As globalization continues to bring the world closer together, an increasing number of Pakistani individuals and entrepreneurs are seeking opportunities beyond their homeland.

Whether it’s pursuing higher education, exploring business prospects, or simply building a better life abroad, the aspirations of overseas Pakistanis are diverse and boundless.

However, realizing these dreams often requires financial assistance through loans. Fortunately, there are several proven ways to get a Personal Loan For Overseas Pakistanis for both personal and business purposes.

| Developer | Project | Financing Option |

|---|---|---|

| BRB GROUP | – | Shariah-compliant |

| EMAAR | Emaar Apartment (Karachi) | Shariah-compliant |

| Oasis Park Residencia (Karachi) | Shariah-compliant | |

| Chapel Courtyard (Karachi) | Shariah-compliant | |

| CHAPALUPTOWN PURSUKON | Chapal Uptown (Karachi) | Shariah-compliant |

| REHAISH AASAISHON KAY SAATH | ||

| GFS BUILDERS & DEVELOPERS | North Town Residency (Karachi) | Shariah-compliant |

In this article, we will explore three reliable avenues that have helped numerous individuals and entrepreneurs obtain the necessary funds (Loan For Overseas Pakistanis) to turn their aspirations into reality.

So, let’s explore these proven ways of getting a loan for overseas Pakistanis, ensuring that no dream remains out of reach.

Recommended Reading: How To Get Dubai Islamic Bank Personal Loan {100% Sharia compliance}

Loan For Overseas Pakistani | Personal Loan For Overseas Pakistani

Table of Contents

- Loan For Overseas Pakistani | Personal Loan For Overseas Pakistani

Recommended Reading: Dubai Islamic Bank Personal Loan {10 Million}

Meezan Bank Home Loan For Overseas Pakistani

If you’re a Pakistani working abroad and looking to get a loan in Pakistan, there are several ways to do so easily and quickly. One great option is the Meezan Bank Easy Home Scheme, which offers interest-free (Riba-free) financing tailored specifically for both Pakistani residents and overseas Pakistanis.

This scheme allows you to finance a home without compromising on religious beliefs. Meezan Bank understands the unique financial needs of overseas Pakistanis and provides solutions that cater to their circumstances. With this scheme, fulfilling your dream of owning a home becomes accessible and straightforward.

Meezan Bank Loan For Overseas Pakistani Key Features

Loan For Overseas Pakistani: Key Features of Meezan Bank Loan For Overseas Pakistani:

| Key Features | Details |

|---|---|

| Highest Financing Amounts | Provides the highest possible loan amounts |

| Maximum Finance against Property | Offers financing up to the maximum property value |

| Value | |

| Flexibility to make Partial | Allows for partial pre-payments, offering flexibility |

| Pre-payments | |

| Shariah Compliant Life Takaful | Offers Shariah-compliant life Takaful facility |

| Facility | |

| Affordable Installments and | Ensures affordable installments with regular reducing |

| regular reducing monthly rental | monthly rental payments |

Meezan Bank Loan For Overseas Pakistani Eligibility Criteria

Loan For Overseas Pakistani: Eligibility Criteria for Meezan Bank Loan for Overseas Pakistani:

| Eligibility Criteria | Details |

|---|---|

| Citizenship | Lien Based: All Non-Resident RDA holders with valid NICOP & POC |

| Non-Lien Based: All Non-Resident RDA holders with valid NICOP | |

| Product Category | Buyer, Builder, Renovation |

| Segment | Salaried Individual |

| Non-salaried individual (earning via business) | |

| Age (Applicant & Co-Applicant) | |

| Lien Based: 20 to 65 years | |

| Non-Lien Based: 20 to 65 years | |

| (Applicant must not exceed 60 years unless justified) | |

| Co-Applicant: Must not exceed 65 years at maturity | |

| (Or same as applicant if income is clubbed) | |

| Financing Range & Tenure | |

| Financing Range | Minimum Rs. 500,000/-; Maximum: No cap |

| Financing Tenure | 3 to 25 Years |

| Co-Applicant | NRP for Income Clubbing |

| Net Monthly Income | Lien Based: No minimum income criteria |

| Non-Lien Based: No minimum income criteria; | |

| Maximum 50% DBR considered | |

| Employment Tenure | Lien Based: Minimum one year overall |

| Non-Lien Based: Minimum two years overall | |

| Creation of Mortgage | Lien Based: No requirement of mortgage |

| Non-Lien Based: Equitable mortgage with token registered mortgage | |

| Physical Presence | Lien Based: Not required |

| Non-Lien Based: Physical presence or Power of Attorney (POA) required |

Meezan Bank Loan For Overseas Pakistani Document Requirements

Loan For Overseas Pakistani: Documents Required for Meezan Bank Loan for Overseas Pakistani:

| Documents Required | Details |

|---|---|

| Easy Home Application Form | Downloadable from Meezan Bank’s website |

| Applicant’s NICOP / POC / CNIC issued by NADRA | |

| Co-Applicant’s CNIC issued by NADRA | |

| Passport-sized colored Photographs of Applicant and Co-Applicant | Two photographs each |

| Employer’s Certificate | Attested by the relevant Pakistani Embassy in the country of employment |

| Employment Contract (if applicable) | |

| Last three months’ Salary Slip | Original or attested by the Employer |

| Passport | Copy |

| Visa / Work permit / Residence Permit | Copy (e.g., Iqaama, etc.) |

| Professional Association Membership Certificate / Practice License (if applicable) | |

| Bank Statement – last 12 months | Original or attested by the bank with stamp/notary public |

| Details of any financing facility being availed | |

| Educational qualification degree/certificates | Copies |

| Copy of last paid Utility Bills (Electricity/Gas/Telephone) of Co-applicant | Residing in Pakistan |

| Rental Documents (if applicable) | |

| Recent Credit Card Bills (if applicable) | |

| Previous Employment Proof (if applicable) | |

| Copies of last 2 years tax documents (where applicable) | |

| Processing Fees Cheque / Pay order | Any commercial bank in Pakistan |

| Joint Account opening requirement with Meezan Bank | First three months’s Installment to be kept as a lien throughout the financing tenure |

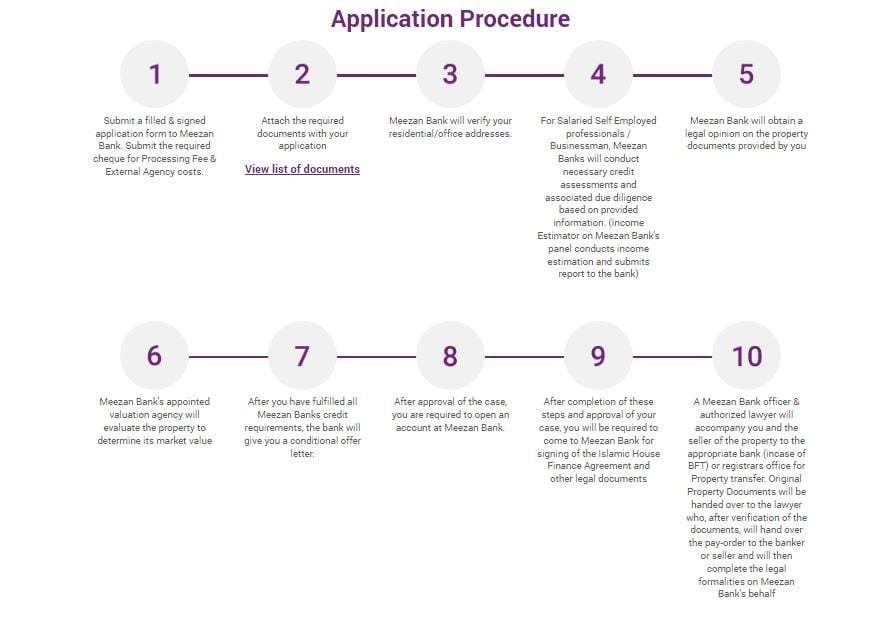

How To Apply For Meezan Bank Home Loan Scheme As Overseas Pakistani

Loan For Overseas Pakistani: Here is a step-by-step guide on how to apply for a Meezan Bank Home Loan:

| Step | Details |

|---|---|

| 1 | Submit a filled & signed application form to Meezan Bank. Submit the required cheque for Processing Fee & External Agency costs. |

| 2 | Attach the required documents with your application. View list of documents |

| 3 | Meezan Bank will verify your residential/office addresses. |

| 4 | Meezan Bank will obtain a legal opinion on the property documents provided by you. |

| 5 | For Salaried Self-employed professionals/businessmen, Meezan Banks will conduct necessary credit assessments and associated due diligence based on the provided information. (Income Estimator on Meezan Bank’s panel conducts income estimation and submits report to the bank) |

| 6 | Meezan Bank’s appointed valuation agency will evaluate the property to determine its market value. |

| 7 | After you have fulfilled all Meezan Bank credit requirements, the bank will give you a conditional offer letter. |

| 8 | After approval of the case, you are required to open an account at Meezan Bank. |

| 9 | After completion of these steps and approval of your case, you will be required to come to Meezan Bank for the signing of the Islamic House Finance Agreement and other legal documents. |

| 10 | A Meezan Bank officer & authorized lawyer will accompany you and the seller of the property to the appropriate bank (in case of BFT) or registrar’s office for Property transfer. Original Property Documents will be handed over to the lawyer who, after verification of the documents, will hand over the pay order to the banker or seller and will then complete the legal formalities on Meezan Bank’s behalf. |

PM Housing Loan Scheme | Mera Pakistan Mera Ghar Scheme

Key Features Of The PM Housing Loan Scheme

Loan For Overseas Pakistani: Key features of the PM Housing Loan Scheme include:

| Benefits & Features | Details |

|---|---|

| Enjoy a 5% rental rate for the first five years | You can benefit from a rental rate of 5% for the initial five years of the financing period. |

| Avail Up to PKR 10M Financing limit | You have the option to avail financing up to PKR 10 million for purchasing housing units. |

| Avail Zero processing charges | There are no processing charges associated with availing the financing under this scheme. |

| Government Subsidy Scheme Features | The scheme offers benefits under the Government Subsidy Scheme, categorized into Tier 1 (NAPHDA), Tier 2, and Tier 3. |

| Three Product Offerings | Offers three product tiers: Tier 1 (NAPHDA), Tier 2, and Tier 3 for different segments of borrowers. |

| Maximum Price of Housing Units | The maximum price of housing units is PKR 3.5 million for Tier 1 and there is no cap for Tier 2 and Tier 3. |

| Financing Tenor | The financing tenor ranges between 5 to 20 years, providing flexibility in repayment. |

| Maximum Financing Amount | The maximum financing amount ranges from PKR 60 million to PKR 10.0 million, depending on the tier. |

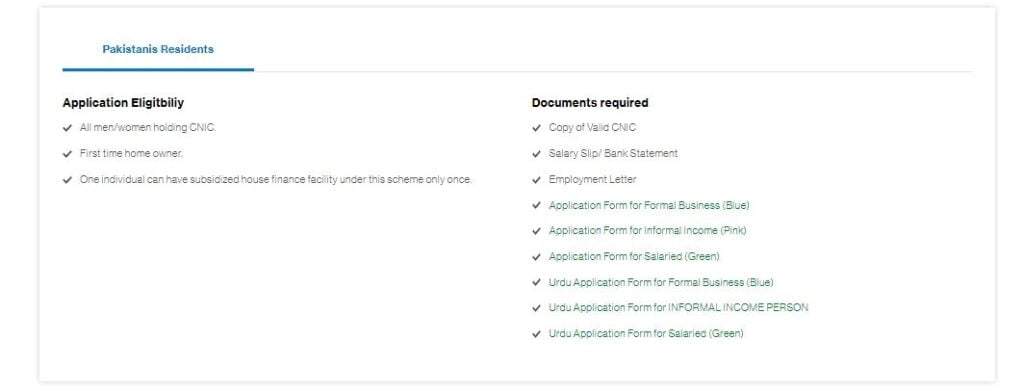

PM Housing Loan Scheme Eligibility Criteria+Documents

Loan For Overseas Pakistani: The PM Housing Loan Scheme eligibility criteria and required documents include:

Eligibility Criteria

- Citizenship Requirement: The scheme is open to both men and women who hold a valid CNIC.

- First-Time Homeowners: The scheme is specifically targeted towards first-time homebuyers. It aims to support individuals who are seeking to purchase their first residential property.

Required Documents

- Copy of Valid CNIC: Applicants need to provide a copy of their valid CNIC as proof of their identity and citizenship. This document verifies the individual’s eligibility as a citizen of the country.

- Salary Slip/Bank Statement: Individuals are required to submit their salary slips or bank statements as proof of income. This documentation helps assess the applicant’s financial stability and repayment capacity, which is crucial for loan approval and determining the loan amount.

- Employment Letter: Applicants need to provide an employment letter from their current employer. This letter serves as evidence of their employment status and income stability. It helps the lender assess the applicant’s ability to repay the loan based on their employment stability.

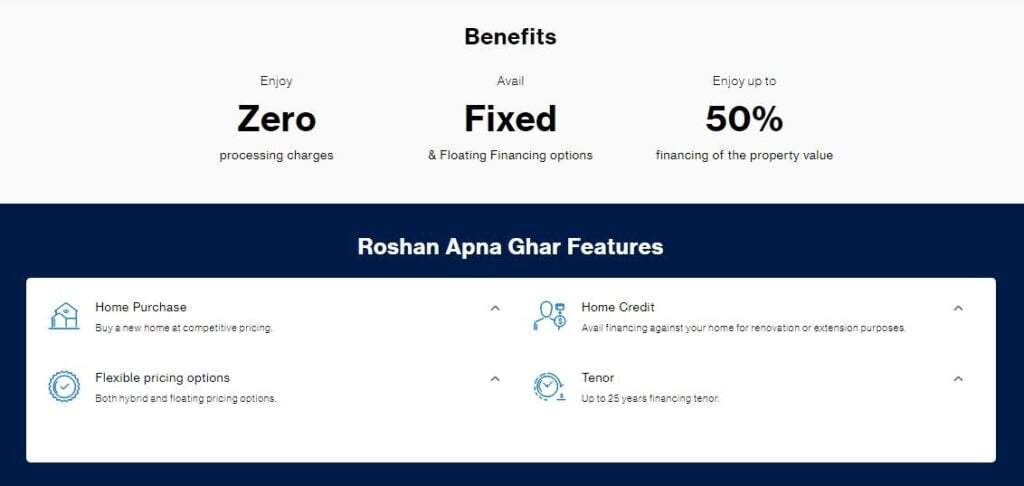

Roshan Apna Ghar Scheme For Overseas

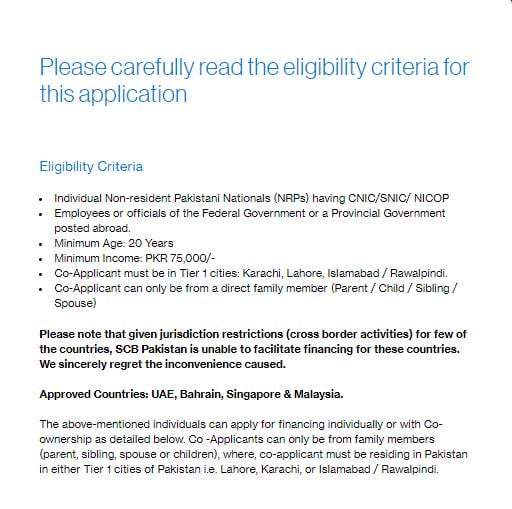

Roshan Apna Ghar Scheme Eligibility Criteria

Loan For Overseas Pakistani: The eligibility criteria for the Roshan Apna Ghar Scheme include:

- Non-Resident Pakistani Nationals (NRPs) Possessing CNIC/SNIC/NICOP: The scheme is specifically designed for non-resident Pakistani nationals who possess a valid Computerized National Identity Card (CNIC), Smart National Identity Card (SNIC), or National Identity Card for Overseas Pakistanis (NICOP). This criterion ensures that the scheme is accessible to Pakistani citizens living abroad.

- Employees or Officials Posted Abroad: The scheme is open to individuals who are employed or serving as officials abroad. This includes individuals working in various professional capacities in foreign countries. The scheme aims to facilitate housing ownership for Pakistani nationals working and living outside the country.

- Minimum Age: The minimum age requirement for applicants is 20 years. This ensures that individuals applying for the scheme are legally eligible to enter into financial contracts and engage in property ownership.

- Minimum Income: Applicants must have a minimum monthly income of PKR 75,000 to be eligible for the scheme. This income requirement ensures that applicants have a stable financial standing to afford the loan repayments and fulfill their financial obligations.

- Co-Applicant Residence: The scheme requires that the co-applicant, who is a direct family member of the applicant, must reside in one of the specified cities, namely Karachi, Lahore, Islamabad, or Rawalpindi. This criterion ensures that there is a local presence for necessary coordination and documentation purposes.

- Co-Applicant Direct Family: The co-applicant for the loan must be a direct family member of the primary applicant. This includes parents, spouses, or children. Having a co-applicant from the immediate family strengthens the loan application and provides additional financial support.

- Non-Resident Pakistanis Residence: The scheme is available for non-resident Pakistanis residing in specific countries, including the United Arab Emirates (UAE), Bahrain, Singapore, and Malaysia. These countries are included to extend the benefits of the scheme to Pakistani nationals residing in popular work destinations.

- Maximum Age: The maximum age limit for salaried individuals is 60 years, while for self-employed individuals, it is 65 years. This ensures that the loan repayment period aligns with the borrower’s remaining working years and provides a reasonable time frame to repay the loan.

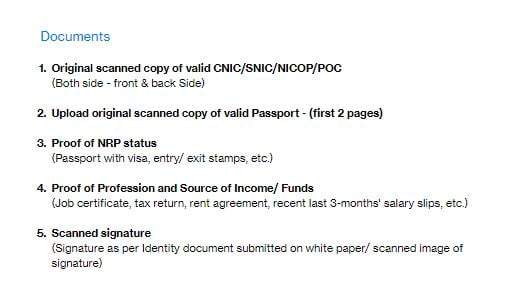

Documents Required Roshan Apna Ghar Scheme Registration

Loan For Overseas Pakistani: The documents required for registration under the Roshan Apna Ghar Scheme include:

- Copy of Valid CNIC: Applicants need to provide a copy of their valid Computerized National Identity Card (CNIC) as proof of their identity and citizenship.

- Salary Slip/Bank Statement: Applicants must submit their salary slips or bank statements as proof of income.

- Employment Letter: An employment letter from the applicant’s current employer is required. This letter serves as evidence of the applicant’s employment status and income stability.

- Valid Passport: Applicants need to provide a copy of their valid passport. This document serves as proof of their identity and supports the verification process for non-resident Pakistani nationals.

- Proof of NRP Status (Visa Entry/Exit Stamp Page): Non-resident Pakistani nationals need to provide proof of their NRP (Non-Resident Pakistani) status, which can be demonstrated through the visa entry/exit stamp page on their passport.

- Proof of Profession and Source of Income/Funds: Applicants are required to submit documents that establish their profession and source of income or funds.

- Scanned Signature: Applicants may need to provide a scanned copy of their signature. This is usually required to authenticate the loan documents and ensure their validity.

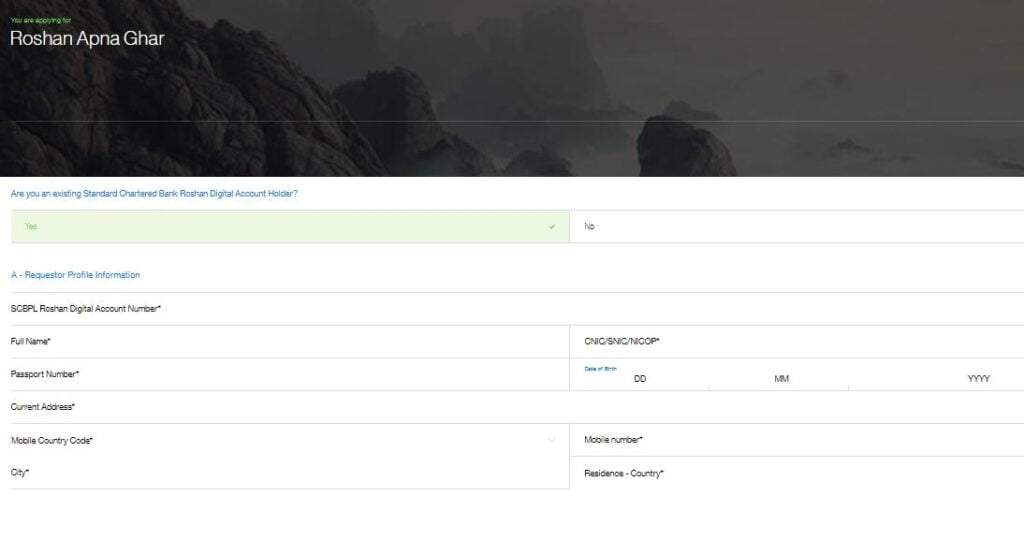

Roshan Apna Ghar Scheme Apply Online

Loan For Overseas Pakistani: To apply for the Roshan Apna Ghar Scheme online, follow the step-by-step guide below using the example of Standard Chartered Bank:

- Visit the Website: Open a web browser and visit the website or Meezan Bank App of the affiliated bank offering the Roshan Apna Ghar Scheme.

- Access the Roshan Apna Ghar Scheme Section: Navigate to the Roshan Apna Ghar Scheme section on the bank’s website.

- Find the Online Application Form: Look for an option to apply online for the Roshan Apna Ghar Scheme. On Standard Chartered Bank’s website, you can find the online application form by visiting the following URL: https://www.sc.com/pk/save/roshan-apna-ghar/apply/

- Fill out the Online Application Form: Click on the provided link to access the online application form. Fill out the form with accurate and complete information.

- Attach Required Documents: The online application form may have a section to upload the required documents

- Review and Submit: Before submitting the online application, review all the entered information and attached documents to ensure accuracy and completeness.

- Confirmation and Follow-up: After submitting the online application, you should receive a confirmation message or notification acknowledging the receipt of your application.

Loan For Overseas Pakistani FAQs

Can Overseas Pakistanis Get Home Loans?

Overseas Pakistanis can get a home loan through government schemes like Naya Pakistan Housing Scheme and Roshan Apna Ghar Schemes while living abroad.

Top 3 Best Banks for Overseas Pakistani?

Following are the best banks for overseas Pakistanis to the best of our knowledge

Standard Chartered

Allied Bank

Faisal Bank

Can Overseas Pakistanis open a bank account in Pakistan while living abroad?

Many a bank allows overseas Pakistanis to open bank accounts while living abroad e.g. MCB Motherland Account. Overseas Pakistanis can access this account from any place and can make financial transactions easily.

Who is eligible for loans under the Roshan Apna Ghar Scheme?

Loan For Overseas Pakistani: Non-Resident Pakistani Nationals (NRPs) possessing CNIC/SNIC/NICOP.

Employees or officials posted abroad.

Non-Resident Pakistanis residing in UAE, Bahrain, Singapore, and Malaysia.

Co-applicants from Karachi, Lahore, Islamabad, or Rawalpindi.

The scheme is open to Non-Resident Pakistani Nationals with a minimum age of 20 years and a minimum income of PKR 75,000.

Who is eligible for a loan for overseas Pakistanis?

Eligibility criteria for Loan For Overseas Pakistanis may vary depending on the specific loan program and lending institution. However, generally, overseas Pakistanis who hold valid CNIC/SNIC/NICOP, have a stable source of income, and meet the minimum income requirements are eligible for these loans. Other factors such as credit history, employment status, and loan purpose may also be considered.

What documents are required to apply for a loan for overseas Pakistanis?

The required documents to get a Loan For Overseas Pakistani may vary depending on the lender and loan program.

However, commonly requested documents include a copy of valid CNIC/SNIC/NICOP, proof of income (such as salary slips or bank statements), employment letter, valid passport, proof of NRP status (visa entry/exit stamp page), proof of profession and source of income/funds, and any other documents specified by the lender.

Can an overseas Pakistani apply for a loan without visiting Pakistan?

Yes, it is possible to apply a Loan For Overseas Pakistani without visiting Pakistan, as many lenders provide online application facilities for overseas Pakistanis.

The online application process allows you to submit the required documents and complete the necessary procedures remotely.

However, you may still need to coordinate with the lender and provide any additional documentation or information as requested.

What is the maximum age limit for getting Loan For Overseas Pakistani applicants?

The maximum age limit for getting a Loan For Overseas Pakistanis is 60 years for salaried individuals and 65 years for self-employed individuals. This age limit ensures that the loan repayment period aligns with the borrower’s remaining working years.

Can Non-Resident Pakistanis residing in countries other than UAE, Bahrain, Singapore, and Malaysia apply for the scheme?

Loan For Overseas Pakistani: The Scheme is open to Non-Resident Pakistanis residing in UAE, Bahrain, Singapore, and Malaysia. It is advisable to check with the specific bank offering the loan for any updates or changes to the eligible countries.

What are the financing options available under the Roshan Apna Ghar Scheme?

The scheme typically offers a variety of financing options, including fixed and floating rates, tailored to the preferences of Overseas Pakistanis.

What are the benefits of the PM Loan Scheme for Overseas Pakistani applicants?

Benefits include lower interest rates, longer repayment tenors, and support for investments in Pakistan.

Can Overseas Pakistanis apply for loans from Meezan Bank?

Yes, Meezan Bank offers loans specifically designed for Overseas Pakistanis to support various financial needs.

Recommended Reading: How To Get Dubai Islamic Bank Personal Loan

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment