If you’re looking for a convenient way to manage your finances jointly, opening a joint account at Standard Chartered Bank could be the perfect solution.

Whether you’re a couple, family members, or business partners, a joint account offers a streamlined approach to shared financial responsibilities.

In this article, we will guide you through the entire process of opening a joint account in Standard Chartered Bank, including eligibility criteria, required documents, and step-by-step instructions.

By following these guidelines, you’ll be able to navigate the account opening process smoothly and enjoy the benefits of a joint account.

So, let’s start and explore the opening of a joint account in Standard Chartered Bank and discover how you can start managing your finances together!

Recommended Reading: Solar Panel On Installment Meezan Bank | Interest-Free Loan For Solar Panels

How To Open A Joint Account In Standard Chartered Bank | Standard Chartered Account Opening

Table of Contents

Recommended Reading: How To Open A Joint Account In Meezan Bank {Charges+Requirements}

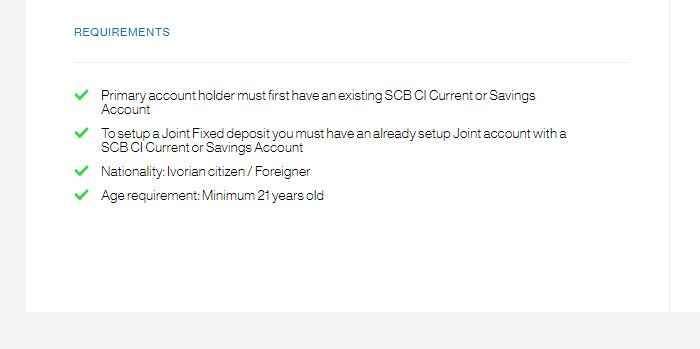

Standard Chartered Bank Joint Account Requirements

Eligibility Criteria | Who Can Open A Joint Account?

To open an account at Standard Chartered Bank, certain eligibility criteria must be met. Here are the key points to consider:

| Requirement | Details |

|---|---|

| Primary Account Holder: | Must have an existing SCB CI Current or Savings Account |

| Joint Account Holder: | Must have an already set account with an SCB CI Current or Savings Account |

| Nationality: | Ivorian citizen or Foreigner |

| Age Requirement: | Minimum 21 years old |

Recommended Reading: NBP Asaan Digital Account (CNIC+PKR 100){Benefits+Limit+Charges}

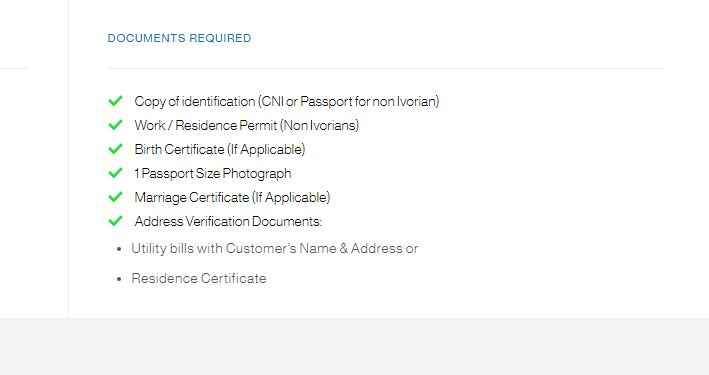

Documents Required To Open A Joint Account In Standard Chartered

When opening an account in Standard Chartered Bank, several documents are required to ensure a smooth and secure process.

Here are the essential documents:

| Document | Details |

|---|---|

| Identification (CNI or Passport for non-Ivorians): | A copy of your ID card (for Ivorians) or Passport (for non-Ivorians) |

| Work/Residence Permit (Non-Ivorians): | If you’re a non-Ivorian, you’ll need to provide a valid work or residence permit |

| Birth Certificate (If Applicable): | Necessary if applicable, to verify the date of birth |

| Passport Size Photograph: | One passport-size photo of each account holder |

| Marriage Certificate (If Applicable): | Required if applying with a spouse for an account |

| Address Verification Documents: | Utility bills or Residence Certificates showing the customer’s name and address |

Recommended Reading: FREE! Bank Alfalah Asaan Current Account Opening Online {Benefits+Limit}

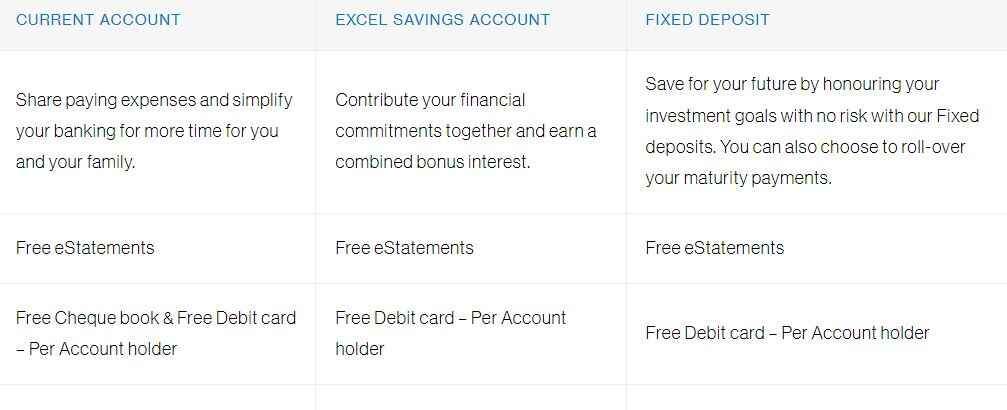

Standard Chartered Joint Account Types

When it comes to account opening, Standard Chartered Bank app offers a range of account types to cater to different financial needs.

Here are the joint account options available:

| Account Type | Features |

|---|---|

| Current Account: | Share expenses easily for more family time |

| Free eStatements for convenient account management | |

| Free Cheque book and Debit card for each account holder | |

| Excel Savings Account: | Combine financial commitments and earn bonus interest |

| Free eStatements for hassle-free account tracking | |

| Free Debit card for each account holder | |

| Fixed Deposit: | Save for the future with no risk and honor your investment goals |

| Free eStatements for easy monitoring | |

| Free Debit card for each account holder | |

| Option to roll over maturity payments for continued savings |

Recommended Reading: Bank Alfalah Digital Account Opening | Bank Alfalah Digital Lifestyle Branch

How To Apply For A Joint Account In Standard Chartered Bank

Applying for a joint account in Standard Chartered Bank follows a process similar to opening a single account. Here are the steps involved:

- Prepare Required Documents: Gather the necessary documents for each intending to open the account.

- Obtain the Account Opening Form: Visit a Standard Chartered Bank branch or access their official website to obtain the account opening form.

- Fill Out the Form: Duly complete the account opening form, ensuring that all the details are accurately filled in for each account holder.

- Submit the Form and Documents: Once the form is filled out, submit it along with the required documents of all the individuals involved in opening the account.

- Sign a Joint Account Mandate: As part of the account opening process, you must sign a “joint account mandate.” This document outlines how you and your account partners want to manage the account, specifying details such as withdrawal limits, etc.

Recommended Reading: Roshan Digital Account For Overseas Pakistanis Online Opening {Charges+Limit}

How To Close A Joint Account?

Closing a joint account requires coordination and cooperation from all account holders. Here’s a step-by-step guide on how to close an account:

| Steps | Details |

|---|---|

| Coordinate with Account Partners | Discuss and agree with all account partners on closing the account. |

| Visit the Bank | All account holders must visit the bank branch where the account is held. |

| Speak with a Bank Representative | Inform a bank representative about your intention to close the account. |

| Cancel Joint Account Mandate | Sign a document called “Account Mandate Cancellation” to close the account. |

| Submit Identification and Account Details | Present identification documents like CNIC/Passport to confirm identity. |

| Settle Outstanding Transactions | Clear or transfer any pending payments, direct debits, or standing orders. |

| Withdraw Remaining Funds | Decide how to distribute any remaining funds among the account holders. |

| Obtain Confirmation of Account Closure | Obtain a confirmation letter or receipt from the bank indicating the successful closure of the account. |

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Pros And Cons Of Joint Account Opening

Pros Of Joint Account Opening

- Shared Financial Responsibility: Joint allow for shared financial responsibility, making it easier to manage household expenses, business finances, or shared goals.

- Convenience and Accessibility: account holders can enjoy convenient access to funds.

- Enhanced Financial Planning: accounts enable collaborative financial planning and budgeting.

- Emergency Preparedness: accounts can be useful during emergencies.

Cons Of Joint Account Opening

- Shared Liability: Joint account holders have equal access and responsibility for the account. This means that each partner is liable for any debts or liabilities incurred by the account, even if they were not directly involved.

- Loss of Individual Control: Opening an account means relinquishing some individual control over finances.

- Financial Transparency: Joint require a high level of financial transparency among account partners.

- Legal Implications: Accounts can have legal implications, especially in the case of divorce, separation, or business disputes.

Recommended Reading: NBP Asaan Digital Account (CNIC+PKR 100){Benefits+Limit+Charges}

Joint Account Opening FAQs

What is a joint account?

A joint account is a bank account that is opened and operated by two or more individuals, known as account partners. Each account partner has equal access and ownership rights over the account.

Who can open a joint account?

Accounts can be opened by couples, family members, business partners, or any group of individuals who want to manage their finances collectively.

What are the benefits of opening a joint account?

Some benefits of account opening include shared financial responsibility, convenience in managing shared expenses, enhanced financial planning, and emergency preparedness.

What documents are required to open a joint account?

The required documents typically include identification documents (such as CNIC/Passport), work/residence permits (for foreign nationals), passport-size photographs, address verification documents, and any additional documents specific to the account holders’ circumstances (e.g., marriage certificates or birth certificates).

Can I open a joint account if I already have an individual account with the same bank?

Yes, it is possible to open an account even if you already have an individual account with the same bank. The bank will guide you through the process of converting your account into an account or opening a separate joint account.

Can a joint account be opened with individuals of different nationalities?

Yes, joint accounts can be opened with individuals of different nationalities. Standard Chartered Bank, like many other banks, allows Ivorian citizens and foreign nationals to open accounts.

Do all joint account holders need to be physically present to open the account?

Yes, it is typically required for all account holders to be physically present at the bank to open an account. This ensures that all parties provide their consent and complete the necessary paperwork.

How is the account managed in a joint account?

In a joint account, all account partners have equal rights and access to manage the account. Withdrawals, deposits, and other account activities require the consent of all account holders as specified in the account mandate.

Can I remove an account partner from a joint account?

Removing an account partner from an account can be a complex process. It often requires the agreement and consent of all account holders and may involve legal procedures. It is advisable to consult with the bank for specific guidance in such cases.

Can joint accounts have different types, such as savings or fixed deposit accounts?

Yes, accounts can be opened in different types offered by the bank, such as current accounts, savings accounts, or fixed deposit accounts. The account type can be chosen based on the financial goals and requirements of the account holders.

Can I open a joint account with more than two individuals?

Yes, accounts can be opened with more than two individuals. Some banks allow accounts with up to four or five account holders, depending on their policies.

Can a joint account be opened with a minor?

Yes, it is possible to open an account with a minor. However, the account management and access may vary based on the minor’s age and the bank’s policies. It may require a guardian or parent to be listed as an account holder until the minor reaches the age of majority.

Can I convert my individual account into an account?

Yes, in most cases, you can convert your individual account into an account by adding account partners. This typically involves filling out the necessary forms and providing the required documentation at the bank.

Can I switch from an account to an individual account later?

Yes, it is generally possible to switch from an account to an individual account. However, this process may vary depending on the bank’s policies and procedures. It usually involves closing the account and opening a new individual account.

Can I add or remove account partners from an existing joint account?

Adding or removing account partners from an existing account can be a complex process. It often requires the agreement and consent of all account holders and may involve legal procedures. It is advisable to consult with the bank for specific guidance in such cases.

Can I have both a joint account and an individual account with the same bank?

Yes, it is possible to have both an account and an individual account with the same bank. This allows you to separate your personal finances while still having the convenience of an account for shared expenses or financial goals.

Are joint accounts insured by deposit insurance schemes?

Deposit insurance coverage for accounts varies by country and deposit insurance schemes.

It is recommended to inquire with the bank or relevant authorities regarding the deposit insurance coverage for accounts in your jurisdiction.

Recommended Reading: Meezan Bank Account Opening Online {Local+Overseas}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment