In recent years, the concept of freelancing has gained significant popularity among professionals looking for more flexibility and control over their work-life balance.

However, for many freelancers, managing their finances and getting paid in a timely and secure manner can be a challenge.

To address these concerns, Habib Bank Limited (HBL), one of the leading banks in Pakistan, has introduced its Freelancer Account, an online platform designed specifically for freelancers.

This account offers a range of features tailored to the needs of freelancers, including easy account opening procedures, convenient online banking services, and competitive transaction fees.

In this article, we will explore the HBL Freelancer Account including:

- HBL Freelancer Account Opening Online

- Eligibility Criteria

- Freelancer Account Key Features

- How To Open an HBL Freelancer Account Online Step-By-Step?

- HBL Helpline Number

- HBL Freelancer Account Pros And Cons

- FAQs | HBL Freelancer Account

HBL partners with @PAFLA to empower Pakistani Freelancers and bring them into the formal economy through Freelancer digital accounts and solutions. @statebank_Pak pic.twitter.com/9deLVqGJSF

— HBL (@HBLPak) May 27, 2022

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

HBL Freelancer Account Opening Online | HBL Freelancer Account {Islamic Banking}

Table of Contents

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

Eligibility Criteria

To be eligible for an HBL Freelancer Account, applicants must meet certain criteria. One of the key requirements is to provide valid identification documents.

- Specifically, applicants must submit images of both the front and back of their Computerized National Identity Card (CNIC).

- The CNIC must be valid and not expired, and the images should be clear and legible to avoid any delays in the account opening process.

- Additionally, the name on the CNIC must match the name on the account application form to ensure accurate record-keeping and compliance with regulatory requirements.

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

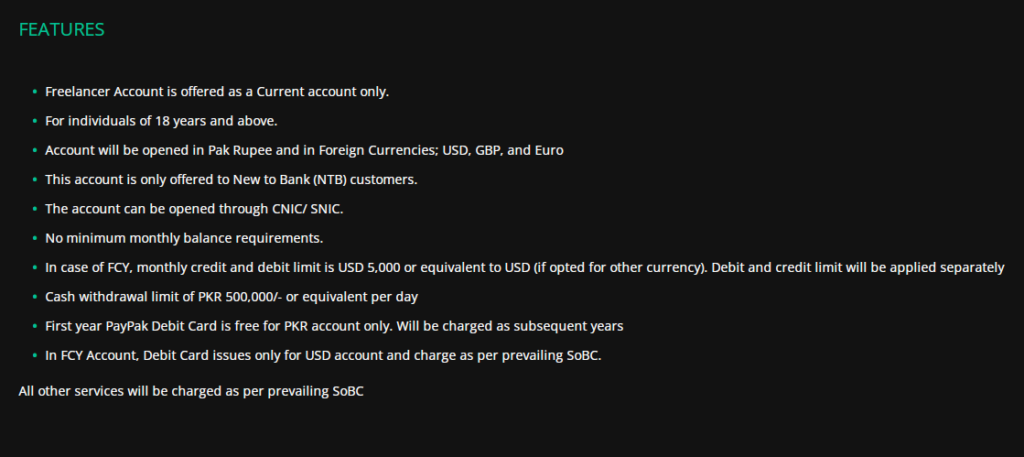

Freelancer Account Key Features

| Features | Details |

|---|---|

| Account Type: | A Freelancer Account is available as a Current account only. |

| Age Requirement: | Open to individuals aged 18 years and above. |

| Currency Options: | Accounts can be opened in Pakistani Rupee (PKR) as well as Foreign Currencies: USD, GBP, and Euro. |

| Customer Eligibility: | Exclusive to New to Bank (NTB) customers. |

| Identification Method: | The account can be opened using CNIC/SNIC. |

| Minimum Balance Requirement: | No minimum monthly balance requirements. |

| Foreign Currency Limits: | For FCY accounts, monthly credit and debit limits are capped at USD 5,000 or equivalent. Debit and credit limits are applied separately. |

| Cash Withdrawal Limit: | Daily cash withdrawal limit of PKR 500,000. |

| Free Debit Card: | First-year PayPak Debit Card is issued free for PKR accounts; subsequent years are charged. |

| Debit Card: | Debit cards are issued only for USD accounts in FCY; charges apply as per the prevailing Schedule of Bank Charges. |

| Other Service Charges: | All other services are subject to charges as per the prevailing Schedule of Bank Charges. |

Recommended Reading: Top 5 Best Bank Account For Freelancers In Pakistan {Tried+Tested}

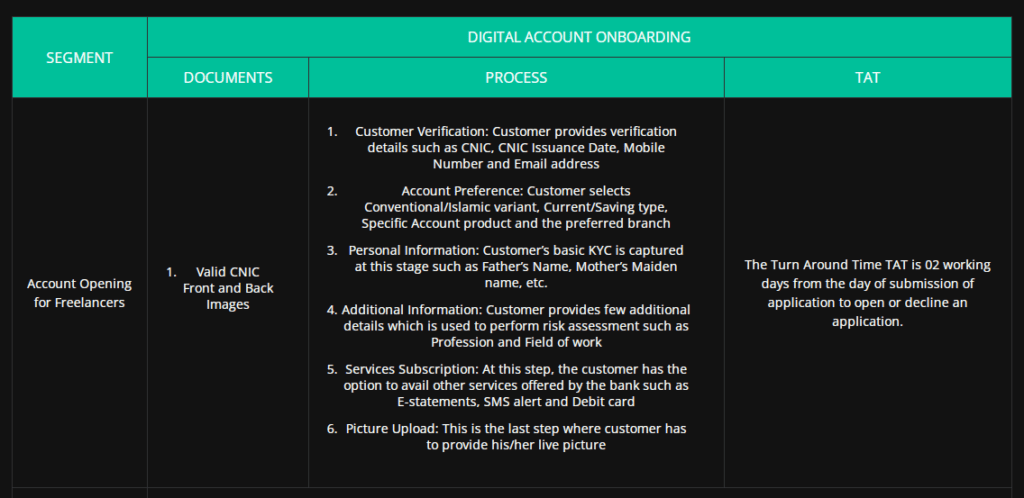

How To Open an HBL Freelancer Account Online Step-By-Step?

Opening an HBL Freelancer Account online is a simple and convenient process that can be completed in a few easy steps.

Here is a step-by-step guide to help you through the account opening process:

| Segment | Digital Account Onboarding |

|---|---|

| Documents: | Valid CNIC Front and Back Images |

| Process: | 1. Customer Verification: Provide CNIC details, mobile number, and email address. 2. Account Preference: Choose account type and branch. 3. Personal Information: Fill in basic KYC details. 4. Additional Information: Provide profession and field of work for risk assessment. 5. Services Subscription: Opt for additional services like E-statements, SMS alerts, and Debit cards. 6. Picture Upload: Submit a live picture. |

| TAT: | 02 working days from application submission for account opening decision. |

Recommended Reading: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

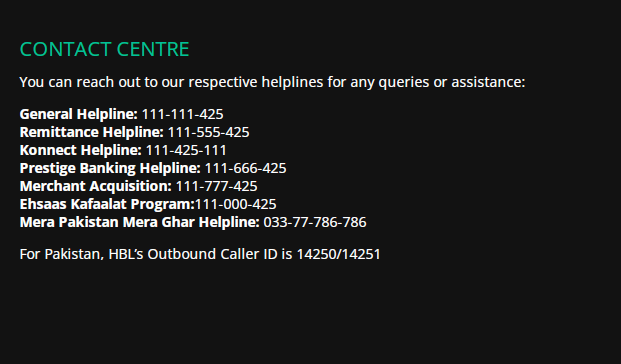

HBL Helpline Number

If you need to contact Habib Bank Limited for any queries or concerns, you can use the following contact details:

Website: You can visit the HBL app or website at www.hbl.com, which contains a wealth of information about the bank’s products, services, and offerings.

Helpline: You can contact HBL’s customer service helpline for assistance with your account, transactions, or any other queries:

- General Helpline: 111-111-425

- Remittance Helpline: 111-555-425

Email: If you prefer to email your query or concern, you can send an email to support@hbl.com, and a customer service representative will get back to you as soon as possible.

Address: If you wish to visit an HBL branch in person, you can find the nearest branch to your location by visiting the HBL website and using the Branch Locator tool. HBL’s head office is located at Habib Bank Plaza, I.I. Chundrigar Road, Karachi, Pakistan.

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

HBL Freelancer Account Pros And Cons

HBL Freelancer Account is a specialized account designed for freelancers, which offers a range of benefits tailored to their needs.

Here are some of the pros and cons of opening an HBL Freelancer Account:

| Pros | Cons |

|---|---|

| Easy account opening: | Limited branch network: Some freelancers may find it inconvenient to visit a branch for transactions. |

| Low transaction fees: | Eligibility criteria: Meeting certain criteria, like providing valid identification, may be challenging for some freelancers. |

| Multiple account options: | Regulatory compliance: Compliance requirements may lead to restrictions on account usage for freelancers. |

| Online banking services: | Currency exchange: Converting foreign currency payments may incur additional charges or exchange rate fluctuations. |

| Additional benefits: |

Recommended Reading: Top 3 Loan Apps In Pakistan (5K-50K Urgent Cash) {Interest-free}

FAQs | HBL Freelancer Account

What is an HBL Freelancer Account?

HBL Freelancer Account is a specialized account designed for freelancers, offering a range of benefits tailored to their needs, such as competitive transaction fees, convenient online banking services, and multiple account options.

What are the eligibility criteria for opening an HBL Freelancer Account?

The eligibility criteria for opening an HBL Freelancer Account include being a Pakistani national or a resident foreign national, providing valid identification documents such as CNIC or passport, and meeting any additional criteria as per the bank’s policies.

How can I open an HBL Freelancer Account?

You can open an HBL Freelancer Account by visiting the HBL website and completing the online account opening process, which involves providing personal and professional information and submitting the required documents.

What types of accounts are available under HBL Freelancer Account?

HBL Freelancer Account offers a range of account types, including Current and Savings accounts, as well as Conventional and Islamic variants, allowing freelancers to choose the account that best suits their needs.

What are the transaction fees for HBL Freelancer Account?

HBL offers competitive transaction fees for HBL Freelancer Accounts, which may vary depending on the type of transaction, account type, and other factors.

Does HBL Freelancer Account offer online banking services?

Yes, HBL Freelancer Account comes with convenient online banking services, allowing freelancers to manage their finances from the comfort of their homes or workplaces.

What are the additional benefits of the HBL Freelancer Account?

HBL offers additional benefits such as SMS alerts, e-statements, and a Debit card, which can help freelancers to manage their finances more efficiently.

What is the minimum balance requirement for HBL Freelancer Account?

The minimum balance requirement for HBL Freelancer Account varies depending on the type of account and other factors, so it is best to check with the bank for specific details.

What is the maximum limit for withdrawals and transfers for HBL Freelancer Account?

The maximum limit for withdrawals and transfers for HBL Freelancer Account varies depending on the type of account, transaction type, and other factors, so it is best to check with the bank for specific details.

What is the process for closing an HBL Freelancer Account?

To close an HBL Freelancer Account, you should contact the bank’s customer service helpline or visit a branch in person and follow the necessary procedures as per the bank’s policies.

Is there a fee for the first year of the PayPal Debit Card for PKR accounts?

No, the first year’s issuance of the PayPal Debit Card is usually free for PKR accounts. However, subsequent years may incur charges as per the prevailing fee structure.

How long does it take to open an HBL Freelancer Account?

The account opening process can vary depending on various factors, including the completion of required documentation and verification procedures.

It is recommended to contact HBL or visit a branch to get an estimated timeline for opening the account.

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment