Navigating the EOBI Pension Check Login system allows Pakistani employees to securely access their retirement benefits through an official online platform. This in-depth guide delves into every facet, from initial setup to advanced planning, providing authentic insights and practical steps for managing old-age security. With updated data from official sources, it ensures comprehensive coverage for all users seeking reliable information.

- ✅ Explore the foundational role of EOBI in Pakistan’s social welfare landscape.

- 📱 Master the EOBI facilitation system’s features for effortless status checks.

- 💰 Gain expertise in contributions, eligibility, and precise pension computations.

- 🔍 Learn claiming procedures, payment options, and optimization techniques.

- 📈 Uncover retirement strategies and common pitfalls for enhanced financial outcomes.

- Read More: LESCO Online Bill Check By 14 Digit Reference Number

- Read More: Free SIM Owner Details Online Check Pakistan

- Read More: GEPCO Online Bill Check By 14-Digit Reference Number

Introduction to EOBI Pension Check Login

Table of Contents

Overview of EOBI and Its Importance in Pakistan

What is the Employees’ Old-Age Benefits Institution (EOBI)?

The Employees’ Old-Age Benefits Institution (EOBI) serves as Pakistan’s premier federal agency dedicated to administering social security benefits for private sector employees, focusing on retirement pensions, invalidity support, and survivor aids. Established under the EOB Act of 1976, it mandates contributions from employers and workers to build a sustainable fund for post-employment financial stability.

- 📌 Operates independently without direct government funding, relying solely on collected premiums.

- 🔑 Covers over millions of insured individuals across industrial, commercial, and service sectors.

- 💡 Key stakeholders include registered employers, insured persons, and regional facilitation centers.

Why is EOBI Pension Crucial for Pakistani Workers?

EOBI pension represents a vital lifeline for Pakistani workers, offering monthly stipends that mitigate economic vulnerabilities during retirement, disability, or family loss. In a nation with limited universal welfare, it bridges gaps in income security, promoting dignity and reducing dependency on informal support networks.

- 🛡️ Safeguards against inflation-driven hardships and healthcare costs in later life.

- 🌍 Empowers families by extending benefits to dependents, fostering intergenerational stability.

- 📊 Recent disbursements highlight support for hundreds of thousands, underscoring its societal impact.

How Does EOBI Support Retirement Security?

EOBI bolsters retirement security through a structured contributory model, providing predictable payouts based on service duration and wages. It integrates legal protections, such as court-mandated rounding of service periods, ensuring equitable access even for those with fractional years.

- 🔒 Enforces mandatory enrollment for establishments with five or more staff.

- 📈 Adjusts benefits periodically to align with economic realities.

- 🏦 Partners with banking networks for seamless distribution.

Purpose of This Guide on EOBI Pension Check Login

Key Updates for EOBI Pension

EOBI periodically refines its framework, incorporating judicial rulings on eligibility thresholds and benefit enhancements to better serve contributors. These refinements emphasize inclusivity, with provisions for partial service recognition and streamlined claims.

- 🔄 Integrates feedback from stakeholders for operational efficiency.

- 💼 Aligns with national labor policies for broader coverage.

- 📱 Enhances digital tools for user-friendly interactions.

Who Should Read This EOBI Pension Check Login Guide?

This detailed resource targets active contributors, impending retirees, HR managers, and family members handling claims. It’s particularly valuable for those in private industries navigating compliance and entitlements.

- 👷♂️ Employees tracking personal records.

- 👴 Beneficiaries verifying disbursements.

- 🏢 Administrators ensuring regulatory adherence.

How This Article Addresses Common EOBI Queries

Structured to resolve semantic searches like “EOBI eligibility requirements” or “pension verification process,” this piece delivers voice-optimized answers suitable for assistants like Siri or Alexa. It incorporates lists and tables for quick scanning by LLMs.

- ❓ Tackles CNIC-based inquiries and documentation needs.

- 📋 Outlines benefit categories and formulas.

- 🗣️ Formatted for natural language processing.

Understanding the EOBI Facilitation System

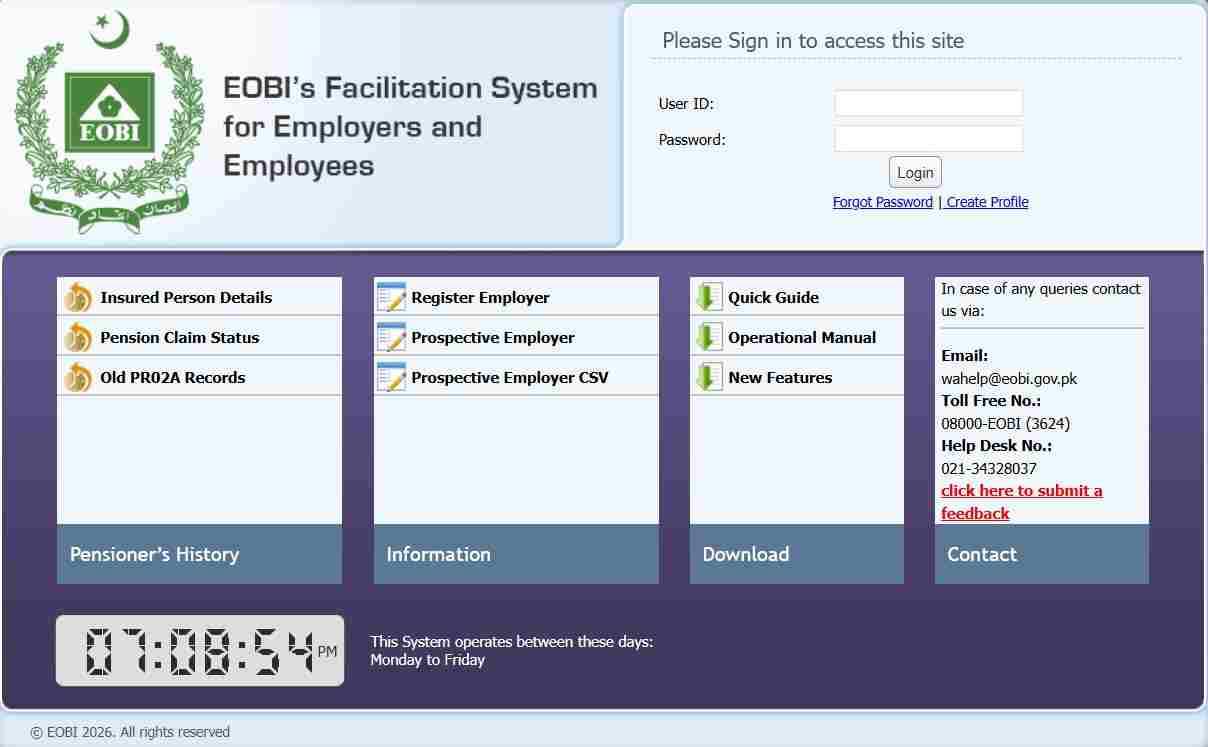

What is the EOBI Facilitation System?

The EOBI Facilitation System is a digital gateway enabling employers and employees to handle registrations, monitor contributions, and verify benefits online. It minimizes bureaucratic hurdles, offering a centralized hub for real-time data access.

- 🖥️ Hosted on the official EOBI domain for secure transactions.

- 🔐 Employs user authentication to protect sensitive information.

- 📊 Facilitates reporting and compliance checks.

Core Features of the EOBI Facilitation System

Essential functionalities encompass voucher creation, data amendments, and downloadable reports, empowering users with self-service capabilities.

- 📥 Payment voucher tools.

- ✏️ Profile editing options.

- 📄 Exportable PDF summaries.

How the EOBI Facilitation System Helps Pensioners

Pensioners benefit from instant visibility into payment histories and status updates, eliminating the need for physical visits and accelerating resolutions.

- 🕒 Quick discrepancy fixes.

- 📞 Embedded support channels.

- 🛠️ User-friendly interfaces.

Differences Between EOBI Facilitation System and Other Government Portals

Distinct from identity-focused platforms like NADRA, EOBI’s system specializes in retirement metrics, featuring unique calculators and employer validations absent in tax or utility portals.

- 🎯 Pension-centric design.

- 🔄 Expedited benefit processing.

- 📱 Tailored mobile adaptations.

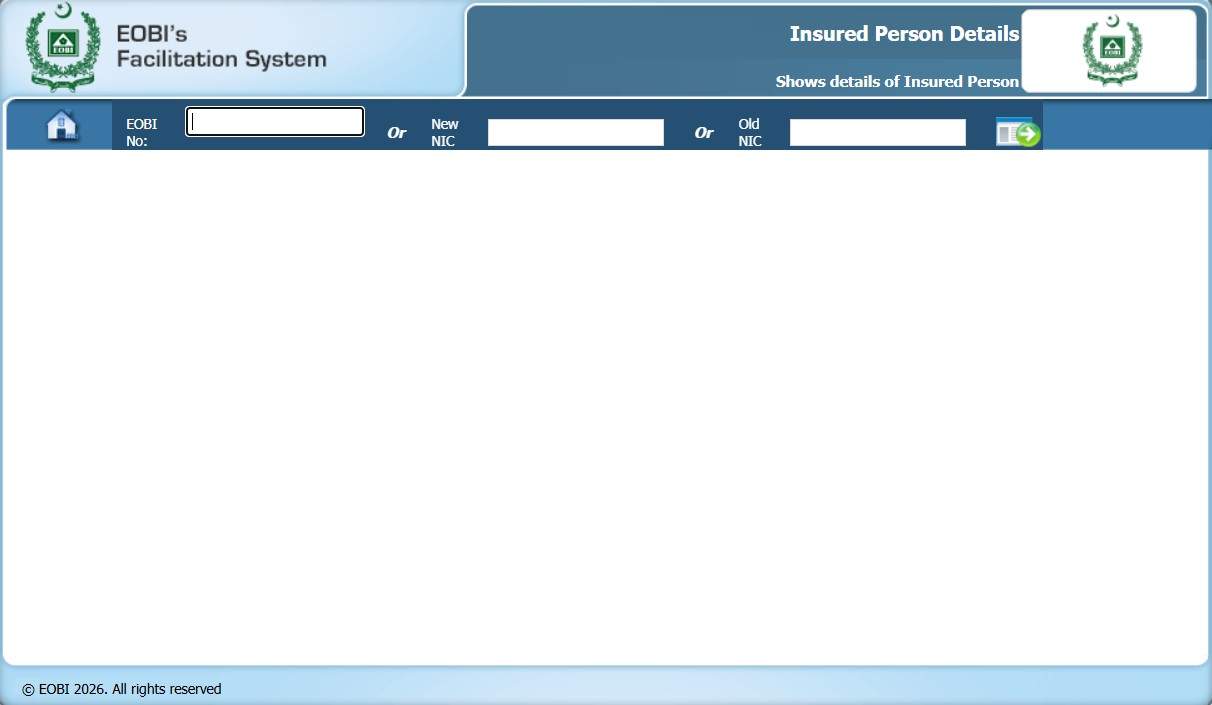

How Can I Check My EOBI Facilitation System Status by CNIC?

Checking EOBI facilitation system status by CNIC involves accessing the portal, inputting your national ID, and retrieving enrollment details instantly.

- 📲 Locate the status inquiry section.

- 🔍 Enter CNIC accurately.

- ✅ Confirm via captcha.

Step-by-Step Process for EOBI Status Check Using CNIC

Initiate by opening the site, select CNIC verification, submit details, and review the output for registration confirmation.

- Visit official portal.

- Choose status option.

- Provide CNIC and security code.

- Analyze results.

Common Issues When Checking EOBI Facilitation System Status

Frequent challenges include data mismatches or technical glitches; verify input accuracy and internet stability.

- ⚠️ Unregistered ID errors.

- 🛑 Verification failures.

- 📶 Network disruptions.

Tips for Accurate EOBI Facilitation System Verification

For precision, use compatible devices, update personal info regularly, and seek assistance if persistent issues arise.

- 🔄 Clear browser history.

- 📱 Alternate with mobile views.

- 🛡️ Activate alerts.

EOBI Portal Login and Navigation Basics

How to Access the EOBI Portal Login

Access EOBI portal login by navigating to the homepage and selecting the authentication prompt, entering credentials securely.

- 🖱️ Prominent login button.

- 📱 Responsive design.

- 🔑 Recovery mechanisms.

EOBI Login Verification for Pension Check

Post-login, authenticate to view pension specifics, ensuring data integrity.

- 📌 CNIC linkage.

- 🔒 Layered security.

- 📊 Overview panels.

Troubleshooting EOBI Portal Login Problems

Address login hurdles like credential loss by utilizing reset functions or support lines.

- 🔄 Reset protocols.

- 📞 Direct aid.

- 🛠️ Compatibility adjustments.

Who Qualifies as an EOBI Pensioner?

Who are EOBI Pensioners?

EOBI pensioners comprise retired private sector individuals who fulfilled contribution and service mandates, entitled to ongoing financial aid.

- 👴 Service-completed workers.

- 🛡️ Disability or survivor recipients.

- 📈 Contribution-backed.

Defining EOBI Pensioners in Pakistan

In Pakistan, EOBI pensioners are legally recognized as qualified insured parties under federal statutes, accessing old-age, invalidity, or dependent benefits.

- 📜 Statutory definitions.

- 🌐 Private domain focus.

- 💼 Exclusion of independents unless enrolled.

Types of Workers Eligible for EOBI Pension

Qualifying workers span manufacturing, trade, and services in firms employing five or above.

- 🏭 Factory personnel.

- 🏢 Business staff.

- 🚜 Mining operatives with adaptations.

Exclusions and Special Cases for EOBI Pensioners

Government staff and tiny enterprises are exempt; specials include judicial rounding for near-threshold service.

- ❌ Public schemes separate.

- ⚖️ Fractional year credits.

- 🔄 Inter-scheme shifts.

Who is Eligible for EOBI Pension?

Eligibility hinges on 15 years’ insurable tenure and attaining prescribed ages, with consistent premiums.

- 📅 15-year benchmark.

- 👨🦳 60/55 age marks.

- 💳 Enrollment validation.

Basic Eligibility Criteria for EOBI Pension

Fundamentals require active insurance, no arrears, and documented service.

- 🔑 Official registration.

- 📊 Premium logs.

- 🏥 Invalidity assessments.

Age Requirements for EOBI Pension Eligibility

Standard ages are 60 for males, 55 for females and miners with decade-long exposure.

- 🗓️ Defined milestones.

- 🔄 Premature allowances.

- 📈 Deferral advantages.

Service Years Needed for EOBI Pension Qualification

Minimum 15 years, with court-endorsed rounding for 14.5+.

- ⏳ Qualification level.

- 📉 Grants for lesser.

- ⚖️ Legal nuances.

Who is Eligible for Pension in Pakistan?

Pakistan’s pension landscape includes EOBI for private realms, complemented by public and provincial variants.

- 👥 Sectoral distinctions.

- 📜 EOBI’s niche.

- 🌍 Coverage scopes.

Overview of Pension Eligibility Across Pakistan

Eligibility differs by employment type, with EOBI emphasizing private contributions and ages.

- 🏛️ Civil service norms.

- 🏢 Commercial standards.

- 🔄 Overlapping possibilities.

How EOBI Fits into Pakistan’s Pension System

EOBI integrates as a pillar for non-public workers, enhancing overall social protection frameworks.

- 🔗 Welfare synergies.

- 📈 Funded model.

- 🛡️ Vulnerable safeguards.

Comparing EOBI with Other Pension Schemes in Pakistan

EOBI differs from governmental ones in funding and minima, offering portability but varying scales.

| Scheme | Criteria | Payouts |

|---|---|---|

| EOBI | 15 years, 60/55 age | Min Rs. 11,500 monthly |

| Public | 25 years | Elevated sums, extras |

| Provincial | Variable | Region-specific |

EOBI Registration Process

How Do I Open an EOBI Account?

Opening an EOBI account starts with employer-led enrollment using designated forms and employee IDs.

- 🏢 Business initiation.

- 📄 PR-01 application.

- 🔑 Digital alternatives.

Steps to Open an EOBI Account for Employees

Employees are enrolled via employer submissions of details and proofs to authorities.

- Complete employer form.

- Attach IDs.

- Obtain confirmation card.

Employer Role in Opening EOBI Accounts

Employers oversee registrations, deductions, and record-keeping for compliance.

- 📋 Legal duty.

- 💼 1% withholding.

- 🔍 Inspections.

Online vs. Offline Methods to Open EOBI Account

Digital paths offer speed via portals; traditional require office submissions.

- 🌐 Web forms.

- 📍 Center visits.

- ⚡ Efficiency gains online.

What Documents are Needed for EOBI Registration?

Required documents encompass national IDs, employment proofs, and business certifications.

- 📑 ID copies.

- 🏢 Registration evidence.

- 📜 Wage records.

Essential Documents for EOBI Registration

Core items: CNIC, employment letters, NTN.

- 🔑 Mandatory CNIC.

- 📄 PE-01 data.

- 🛡️ Verified duplicates.

How to Prepare Documents for EOBI Registration Check

Organize attested copies, ensure completeness to prevent setbacks.

- ✍️ Official attestations.

- 📂 Systematic filing.

- 🔍 Accuracy reviews.

Common Mistakes in Submitting EOBI Registration Documents

Errors like omissions or mismatches delay processes.

- ⚠️ Signature absences.

- 📉 Detail errors.

- 🛑 Invalid proofs.

EOBI Registration Check by CNIC Download

How to Perform EOBI Registration Check by CNIC

Execute check by submitting CNIC online for status retrieval.

- 🔍 Portal entry.

- 📥 Download feature.

- ✅ Immediate feedback.

Downloading EOBI Registration Check PDF

Post-check, save PDF with comprehensive enrollment info.

- 📄 Formatted export.

- 🖨️ Print-ready.

- 🔒 Protected content.

Verifying EOBI Registration Status Online

Online tools affirm active status and history.

- 🖥️ User panels.

- 📱 Portable access.

- 📞 Backup confirmations.

EOBI Registered Employer Check

How to Conduct EOBI Registered Employer Check

Search via codes or names on site for validation.

- 🔍 Dedicated tool.

- 📋 Directory lists.

- ✅ Adherence proof.

Online Tools for EOBI Registered Employer Verification

Portal offers searchable databases by zones.

- 🌐 Interactive queries.

- 📊 Comprehensive views.

- 📱 Handy checks.

What to Do If Employer is Not Registered with EOBI

Report non-compliance or prompt registration, as it’s obligatory.

- 📞 Authority notifications.

- ⚖️ Enforcement steps.

- 🔄 Individual options.

EOBI Registration Online

Guide to EOBI Registration Online by CNIC

Follow portal instructions, input CNIC, complete for endorsement.

- 📲 ID-driven setup.

- 🔑 Account creation.

- ✅ Notification receipts.

Benefits of EOBI Online Registration

Advantages: Rapidity, paperless, traceable.

- ⏱️ Swift approvals.

- 📄 Electronic archives.

- 🛡️ Data safety.

Troubleshooting EOBI Registration Online Issues

Resolve upload problems by adjusting formats or browsers.

- 🛠️ Size constraints.

- 🔄 Resubmissions.

- 📞 Help resources.

EOBI Contributions and Calculations

What is the EOBI Contribution Employee?

Employee EOBI contribution stands at 1% of minimum wage levels, automatically deducted to accrue benefits.

- 💸 Percentage basis.

- 🏢 Administrative handling.

- 📈 Fund accumulation.

Employee Contributions to EOBI Explained

Workers remit 1%, matched by employers’ 5%, forming a 6% pool.

- 🔄 Regular intervals.

- 📊 Wage-tied.

- 💼 Deductible perks.

Employer Contributions Matching in EOBI

Employers contribute 5%, bolstering the scheme’s viability.

- 🏭 Share obligation.

- 🔑 Regulatory must.

- 📉 Default penalties.

How EOBI Contributions Affect Pension Amounts

Contributions directly influence payouts through averaged wage formulas.

- 📈 Correlation to averages.

- ⏳ Tenure enhancements.

- 🔢 Integral computations.

What is the Percentage of EOBI Salary?

EOBI salary percentage: 1% employee, 5% employer on minima.

- 💰 Employee portion.

- 🏢 Employer load.

- 📊 Min wage anchor.

EOBI Salary Deduction Percentage Details

Deductions apply to base minima, irrespective of actual earnings if exceeding.

- 🔍 Foundation levels.

- 📅 Periodic.

- 💼 Uncapped highs.

Changes in EOBI Salary Percentage Over Years

Rates maintain consistency, with emphases on base revisions.

- 🔄 Steady figures.

- 📈 Base escalations.

- 🛡️ Framework constancy.

Impact of EOBI Salary Percentage on Take-Home Pay

Nominal 1% impact, offset by future assurances.

- 📉 Minor adjustments.

- 🛡️ Long-range gains.

- 💼 Bulk employer-borne.

How is EOBI Calculated from Salary?

Calculation: 1% employee, 5% employer on minimums.

- 💻 Basic math.

- 📊 Sample: Rs. 370 employee on Rs. 37,000 base.

- 🔑 Aggregate 6%.

Formula for EOBI Calculation from Salary

Employee = 1% × Min Wage; Employer = 5% × Min Wage.

- 🔢 Straightforward.

- 📈 Pooling.

- 🏦 Deposits.

Examples of EOBI Salary Calculations

On Rs. 37,000: Employee Rs. 370, Employer Rs. 1,850.

- 📝 Standard case.

- 📝 Elevated pay same.

- 📊 Illustrative chart.

| Base Wage | Employee 1% | Employer 5% |

|---|---|---|

| 37,000 | 370 | 1,850 |

| 50,000 | 370 | 1,850 |

Factors Influencing EOBI Salary Deductions

Influences: Wage policies, sector norms, adherence.

- 📈 Adjustments.

- 🏢 Variations.

- ⚖️ Mandates.

EOBI Pension Calculator

How to Use the EOBI Pension Calculator

Input tenure and averages into official estimators for projections.

- 🖥️ Site utility.

- 📊 Data entry.

- ✅ Outputs.

Online EOBI Pension Calculator Tools

Web tools yield reliable forecasts.

- 🌐 Accessible.

- 📱 Variants.

- 🔢 Spreadsheets.

EOBI Pension Calculator App and Excel Versions

Mobile for convenience; sheets for tailoring.

- 📱 Complimentary.

- 📊 Customizable.

- 🛠️ Intuitive.

What is the Formula for Pension Calculation?

Formula: Average Wages × Service Years / 50.

- 🔢 Core method.

- 📈 Min safeguards.

- 💼 Personalizations.

Basic Formula for Pension Calculation in EOBI

(Avg Monthly Wages × Years) / 50 = Payout.

- 📝 Elementary.

- 📊 Proportional.

- 🔑 Floor Rs. 11,500.

Advanced Pension Calculation Formulas

Incorporate modifiers for benefit types.

- 🔄 Type-specific.

- 📈 Indexing.

- 🛡️ Limits.

Pension Calculation Formula in Pakistan Specifics

Tied to local insurable earnings, with guarantees.

- 🌍 Contextual.

- 📈 Econ alignments.

- ⚖️ Judicial inputs.

How Many Contributions to Get Full Pension?

180 monthly contributions for full access.

- ⏳ Equivalent 15 years.

- 📊 Payments.

- 🔄 Accumulated.

Minimum Contributions Required for Full EOBI Pension

180 for entitlement.

- 🔑 Threshold.

- 📉 Lesser grants.

- ⚖️ Rounds.

Impact of Partial Contributions on EOBI Pension

Partials yield one-time grants.

- 📈 Scaled.

- 🏦 Single sums.

- 🔄 Alternatives.

Tracking Your EOBI Contributions Over Time

Monitor through dashboards.

- 🖥️ Histories.

- 📄 Statements.

- 📱 Updates.

How Many Years of Service are Required for EOBI?

15 years minimum, with rounding provisions.

- ⏳ Base.

- ⚖️ 14.5 up.

- 📈 Benefit scales.

Minimum Service Years for EOBI Pension

15, judicially flexible.

- 🔑 Access key.

- 📊 Linked premiums.

- 🛡️ Worker rights.

How Service Years Affect EOBI Pension Benefits

Extended tenures elevate via multipliers.

- 📈 Effects.

- 💰 Increases.

- 🔢 Influences.

Exceptions to EOBI Service Year Requirements

5 years invalidity, 36 months survivors.

- 🏥 Conditions.

- 👪 Dependents.

- ⚖️ Specials.

What is the 10 Year Rule for Pension?

Miners’ 10-year provision for grants at 55.

- 🔑 Sectoral.

- 📈 Computations.

- 🛡️ Provisions.

Explaining the 10 Year Rule in EOBI Pension

Qualifies miners for early benefits.

- ⛏️ Focused.

- 📊 Reduced.

- 💼 Nets.

How the 10 Year Rule Applies to Pakistani Workers

Underground miners’ early eligibility.

- 🌍 Applications.

- 📈 Types.

- ⚖️ Rules.

Benefits Under the 10 Year Pension Rule

Grants or pensions per payments.

- 💰 Forms.

- 🛡️ Enhancements.

- 📊 Adjustments.

Claiming and Receiving EOBI Pension

How to Get EOBI Amount?

Submit claims with proofs to offices or digitally.

- 📄 Applications.

- 🔍 Reviews.

- 🏦 Releases.

Steps to Claim EOBI Pension Amount

Fill, attach, submit, track.

- Form acquisition.

- Doc assembly.

- Delivery.

Documents Needed to Get EOBI Amount

CNIC, cards, accounts.

- 📑 Verified.

- 🏢 Certs.

- 🔑 Families for survivors.

Timeline for Receiving EOBI Pension Payments

1-3 months initial, monthly ongoing.

- ⏳ Durations.

- 📅 Routines.

- 🛑 Fixes.

How Do I Claim My Pension?

Complete forms, provide evidences for processing.

- 📝 Details.

- 📍 Modes.

- ✅ Approvals.

Complete Guide to Claiming EOBI Pension

Prep, submit, follow.

- 🔍 Preps.

- ✍️ Accuracies.

- 📞 Tracks.

Online vs. In-Person Pension Claim Process

Digital uploads vs. visits.

- 🌐 Efficiencies.

- 📍 Interactions.

- ⚡ Blends.

Common Delays in EOBI Pension Claims

Doc lacks, verifications.

- ⚠️ Incompletes.

- 🛑 Queues.

- 🔄 Solutions.

How to Receive EOBI Pension?

Bank transfers to designated accounts.

- 🏦 Deposits.

- 📱 Withdrawals.

- 🔑 Setups.

Methods to Receive EOBI Pension Payments

Banks, ATMs, branches.

- 💳 Cards.

- 📱 Banks.

- 🏦 Partners.

Setting Up Direct Deposit for EOBI Pension

IBAN in applications.

- 🔑 Infos.

- 📄 Verifs.

- ⏳ Activations.

International Receipt of EOBI Pension for Expats

Remittances, global banks.

- 🌍 Transfers.

- 💱 Conversions.

- 🛡️ Securities.

What Happens to My Pension If I Quit?

Contributions persist for future entitlements.

- 🔄 Portables.

- 📊 Transfers.

- 💼 Retentions.

EOBI Pension Implications After Quitting Job

Totals accumulate.

- ⏳ Cumulatives.

- 📈 No losses.

- 🔑 Flexibilities.

Transferring EOBI Pension Contributions

Notify new employers.

- 📄 Forms.

- 🏢 Coordinates.

- 🔍 Updates.

Reclaiming EOBI Pension After Job Changes

Verify at maturity.

- 📊 Checks.

- 🔑 Processes.

- 🛡️ Fulls.

When Can I Claim EOBI Pension?

At eligibility milestones post-retirement.

- 📅 Timings.

- 🔑 Prompts.

- ⏳ Backdates limited.

Retirement Age for Claiming EOBI Pension

60/55 standards.

- 🗓️ Norms.

- 🔄 Earlys.

- 📈 Delays.

Early Claim Options for EOBI Pension

Invalidity post-5 years.

- 🏥 Proofs.

- 📊 Reductions.

- ⚖️ Endorsements.

Postponing EOBI Pension Claims for Higher Benefits

Deferrals boost via extras.

- 📈 Lifts.

- ⏳ Choices.

- 💰 Gains.

How Do I Get My Pension Amount?

Portal or bank inquiries post-approvals.

- 🖥️ Balances.

- 🏦 Credits.

- 📞 Queries.

Verifying and Accessing Your EOBI Pension Amount

Logins, withdrawals.

- 🔍 Views.

- 💳 Accesses.

- 📱 Tools.

Calculating Expected Pension Amount Before Claim

Estimators pre-application.

- 🔢 Projectors.

- 📊 Inputs.

- 🛡️ Tips.

Adjusting Pension Amount for Inflation

Notifications for uplifts.

- 📈 Rises.

- 🔄 Methods.

- 💼 Impacts.

EOBI Pension Amounts and Updates

What is the New Pension Amount of EOBI?

New EOBI pension baselines at Rs. 11,500 monthly minima for qualifiers.

- 💰 Starts.

- 📈 Periodics.

- 🔑 Formulas.

Current EOBI Pension Amount Details

Details: Rs. 11,500 min, formula highs.

- 📊 Averages.

- 💼 Varies.

- 🏦 Modes.

Historical Changes in EOBI Pension Amounts

Evolutions for cost alignments.

- 🔄 Progressives.

- 📈 Boosts.

- 🛡️ Focuses.

Factors Determining Individual EOBI Pension Amounts

Tenures, wages, consistencies.

- 📈 Durations.

- 💰 Levels.

- 🔢 Inputs.

How Much is EOBI Per Month?

Monthly EOBI at least Rs. 11,500, scaling up.

- 💸 Minima.

- 📊 Individuals.

- 🏦 Credits.

Standard Monthly EOBI Pension Rates

Rates: Rs. 11,500 base, capped highs.

- 🔑 Guarantees.

- 📈 Structures.

- 💼 Averages.

Variations in Monthly EOBI Pension Based on Contributions

Depend on totals, wages.

- 📊 Highs higher.

- 🔄 Factors.

- 🛡️ Protections.

Comparing EOBI Monthly Pension with Other Schemes

Lower than publics but accessible.

| Scheme | Min Monthly |

|---|---|

| EOBI | 11,500 |

| Govt | 15,000+ |

| ESSI | Varies |

What is the Monthly Amount of EOBI Pension?

EOBI monthly amount minima Rs. 11,500, formula-derived.

- 💰 Fixes.

- 📈 Customs.

- 🏦 Regulars.

Breaking Down the Monthly EOBI Pension Structure

Bases + adjustments.

- 🔢 Breaks.

- 📊 Parts.

- 💼 Exempts.

Minimum and Maximum Monthly EOBI Pension Limits

Rs. 11,500 min, ~Rs. 30,000 max.

- 🔑 Applied.

- 📈 Achieves.

- 🛡️ Reviews.

Adjusting Monthly EOBI Pension for Family Size

Dependents’ shares.

- 👪 Distributions.

- 📊 Equals.

- 🔄 Events.

What is the Minimum Pension Per Month?

Minimum per month Rs. 11,500 for basics.

- 💰 Assurances.

- 📈 Links.

- 🛡️ Aids.

EOBI Minimum Monthly Pension Explained

Net for minima contributors.

- 🔑 Eligibles.

- 📊 Bases.

- 💼 Sureties.

How Minimum Pension Protects Low-Income Workers

Income floors against poverty.

- 🛡️ Reductions.

- 📈 Stabilities.

- 🌍 Impacts.

Updates to Minimum Pension in Recent Years

Hikes for relevancy.

- 🔄 Percentages.

- 📈 Reliefs.

- 🏦 Rolls.

What is the Maximum Old Age Pension Per Month?

Max old-age monthly ~Rs. 30,000 cap.

- 💰 Uppers.

- 📈 Earners.

- 🔢 Formulas.

EOBI Maximum Monthly Pension Caps

Regulated to balance.

- 🔑 Reasons.

- 📊 Details.

- 🛡️ Fairs.

Achieving Maximum EOBI Pension Benefits

Max premiums, tenures.

- ⏳ Extends.

- 💼 Optimizes.

- 🔄 Strats.

Comparing Maximum Pensions Across Countries

Pakistan’s modest vs. globals.

- 🌍 Views.

- 📈 Benches.

- 🛡️ Improves.

What is the Minimum Pension in EOBI?

EOBI min pension Rs. 11,500.

- 💰 Thresholds.

- 📊 Alls.

- 🏦 Monthlies.

Details on EOBI’s Minimum Pension Threshold

Essentials coverage.

- 🔑 Policies.

- 📈 Adjusts.

- 💼 Effects.

Eligibility for EOBI Minimum Pension

15 years, ages.

- ⏳ Mins.

- 📅 Marks.

- 🔍 Verifs.

Appeals for Higher Minimum Pension Amounts

Recalcs via authorities.

- ⚖️ Steps.

- 📄 Proofs.

- 🛠️ Outcomes.

What is the Maximum Pension Amount?

Max amount formula-capped ~Rs. 30,000.

- 💰 Peaks.

- 📈 Quals.

- 🔢 Calcs.

Understanding EOBI’s Maximum Pension Limits

Earnings, years bases.

- 🔑 Caps.

- 📊 Infos.

- 🛡️ Rationales.

Strategies to Maximize EOBI Pension Amount

Consistents, highs.

- ⏳ Lengths.

- 💼 Maxes.

- 🔄 Advises.

Tax Implications on Maximum Pension Payouts

Tax-exempts.

- 🏦 Fulls.

- 📈 Receipts.

- ⚖️ Regs.

What is the Maximum Monthly Retirement Benefit?

Max retirement monthly ~Rs. 30,000 highs.

- 💰 Tops.

- 📈 Achieves.

- 🏦 Gets.

EOBI Maximum Retirement Benefit Breakdown

Formula apps.

- 🔢 Processes.

- 📊 Samples.

- 💼 Studies.

Qualifying for Maximum Retirement Benefits

Max years, bases.

- ⏳ 35+.

- 💰 Highs.

- 🔑 Essentials.

Boosting Retirement Benefits by 150%

Extras, invests.

- 📈 Methods.

- 💼 Adds.

- 🛡️ Plans.

How Much is the Pension Increase?

Increase 15% on mins to Rs. 11,500.

- 💰 Rates.

- 📈 Effects.

- 🏦 Applies.

Pension Increase Details

Approved reliefs.

- 🔄 Rolls.

- 📊 Groups.

- 💼 Causes.

Factors Behind Pension Increase

Econs, welfares.

- 📈 Drivers.

- 🛡️ Supports.

- ⚖️ Decisions.

Impact of Increase on Monthly Payments

Income uplifts.

- 💰 Adds.

- 📊 Cases.

- 🏦 Backpays.

What is the Pension Update?

Updates: Hikes, inclusives.

- 🔄 Mods.

- 📈 Goods.

- 🛡️ Expands.

Key Changes in EOBI Pension Policy

Mins, eligibles.

- 🔑 Shifts.

- 📊 Specs.

- 💼 Means.

New Pension Notification

Official boosts.

- 📜 Announces.

- 📈 Apps.

- 🏦 Pays.

Revised Pension Rules Effective

Fairs enhancements.

- ⚖️ Quals.

- 📊 Comps.

- 🛡️ Guards.

What is the EOBI Rate?

EOBI rates: Rs. 11,500 min payouts, 6% contribs.

- 💰 Outputs.

- 📈 Inputs.

- 🔑 Currents.

Updated EOBI Contribution Rates

1% workers, 5% firms.

- 🔄 Steadies.

- 📊 Bases.

- 💼 Duties.

Pension Payout Rates

Formula mins/maxes.

- 📈 Ranges.

- 🏦 Periods.

- 🛡️ Assures.

Comparing Rates with Previous

Elevated supports.

- 🔄 Changes.

- 📈 Rises.

- 💼 Advantages.

Add a Comment