Dubai Islamic Bank freelancer account opening online not only simplifies the account opening process but also aligns with the growing needs and preferences of the evolving freelance community in Pakistan.

This article explains eligibility, benefits, document requirements, and a step-by-step process for free for Dubai Islamic Bank Pakistan Freelancer Account Opening Online. So, let’s start our guide!

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

Dubai Islamic Bank Freelancer Account Opening Online Pakistan

Table of Contents

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

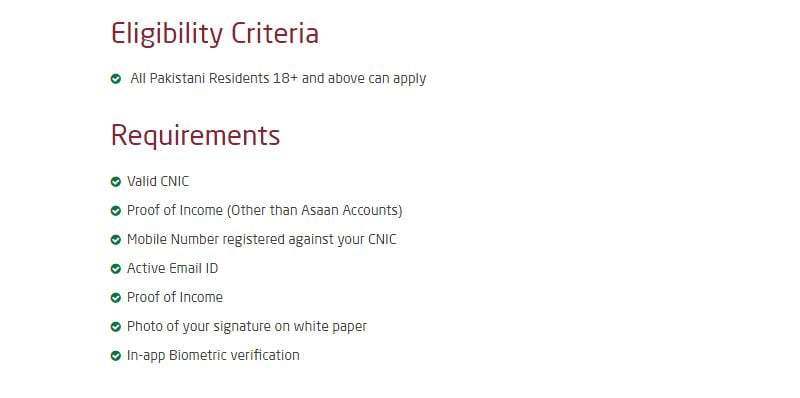

Dubai Islamic Bank Account Opening Requirements

Dubai Islamic Bank Freelancer Account Opening Requirements:

| Requirement | Description |

|---|---|

| Pakistani Residency and Age: | Applicants must be residents of Pakistan and at least 18 years old. |

| Verification: | Ensures eligibility for financial agreements with DIB. |

| Valid CNIC: | Essential identification document proving identity and legal status in Pakistan. |

| Proof of Income: | Required for non-Asaan Accounts to assess financial standing. Documents may include salary slips, bank statements, or tax returns. |

| Mobile Number Registered against CNIC: | Vital for secure communication and mobile banking services. |

| Active Email ID: | Necessary for receiving notifications and account-related information securely. |

| Photo of Signature on White Paper: | A clear image of the signature on white paper for transaction authentication and fraud prevention. |

| In-App Biometric Verification: | Utilizes unique biometric data for secure identity authentication within the DIB app. |

| Enhances security and user experience. |

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Dubai Islamic Bank Freelancer Account Benefits

Dubai Islamic Bank Freelancer Account Benefits:

| Feature | Details |

|---|---|

| Instant Account Opening Anytime, Anywhere: | Open your account instantly without paperwork, anytime, anywhere, allowing you to focus on your work promptly. |

| Paperless and Time-Efficient: | Complete the entire account opening process online, saving time and effort with a paperless and digital approach. |

| Current & Savings PKR/ FCY Accounts: | Choose between current and savings accounts to manage funds efficiently based on Islamic banking principles. |

| Monthly Limit of USD 5,000 or Equivalent: | Enjoy a generous monthly transaction limit for international transactions and cross-border financial activities. |

| Cash Withdrawal Limit of PKR 500,000/- or Equivalent per Day: | Access substantial funds with a high daily cash withdrawal limit, providing convenience and flexibility. |

| Payment of Bills (Utilities): | Easily pay utility bills like electricity and gas through an integrated platform, saving time and effort. |

| Debit Card, Cheque Book & SMS Alert Service: | Benefit from essential banking services including a debit card, checkbook, and real-time SMS alerts for account activities. |

| Free E-Statements: | Receive detailed electronic statements at no cost, providing insights into account transactions and balances. |

| Phone Banking Offering 24/7: | Access round-the-clock phone banking services for assistance with transactions, inquiries, and support. |

| Free Online Banking: | Enjoy secure and convenient access to your account online, allowing for fund transfers, bill payments, and more. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

How To Open Dubai Islamic Bank Freelancer Account Online | DIB Pakistan Online Account Opening

Step-by-Step Guide: How to Open a Dubai Islamic Bank Freelancer Account Online

- Visit the DIB Website: Start by visiting the Dubai Islamic Bank (DIB) website at https://www.dibpak.com/index.php/digital-account-opening. This webpage serves as the gateway to their digital account opening process.

- Download the DIB Digital App: Once on the DIB website, locate and download the DIB Digital App. This app is available for both Android and iOS devices, ensuring compatibility with a wide range of smartphones and tablets.

- Launch the DIB Digital App: After successfully downloading the app, locate it on your device and launch it. The app icon typically appears on the home screen or in the app drawer.

- Register as a New User: Upon launching the app, you will be prompted to register as a new user. Provide the required information, including your full name, valid mobile number, and active email address.

- Verify Your Mobile Number: To ensure the security of your account and identity, DIB will send a verification code to the mobile number you provided during registration.

- Accept Terms and Conditions: Read and accept the terms and conditions presented by DIB regarding the usage and services of the app.

- Select “Open an Account”: Within the DIB Digital App, you will find various banking services and options. Locate the “Open an Account” section and select it to begin the freelancer account opening process.

- Provide Personal Details: In this step, you will be asked to enter your personal information, including your full name, date of birth, nationality, and residential address. Ensure that the information provided is accurate and matches the details on your valid CNIC.

- Submit Proof of Income: As part of the account opening requirements, you will need to provide proof of income. Follow the instructions within the app to upload the necessary documents, such as salary slips, bank statements, or tax returns.

- Capture and Submit Signature: Using the camera on your device, capture a clear photo of your signature on white paper.

- Complete Biometric Verification: DIB employs in-app biometric verification for enhanced security. Follow the instructions to complete the biometric verification process using your device’s supported biometric authentication feature, such as fingerprint or facial recognition.

- Review and Confirm: Once all the necessary information and documents have been provided, review the details you have entered for accuracy. Make any necessary edits, if required.

- Wait for Account Approval: After submitting your account opening application, DIB will review your information and documents. The bank will communicate with you via email or SMS regarding the status of your application.

- Account Activation: Upon approval of your account opening application, DIB will provide you with further instructions on how to activate your freelancer account.

- Start Enjoying Your Freelancer Account: Once your Dubai Islamic Bank freelancer account is activated, you can start enjoying the benefits and features provided.

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

Dubai Islamic Bank Helpline

For any inquiries or assistance regarding your Dubai Islamic Bank freelancer account, you can contact the Dubai Islamic Bank helpline at 111-786-DIB(342).

The dedicated helpline is available to provide support and address any concerns you may have related to your account or banking services. For complaints, Dubai Islamic Bank has a specific hotline number: 111-786-342.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

Dubai Islamic Bank Freelancer Account FAQs

What is a Dubai Islamic Bank Freelancer Account?

A Dubai Islamic Bank Freelancer Account is a specialized banking account designed to cater to the unique financial needs of freelancers. It offers a range of services and features tailored to support freelancers in managing their finances, making transactions, and accessing essential banking services.

Can I open a Dubai Islamic Bank freelancer account online?

Yes, Dubai Islamic Bank provides the option to open a freelancer account online through their digital account opening process. You can visit the DIB website or download the DIB Digital App to initiate the account opening procedure.

What are the age requirements to open a freelancer account with Dubai Islamic Bank?

To open a freelancer account with Dubai Islamic Bank, you need to be a Pakistani resident and at least 18 years old.

What documents are required to open a Dubai Islamic Bank freelancer account?

The documents required to open a Dubai Islamic Bank freelancer account include a valid CNIC, proof of income (excluding Asaan Accounts), a mobile number registered against your CNIC, an active email ID, and a photo of your signature on white paper.

What is the process for verifying my mobile number during the Dubai Islamic Bank freelancer account?

During the Dubai Islamic Bank freelancer account opening process, Dubai Islamic Bank will send a verification code to the mobile number you provided. You will need to enter this code within the DIB Digital App to successfully verify your mobile number.

Can I choose between a current account and a savings account for my freelancer account?

Yes, the Dubai Islamic Bank freelancer account offers freelancers the flexibility to choose between current and savings accounts based on their financial needs and preferences.

Is there a limit on international transactions with the Dubai Islamic Bank freelancer account?

Yes, the Dubai Islamic Bank freelancer account account has a monthly transaction limit of USD 5,000 or its equivalent in other currencies. This allows freelancers to engage in international transactions and receive payments from clients abroad.

What is the daily cash withdrawal limit for the Dubai Islamic Bank freelancer account?

Dubai Islamic Bank freelancer account sets a cash withdrawal limit of PKR 500,000 or its equivalent per day for the freelancer account, providing freelancers with convenient access to their funds.

How long does it take for the Dubai Islamic Bank freelancer account opening process to be completed?

The Dubai Islamic Bank freelancer account opening process typically takes a few business days. After submitting your application, Dubai Islamic Bank will review the information and documents provided before approving the account.

Can I access my Dubai Islamic Bank freelancer account through online banking?

Yes, the Dubai Islamic Bank freelancer account provides free online banking services with the freelancer account. This allows you to access your account, perform transactions, manage funds, and avail of various banking services conveniently through the bank’s online banking platform.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment