Acknowledging the freelance economy trend, Askari Bank has launched its Freelancer Account, designed to address the specific requirements of Pakistani freelancers.

In this article, we will explain the features/benefits, and offerings of the Askari Bank Freelancer Account:

- Askari Bank Account Opening Eligibility Criteria

- Documents Required To Open Freelancer Account

- Askari Bank Freelancer Account Key Features

- Askari Bank Account Opening Online

- Askari Bank Helpline Number

- Askari Bank Freelancer Account Pros And Cons

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

Askari Bank Freelancer Account | Askari Bank Account Opening Online

Table of Contents

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

Askari Bank Account Opening Eligibility Criteria

To open an Askari Bank Freelancer Account, you must meet certain eligibility criteria. These requirements include:

| Requirement | Details |

|---|---|

| Freelancer Status: | To qualify for the Freelancer Account, you must operate as a freelancer within Pakistan. |

| Age Limit: | You need to be at least 18 years old to open a Freelancer Account with Askari Bank. |

| Valid CNIC: | Possession of a valid CNIC issued by NADRA is required. |

| Proof of Income: | You must provide evidence of your freelance income, such as bank statements, contracts, or tax returns. |

| Intended Account Usage: | Show that the account will primarily be used for freelance transactions and business purposes. |

| Minimum Deposit: | Depending on the chosen account type, there may be a minimum deposit requirement to open the Freelancer Account. |

Meeting these eligibility criteria is necessary to open an Askari Bank Freelancer Account and access the various benefits and features it offers to freelancers in Pakistan.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

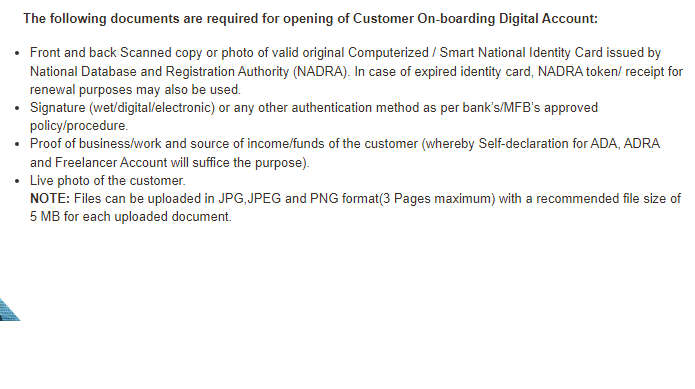

Documents Required To Open Freelancer Account

To open an Askari Bank Freelancer Account, you need to provide certain documents as part of the account opening process. These may include:

| Required Documents | Description |

|---|---|

| Scanned Copy or Photo of CNIC: | Provide a scanned copy or photo of your valid original CNIC issued by NADRA. If the CNIC is expired, you can submit a NADRA token/receipt for renewal. |

| Signature or Other Authentication Method: | Submit your signature using wet, digital, or electronic methods, as per the bank’s approved policy. |

| Proof of Business/Work and Source of Income/Funds: | Present proof of your business/work and the source of your income/funds. A self-declaration for ADA, ADRA, and Freelancer Account is acceptable for this purpose. |

| Live Photo of the Customer: | Provide a live photo of yourself as part of the customer onboarding process. |

| Note: | Files should be uploaded in JPG, JPEG, or PNG format, with a maximum of 3 pages. The recommended file size for each document is 5 MB. |

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

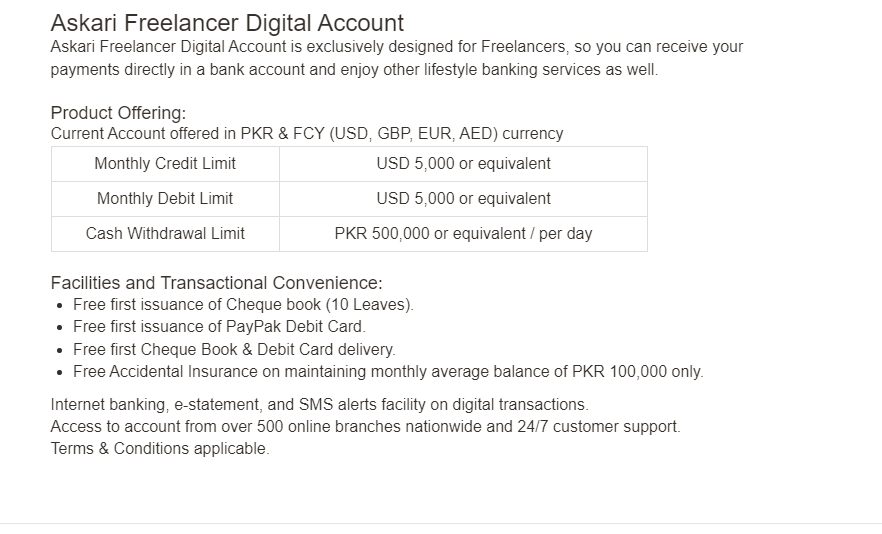

Askari Bank Freelancer Account Key Features

The Askari Bank Freelancer Account is to meet the unique banking needs of freelancers in Pakistan. It offers a range of features that make it an attractive financial solution for freelancers. Here are the key features of the Askari Bank Freelancer Account:

| Feature | Description |

|---|---|

| Product Offering: | Askari Freelancer Digital Account is exclusively for Freelancers, offering Current Accounts in PKR & FCY currencies (USD, GBP, EUR, AED). |

| Monthly Credit Limit: | Enjoy a monthly credit limit of USD 5,000 or equivalent for transactions. |

| Monthly Debit Limit: | Make transactions up to USD 5,000 or equivalent with the monthly debit limit. |

| Cash Withdrawal Limit: | Access up to PKR 500,000 or equivalent per day for cash withdrawals. |

| Facilities and Transactional Convenience: | – Free first issuance of 10-leaf Cheque book and PayPak Debit Card. – Complimentary delivery of the first Cheque book and Debit Card. – Free Accidental Insurance with a monthly average balance of PKR 100,000. – Enjoy Internet banking, e-statements, and SMS alerts for digital transactions. – Access your account through over 500 online branches nationwide and receive 24/7 customer support. |

| Terms & Conditions: | Applicable terms and conditions govern the usage and benefits of the Askari Freelancer Digital Account. |

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

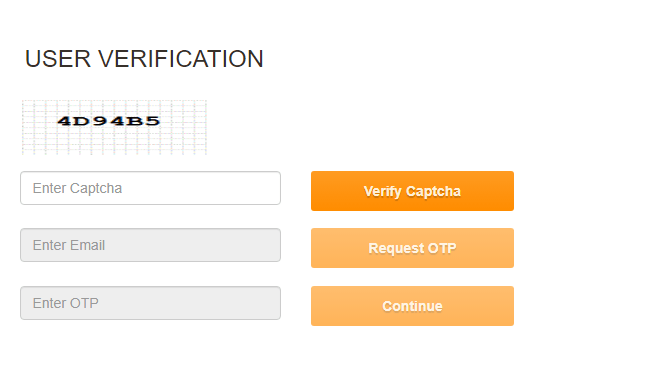

Askari Bank Account Opening Online

Opening an Askari Bank Freelancer Account online is a quick and easy process. Here is a step-by-step guide to opening an account online:

- Step 1: Visit the Askari Bank App or website (https://secureportal.askaribank.com/digital-account) and click on the “Open an Account” button.

- Step 2: Select the “Freelancer Account” option from the account type drop-down menu.

- Step 3: Fill out the online application form with your personal and contact details, including your name, CNIC number, email address, and mobile number.

- Step 4: Provide your freelance income details, including your monthly income and your primary source of income.

- Step 5: Choose your account type and currency, and provide any additional details as required.

- Step 6: Upload the required documents, including your CNIC, proof of income, proof of residence, and any other documents that may be requested.

- Step 7: Review and confirm your details and documents before submitting your application.

- Step 8: Once your application has been submitted, you will receive a confirmation email with your account number and other details.

- Step 9: Your account will be activated within a few business days, after which you can start using it for all your freelance banking needs.

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

Askari Bank Helpline Number

If you need assistance or have any queries related to your Askari Bank Freelancer Account, you can reach out to the Askari Bank Helpline for support.

Here are the contact details for the helpline:

Phone: You can call the helpline at 111-000-787 from anywhere in Pakistan to speak to a customer service representative who will assist you with your query or concern.

Email: You can also send an email to support@askaribank.com.pk with your query or concern, and a customer service representative will respond to you within 24-48 hours.

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

Askari Bank Freelancer Account Pros And Cons

Like any financial product, it has its own set of pros and cons. Here are some of the pros and cons of the Askari Bank Freelancer Account:

Pros Of Askari Bank Freelancer Account

- Multiple Currency Support: The account supports both PKR and FCY (USD, GBP, EUR, AED) currencies, making it easier for freelancers to manage their international transactions.

- Flexible Limits: The account has flexible credit and debit limits, allowing freelancers to manage their finances according to their specific needs.

- Convenient Facilities: The account offers a range of convenient facilities, including free issuance of the first checkbook, the free first issuance of the UnionPay Debit Card, internet banking, and e-statements.

- Easy Access: The account can be accessed from over 600 online branches nationwide, making it easier for freelancers to manage their banking needs.

- Value-Added Services: The account offers value-added services such as free accidental insurance on maintaining a monthly average balance of PKR 100,000 or above, providing added value to freelancers.

Cons Of Askari Bank Freelancer Account

- Limited Withdrawal Limit: The account has a cash withdrawal limit of PKR 500,000 or equivalent per day, which may be insufficient for some freelancers.

- Minimum Balance Requirement: The account has a minimum balance requirement of PKR 10,000, which may be a challenge for some freelancers.

- Limited Transaction Limits: The account has a monthly credit limit of USD 5,000 or equivalent and a monthly debit limit of USD 5,000 or equivalent, which may be restrictive for some freelancers.

- Limited Free Facilities: While the account offers some free facilities, additional transactions and services may be subject to fees.

Recommended Reading: Top 5 Best Bank Account For Freelancers In Pakistan {Tried+Tested}

Askari Bank Freelancer Account FAQs

Who can apply for an Askari Bank Freelancer Account?

Freelancers who are Pakistani nationals and are currently residing in Pakistan can apply for this account.

What is the minimum balance requirement for the Askari Bank Freelancer Account?

The minimum balance requirement for this account is PKR 10,000.

What is the cash withdrawal limit for the Askari Bank Freelancer Account?

The cash withdrawal limit for this account is PKR 500,000 or equivalent per day.

What is the monthly credit limit for the Askari Bank Freelancer Account?

The monthly credit limit for this account is USD 5,000 or equivalent.

What is the monthly debit limit for the Askari Bank Freelancer Account?

The monthly debit limit for this account is USD 5,000 or equivalent.

Are there any fees associated with the Askari Bank Freelancer Account?

Some transactions and services may be subject to fees and charges. Please refer to the Askari Bank website or contact customer service for more information.

Can I apply for the Askari Bank Freelancer Account online?

Yes, you can apply for this account online through the Askari Bank website.

What value-added services are included with the Askari Bank Freelancer Account?

On maintaining a monthly average balance of PKR 100,000 or above, you can enjoy free accidental insurance.

Can I access my Askari Bank Freelancer Account from anywhere in Pakistan?

Yes, you can access your account from over 600 online branches nationwide.

What types of currencies does the Askari Bank Freelancer Account support?

The account supports PKR and FCY (USD, GBP, EUR, AED) currencies.

What types of transactions can I perform with the Askari Bank Freelancer Account?

With this account, you can perform a variety of transactions, including local and international fund transfers, bill payments, and online purchases.

How long does it take to open an Askari Bank Freelancer Account?

The account opening process can take up to 10 business days, depending on the completeness of the required documentation.

What should I do if I lose my Askari Bank Freelancer Account debit card?

If your debit card is lost or stolen, please contact Askari Bank customer service immediately to report the incident and block your card.

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment