In the ever-evolving landscape of freelance work and online entrepreneurship, having a reliable and efficient banking partner is crucial.

Faysal Bank understands the unique needs of freelancers and digital entrepreneurs and offers a specialized banking solution designed to cater to their requirements.

With the Faysal Bank Freelancer Account, freelancers can enjoy a seamless and hassle-free banking experience tailored to their professional endeavors.

In this article, we will explore the Faysal Bank Freelancer Account:

- Faysal Bank Freelancer Account Key Features

- Faysal Bank Freelancer Account Eligibility Criteria

- Faysal Bank Freelancer Account Documents Required

- Faysal Bank Freelancer Account Opening Online

- Faysal Bank Helpline Number

- Faysal Bank Freelancer Account Pros And Cons

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Table of Contents

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

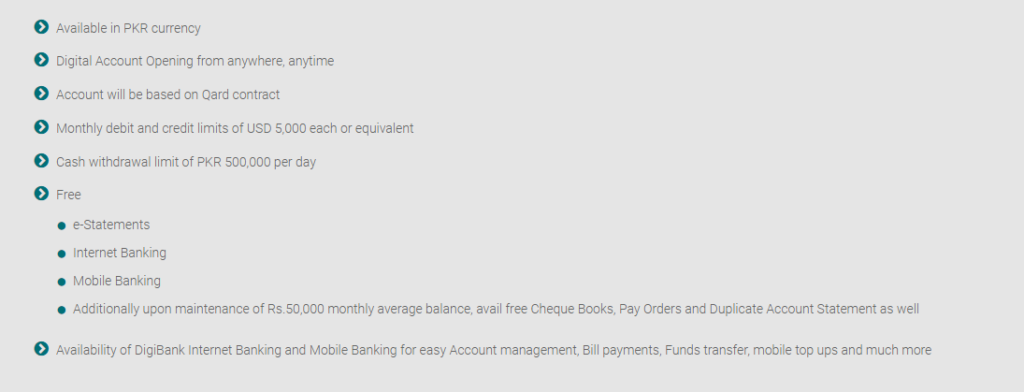

Faysal Bank Freelancer Account Key Features

| Features | Details |

|---|---|

| PKR Currency: | Conduct transactions conveniently in Pakistani Rupees (PKR), ideal for freelancers based in Pakistan. |

| Digital Account Opening: | Open your account digitally from anywhere, anytime, saving valuable time and effort. |

| Qard-Based Account: | Operates on a Qard contract, ensuring transparency and compliance with Islamic banking principles. |

| Monthly Debit and Credit Limits: | Enjoy generous monthly limits of USD 5,000 each or equivalent for debit and credit transactions, facilitating effective financial management. |

| Cash Withdrawal Limit: | Conveniently withdraw up to PKR 500,000 per day, providing quick access to your funds as needed. |

| Free e-Statements: | Receive complimentary e-statements for easy access to transaction details, reducing paperwork and enhancing organization. |

| Internet Banking: | Access the Faysal Bank Internet Banking platform for convenient account management, bill payments, and fund transfers online. |

| Mobile Banking: | Manage your finances on the go with the Faysal Bank Mobile Banking app, offering features such as account management, fund transfers, and mobile top-ups. |

| Free Additional Benefits: | Unlock additional perks such as free ChequeBooks, Pay Orders, and Duplicate Account Statements by maintaining a monthly average balance of Rs. 50,000. |

| DigiBank Services: | Access the comprehensive DigiBank platform, encompassing Internet Banking and Mobile Banking for seamless account management. Enjoy features like bill payments, fund transfers, and more, all within one integrated platform. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

Eligibility Criteria

| Requirements | Details |

|---|---|

| Freelancer Status: | This account is designed specifically for freelancers and digital entrepreneurs. |

| Age Requirement: | Applicants must be at least 18 years old, meeting the minimum age set by Faysal Bank. |

| Nationality: | Available to Pakistani nationals or individuals with valid Pakistani residency status. |

| Valid Identification: | Valid identification documents, like a National Identity Card (NIC) or a valid passport, are required for account opening. |

| Proof of Freelance Work: | During the account opening process, applicants may need to provide evidence of freelance work, such as client contracts or bank statements. |

| Regulatory Compliance: | Applicants must adhere to all regulatory requirements established by Faysal Bank and the State Bank of Pakistan. |

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

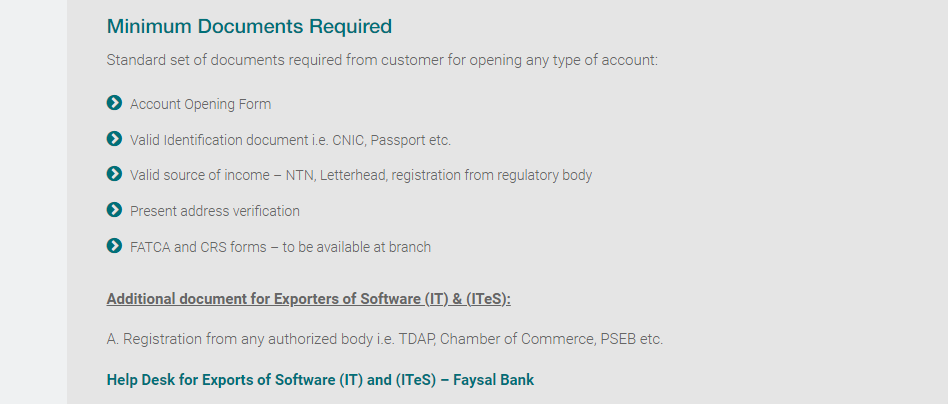

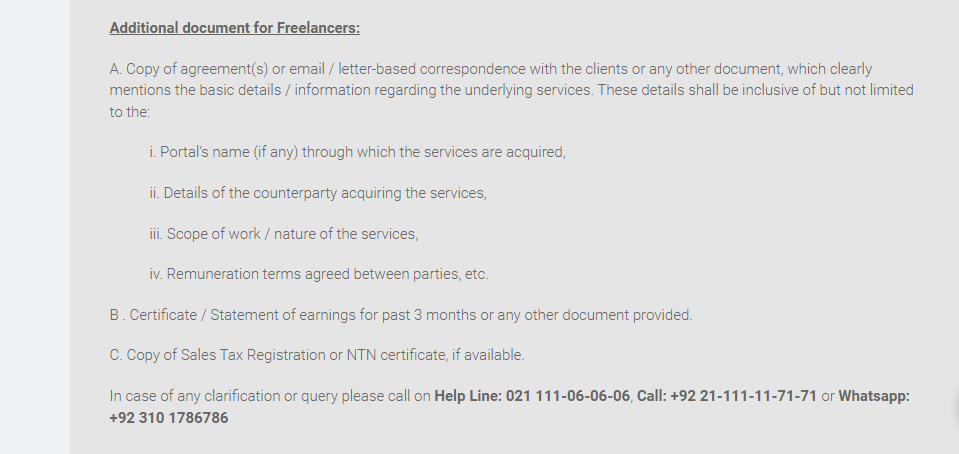

Documents Required

- Valid Identification: Applicants need to provide a valid and current identification document such as a Computerized National Identity Card (CNIC), Smart National Identity Card (SNIC), or National Identity Card for Overseas Pakistanis (NICOP).

- Proof of Income: Individuals are required to submit their last salary slip or a salary certificate as proof of income. This document helps establish the applicant’s financial stability.

- Specimen Digital Signature: Applicants are requested to provide a specimen of their digital signature. This signature will be used for authentication purposes during digital transactions and account management.

- Live Selfie: A live selfie, or a recent photograph of the applicant, may be required to verify their identity and match it with the provided identification document.

Please note that these document requirements are subject to the policies and regulations set by Faysal Bank.

It is advisable to directly contact the bank or visit their official website for the most accurate and up-to-date information regarding the specific documents required for opening a Faysal Bank Freelancer Account.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

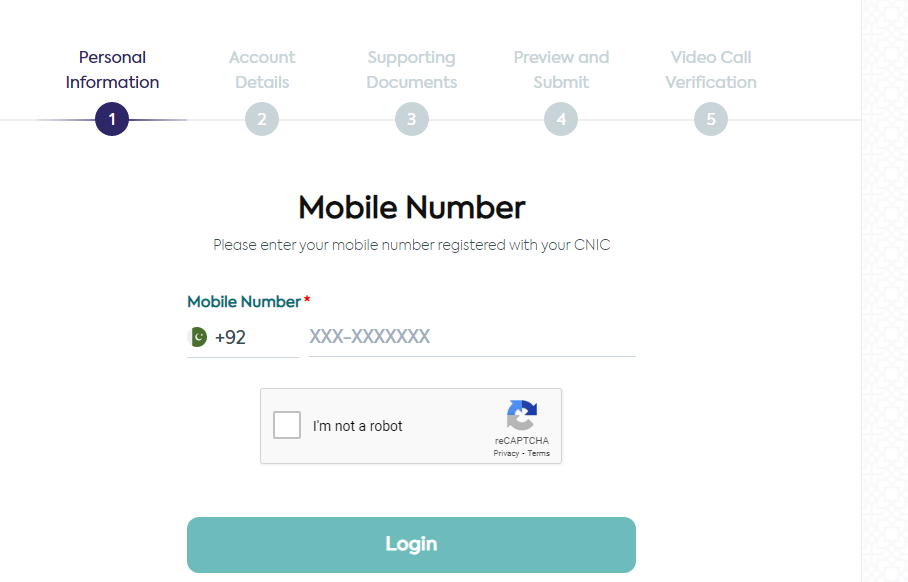

Faysal Bank Freelancer Account Opening Online

Following is a step-by-step guide to opening Faysal Bank Freelancer Account Opening Online:

Visit the Faysal Bank Website: Go to the Faysal Bank app or website by typing the URL https://digionboard.faysalbank.com/ in your web browser.

| Steps | Description |

|---|---|

| Visit Website: | Begin by accessing the website’s main page. Locate and navigate to the “Freelancer Account Opening” section. |

| Personal Information: | Enter accurate personal details, including your full name, CNIC number, date of birth, and contact information, as prompted by the online application form. |

| Account Details: | Select the account type as “Freelancer Account” from the options provided. Indicate your preferred currency as PKR and specify your residency status, whether resident or non-resident of Pakistan, as required. |

| Supporting Documents: | Follow the instructions to upload necessary documents, such as a scanned copy of your valid CNIC and proof of freelance work, such as client contracts or invoices. |

| Preview and Submit: | Review all entered information carefully to ensure accuracy and completeness. Once satisfied, proceed to click on the “Submit” or “Next” button to advance to the next stage of the application process. |

| Video Call Verification: | Be prepared for a potential video call verification, as requested by Faysal Bank to confirm your identity. Follow the provided instructions to initiate the call and have your original identification documents ready for verification during the call. |

| Application Processing: | Upon completion of the video call verification, your application will undergo processing by Faysal Bank. Stay updated on your application status through email or other communication channels, as notifications regarding progress may be sent. |

Note that the exact steps and requirements may vary slightly depending on Faysal Bank’s current policies and procedures.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

Faysal Bank Helpline Number

For any queries, assistance, or to address customer complaints, you can reach out to Faysal Bank through the following helpline numbers and contact details:

- Helpline Number: 021 111-06-06-06

- Call: +92 21-111-11-71-71

- WhatsApp: +92 310 1786786

- Email: customercomplaint@faysalbank.com

Feel free to contact Faysal Bank via phone, WhatsApp, or email for prompt support and guidance.

Their dedicated customer service team is available to assist you with your banking needs and address any concerns or issues you may have.

Faysal Bank Freelancer Account Pros And Cons

- Especially for Freelancers: This account is made just for freelancers, offering features and services tailored to their needs.

- Easily Online Account Opening: You can open a Faysal Bank Freelancer Account online easily, saving time and avoiding trips to the bank.

- Debit and Credit Limits: Freelancers get monthly limits of USD 5,000 each for debit and credit transactions, helping them manage their money well.

- Competitive Cash Withdrawal Limit: The account lets you withdraw up to PKR 500,000 per day in cash, so you can access your money quickly.

- Free e-Statements: Faysal Bank gives freelancers complimentary e-statements, making it easy to track transactions without paper statements.

- Additional Benefits with Minimum Balance: Keep a monthly average balance of Rs. 50,000 to enjoy free ChequeBooks, Pay Orders, and Duplicate Account Statements.

- Digital Banking: Manage your account easily with Faysal Bank’s Internet Banking and Mobile Banking services. Pay bills, transfer funds, and do more banking tasks online or on your phone.

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

Faysal Bank Freelancer Account FAQs

Who is eligible to open a Faysal Bank Freelancer Account?

The Faysal Bank Freelancer Account is available to Pakistani nationals or individuals holding a valid Pakistani residency status who work as freelancers or digital entrepreneurs.

Can I open a Faysal Bank Freelancer Account online?

Yes, you can open a Faysal Bank Freelancer Account conveniently online through the bank’s website. The online account opening process saves time and eliminates the need for in-person visits to the bank.

What documents are required to open a Faysal Bank Freelancer Account?

The required documents typically include a valid CNIC/SNIC/NICOP, the last salary slip/salary certificate, a specimen of digital signature, and a live selfie (picture).

However, specific document requirements may vary, so it’s advisable to visit the bank’s website or contact their customer service for the latest information.

Is there a minimum balance requirement for the Faysal Bank Freelancer Account?

Yes, there is a minimum average monthly balance requirement of Rs. 50,000 to avail of additional benefits such as free Cheques Books, Pay Orders, and Duplicate Account Statements.

What are the debit and credit limits for the Faysal Bank Freelancer Account?

The Freelancer Account offers monthly debit and credit limits of USD 5,000 each or the equivalent in the account’s chosen currency.

Are there any fees associated with the Faysal Bank Freelancer Account?

While certain services and features may be provided for free, there may be fees and charges associated with certain transactions or additional services.

It’s recommended to review the bank’s fee schedule or consult with their customer service for detailed information.

Can I manage my Faysal Bank Freelancer Account online?

Yes, Faysal Bank provides digital banking services, including Internet Banking and Mobile Banking, which allow you to conveniently manage your Freelancer Account, make bill payments, transfer funds, and perform various other banking activities.

How can I contact Faysal Bank for support or queries regarding the Freelancer Account?

You can reach Faysal Bank’s helpline numbers at 021 111-06-06-06 or +92 21-111-11-71-71.

Alternatively, you can contact them via WhatsApp at +92 310 1786786 or send an email to customercomplaint@faysalbank.com.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment