With the increasing dependence on technology in our everyday lives, online banking has become a vital component of financial management. This holds especially true for freelancers who require a flexible and hassle-free mode of conducting their financial transactions.

Bank Alfalah, a prominent bank in Pakistan, recognizes this need and has developed a Freelancer Account catering specifically to freelancers.

Bank Alfalah Freelancer Account provides a range of benefits such as online payment processing, no minimum balance requirement, and access to a diverse range of financial services.

This article aims to provide a step-by-step guide on how to open a Bank Alfalah Freelancer Account online in a mere 5 minutes.

With Bank Alfalah Freelancer Digital Account, get your international freelance payments conveniently deposited into your account!

— Bank Alfalah (@BankAlfalahPAK) February 21, 2022

Open your Bank Alfalah Freelancer Digital Account today!

For details visit, https://t.co/eNcLoYUH0I#BankAlfalah #FreelancerDigitalAccount #Rapid pic.twitter.com/h2mZpQeQXu

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

How To Open Bank Alfalah Freelancer Account

Table of Contents

Eligibility Criteria

To open a Bank Alfalah Freelancer Account, certain eligibility criteria need to be met.

These requirements are put in place to ensure that the account holder can make the most of the features and services offered by the account.

| Eligibility Criteria | Details |

|---|---|

| Citizenship: | Must be a Pakistani citizen or a foreigner residing in Pakistan. |

| Employment Status: | Must be a freelancer or self-employed individual earning income through freelance work. |

| Age: | Must be at least 18 years old. |

| Identification: | Must possess a valid CNIC or passport. |

| Contact Information: | Must provide a valid email address and phone number. |

| Must adhere to the bank’s Anti-Money Laundering policies: | Must furnish proof of income and freelance work. |

| Compliance: | Must adhere to the bank’s Anti-Money Laundering and policies. |

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

Bank Alfalah Freelancer Account Benefits

Bank Alfalah’s Freelancer Account comes with a range of benefits that make it an ideal choice for freelancers who need a flexible and convenient way to manage their finances.

Here are some of the key benefits of this account:

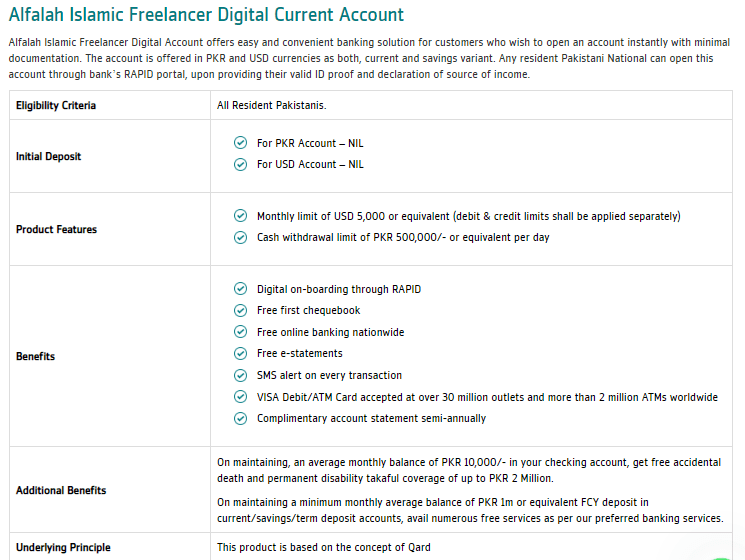

| Alfalah Islamic Freelancer Digital Current Account | Description |

|---|---|

| Eligibility Criteria: | Available for all resident Pakistanis. |

| Initial Deposit: | 1. No initial deposit is required for a PKR Account. 2. No initial deposit is required for a USD Account. |

| Product Features: | Monthly limit of USD 5,000 for both debit and credit transactions. |

| Cash withdrawal limit of PKR 500,000 or equivalent per day. | |

| Digital onboarding through RAPID for instant account opening. | |

| Free first checkbook provided. | |

| Benefits: | Free nationwide online banking and e-statements. |

| SMS alerts for every transaction. | |

| VISA Debit/ATM Card accepted globally at over 30 million outlets and 2 million ATMs. | |

| Complimentary account statements are issued semi-annually. | |

| Free accidental death and permanent disability takaful coverage up to PKR 2 Million on maintaining an average monthly balance of PKR 10,000. | |

| Additional Benefits: | Getting numerous free services with a minimum monthly average balance of PKR 1m or deposit in other accounts. |

| Underlying Principle: | Based on the concept of Qard, ensuring compliance with Islamic banking principles. |

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

Bank Alfalah Freelancer Account Opening Online Step-By-Step

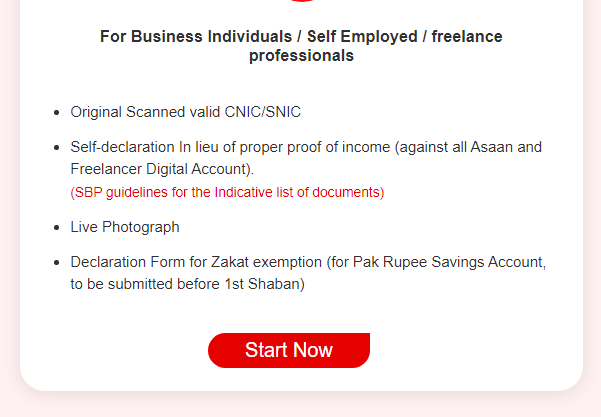

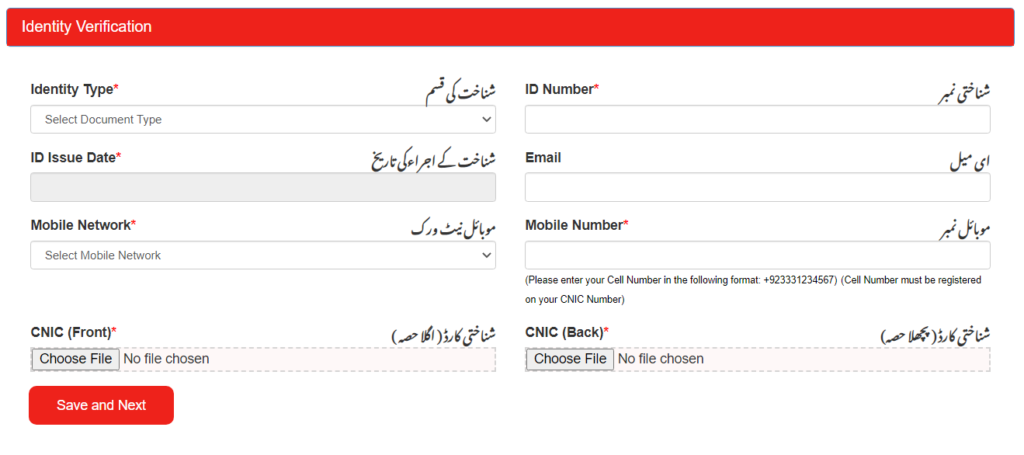

Opening a Bank Alfalah Freelancer Account online is a straightforward and hassle-free process. Here is a step-by-step guide to help you open an account quickly:

- Step 1: Visit the Bank Alfalah website: Go to the Bank Alfalah app or website and navigate to the ‘Apply Online section.

- Step 2: Choose the Freelancer Account option: Select the ‘Freelancer Account’ option from the list of account types available.

- Step 3: Fill out the application form: Fill out the application form with accurate and relevant information. Make sure to double-check the information before submitting the form.

- Step 4: Upload the required documents: Upload the required documents such as a copy of your CNIC, passport, proof of income, and proof of address.

- Step 5: Agree to the Terms and Conditions: Carefully read and agree to the terms and conditions of opening a Bank Alfalah Freelancer Account.

- Step 6: Apply: Once you have completed all the steps, submit your application.

- Step 7: Verification and confirmation: After submission, Bank Alfalah will verify your application and documents. You will receive a confirmation email or message once your account is opened.

- Step 8: Activate your account: To activate your account, you will receive a welcome kit containing your account number, debit card, and other necessary information. Follow the instructions provided in the kit to activate your account.

In conclusion, opening a Bank Alfalah Freelancer Account online is a simple and efficient process. Just follow these steps, and you can open an account within a few minutes and enjoy the benefits of the account.

Recommended Reading: Top 5 Best Bank Account For Freelancers In Pakistan {Tried+Tested}

Bank Alfalah Freelancer Account Pros And Cons

Bank Alfalah Freelancer Account is a specialized account designed for freelancers to cater to their specific financial needs. However, like any other account, it has its pros and cons.

Here are some of the advantages and disadvantages of opening a Bank Alfalah Freelancer Account:

| Pros | Cons |

|---|---|

| Multi-currency account: | Monthly transaction limit: The account has a monthly transaction limit of USD 5,000 or equivalent, which may be insufficient for some freelancers. |

| No minimum balance requirement: | Limited branch network: Bank Alfalah’s branch network is limited, making it challenging for some freelancers to access their accounts easily. |

| Debit card and Chequebook issuance: | Limited customer support: Some freelancers have experienced issues with the responsiveness of Bank Alfalah’s customer support. |

| Free SMS alerts and e-statements: | Charges: Bank Alfalah may levy charges for services like checkbook issuance, impacting the account holder’s finances. |

| High daily cash withdrawal limit: |

Recommended Reading: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

Bank Alfalah Freelancer Account FAQs

What is Bank Alfalah Freelancer Account?

Bank Alfalah Freelancer Account is a specialized account designed for freelancers to cater to their specific financial needs. The account is available in both local and foreign currencies and comes with a range of features and benefits, including no minimum balance requirement, debit card, and Cheque book issuance, and free SMS alerts and e-statements.

Who is eligible to open a Bank Alfalah Freelancer Account?

Individuals who are freelancers and have a valid National Identity Card (NIC) or passport can open a Bank Alfalah Freelancer Account.

How can I apply for a Bank Alfalah Freelancer Account?

You can apply for a Bank Alfalah Freelancer Account online by visiting the Bank Alfalah website and filling out the application form. You will need to provide your personal information, proof of income, and other necessary documents to complete the application process.

Is there a minimum balance requirement for a Bank Alfalah Freelancer Account?

No, there is no minimum balance requirement for a Bank Alfalah Freelancer Account.

What is the monthly transaction limit for a Bank Alfalah Freelancer Account?

The monthly transaction limit for a Bank Alfalah Freelancer Account is USD 5,000 or the equivalent in other currencies. The debit and credit limits are applied separately.

What is the daily cash withdrawal limit for a Bank Alfalah Freelancer Account?

The daily cash withdrawal limit for a Bank Alfalah Freelancer Account is Rs. 500,000 or the equivalent in other currencies.

Does Bank Alfalah charge any fees for a Freelancer Account?

Yes, Bank Alfalah may charge fees for services such as checkbook issuance and other transactions. You can check the Bank Alfalah website or contact customer support to get more information about the fees.

What if I need assistance or have further questions?

Bank Alfalah has a dedicated customer service team available to address any queries or concerns. You can reach out to their customer support through phone, email, or visit a branch for in-person assistance.

Can I hold multiple currencies in my Bank Alfalah Freelancer Account?

Yes, the Bank Alfalah Freelancer Account offers the option to hold multiple currencies. It is available in both local currency (PKR) and foreign currency (FCY), with FCY limited to USD only.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment