Loan For Business In Pakistan: Founded in 2012, Ihsaas Trust has a vision to uplift the social well-being of the lives of underprivileged individuals in Karachi.

Ihsaas Trust offers interest-free micro-loans, and providing proven micro-business models, advisory services, and training, Ihsaas Trust aims to empower aspiring entrepreneurs and individuals in need of financial support.

The Trust’s commitment extends to facilitating small-scale enterprises, with loan limits reaching up to PKR 5 lakh for those looking to establish a business and PKR 25,000 for personal needs.

In this article, we will explore the eligibility criteria, the application process to get a loan for business in Pakistan without interest, and how it is changing the lives of poor ones in Pakistan, especially in Karachi.

Recommended Reading: How To Get 50,000 Loan In Pakistan {20K-50K} (Interest-Free)

Loan For Business In Pakistan Without Interest | Ihsaas Trust

Table of Contents

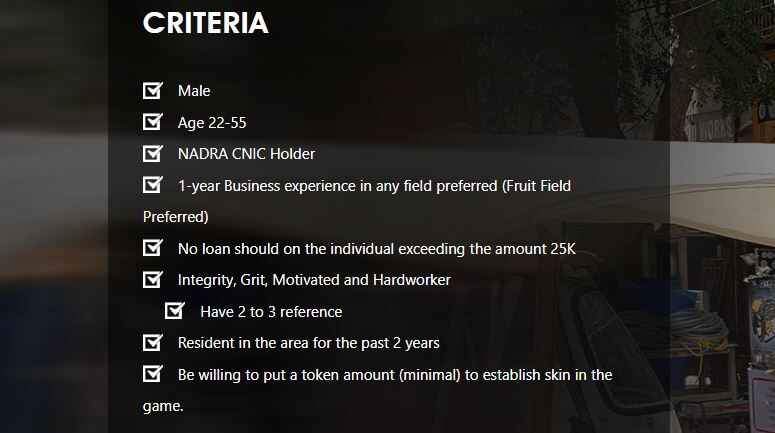

Eligibility Criteria

To be eligible for Ihsaas welfare loans, individuals must meet the following criteria:

| Criteria | Requirements |

|---|---|

| Gender: | Male |

| Age: | 22-55 years |

| Employment: | Works |

| Documentation: | NADRA CNIC Holder |

| Experience: | 1-year business experience, preferably in any field |

| Financial Responsibility: | No existing loan exceeding PKR 25,000 |

| Personal Attributes: | Integrity, grit, motivation, and hardworking attitude |

| References: | 2 to 3 references |

| Residency: | Resided in the area for the past 2 years |

| Financial Contribution: | Willingness to contribute a minimal token amount as investment |

Recommended Reading: Pakistan Red Crescent Society (Services+Helpline) {Guide Post}

Ihsaas Trust Loan Schemes | Ihsaas Trust Loan Programs

Ihsaas Welfare offers two types of schemes/programs to assist the underprivileged:

- Philanthropic Disbursement

- Enterprise Facilitation

| Philanthropic Disbursement | Enterprise Facilitation |

|---|---|

| Financial Support: | Overview: |

| Financial assistance for healthcare needs across primary, secondary, and tertiary sectors | Addressing the healthcare needs of Karachi’s underprivileged, emphasizing quality care |

| Ration Support: | Supporting Micro-entrepreneurs: |

| Direct cash transfers for purchasing rations, utilizing mobile payment solutions for swift disbursement | Assisting individuals in establishing and running micro-businesses |

| Where We Invest: | Program Stages: |

| Investing in immediate support for individuals and families through Zakat or Sadaqa | Selection of potential beneficiaries |

| Focusing on enabling recipients to become self-sufficient over time | Capacity development for micro-entrepreneurs |

| Enterprise Development: | Access to initial infrastructure |

| Assisting individuals in starting and managing micro-businesses |

Recommended Reading: How To Donate Money To Edhi Foundation (Services+Helpline) {Ultimate Guide}

Business Loan Schemes By Ihsaas Trust

Ihsaas Welfare/Trust offers business loan schemes tailored to empower micro-entrepreneurs, providing them with comprehensive end-to-end business advisory services.

The following points highlight key aspects of these schemes:

| Micro-Entrepreneurs Empowerment | Micro Business Loan Facility | End-to-End Business Advisory Services |

|---|---|---|

| Ihsaas Trust focuses on empowering micro-entrepreneurs to drive economic growth and create employment opportunities within their communities. | Ihsaas Welfare offers interest-free loans to aspiring entrepreneurs for starting or growing their micro-businesses. | In addition to financial assistance, Ihsaas Welfare provides comprehensive business advisory services to loan recipients. |

| By providing interest-free business loans, the Trust enables individuals to establish and expand their micro-businesses without the burden of high interest rates. | Loans receive guidance in various aspects of business operations, including planning, marketing, and financial management, to effectively manage and grow their businesses. |

Recommended Reading: Micro-Insurance: 3 Types Of Kashf Foundation Insurance {Updated}

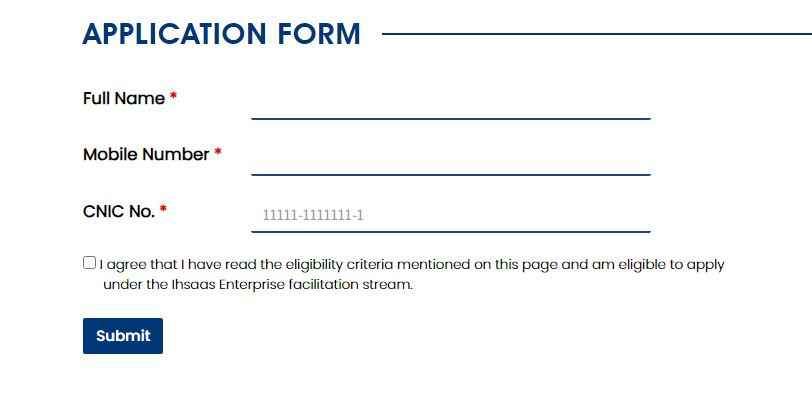

Loan For Business In Pakistan Without Interest Online Apply | Ihsaas Trust

To apply for Ihsaas welfare Loans online, follow these step-by-step instructions:

| Steps to Apply for a Loan with Ihsaas Trust |

|---|

| 1. Visit the official website of Ihsaas Trust at https://ihsaas.pk/. |

| 2. Navigate to the loan application section on the website. |

| 3. Access the online application form by clicking the provided link or button. |

| 4. Fill in your Full Name, Mobile Number, and CNIC No. (Computerized National Identity Card Number) in the required fields. |

| 5. Review the filled application form for accuracy and completeness. |

| 6. Click on the “Submit” or “Apply” button to submit your application. |

| 7. Await verification and processing by the Ihsaas welfare team. |

| 8. Be patient during this stage as verification and processing may take some time. |

| 9. Expect communication from Ihsaas welfare regarding the status of your loan application. |

| 10. Respond promptly to any queries or provide additional information if required. |

Recommended Reading: Interest-free Student Loan In Pakistan (60K-3Lakh) | Kashaf Loan

FAQs | Loan For Business In Pakistan

How much loan anyone can get from Ihsaas Trust?

For personal needs, anyone can get up to a PKR 25,000 loan without interest from Ihsaas welfare.

How can I apply for a business loan from Ihsaas Trust?

To apply for a business loan from Ihsaas Welfare, you can visit their official website at https://ihsaas.pk/ and fill out the online application form.

Provide your full name, mobile number, and CNIC (Computerized National Identity Card) number as requested.

Is there an age limit to qualify for a business loan from Ihsaas Trust?

Yes, Ihsaas welfare has an age limit of 22 to 55 years for individuals seeking a business loan. Applicants must fall within this age range to be eligible.

What is the loan limit for starting a business through Ihsaas Trust?

Ihsaas welfare offers a loan limit of up to PKR 5 lakh for individuals who want to start a business. This amount can provide a significant boost to help entrepreneurs establish and grow their micro-businesses.

Can I apply for a loan if I don’t have any prior business experience?

It is preferred that applicants have at least one year of business experience, preferably in a micro-business like a fruit field.

However, the specific requirements may vary, and it is advisable to contact Ihsaas Welfare directly for further information regarding your eligibility.

What is the maximum loan limit for personal needs through Ihsaas Trust?

Ihsaas Welfare provides a maximum loan limit of PKR 25,000 for personal needs. This amount can assist individuals in meeting their immediate financial requirements.

Do I need to provide references when applying for a business loan?

Yes, Ihsaas Trust requires applicants to provide two to three references who can vouch for their credibility and character. These references play a part in the Trust’s due diligence process.

How long does it take for the loan application to be processed?

The processing time for loan applications may vary. Once you have submitted your application, it will be reviewed by the Ihsaas welfare team.

They will conduct the necessary verifications and background checks. It is recommended to patiently await communication from Ihsaas Welfare regarding the status of your application.

Are the business loans provided by Ihsaas Trust interest-free?

Yes, Ihsaas Trust offers interest-free business loans to support micro-entrepreneurs. This helps individuals focus on establishing and growing their businesses without the burden of high interest rates.

Does Ihsaas Trust offer any advisory services for loan recipients?

Yes, Ihsaas Trust provides end-to-end business advisory services to loan recipients. These services include guidance and support in various aspects of business operations, such as planning, marketing, and financial management.

The goal is to equip borrowers with the necessary knowledge and skills to manage and expand their micro-businesses effectively.

How much loan is offered by these organizations?

loan offered by these organizations:

Loan For Business amounts ranging from 25k to 5Lakh.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment