Under the Prime Minister Youth Loan Scheme, eligible applicants can receive loans ranging from PKR 5 Lakhs to PKR 15 Lakhs at a low interest rate, with a repayment period of up to eight years.

Through the Prime Minister Youth Loan Scheme, young entrepreneurs can access business loans on easy terms and with low markup rates through a network of 15 commercial, Islamic, and SME banks.

This article will explore the eligibility criteria, amount of loans, the application process, and benefits of the Prime Minister Youth Loan Scheme and its impact on the economy of Pakistan.

Recommended Reading: Prime Minister Youth Development Package 2024 | PM Youth Program

Prime Minister Youth Loan Scheme | PM Youth Program

Table of Contents

Recommended Reading: Prime Minister Youth Business Loan Scheme Apply Online (Step-by-Step Process)

PM Youth Program Eligibility Criteria

Here are the eligibility criteria for the Prime Minister Youth Loan Scheme in Pakistan:

| Category | Details |

|---|---|

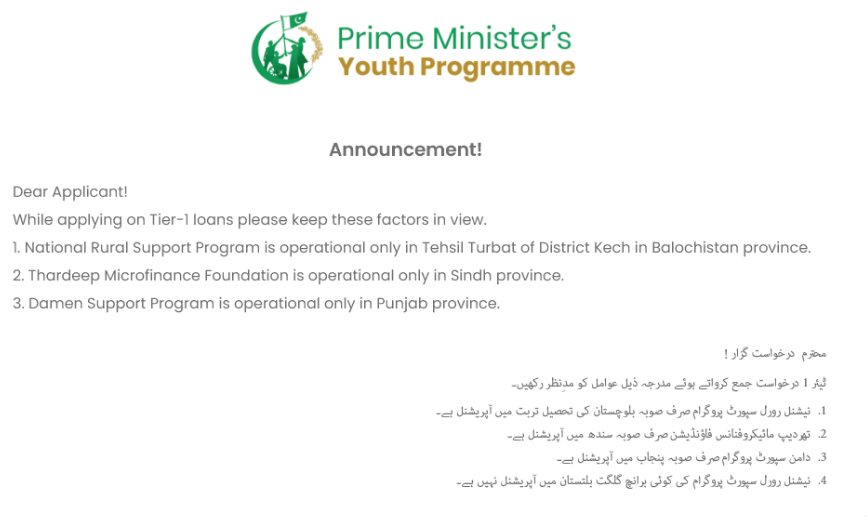

| Operational Areas | National Rural Support Program: Tehsil Turbat, District Kech, Balochistan |

| Thardeep Microfinance Foundation: Sindh province | |

| Damen Support Program: Punjab province | |

| Age Limit | The applicant must be between 18 and 45 years of age. |

| Citizenship | The applicant must be a Pakistani citizen. |

| Educational Qualification | The applicant must have at least a Matriculation certificate or equivalent. |

| Business Plan | The applicant must submit a well-structured business plan for the proposed project. |

| Guarantor | The applicant must provide at least 2 personal guarantors or collateral for the loan. |

| Credit History | The applicant’s credit history must be clear, with no previous defaults on loans or credit card payments. |

| Nature of Business | The loan is available for business and agriculture projects only. |

| Loan Amount | The loan amount is subject to the business plan’s feasibility and the applicant’s repayment capacity. |

| Loan Purpose | The loan must be utilized for the specific purpose mentioned in the business plan. |

| Loan Repayment | The applicant must have the ability to repay the loan within the stipulated time frame. |

Recommended Reading: Kamyab Jawan Program | Prime Minister Loan Scheme (Business+Agriculture)

Documents Required

Here are the documents required to apply for the Prime Minister Youth Loan Scheme online in Pakistan:

| Category | Details |

|---|---|

| New Loan Scheme | Prime Minister’s Youth Business & Agriculture Loan Scheme, providing interest-free loans |

| Action Required | Re-apply by filling out the online form available at the PM Youth Program portal: PM Youth Program Portal |

| Priority | Applications will be processed on priority for previous-stage applicants |

| Required Documents | |

| National Identity Card | A valid CNIC of the applicant |

| Guarantor’s CNIC | CNIC of the personal guarantor |

| Business Plan | A detailed business plan outlining the proposed project |

| Educational Certificates | Educational certificates (e.g., Matriculation, Intermediate, Bachelor’s degree) |

| Bank Statement | Applicant’s bank statement for the last six months |

| Income Proof | Proof of income, such as salary slips or business income statements |

| Photographs | Passport-sized photographs of the applicant and guarantor |

| Utility Bills | Recent utility bills of the applicant’s residence or business address |

| Collateral Documents | Collateral documents, if applicable |

| Other Certificates | Any other relevant certificates or documents (e.g., licenses, permits, registration documents) |

Recommended Reading: Kamyab Jawan Program Loan Online Apply {5-30Lakh}

Prime Minister Youth Loan Scheme Tiers

The Prime Minister Youth Loan Scheme offers loans under three tiers to support the entrepreneurial aspirations of Pakistani youth.

These tiers have been structured to cater to the diverse needs of young entrepreneurs and provide financing for a range of business projects.

| Tier | Loan Amount Range | Markup Rate | Details |

|---|---|---|---|

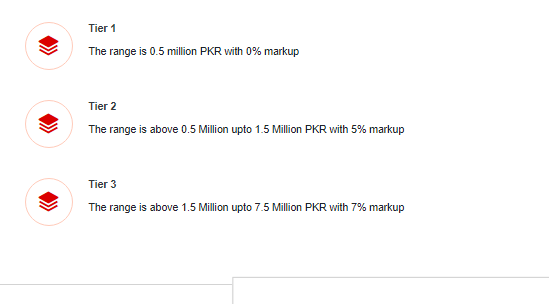

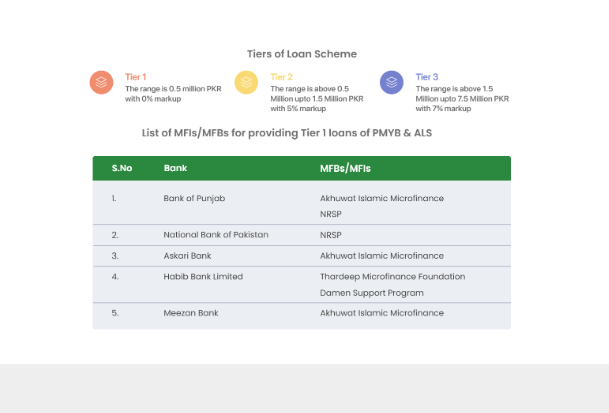

| Tier 1 | Up to 0.5 Million PKR | 0% | Suitable for small-scale business projects needing minimal financing |

| Tier 2 | Above 0.5 Million up to 1.5 Million PKR | 5% | For entrepreneurs requiring higher financing to support their business projects |

| Tier 3 | Above 1.5 Million up to 7.5 Million PKR | 7% | Designed for large-scale business projects needing significant financing |

The scheme’s various tiers ensure that every aspiring entrepreneur can find the right level of financing to support their business aspirations.

| S.No | Bank | MFBC/MFIs |

|---|---|---|

| 1 | Bank of Punjab | Akhuwat Islamic Microfinance, NRSP |

| 2 | National Bank of Pakistan | NRSP |

| 3 | Askari Bank | Akhuwat Islamic Microfinance, Thardeep Microfinance Foundation, Damen Support Program |

| 4 | Habib Bank Limited | Akhuwat Islamic Microfinance |

| 5 | Meezan Bank | Akhuwat Islamic Microfinance |

Recommended Reading: PM Youth Program | PM Green Youth Movement (Projects+Features)

Prime Minister Youth Loan Scheme Online Application Process

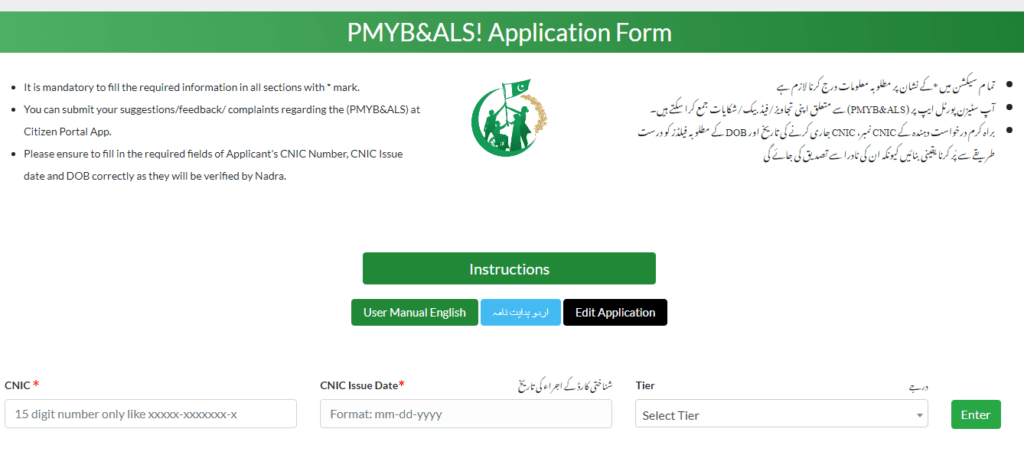

Here is the step-by-step process to apply for the Prime Minister Youth Loan Scheme online via the official website: https://pmyp.gov.pk/BankForm/newApplicantForm

- Register on the PM Youth Loan Scheme website: Go to the website and click on the “New Applicant Registration” button.

- Login to your account: Once you have activated your account, log in using your email and password.

- Fill out the application form: Select “New Application” from the dashboard and fill out the application form with all the necessary details.

- Upload the required documents: Scan and upload the required documents, such as your CNIC, guarantor’s CNIC, educational certificates, business plan, bank statements, income proof, photographs, and utility bills, as applicable.

- Submit the application: Review the application form and documents for accuracy and completeness.

- Track the application status: After submitting the application, you can track the status of your application on the dashboard of your account.

- Receive loan approval: If your application is approved, you will be contacted by the lending institution to complete the loan disbursement process.

Recommended Reading: Youth Entrepreneurship Scheme (PMKJ-YES) [Application Process+Tracking]

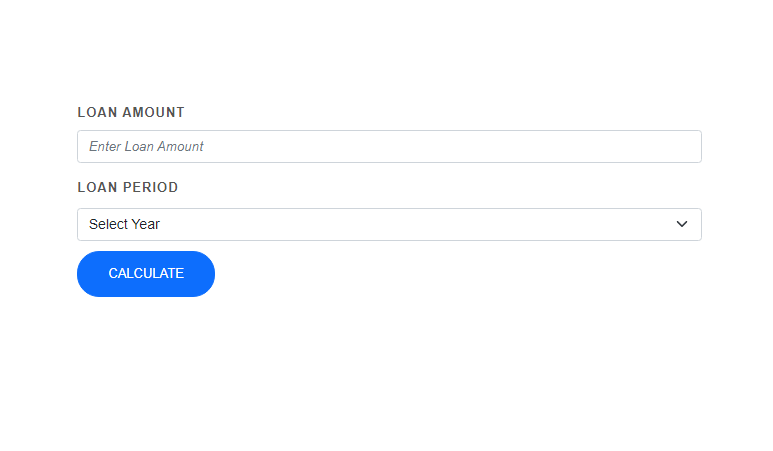

Prime Minister Youth Loan Calculator

The Prime Minister Youth Loan Calculator is a tool available on the PMYLS website that helps you calculate your loan repayment amount based on the loan amount and loan period.

Here’s how to use it:

- Go to https://pmyp.gov.pk/pmyphome/Calculator

- Enter the Loan Amount you wish to apply for in the designated field.

- Select the Loan Period by choosing the number of years from the dropdown list.

- Click on “Calculate” to see the monthly installment amount and total repayment amount.

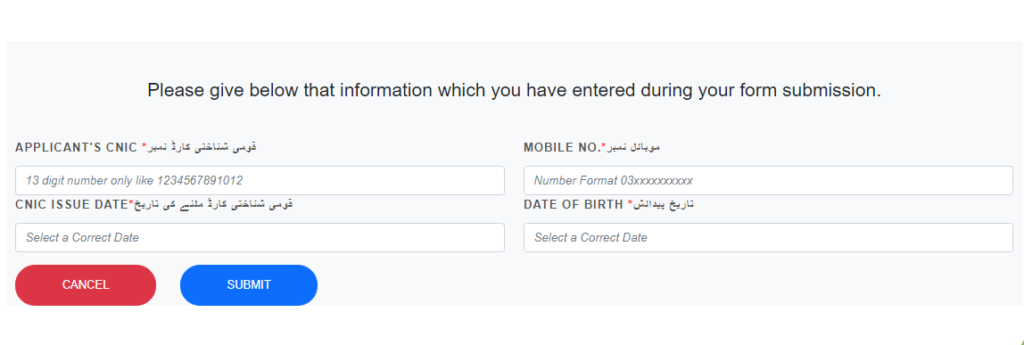

Application Tracking

The Prime Minister Youth Loan Scheme offers an online application tracking system, which allows applicants to monitor the progress of their loan application.

Here are the steps to track your loan application status:

- Visit the PM Youth Loan Scheme website: Go to https://pmyp.gov.pk/pmyphome/TraceApplication

- Enter your tracking ID: Enter the tracking ID that was provided to you when you submitted your loan application.

- Click on the “Track” button: Once you have entered the tracking ID, click on the “Track” button to view the status of your loan application.

- View application status: The tracking system will display the status of your loan application, including whether it has been approved, rejected, or is still under review. You may also receive updates via SMS and email.

- Contact the lending institution: If you have any questions or concerns regarding the status of your loan application, you can contact the lending institution directly for further information.

Recommended Reading: Prime Minister Youth Development Package | PM Youth Program

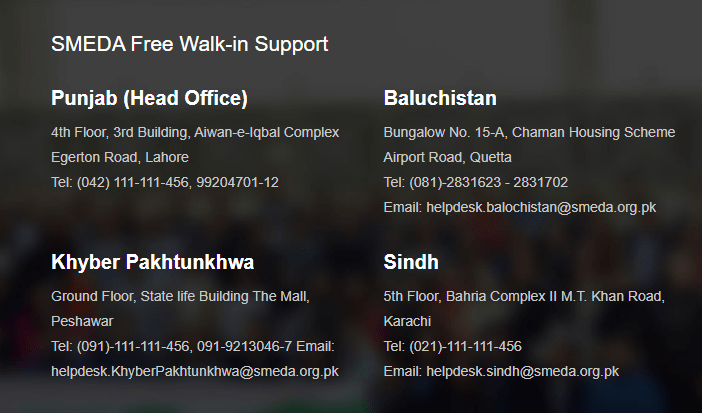

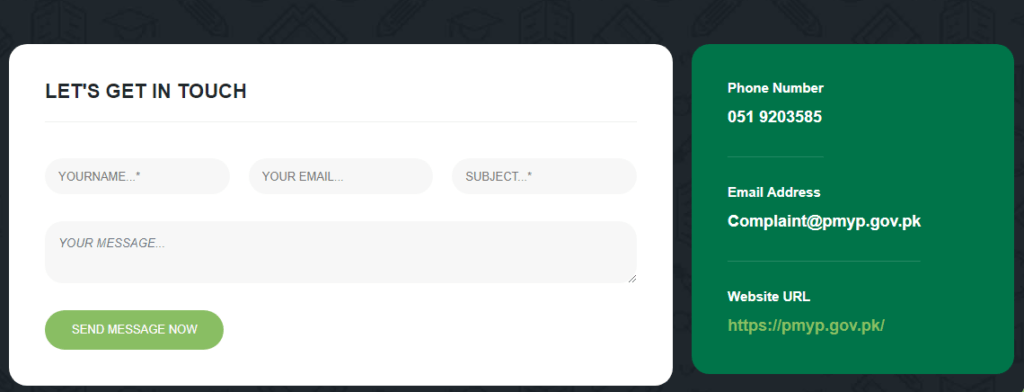

Prime Minister Youth Program Contact Number

Here is the contact information for the Prime Minister Youth Program:

- Website: https://pmyp.gov.pk

- Email Address: Complaint@pmyp.gov.pk

- Address: 4th Floor, 3rd Building, Aiwan-e-Iqbal Complex Egerton Road, Lahore

- Telephone: (042) 111-111-456, 99204701-12

You can also visit the PMYLS website for additional information and resources about the program.

Recommended Reading: Prime Minister Youth Business Loan Scheme Apply Online (Step-by-Step Process)

PM Youth Loan Scheme Pros And Cons

The Prime Minister Youth Loan Scheme (PMYLS) is a government-backed initiative aimed at providing financial assistance to young entrepreneurs in Pakistan.

Like any program, PMYLS has its own set of pros and cons.

Pros:

- Access to financing: PMYLS provides financial support to young entrepreneurs who may not have access to traditional sources of financing.

- Affordable interest rates: The scheme offers loans with competitive interest rates, which makes it an attractive financing option for young entrepreneurs.

- Flexible loan terms: PMYLS offers flexible loan repayment terms, which makes it easier for young entrepreneurs to manage their finances.

- Easy application process: The online application process is simple and streamlined, which reduces the barriers to entry for young entrepreneurs.

- Government support: As a government-backed program, PMYLS provides a sense of security to borrowers, which can increase their confidence in taking on debt.

Cons:

- Strict eligibility criteria: The scheme has strict eligibility criteria, which means that not all young entrepreneurs will qualify for the program.

- Limited loan amounts: The loan amounts available under the scheme are limited, which may not be sufficient for some business projects.

- Lengthy application process: Although the application process is easy, it can still be lengthy, which may discourage some young entrepreneurs from applying.

- Collateral requirements: PMYLS requires collateral for loans, which can be a barrier to entry for some young entrepreneurs who may not have the necessary assets.

- Risk of default: As with any lending program, there is a risk of default, which could have negative consequences for both borrowers and the government.

Recommended Reading: Kamyab Jawan Program | Prime Minister Loan Scheme (Business+Agriculture)

FAQs | Prime Minister Youth Loan Scheme

What is the Prime Minister Youth Loan Scheme (PMYLS)?

PMYLS is a government-backed initiative aimed at providing financial assistance to young entrepreneurs in Pakistan.

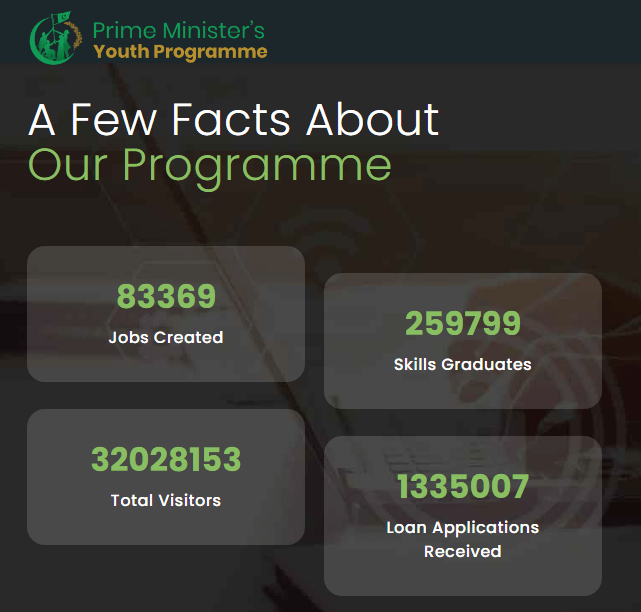

What is the Prime Minister Youth Program?

The Prime Minister Youth Program is a collection of initiatives launched by the government of Pakistan aimed at providing financial assistance, skill development, and employment opportunities to young people in the country.

What are the different initiatives under the Prime Minister Youth Program?

There are several initiatives under the Prime Minister Youth Program, including the Youth Loan Scheme, Youth Skills Development Program, Youth Training Program, Youth Business Loan Scheme, and the Youth Laptop Scheme.

Who is eligible for the Prime Minister Youth Program?

The eligibility criteria vary for each initiative under the program. Generally, young people between the ages of 18-35 years who are Pakistani citizens and meet the program’s specific requirements are eligible to apply.

How can I apply for the Prime Minister Youth Program?

The application process for each initiative under the program is different. Some applications can be submitted online, while others require in-person visits to the relevant offices.

What is the loan amount offered under the PMYLS?

The loan amount offered under the PMYLS ranges from PKR 500,000 to PKR 7,500,000, depending on the tier.

How can I apply for a PMYLS loan?

You can apply for a PMYLS loan online through the PMYLS website or by visiting one of the participating banks.

What happens if I default on my PMYLS loan?

If you default on your PMYLS loan, the lending institution may take legal action against you to recover the outstanding amount. This may also affect your credit rating and make it difficult for you to obtain financing in the future.

How can I apply for a PM Youth Loan Scheme?

The application process may vary depending on the country and scheme. Generally, you will need to submit a detailed business plan or project proposal along with your application form.

You may also be required to provide supporting documents such as identification proof, educational certificates, and financial statements.

It is recommended to visit the official website or contact the concerned authority to obtain the application form and understand the complete application procedure.

Can I apply for multiple PM Youth Loan Schemes simultaneously?

Yes, In general, you may be able to apply for multiple schemes if you meet the eligibility criteria.

However, it is important to check the guidelines of each scheme to understand any restrictions or limitations on applying for multiple loans simultaneously.

Recommended Reading: Kamyab Jawan Program Loan Online Apply {5-30Lakh}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment