The world is evolving rapidly, and the nature of work is changing with it. With the rise of remote work, freelancing has become a viable career option for many people worldwide.

Freelancing has emerged as a popular alternative to traditional employment, allowing individuals to work on their terms and showcase their skills to a global market.

Recognizing the potential of this trend, United Bank Limited (UBL) has launched a dedicated Freelancer Account to cater to the financial needs of freelancers in Pakistan.

The process of opening a UBL Account is hassle-free and can be completed entirely online on mobile or laptop simply from your bed.

In this article, we will explore the details of the UBL Freelancer Account including:

- UBL Freelancer Account Eligibility Criteria

- UBL Freelancer Account Documents Required

- Benefits Of UBL Freelancer Account

- How To Open a UBL Freelancer Account Online Step-By-Step

- UBL Helpline

- UBL Freelancer Account Pros And Cons

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

UBL Freelancer Account | UBL Digital Freelancer Account Opening

Table of Contents

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Eligibility Criteria

To open a UBL Account, certain eligibility criteria must be met. These include:

| Eligibility Criteria | Details |

|---|---|

| Resident of Pakistan: | You must live in Pakistan and have a valid Pakistani address. |

| Active CNIC: | You need an active Computerized National Identity Card for identity verification. |

| Age 18 or older: | You must be at least 18 years old to open a UBL Freelancer Account. |

| Valid Email & Phone: | Provide a working email address and phone number for communication and verification. |

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

Documents Required

To open a UBL app or website, there are certain documents that you must provide. These include:

| UBL Freelancer Account Requirements | Description |

|---|---|

| Eligible Individuals: | Residents of Pakistan engaged in digital/online services, including IT, receiving payments from outside Pakistan. |

| Documentary Requirements: | Copy of CNIC/NICOP/POC (or B-Form/Juvenile Card for minors) Export Agreement/Undertaking as a freelancer |

| Additional Opportunity: | Visit the nearest UBL branch for an ESFCA account opening. |

| ESFCA Account Opening: | Visit the nearest UBL branch for ESFCA account opening. |

| ESFCA Benefits: | Retain USD 5,000 (or equivalent FCY) per month or 50% of freelancing remittance income, whichever is higher. |

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

Benefits Of UBL Freelancer Account

UBL Account offers a range of benefits to freelancers in Pakistan. These benefits include:

| UBL Freelancer Account Features | Details |

|---|---|

| No Initial Deposit: | You don’t need any initial deposit to open a UBL Freelancer Account. |

| Digital Account Opening: | Open your account online via UBL Digital App or Netbanking, making it convenient and time-saving. |

| Biometric Authentication at ATM: | Complete the account opening process with biometric authentication at any UBL ATM. |

| No Minimum Balance Requirement: | There’s no minimum balance required, ensuring you won’t be charged for a low balance. |

| 24/7 Banking: | Access your account anytime, anywhere through UBL Digital App or Netbanking. |

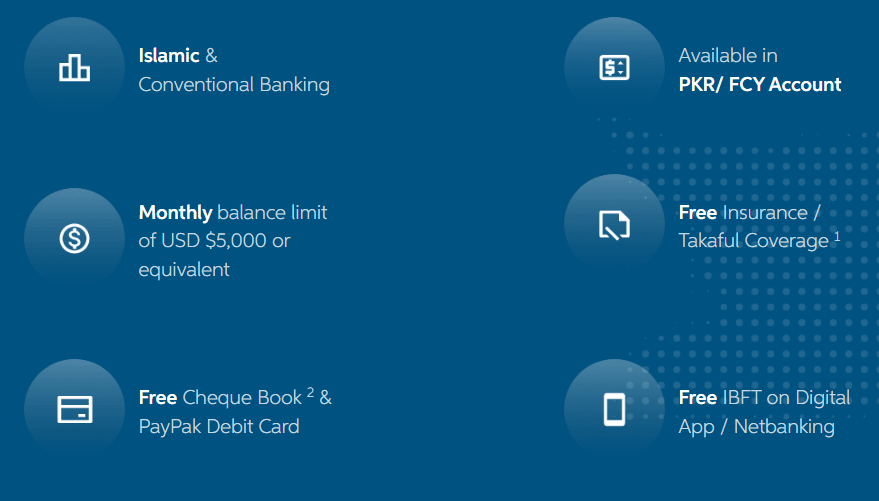

| Islamic & Conventional Banking Options: | Choose between Islamic and conventional banking modes for flexibility. |

| Available in PKR/FCY: | Free Cheque Book & PayPal Debit Card |

| Monthly Balance Limit: | Maintain up to USD 5,000 or equivalent monthly balance in your account. |

| Free Insurance: | Enjoy complimentary insurance with your UBL Freelancer Account. |

| Free Cheque Book & Pay Pak Debit Card: | Receive a free checkbook and Pay Pak debit card with your account. |

| Free IBFT Transfers: | Transfer funds between UBL accounts or to other banks for free using the UBL Digital App or Netbanking. |

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

How To Open a UBL Freelancer Account Online Step-By-Step?

Opening a UBL Account is a simple process that can be completed online in just a few steps. Here’s a step-by-step guide to help you get started:

- Visit the UBL Website at: https://www.ubldigital.com/ubl-digital-account/form?account-type=freelancer: To start the account opening process, visit the UBL website and select the “UBL Freelancer Account” option.

- Set Preferences: In this step, you will need to set your preferences for the type of account you want to open. You can choose between Islamic or conventional banking, and select your preferred account currency (PKR or FCY).

- Personal Details: Enter your details, including your name, CNIC number, date of birth, and contact information.

- Verification of Personal Details: In this step, you will need to verify your details. You will be asked to enter a one-time password (OTP) sent to your mobile number for verification.

- Additional Details: Provide any additional details that are required, such as your occupation, source of income, and purpose of account opening.

- Account Details: Here, you will need to select the type of account you want to open, such as a savings or current account.

- Review Application: Before submitting your application, review all the information you have provided to ensure that it is accurate and complete.

- Submit Application: Once you are satisfied with your application, submit it online by clicking on the “Submit” button.

- Biometric Verification: After submitting your application, visit any UBL ATM to complete your biometric verification.

- Wait for Approval: Once you have completed the biometric verification, wait for UBL to approve your account opening application.

- Receive Account Details: Once your account is approved, you will receive your account details via email or SMS.

By following these simple steps, you can easily open a UBL Freelancer Account online and start enjoying its many benefits.

Recommended Reading: Free! How To Open Meezan Bank Freelancer Account {Ultimate Guide}

UBL Helpline

If you need to get in touch with UBL customer support for any queries or assistance, there are several ways to contact them. Here is the contact information for UBL Helpline:

Website

You can visit the UBL website at https://ubldigital.com/More/ContactUs for more information about their services, products, and contact details.

24/7 UBL Contact Center

You can call UBL’s 24/7 contact center at 111-825-888 (UAN) for any queries or assistance regarding your UBL account.

Telephone/Mobile Numbers

If you prefer to speak with a UBL representative directly, you can call their landline number at 021-99217334-38.

For people in Azad Jammu Kashmir

If you are located in Azad Jammu Kashmir, you can reach UBL customer service at (021)32446949.

- Fax: You can also fax UBL customer services at 021-99207697 for any complaints or feedback.

- Email: For any general inquiries or assistance, you can email UBL customer services at customer.services@ubl.com.pk.

Overall, UBL provides a range of contact options for their customers, making it easier for them to reach out and get the help they need.

Recommended Reading: Top 5 Best Bank Account For Freelancers In Pakistan {Tried+Tested}

Pros Of UBL Freelancer Account

UBL Freelancer Account is a great option for individuals who work as freelancers or are self-employed. It offers a range of benefits and advantages, but there are also some drawbacks to consider.

Here are the pros and cons of opening a UBL Freelancer Account:

- No initial deposit required: One of the biggest advantages of the UBL Freelancer Account is that there is no requirement for an initial deposit. This makes it easier for individuals to open an account and start using it right away.

- Digital account opening: UBL Freelancer Account can be opened online, making it a convenient and hassle-free process for busy freelancers who may not have the time to visit a bank branch.

- No minimum balance requirement: UBL Freelancer Account does not require a minimum balance, which means that users can maintain a low balance without incurring any fees or penalties.

- 24/7 banking with UBL Digital App & Netbanking: UBL Freelancer Account offers 24/7 banking services through its digital app and net banking, which means that users can easily access their accounts and perform transactions at any time.

- Islamic and Conventional Banking: UBL Freelancer Account offers both Islamic and conventional banking options, giving users the flexibility to choose a banking system that aligns with their beliefs and values.

- Monthly balance limit of USD 5,000 or equivalent: The UBL Freelancer Account has a monthly balance limit of USD 5,000 or equivalent, which can be a useful tool for budgeting and managing finances.

Recommended Reading: List Of Online Loan Apps That Are Scamming People In Pakistan {Updated}

UBL Freelancer Account FAQs

What is a UBL Freelancer Account?

UBL Freelancer Account is a digital account designed for freelancers and professionals who work online and want to receive their payments in Pakistan.

It offers a range of benefits and features, including no initial deposit, no minimum balance requirement, free insurance/takaful coverage, and 24/7 banking with UBL Digital App & Netbanking.

Who can open a UBL Freelancer Account?

Resident Pakistanis with an active CNIC and aged 18 years or above can open a UBL Freelancer Account. Freelancers and professionals who work online can benefit from this account and receive their payments from clients globally.

What documents are required to open a UBL Freelancer Account?

You will need to provide a digital copy of your valid CNIC, a mobile phone number registered with your CNIC, a digital copy of your signature, and a webcam for taking a live photo.

How can I open a UBL Freelancer Account online?

You can open a UBL Freelancer Account online by visiting the UBL website at https://www.ubldigital.com/ubl-digital-account/form?account-type=freelancer and following the step-by-step process.

You will need to provide your personal and account details, verify your identity, and review and submit your application.

What is the monthly balance limit for the UBL Freelancer Account?

The monthly balance limit for the UBL Freelancer Account is USD 5,000 or its equivalent in PKR.

Can I use UBL Freelancer Account for Islamic and conventional banking?

Yes, the UBL Freelancer Account offers both Islamic and conventional banking options, so you can choose the one that suits your preferences and needs.

Is there any minimum balance requirement for a UBL Freelancer Account?

No, there is no minimum balance requirement for the UBL Freelancer Account, making it a convenient option for freelancers and professionals who work online.

How can I contact UBL customer support for any queries or assistance regarding my UBL Freelancer Account?

You can contact UBL customer support through their website, email, 24/7 contact center, telephone, and fax. The contact details are available on the UBL website, and you can choose the option that is most convenient for you.

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment