In today’s digital age, freelancers are rapidly becoming an indispensable part of the workforce and they need a banking solution that caters to their unique financial requirements.

The Bank of Punjab (BOP) is a forward-thinking financial institution that understands the needs of freelancers and has designed a specialized Freelancer Account to serve them.

This account offers a host of exciting features and benefits that are tailored to help freelancers manage their finances effectively.

In this article, we will discuss Bank of Punjab Freelancer Account details including:

- Eligibility Criteria

- Documents Required

- Bank Of Punjab Freelancer Account Key Features

- BOP Account Opening Online Step-By-Step Process

- BOP Helpline Number

- Bank Of Punjab Freelancer Account Pros And Cons

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

Bank Of Punjab Freelancer Account | BOP Account Opening Online

Table of Contents

- Bank Of Punjab Freelancer Account | BOP Account Opening Online

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

Eligibility Criteria

To open a Bank of Punjab Freelancer Account, you must fulfill the following eligibility criteria:

- Identity Verification: You need to provide original scanned copies of your CNIC/NICOP/POC, both front and back sides, and the first two pages of your Pakistani or foreign country passport.

- Signature Verification: You must provide a signature on a white paper stating your identity number.

- NRP Status Verification: If you are a non-resident Pakistani (NRP), you must provide proof of your NRP status, such as a scanned copy of your POC, visa, entry/exit stamps, work permit, etc.

- Proof of Profession: You need to submit proof of your profession as a freelancer, such as a copy of your freelance contract or a letter from your client.

- Source of Income Verification: You must provide evidence of your sources of income, such as bank statements or tax returns, to prove that you have a steady stream of income as a freelancer.

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

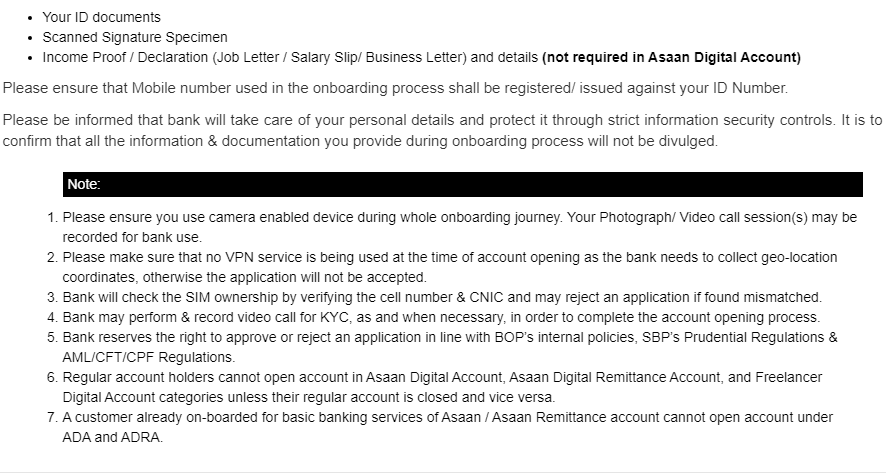

Documents Required

To open a Bank of Punjab Freelancer Account, you must provide the following documents:

| Documents/Papers to be Obtained | Details |

|---|---|

| Copy of Valid Identity Document: | Obtain a copy of the applicable valid identity document, which could be a CNIC/SNIC/NICOP/SNICOP for Pakistani citizens, a Passport for foreign citizens, or other valid documents as listed. |

| Passport Size Photograph: | If the individual has shaky or immature signatures, a passport size photograph, along with thumb impressions, will be obtained in addition to the CNIC or other valid document mentioned. |

| Visit Report: | If business transactions are permitted in a personal account where constituent documents are unavailable, a visit report must be obtained. |

| Name Screening: | Mandatory name screening of individuals, next of kin, and walk-in customers must be conducted to ensure compliance with regulatory requirements. |

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

Bank Of Punjab Freelancer Account Key Features

Bank of Punjab Freelancer Account comes with a range of key features to cater to the unique financial needs of freelancers. Some of its key features include:

| Key Features | Details |

|---|---|

| Instant Account Opening: | Start using your account immediately with instant account opening, without any waiting period. |

| Zero Minimum Balance: | Open your account with any amount as there are no minimum balance requirements, allowing flexibility in maintaining your account. |

| Receive Overseas Payments: | Easily receive overseas freelancing payments directly into your account, eliminating the hassle of dealing with international banking procedures. |

| Currency Flexibility: | Enjoy the flexibility of managing your finances in multiple currencies, including PKR, USD, GBP, and EUR, to suit your needs. |

| Withdrawal and Transaction Limits: | Benefit from withdrawal limits of PKR 500,000 per day, and monthly debit and credit limits of USD 5,000, ensuring the safety of your funds and convenient financial management. |

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

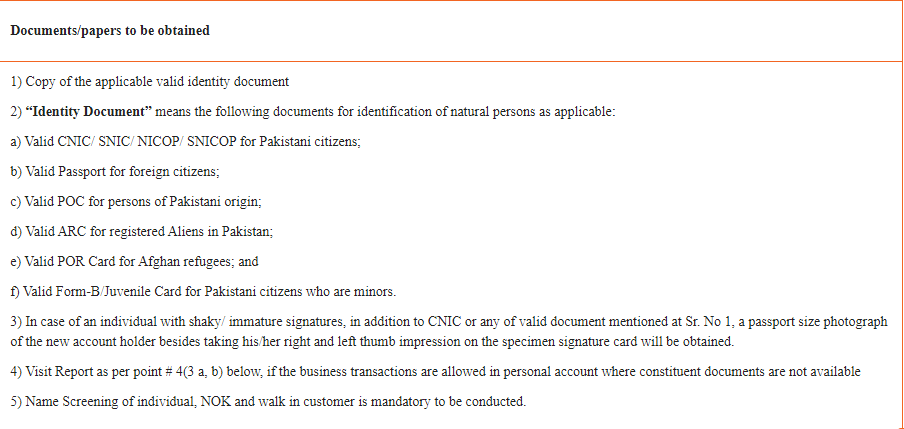

BOP Account Opening Online Step-By-Step Process

Opening a Bank of Punjab Freelancer Account is a quick and hassle-free process that you can complete online in just a few simple steps. Here is a step-by-step guide on how to open a BOP app account online:

- Step 1: Visit the Bank of Punjab’s digital account opening portal at https://digitalaccount.bop.com.pk. Click on the “Open Account Now” button to begin the account opening process.

- Step 2: Select the type of account you want to open, in this case, select “Freelancer Account.”

- Step 3: Enter your personal details such as your name, CNIC/NICOP/POC number, date of birth, and contact information.

- Step 4: Upload scanned copies of your ID documents such as your CNIC/NICOP/POC and the first two pages of your Pakistani or foreign country passport.

- Step 5: Provide a scanned copy of your signature specimen and proof of your source of income, such as a job letter, salary slip, or business letter.

- Step 6: Review and confirm your details before submitting your application.

- Step 7: Once you have submitted your application, wait for the bank’s confirmation email, which will contain your account details.

By following these simple steps, you can open a BOP Freelancer Account online and enjoy its tailored services that cater to your unique financial requirements as a freelancer.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

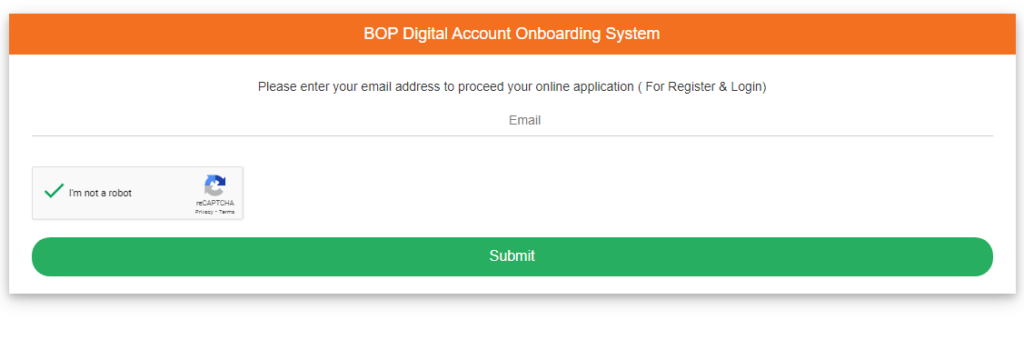

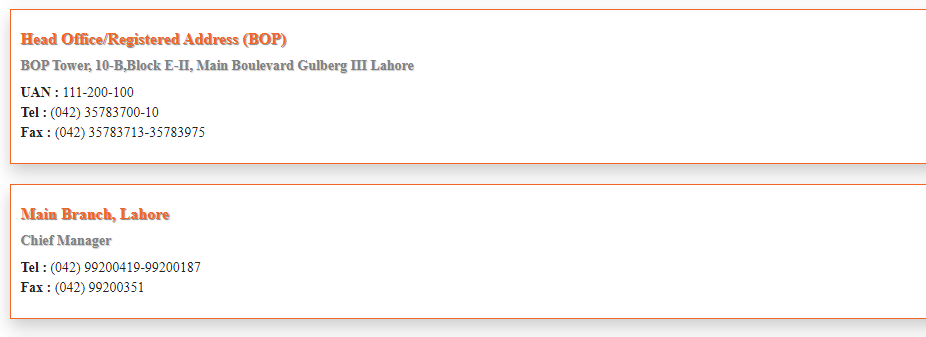

BOP Helpline Number

If you have any queries or concerns related to your Bank of Punjab Freelancer Account, you can get in touch with their customer support team using the following contact details:

Head Office/Registered Address: BOP Tower, 10-B, Block E-II, Main Boulevard Gulberg III Lahore

- UAN: 111-200-100

- Tel: (042) 35783700-10

- Fax: (042) 35783713-35783975

Main Branch, Lahore:

- Tel: (042) 99200419-99200187

- Fax: (042) 99200351

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

Bank Of Punjab Freelancer Account Pros And Cons

Bank of Punjab Freelancer Account is a tailored banking solution for freelancers that comes with its own set of advantages and disadvantages.

Here are some of the pros and cons of having a Bank of Punjab Freelancer Account:

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

Pros Of Bank Of Punjab Freelancer Account

- Dedicated Services: The Bank of Punjab Freelancer Account is designed specifically to cater to the unique financial needs of freelancers, offering tailored services that are not available with regular accounts.

- Convenient Online Banking: The Bank of Punjab Freelancer Account comes with an online banking facility that allows you to manage your account conveniently from anywhere, anytime.

- Competitive Profit Rates: The account offers competitive profit rates on your deposits, which can help you grow your savings over time.

- Easy Account Opening Process: The Bank of Punjab Freelancer Account has a simple and hassle-free account opening process that can be completed online, saving you time and effort.

Cons Of Bank Of Punjab Freelancer Account

- Limited Branch Network: The Bank of Punjab has a limited branch network, which can make it challenging for customers living outside the areas where the bank has its branches.

- Fees and Charges: The account comes with various fees and charges, such as account maintenance fees, transaction fees, and ATM withdrawal fees, which can add up over time and impact your savings.

- Minimum Balance Requirement: The Bank of Punjab Freelancer Account has a minimum balance requirement, which means that you need to maintain a certain balance in your account at all times to avoid penalties.

- Limited Services: While the Bank of Punjab Freelancer Account offers tailored services for freelancers, it may not offer the same range of services as regular accounts, such as personal loans or credit cards.

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

BOP Freelancer Account FAQs

What is a Bank of Punjab Freelancer Account?

A Bank of Punjab Freelancer Account is a specialized account designed to cater to the unique financial needs of freelancers. It offers tailored services such as easy account opening, competitive profit rates, online banking, and a dedicated customer support team.

What are the eligibility criteria for opening a Bank of Punjab Freelancer Account?

The eligibility criteria for opening a Bank of Punjab Freelancer Account include providing an original scanned CNIC/NICOP/POC, originally scanned passport, proof of NRP status, and proof of profession and source of income.

What documents are required to open a Bank of Punjab Freelancer Account?

To open a Bank of Punjab Freelancer Account, you need to provide your ID documents, scanned signature specimen, and income proof/declaration such as a job letter, salary slip, or business letter.

Is there a minimum balance requirement for a Bank of Punjab Freelancer Account?

Yes, there is a minimum balance requirement for a Bank of Punjab Freelancer Account, and you need to maintain a certain balance in your account at all times to avoid penalties.

How can I open a Bank of Punjab Freelancer Account?

You can open a Bank of Punjab Freelancer Account online by visiting their website at https://digitalaccount.bop.com.pk.

What are the fees and charges associated with a Bank of Punjab Freelancer Account?

The Bank of Punjab Freelancer Account comes with various fees and charges such as account maintenance fees, transaction fees, and ATM withdrawal fees.

Can I access my Bank of Punjab Freelancer Account online?

Yes, you can access your Bank of Punjab Freelancer Account online through their Internet banking facility.

What currencies are available for the Bank of Punjab Freelancer Account?

The Bank of Punjab Freelancer Account is available in PKR, USD, GBP, and EUR, giving you greater flexibility in managing your finances.

Is there a minimum balance requirement for the Bank of Punjab Freelancer Account?

No, there is no minimum balance requirement for a Bank of Punjab Freelancer Account.

What are the withdrawal and transaction limits for the Bank of Punjab Freelancer Account?

The account comes with withdrawal limits of PKR 500,000 per day or equivalent, and monthly debit and credit limits of USD 5,000 or equivalent.

What is the BOP helpline number?

You can contact the Bank of Punjab on their UAN number 111-200-100.

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment