In an era marked by digital advancements and global connectivity, financial inclusivity has become a paramount concern for governments worldwide.

Recognizing the significance of their overseas diaspora, the Government of Pakistan pioneered to bridge the gap between expatriate Pakistanis and their homeland by introducing the Roshan Digital Account For Overseas Pakistanis.

Roshan Digital Account for overseas Pakistanis provides a seamless and convenient platform for overseas Pakistanis to engage in financial transactions, investments, and savings from anywhere in the world.

This article will explain the Eligibility criteria, account opening charges, and transaction limits, and provide a step-by-step guide to opening a Roshan Digital Account For Overseas Pakistanis online for free. So, let’s start our guide!

Recommended Reading: Meezan Bank Account Opening Online (Charges+Req+Limit) {Riba-Free}

Roshan Digital Account For Overseas Pakistanis Online Opening

Table of Contents

- Roshan Digital Account For Overseas Pakistanis Online Opening

- Roshan Digital Account For Overseas Pakistani Benefits

- Roshan Digital Account Eligibility Criteria

- Documents Required For Roshan Digital Account For Overseas Pakistani

- Best Bank For Roshan Digital Account For Overseas Pakistani

- How To Open a Roshan Digital Account Online?

- Roshan Digital Account Pros And Cons

- Roshan Digital Account FAQs | Roshan Digital Account For Overseas Pakistanis

Roshan Digital Account For Overseas Pakistani Benefits

Benefits of Roshan Digital Account For Overseas Pakistanis:

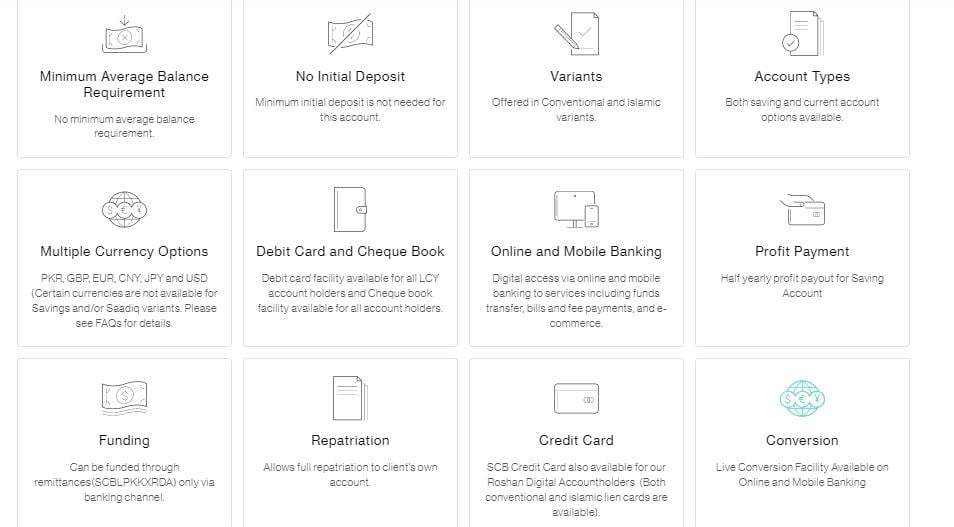

| Feature | Details |

|---|---|

| Minimum Average Balance: | No need to maintain a minimum average balance. |

| Multiple Currency Options: | Choose from PKR, GBP, EUR, CNY, JPY, and USD (Certain currencies have restrictions on savings accounts). |

| Funding: | Fund your account through remittances only (SCBLPKKXRDA). |

| No Initial Deposit: | No initial deposit is required to open the account. |

| Debit Card and Chequebook: | Enjoy debit card and checkbook facilities. |

| Repatriation: | Full repatriation is allowed to your account. |

| Variants: | Choose between Conventional and Islamic variants. |

| Online and Mobile Banking: | Access your account digitally for transfers, bill payments, and e-commerce via online and mobile banking. |

| Credit Card: | SCB Credit Card available for Roshan Digital Accountholders (Both conventional and Islamic cards). |

| Account Types: | Both savings and current account options are available. |

| Profit Payment: | Receive profit payouts twice a year for savings accounts. |

| Conversion: | Enjoy live currency conversion through online and mobile banking. |

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

Roshan Digital Account Eligibility Criteria

Eligibility Criteria for Roshan Digital Account For Overseas Pakistanis:

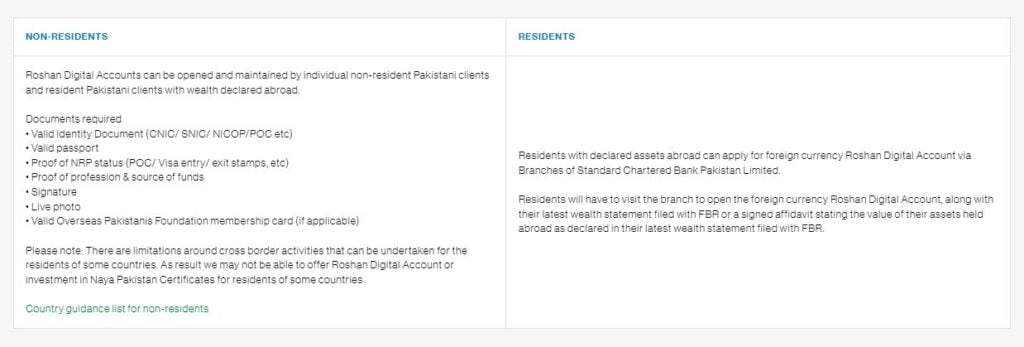

| NON-RESIDENTS | RESIDENTS |

|---|---|

| Non-resident Pakistanis and residents with wealth declared abroad can | Pakistani residents with assets declared abroad can apply for a foreign currency Roshan |

| open and maintain Roshan Digital Accounts. | Digital Account at Standard Chartered Bank Pakistan Limited branches. |

| Residents must visit the branch and provide their latest wealth statement filed with the | |

| FBR or a signed affidavit stating the value of their assets abroad as declared in the | |

| wealth statement filed with the FBR. | |

| Required Documents | Required Documents |

| Valid Identity Document (CNIC/SNIC/NICOP/POC, etc.) | Valid Identity Document (CNIC/SNIC/NICOP/POC, etc.) |

| Valid passport | Valid passport |

| Proof of NRP status (POC/Visa entry/exit stamps, etc.) | Proof of NRP status (POC/Visa entry/exit stamps, etc.) |

| Proof of profession & source of funds | Proof of profession & source of funds |

| Signature | Signature |

| Live photo | Live photo |

| Valid Overseas Pakistanis Foundation membership card (if applicable) | Valid Overseas Pakistanis Foundation membership card (if applicable) |

| Residents from certain countries may face limitations on cross-border activities and may | |

| not be eligible for Roshan Digital Accounts or Naya Pakistan Certificates. | |

| Country guidance list for non-residents | |

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

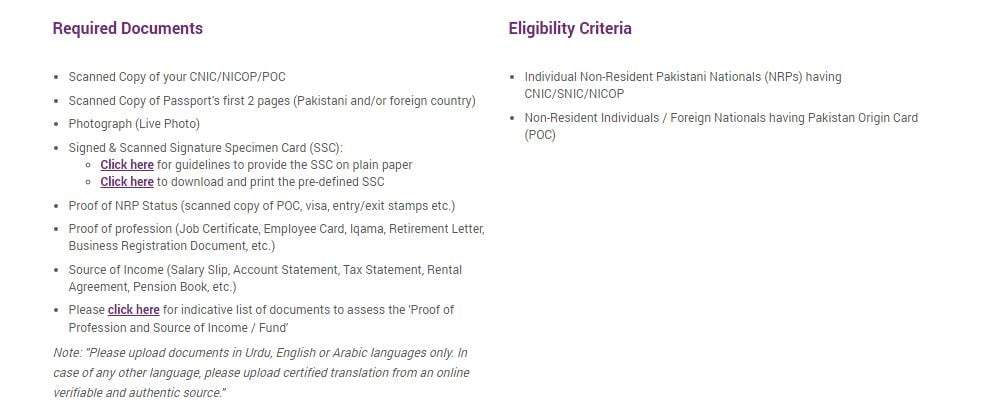

Documents Required For Roshan Digital Account For Overseas Pakistani

Documents Required for Roshan Digital Account For Overseas Pakistanis:

| NON-RESIDENTS: | RESIDENTS: |

|---|---|

| Non-resident Pakistanis and residents with wealth declared abroad can | Pakistani residents with assets declared abroad can apply for a foreign currency Roshan |

| open and maintain Roshan Digital Accounts. | Digital Account at Standard Chartered Bank Pakistan Limited branches. |

| Residents must visit the branch and provide their latest wealth statement filed with the | |

| FBR or a signed affidavit stating the value of their assets abroad as declared in the | |

| wealth statement filed with the FBR. | |

| Required Documents: | Required Documents: |

| Valid Identity Document (CNIC/SNIC/NICOP/POC, etc.) | Valid Identity Document (CNIC/SNIC/NICOP/POC, etc.) |

| Valid passport | Valid passport |

| Proof of NRP status (POC/Visa entry/exit stamps, etc.) | Proof of NRP status (POC/Visa entry/exit stamps, etc.) |

| Proof of profession & source of funds | Proof of profession & source of funds |

| Signature | Signature |

| Live photo | Live photo |

| Valid Overseas Pakistanis Foundation membership card (if applicable) | Valid Overseas Pakistanis Foundation membership card (if applicable) |

| Residents from certain countries may face limitations on cross-border activities and may | |

| not be eligible for Roshan Digital Accounts or Naya Pakistan Certificates. | |

| Country guidance list for non-residents: |

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Best Bank For Roshan Digital Account For Overseas Pakistani

Before making a decision, it is advisable to consider factors such as fees, transaction limits, account management options, and any additional services offered by the banks listed for the Roshan Digital Account For Overseas Pakistanis.

Roshan Digital Account Banks List

The Roshan Digital Account For Overseas Pakistanis can be opened in the following banks:

- JS Bank

- MCB Bank

- Meezan Bank

- Samba Bank

- Standard Chartered Bank

- United Bank

- Allied Bank

- Bank Alfalah

- Bank Al Habib

- Bank of Punjab

- Dubai Islamic Bank

- Faysal Bank

- Habib Bank

- HabibMetro

Best Banks For Roshan Digital Account Opening (Suggested):

Based on our suggestion, the best banks for opening a Roshan Digital Account For Overseas Pakistanis are:

- Meezan Bank: The Meezan Bank app is known for its strong commitment to Islamic banking principles, offering Shariah-compliant financial solutions. Visit Meezan Bank for online account opening by clicking here https://www.meezanbank.com/roshan-digital-account/.

- Standard Chartered Bank: Standard Chartered Bank is a global banking institution with a strong presence in Pakistan. Visit Standard Chartered Bank for online account opening by clicking here https://www.sc.com/pk/save/roshan-digital-account/.

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

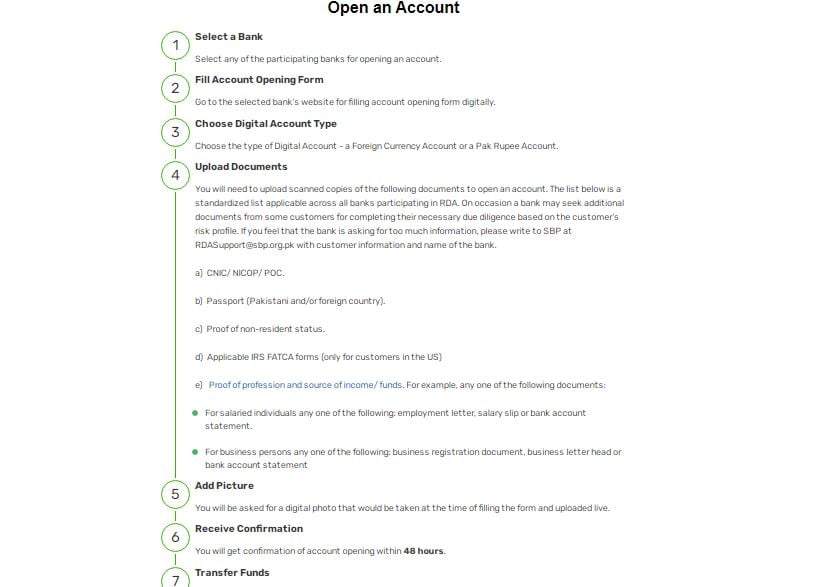

How To Open a Roshan Digital Account Online?

Opening a Roshan Digital Account For Overseas Pakistanis online involves a straightforward process. By selecting a bank from the available options, you can access the bank’s online portal to fill in the account opening form.

Here is step by step process for Opening a Roshan Digital Account For Overseas Pakistanis Online:

| Steps | Details |

|---|---|

| Select a Bank: | Choose any participating bank where you want to open your account. |

| Fill Account Opening Form: | Visit the selected bank’s website and fill out the account opening form digitally. |

| Choose Digital Account Type: | Decide whether you want to open a Foreign Currency Account or a Pak Rupee Account. |

| Upload Documents: | Scan and upload copies of required documents: |

| CNIC/NICOP/POC | |

| Passport (Pakistani and/or foreign) | |

| Proof of non-resident status | |

| Applicable IRS FATCA forms (only for US customers) | |

| Proof of profession and source of income/funds (e.g., employment letter, salary slip, business registration document) | |

| Add Picture: | Take a digital photo during the form-filling process and upload it. |

| Receive Confirmation: | Expect confirmation of your account opening within 48 hours. |

| Transfer Funds: | Once your account is open, you can transfer funds into it. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

Roshan Digital Account Pros And Cons

Pros Of Roshan Digital Account For Overseas Pakistanis

- The Roshan Digital Account For Overseas Pakistanis makes banking easy for overseas Pakistanis, letting them handle their money and transactions from anywhere.

- You can send and receive money internationally without hassle, making remittances and cross-border transactions smooth.

- Plus, you can invest in Pakistan’s economy, with options like Shariah-compliant shares, Sukuk, and the Islamic Naya Pakistan Certificate, potentially earning good returns.

- With 24/7 online banking, you can pay bills, transfer funds, and manage your finances conveniently.

- And for those who prefer Islamic banking, there are Shariah-compliant options available to meet your needs while staying ethically sound.

Cons Of Roshan Digital Account For Overseas Pakistanis

- limited Local Transactions: While Roshan Digital Account For Overseas Pakistanis are great for international transactions, they might not offer all the perks of regular local accounts in Pakistan.

- Regulatory Compliance: Opening and running a Roshan Digital Account For Overseas Pakistanis means following certain rules and providing specific documents.

- Currency Exchange Risks: If you keep your account in a foreign currency, be aware that changes in exchange rates could affect how much your money is worth.

- Limited Bank Options: You might not have as many choices for banks with Roshan Digital Account For Overseas Pakistanis.

- Security Risks: Like with any online banking, there are risks of cyber threats.

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

Roshan Digital Account FAQs | Roshan Digital Account For Overseas Pakistanis

What is a Roshan Digital Account?

A Roshan Digital Account For Overseas Pakistanis is a digital banking solution introduced by the State Bank of Pakistan to facilitate overseas Pakistanis in managing their finances and making investments in Pakistan.

Who is eligible to open a Roshan Digital Account For Overseas Pakistanis?

Non-resident Pakistani nationals (NRPs) possessing a valid CNIC/SNIC/NICOP, non-residents with valid passports, and residents with declared assets abroad are eligible to open a Roshan Digital Account. The eligibility criteria may vary slightly depending on the bank chosen for opening the account.

What documents are required to open a Roshan Digital Account?

The required documents typically include a scanned copy of your CNIC/NICOP/POC, passport’s first two pages, proof of NRP status, proof of profession, source of income, and a recent photograph. The specific document requirements may vary slightly between banks.

Can I open a Roshan Digital Account For Overseas Pakistanis in a foreign currency?

Yes, Roshan Digital Accounts can be opened in both Pakistani Rupees (PKR) and foreign currencies such as USD, GBP, or EUR. This allows account holders to hold and transact in their preferred currency.

What services can I access through a Roshan Digital Account?

Roshan Digital Account For Overseas Pakistanis holders can access a wide range of services, including fund transfers, bill payments, investment opportunities in shares and Sukuk, wealth management products, and the option to invest in the Islamic Naya Pakistan Certificate (INPC) scheme.

Are Roshan Digital Accounts Shariah-compliant?

Yes, some banks offering Roshan Digital Accounts provide Shariah-compliant options. This includes the opportunity to invest in Shariah-compliant shares, Sukuk, and Islamic investment products. It is advisable to check with the chosen bank for their specific Shariah-compliant offerings.

Are there any charges or fees associated with a Roshan Digital Account?

While the account opening itself is generally free of charge, there may be certain transactional fees, maintenance charges, or other fees associated with specific services offered by the bank.

How long does it take to open a Roshan Digital Account?

The account opening process is typically completed within 48 hours, subject to the bank’s internal procedures and verification processes.

However, the actual timeline may vary based on the completeness of the documentation provided and the bank’s operational efficiency.

Can I transfer funds from my overseas account to my Roshan Digital Account?

Yes, one of the key features of the Roshan Digital Account is the ability to transfer funds from your overseas account to your account in Pakistan. Banks provide guidelines and instructions for transferring funds securely.

Can I link my Roshan Digital Account with a local Pakistani bank account?

Yes, some banks offer the option to link your Roshan Digital Account with a local Pakistani bank account. This allows for convenient transfer of funds between accounts and provides flexibility in managing your finances.

Can I open a Roshan Digital Account in any bank of my choice?

Roshan Digital Accounts can be opened in a select list of banks approved by the State Bank of Pakistan.

These banks include JS Bank, MCB Bank, Meezan Bank, Samba Bank, Standard Chartered Bank, United Bank, Allied Bank, Bank Alfalah, Bank Al Habib, Bank of Punjab, Dubai Islamic Bank, Faysal Bank, Habib Bank, and HabibMetro.

What are the suggested best banks for opening a Roshan Digital Account?

According to our suggestion, the best banks for opening a Roshan Digital Account are Meezan Bank and Standard Chartered Bank.

These banks have been recognized for their services, convenience, and customer satisfaction.

Is there an initial deposit required to open a Roshan Digital Account?

No, there is generally no initial deposit requirement to open a Roshan Digital Account. However, it is advisable to check with the chosen bank for any specific deposit requirements or minimum balance criteria for the account.

Is the Roshan Digital Account free from riba (interest)?

Yes, the Roshan Digital Account aims to provide a riba-free (interest-free) banking solution, aligning with Islamic principles.

However, it is important to review the terms and conditions provided by the chosen bank to ensure compliance with Islamic banking practices.

Can I convert my existing Pakistani bank account into a Roshan Digital Account?

No, a Roshan Digital Account needs to be opened separately as a designated account for overseas Pakistanis. It is not possible to convert an existing Pakistani bank account into a Roshan Digital Account.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment