As a freelancer in Pakistan, it’s essential to have a reliable and convenient bank account to manage your finances.

With so many Bank options for Freelancers In Pakistan options available in the country, it can be overwhelming to choose the right one that caters to your specific needs.

These Top 5 Best Bank Accounts for Freelancers In Pakistan In Pakistan are:

- Standard Chartered Saadiq Asaan Account

- Meezan Asaan Account

- Faysal Bank Roshan Digital Account

- HBL Freedom Account

- Allied Bank Asaan Account

In this article, we have compiled a list of the top 5 best bank accounts for freelancers in Pakistan, to help you make an informed decision and streamline your financial management.

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

List Of Best Bank Account For Freelancers In Pakistan

Table of Contents

Following is a list of the top 5 best bank accounts for freelancers in Pakistan, to help you make an informed decision and streamline your financial management.

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

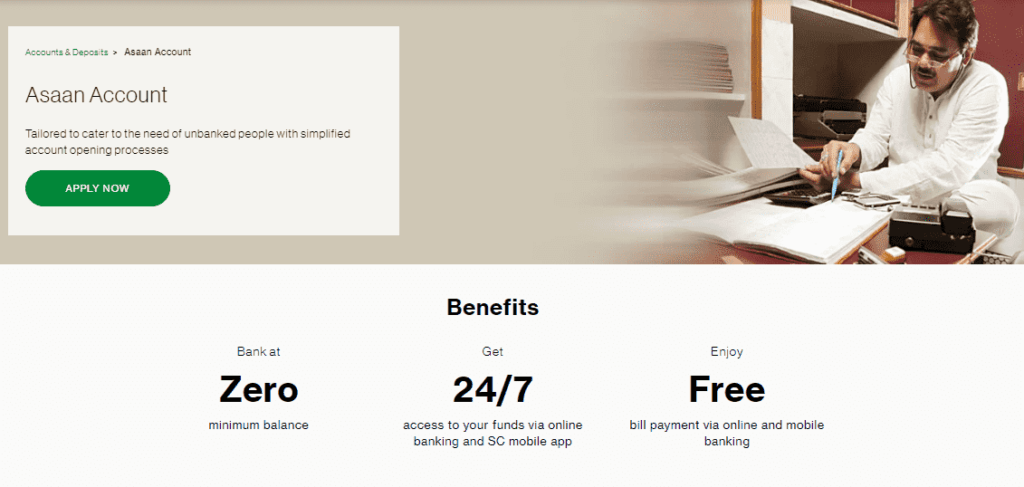

Standard Chartered Saadiq Asaan Account

The Standard Chartered Saadiq Asaan bank account for freelancers is a Shariah-compliant current account offered by Standard Chartered Bank.

| Account Features | Details |

|---|---|

| Freelancing Payments: | Easily receive overseas freelancing payments directly into your account. |

| Currency: | Freelancer accounts are available in PKR, USD, GBP, and EUR, providing greater flexibility. |

| Limits: | Cash withdrawal limit of PKR 500,000 per day or equivalent, with a monthly debit and credit limit of USD 5,000. |

| Variants: | Available in both Conventional and Seediq variants, catering to different banking preferences. |

| Eligibility Criteria | |

| Pakistani Citizenship: | The applicant must be a Pakistani citizen. |

| Minimum Age: | The minimum age requirement for opening an account is 18 years and above. |

| Proof of Identification and Address: | The applicant must provide valid proof of identification and address verification as per the bank’s requirements. |

| Freelancing Income/Experience: | The applicant must provide evidence of their freelancing income or work experience, as specified by the bank. |

| Required Documents: | |

| Valid and Registered Mobile Number: | The applicant must have a mobile number that is both valid and registered in their name. |

| National Identity Card (NIC/SNIC): | An NIC or SNIC issued by NADRA is necessary for identity verification. |

| Supporting Documents (Optional): | The bank may require additional documents, such as proof of income or address verification, based on their specific criteria. |

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Meezan Asaan Account

“Meezan Asaan Account” is a basic bank account for freelancers offered by Meezan Bank app, which is specifically designed for freelancers, self-employed individuals, and small business owners.

| Account Features | Details |

|---|---|

| Freelancing Payments: | Easily receive overseas freelancing payments directly into your account. |

| Currency: | Freelancer accounts are available in PKR, USD, GBP, and EUR, providing greater flexibility. |

| Limits: | Cash withdrawal limit of PKR 500,000 per day or equivalent, with a monthly debit and credit limit of USD 5,000. |

| Variants: | Available in both Conventional and Seediq variants, catering to different banking preferences. |

| Eligibility Criteria: | |

| Pakistani Citizenship: | The applicant must be a Pakistani citizen. |

| Minimum Age: | The minimum age requirement for opening an account is 18 years and above. |

| Proof of Identification and Address: | The applicant must provide valid proof of identification and address verification as per the bank’s requirements. |

| Freelancing Income/Experience: | The applicant must provide evidence of their freelancing income or work experience, as specified by the bank. |

| Required Documents: | |

| Valid and Registered Mobile Number: | The applicant must have a mobile number that is both valid and registered in their name. |

| National Identity Card (NIC/SNIC): | An NIC or SNIC issued by NADRA is necessary for identity verification. |

| Supporting Documents (Optional): | Additional documents may be required by the bank, such as proof of income or address verification, based on their specific criteria. |

| Meezan Freelancer Account Key Features: | |

| Free Chequebook & Pay Orders: | Receive a chequebook and pay orders at no additional cost. |

| Free Online Branch Banking: | Access banking services online without any charges. |

| Free Internet & Mobile Banking App: | Use the bank’s internet and mobile banking app for free. |

| Inward Foreign Remittance | Receive money from abroad directly into your account. |

| Attractive Conversion Rates | Benefit from competitive rates when converting currencies. |

| Opportunity to Invest in COIIs | Receive a checkbook and pay orders at no additional cost. |

| 50% Waiver on Processing Fee: | Enjoy a 50% discount on processing fees for Car Ijarah, Apni Bike, and Meezan Solar. |

| Exclusive Pricing on Consumer Products: | Get exclusive discounted pricing on Car Ijarah, Apni Bike, and Meezan Solar products. |

| Collaboration with PAFLA: | Partnered with Pakistan Freelancers Association for mutual benefits. |

| Tax Facilitation Services: | Avail tax facilitation services through Befiler at discounted rates. |

| NTN Registration Fee: | One-time fee for NTN registration with FBR for non-business individuals. |

| Income Tax Return: | One-time fee for annual income tax return filing for both non-business and business individuals. |

| Monthly Sales Tax Filing: | Fee for monthly sales tax filing based on income type and turnover. |

| Other Local Business Income: | Fee for annual turnover-based income tax filing for individuals. |

| Meezan Freelancer Account Opening Online (Via Digital Channel): | |

| Step: | Description |

| Download the app: | Install the Meezan Bank app on your phone. |

| Verify your mobile number: | Confirm your mobile number by entering the OTP received. |

| Input your ID details: | Enter your ID details (CNIC, etc.) for verification purposes. |

| Provide your occupation details: | Input your occupation details for identification purposes. |

| Perform biometric verification: | Complete biometric verification using your device’s sensors. |

| Capture a Live Selfie: | Take a live selfie to confirm your identity. |

| Review and submit: | Review all the information provided and submit your application. |

| Welcome to Meezan Bank: | Upon successful submission, you’re all set to start banking with Meezan Bank! |

| Meezan Freelancer Account Opening (Via Branch): | |

| Step: | Details |

| Customer visits branch: | Visit a Meezan Bank branch to open an account. |

| Submit Account Opening Form: | Provide the required Account Opening Form and other necessary documents to the bank staff. |

| Information about deposit products: | Receive information about different types of deposit products available. |

| Biometric verification: | Undergo biometric verification conducted by bank staff. |

| Select deposit product: | Choose the desired deposit product for your account. |

| Initial deposit: | Provide the initial deposit amount required for account opening. |

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Faysal Bank Roshan Digital Account

Faysal Bank Roshan Digital Account is a popular bank account for freelancers in Pakistan. This account caters to non-resident Pakistanis and residents, making it a versatile option for those who work with clients from other countries.

Here are some of the benefits and features of the Faysal Bank Roshan Digital bank account for freelancers that make it ideal for freelancers:

| Feature | Details |

|---|---|

| PKR Currency | Conduct transactions in Pakistani Rupees (PKR), suitable for freelancers in Pakistan. |

| Digital Account Opening | Open your account online anytime, anywhere, saving time and effort. |

| Qard-Based Account | Operates on a Qard contract, ensuring compliance with Islamic banking principles. |

| Monthly Debit/Credit Limits | Enjoy monthly limits of USD 5,000 each for debit and credit transactions, aiding financial management. |

| Cash Withdrawal Limit | Conveniently withdraw up to PKR 500,000 per day for quick access to funds. |

| Free e-Statements | Receive complimentary e-statements for easy access to transaction details, reducing paperwork. |

| Internet & Mobile Banking | Access banking services online and manage finances on the go with the Faysal Bank app. |

| Free Additional Benefits | Unlock perks such as free ChequeBooks, Pay Orders, and Duplicate Account Statements by maintaining a monthly average balance of Rs. 50,000. |

| Eligibility Criteria | Details |

| Freelancer Status | Specifically designed for freelancers and digital entrepreneurs. |

| Age Requirement | Applicants must be at least 18 years old. |

| Nationality | Available to Pakistani nationals or those with valid Pakistani residency status. |

| Required Documents | Details |

| Valid Identification | Provide a valid ID such as CNIC, SNIC, or NICOP. |

| Proof of Income | Submit last salary slip or a salary certificate. |

| Specimen Digital Signature | Provide a specimen of your digital signature. |

| Opening Process (Online) | Description |

| Visit Faysal Bank Website | Go to the Faysal Bank website and fill in personal details. |

| Personal Information | Enter accurate personal details including name, CNIC, date of birth, and contact information. |

| Account Details | Select “Freelancer Account” and specify currency and residency status. |

| Supporting Documents | Upload necessary documents such as CNIC and proof of freelance work. |

| Preview and Submit | Review information and click “Submit” to proceed. |

| Video Call Verification | Be prepared for video verification to confirm identity. |

| Application Processing | Application undergoes processing by Faysal Bank. |

| Opening Process (Branch) | Details |

| Customer Visits Branch | Visit a Faysal Bank branch. |

| Submit Account Opening Form | Provide required form and documents. |

| Information about Products | Receive info on deposit products. |

| Biometric Verification | Undergo biometric verification. |

| Select Deposit Product | Choose desired product. |

| Initial Deposit | Provide required initial deposit. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

HBL Freedom Account

HBL Freedom Account is a digital banking solution offered by Habib Bank account for freelancers in Pakistan.

| Eligibility Criteria | Details |

|---|---|

| Resident of Pakistan | Must reside in Pakistan with a valid Pakistani address. |

| Active CNIC | Requires an active Computerized National Identity Card for verification. |

| Age 18 or older | Must be at least 18 years old to open a UBL Freelancer Account. |

| Valid Email & Phone | Provide a working email address and phone number for communication and verification. |

| Documents Required | Details |

| Eligible Individuals | Residents of Pakistan engaged in digital/online services, including IT, receiving payments abroad. |

| Documentary Requirements | Copy of CNIC/NICOP/POC (or B-Form/Juvenile Card for minors) Export Agreement/Undertaking. |

| Additional Opportunity | Visit the nearest UBL branch for ESFCA account opening. |

| Benefits Of UBL Freelancer Account | Details |

| No Initial Deposit | Open your account without any initial deposit. |

| Digital Account Opening | Conveniently open your account online via UBL Digital App or Netbanking. |

| Biometric Authentication | Complete account opening process with biometric authentication at any UBL ATM. |

| No Minimum Balance Requirement | No minimum balance required, ensuring no charges for low balance. |

| 24/7 Banking | Access your account anytime, anywhere through UBL Digital App or Netbanking. |

| Islamic & Conventional Banking | Choose between Islamic and conventional banking modes for flexibility. |

| Available in PKR/FCY | Free Cheque Book & PayPal Debit Card Monthly Balance Limit: Maintain up to USD 5,000. |

| Free Insurance | Enjoy complimentary insurance with your UBL Freelancer Account. |

| Free IBFT Transfers | Transfer funds between UBL accounts or to other banks for free using UBL Digital App or Netbanking. |

| How To Open a UBL Freelancer Account Online Step-By-Step? | Steps |

| Visit UBL Website | Go to UBL website and select “UBL Freelancer Account” option. |

| Set Preferences | Choose between Islamic or conventional banking and select account currency. |

| Personal Details | Enter name, CNIC number, date of birth, and contact information. |

| Verification of Personal Details | Verify details with one-time password (OTP) sent to mobile number. |

| Additional Details | Provide occupation, source of income, and purpose of account opening. |

| Account Details | Select type of account (savings or current). |

| Review Application | Double-check information for accuracy. |

| Submit Application | Click “Submit” to send application. |

| Biometric Verification | Complete biometric verification at any UBL ATM. |

| Wait for Approval | Wait for UBL to approve account opening application. |

| Receive Account Details | Receive account details via email or SMS. |

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

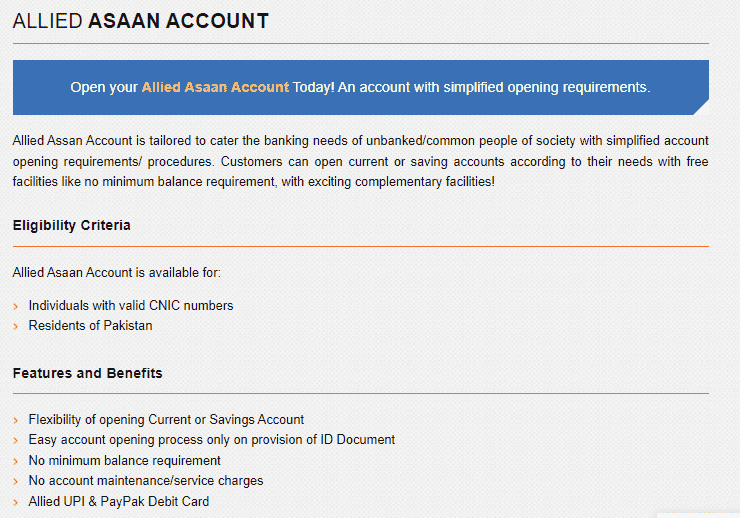

Allied Bank Asaan Account

Allied Bank Asaan Account is a digital account offered by Allied Bank account for freelancers in Pakistan.

It is designed to cater to the needs of freelancers and small business owners who require an efficient and hassle-free banking solution. Below are the benefits of the Allied Bank Asaan bank account for freelancers:

| Allied Asaan Account Features | Details |

|---|---|

| Eligibility Criteria | Individuals with valid CNIC numbers |

| Residents of Pakistan | |

| Features and Benefits: | Flexibility of opening Current or Savings Account |

| Easy account opening process only on provision of ID Document | |

| No minimum balance requirement | |

| No account maintenance/service charges | |

| Enjoy the convenience of Allied UPI & PayPak Debit Cards |

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

Bank Account For Freelancers Pros And Cons

As a freelancer, having a dedicated bank account for freelancers can help you better manage your finances and simplify your accounting. However, like any financial decision, there are bank account for freelancers pros and cons to consider.

Pros:

- Separation of personal and business finances: Having a separate bank account for freelancers business can help you keep track of your income and expenses more easily.

- Professionalism: A dedicated business bank account for freelancerscan help you appear more professional to clients and potential clients.

- Tax preparation: Keeping your business finances separate can make tax preparation easier, as you’ll have a clear record of your income and expenses.

- Access to financial tools: Many business bank account for freelancers offer additional financial tools and services, such as credit cards, loans, and merchant services, which can help you manage and grow your business.

Cons:

- Fees: Some business bank account for freelancers come with fees, such as monthly maintenance fees, transaction fees, and ATM fees.

- Limited interest rates: Business bank account for freelancers typically offer lower interest rates than personal savings accounts.

- Minimum balance requirements: Some business bank account for freelancers require a minimum balance to avoid fees or earn interest, which can be difficult to maintain if you have irregular income or are just starting out.

- Time and effort: Setting up a business bank account for freelancers can take time and effort, especially if you’re a sole proprietor or a freelancer with no employees.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

Bank Account For Freelancers FAQs

Do I need a separate bank account for freelancers business?

It is not a legal requirement to have a separate bank account for freelancers business, but it is highly recommended. It can help you manage your finances better and keep your personal and business finances separate.

Can I use my personal bank account for freelancers business?

Technically, yes. But using your personal bank account for freelancers transactions can make it difficult to track your income and expenses, which can be problematic during tax season. It can also create confusion between personal and business expenses, which can make it difficult to manage your finances.

What type of bank account should I choose for my freelance business?

There are several types ofbank account for freelancers, including business checking accounts, savings accounts, and merchant services accounts. It’s important to consider the fees, interest rates, and minimum balance requirements before choosing an account that suits your needs.

What documents do I need to open a bank account for freelancers business?

You’ll need to provide your business license, tax ID number, and personal identification documents, such as a driver’s license or passport. Depending on the bank, you may also need to provide additional documentation, such as a business plan or proof of income.

Are there any specific bank account for freelancers?

There are several banks that offer bank account for freelancers and small business owners, such as Azlo, Novo, and Mercury.

These accounts often offer features such as no monthly fees, no minimum balance requirements, and access to financial tools and services.

Can I use a virtual bank for my freelance business?

Yes, you can use a virtual bank for your freelance business. Virtual banks, also known as online banks, offer many of the same features as traditional banks, such as checking and savings accounts, loans, and credit cards.

They often have lower fees and higher interest rates than traditional banks, making them a good option for freelancers who want to keep their costs low.

What are the benefits of using a business credit card for my freelance business?

Using a business credit card can help you separate your personal and business expenses, making it easier to manage your finances.

It can also help you build credit for your business, which can be useful if you want to apply for a loan or other financing in the future.

Additionally, many business credit cards offer rewards programs and other perks that can help you save money on business expenses.

Can I open a bank account for my freelance business if I’m a sole proprietor?

Yes, you can open a bank account for your freelance business if you’re a sole proprietor.

You’ll need to provide your social security number or employer identification number (EIN) as your tax ID number.

It’s important to keep in mind that as a sole proprietor, you are personally liable for any debts or legal issues related to your business.

What should I consider when choosing a bank for my freelance business?

When choosing a bank for your freelance business, you should consider factors such as fees, interest rates, minimum balance requirements, online banking capabilities, customer service, and financial tools and services.

It’s important to choose a bank that meets your specific needs and budget, and that you feel comfortable working with.

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment