vary depending on the level of education and program in which the student is enrolled. Generally, students must have a minimum GPA of 2.5, come from low-income households, and provide relevant documents to support their loan application.

What is the maximum loan amount for Akhuwat Student Loans?

The maximum loan amount for Akhuwat Student Loans varies depending on the level of education and program.

The maximum loan amount for master’s level, bachelor’s level, and intermediate level students is PKR 10,000-PKR 50,000.

Is collateral required for Akhuwat Student Loans?

No, Akhuwat Student Loans do not require any collateral.

How can I apply for an Akhuwat Student Loan?

Students can visit the nearest Akhuwat center, fill out the loan application form, submit the required documents, and wait for the loan approval decision.

How long does it take to get a decision on my Akhuwat Student Loan application?

The loan approval decision may take several days or weeks, depending on the volume of loan applications received and the availability of funds.

What is the repayment period for Akhuwat Student Loans?

The repayment period for Akhuwat Student Loans varies depending on the level of education and program. Generally, students are required to repay the loan amount over 10-24 months.

What happens if I am unable to repay my Akhuwat Student Loan?

Failure to repay the loan amount may result in penalties. Students should contact Akhuwat as soon as possible if they are unable to make the loan repayments.

Recommended Reading: Akhuwat Islamic Microfinance {10K-50K} Akhuwat Interest-free Loans

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment