The NBP Student Loan Scheme is a program initiated by the National Bank of Pakistan (NBP) to provide financial assistance to students pursuing basic and higher education in Pakistan.

The scheme aims to support students who face financial constraints and cannot afford to pay for their education expenses. Interest-free loans are provided to cover tuition fees, boarding and lodging expenses, and other academic-related expenses.

The NBP Student Loan Scheme has made it possible for deserving students to continue their education and pursue their career goals without worrying about financial constraints.

This loan scheme has helped thousands of students in Pakistan to fulfill their dreams of higher education and secure a better future for themselves and their families. Let’s discuss its details!

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

NBP Student Loan Scheme | Student Loan Scheme In Pakistan

Table of Contents

- NBP Student Loan Scheme | Student Loan Scheme In Pakistan

- NBP Student Loan Loan Types And Repayment Period

- NBP Student Loan Online Application Process

Recommended Reading: Interest-free Student Loan In Pakistan (60K-3Lakh) | Kashaf Loan

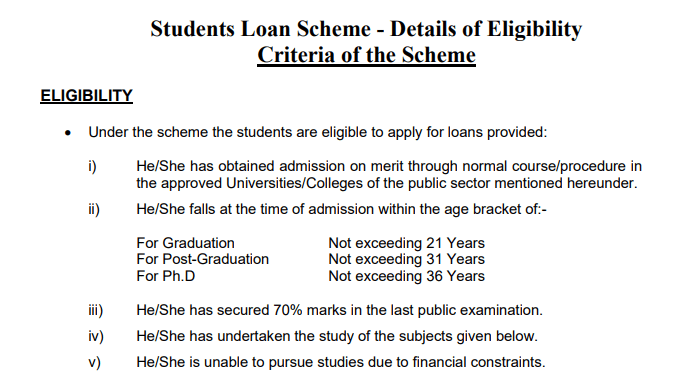

NBP Student Loan Eligibility Criteria

The NBP Student Loan Scheme provides financial assistance to students pursuing higher education in Pakistan. However, to be eligible for the loan, students must meet certain criteria.

The eligibility criteria for the NBP Student Loan Scheme are as follows:

| Criteria | Details |

|---|---|

| Admission Requirement | Admission on merit through the normal procedure in approved public sector universities/colleges. |

| Age Limit | For Graduation: Not exceeding 21 years For Post-Graduation: Not exceeding 31 years For Ph.D.: Not exceeding 36 years |

| Academic Performance | Minimum 70% marks in the last public examination |

| Financial Constraint | Must be unable to pursue studies due to financial constraints |

| Citizenship | Must be a Pakistani citizen |

| Age Range | 18 to 35 years |

| Academic Qualifications | Admission to a HEC-recognized public or private sector university, college, or institute |

| Minimum GPA | Minimum GPA of 2.5 or above in the last academic degree |

| Loan Amount | Varies by study category (e.g., engineering, medical) and degree type (e.g., undergraduate, graduate). Maximum: PKR 2.5 million for local studies, PKR 7.5 million for studies abroad |

| Guarantor Requirement | Must provide a guarantor who is a government employee of at least grade 17 or above |

| Study Subjects | Must undertake study of specific subjects as defined by the loan scheme |

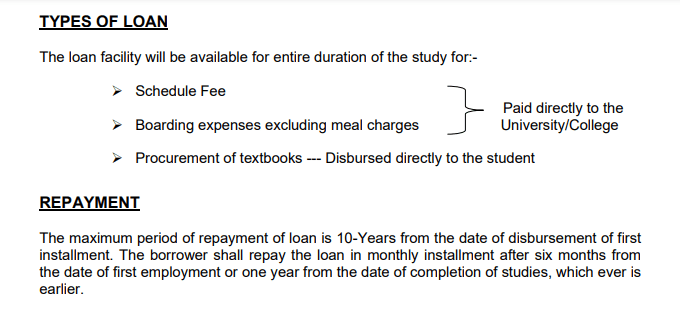

NBP Student Loan Loan Types And Repayment Period

NBP Student Loan Types

| Category | Details |

|---|---|

| Types of Loans | Local Studies Loan: Up to PKR 2.5 million for studies in Pakistan. Studies Abroad Loan: Up to PKR 7.5 million for studies abroad. |

| Covered Expenses | Tuition Fees: Paid directly to the university/college. Boarding Expenses: Excludes meal charges; paid directly to the university/college. Textbooks: Disbursed directly to the student. Other Academic Expenses: Includes laboratory fees, examination fees, etc. |

| Repayment Period | Maximum of 10 years from the date of disbursement of the first installment. |

| Repayment Start | Six months after first employment or one year after completion of studies, whichever is earlier. |

| Repayment Schedule | Monthly or quarterly installments, with no penalty for early repayment. |

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Up To 50Lakh Via Top 5 Banks]

NBP Student Loan Approved Universities

The scheme supports students who are enrolled in universities, colleges, and institutes recognized by the Higher Education Commission (HEC) of Pakistan.

Here are some of the approved universities and institutions for the NBP Student Loan Scheme:

| Sr. # | Universities/Colleges | Designated Branches |

|---|---|---|

| Islamabad | ||

| 1 | Air University, Islamabad | Foreign Office Branch Islamabad |

| 2 | Bahria University, Islamabad | Foreign Office Branch Islamabad |

| 3 | COMSATS Institute of Information Technology, Islamabad | Foreign Office Branch Islamabad |

| 4 | Federal Urdu University of Arts, Sci. & Tech., Islamabad | Foreign Office Branch Islamabad |

| 5 | International Islamic University, Islamabad | Foreign Office Branch Islamabad |

| 6 | National University of Medical Sciences, Islamabad | Foreign Office Branch Islamabad |

| 7 | National University of Modern Languages, Islamabad | Foreign Office Branch Islamabad |

| 8 | National University of Science & Technology, Islamabad | Foreign Office Branch Islamabad |

| 9 | National Defence University, Islamabad | Foreign Office Branch Islamabad |

| 10 | Pakistan Institute of Engineering & Applied Sciences, Islamabad | Foreign Office Branch Islamabad |

| 11 | Pakistan Institute of Development Economics (PIDE) Islamabad | Foreign Office Branch Islamabad |

| 12 | Quaid-e-Azam University, Islamabad | Foreign Office Branch Islamabad |

| 13 | Institute of Space Technology, Islamabad | Foreign Office Branch Islamabad |

| 14 | Shaheed Zulfiqar Ali Bhutto Medical University, Islamabad | Foreign Office Branch Islamabad |

| Lahore | ||

| 1 | Allama Iqbal Medical College, Lahore | Main Branch Lahore |

| 2 | Fatima Jinnah Medical College for Women, Lahore | Main Branch Lahore |

| 3 | Government College University, Lahore | Main Branch Lahore |

| 4 | King Edward Medical College, Lahore | Main Branch Lahore |

| 5 | Kinnaird College for Women, Lahore | Main Branch Lahore |

| 6 | Lahore College for Women University, Lahore | Main Branch Lahore |

| 7 | National College of Arts, Lahore | Main Branch Lahore |

| 8 | University of Education, Lahore | Main Branch Lahore |

| 9 | University of Health Sciences, Lahore | Main Branch Lahore |

| 10 | University of Veterinary and Animal Sciences, Lahore | Main Branch Lahore |

| 11 | Virtual University of Pakistan, Lahore | Main Branch Lahore |

| 12 | Pakistan Institute of Fashion & Design, Lahore | Main Branch Lahore |

| 13 | University of Engineering & Technology, Lahore | Baghbanpura Branch Lahore |

| 14 | University of Punjab, Lahore | New Garden Town Branch Lahore |

| 15 | Information Technology, University of Punjab, Lahore | New Garden Town Branch Lahore |

| 16 | Bahauddin Zakariya University, Multan | Bosan Road Branch Multan |

| 17 | Nishtar Medical College, Multan | Bosan Road Branch Multan |

| 18 | Muhammad Nawaz Sharif University of Agriculture, Multan | Bosan Road Branch Multan |

| 19 | Muhammad Nawaz Sharif University of Engineering & Technology, Multan | Bosan Road Branch Multan |

| 20 | The Women’s University, Multan | Bosan Road Branch Multan |

| 21 | NFC-Institute of Engineering & Technology, Multan | Bosan Road Branch Multan |

| 22 | Ghazi University, Dera Ghazi Khan | Bosan Road Branch Multan |

| 23 | The Women’s University, Multan | Bosan Road Branch, Multan |

| 24 | NFC-Institute of Engineering & Technology, Multan | Bosan Road Branch, Multan |

| 25 | University of Sargodha, Sargodha | City Branch, Sargodha |

| 26 | Sargodha Medical College, Sargodha | City Branch, Sargodha |

| 27 | University College of Agriculture, Sargodha | City Branch, Sargodha |

| 28 | College of Engineering & Technology, Sargodha | City Branch, Sargodha |

| 29 | Law College, Sargodha | City Branch, Sargodha |

| 30 | College of Pharmacy, Sargodha | City Branch, Sargodha |

| 31 | Institute of Food Science & Technology, Sargodha | City Branch, Sargodha |

| 32 | Institute of Art & Design, Sargodha | City Branch, Sargodha |

| 33 | Noon Business School, Sargodha | City Branch, Sargodha |

| 34 | Islamia University, Bahawalpur | Distt. Court Branch Bahawalpur |

| 35 | Govt. Sadiq College for Women University, Bahawalpur | Distt. Court Branch Bahawalpur |

| 36 | Quaid-e-Azam Medical College, Bahawalpur | Fareed Gate Branch Bahawalpur |

| 37 | Khawaja Fareed University of Engineering & Info. Tech., Rahim Yar Khan | Model Town Branch, Rahimyar Khan |

| 38 | Sheikh Zayed Medical College, Rahmyar Khan | Model Town Branch, Rahimyar Khan |

| 39 | University of Engineering & Technology, Taxila | Heavy Mechanical Complex Branch Taxila |

| 40 | University of Gujrat, Gujrat | Main Branch, Gujrat |

| 41 | National University of Sciences & Technology, Rawalpindi | Medical College Branch, Rawalpindi |

| 42 | Rawalpindi Medical College, Rawalpindi | Medical College Branch, Rawalpindi |

| 43 | Pir Mehr Ali Shah Arid Agriculture University, Rawalpindi | Medical College Branch, Rawalpindi |

| 44 | University of Arid Agriculture, Murree Road Rawalpindi | Medical College Branch, Rawalpindi |

| 45 | Fatima Jinnah Women’s University, Rawalpindi | Medical College Branch, Rawalpindi |

| 46 | Govt. College Women University, Sialkot | City Branch, Sialkot |

| 47 | University of Sialkot, Sialkot | City Branch, Sialkot |

| 48 | Khawaja Muhammad Safdar Medical College, Sialkot | City Branch, Sialkot |

| 49 | University of Narowal, Narowal | City Branch, Sialkot |

| 50 | Government College University, Faisalabad | University of Agricultural Branch Faisalabad |

| 51 | Faisalabad Medical College, Faisalabad | University of Agricultural Branch Faisalabad |

| 52 | University of Agriculture, Faisalabad | University of Agricultural Branch Faisalabad |

| 53 | National Textile University, Faisalabad | University of Agricultural Branch Faisalabad |

| 54 | Govt. College for Women University, Faisalabad | University of Agricultural Branch Faisalabad |

| 55 | Sahiwal Medical College, Sahiwal | Farid Town Branch, Sahiwal |

| 56 | University of Okara | Farid Town Branch, Sahiwal |

| Sindh | ||

| 1 | Dow University of Health Sciences, Karachi | Binnori Town Branch Karachi |

| 2 | Benazir Bhutto Shaheed University, Lyari Karachi | Binnori Town Branch Karachi |

| 3 | Jinnah Post Medical Centre (Physiotherapy), Karachi | Binnori Town Branch Karachi |

| 4 | Karachi Medical & Dental College, Karachi | Binnori Town Branch Karachi |

| 5 | Pakistan Naval Academy Karachi | Binnori Town Branch Karachi |

| 6 | Sindh Medical College, Karachi | Binnori Town Branch Karachi |

| 7 | Shaheed Zulfiqar Ali Bhutto University of Law, Karachi | Binnori Town Branch Karachi |

| 8 | Dawood University of Engg: & Tech. Karachi | Binnori Town Branch Karachi |

| 9 | Sindh Madresatul Islam University, Karachi | Binnori Town Branch Karachi |

| 10 | Shaheed Mohtarma Benazir Bhutto Medical College, Lyari | Binnori Town Branch Karachi |

| 11 | Shah Abdul Latif University, Khairpur | Main Branch Khairpur |

| 12 | Gambat Institute of Medical Sciences, Khairpur | Main Branch Khairpur |

| 13 | Shaheed Mohtarma Benazir Bhutto Medical University, Larkana | Main Branch Larkana |

| 14 | Peoples University of Medical & Health Sci. for Women, Benazirabad, Nawabshah | Main Branch Nawabshah |

| 15 | Quaid-e-Awam University |

Recommended Reading: Study Loan In Pakistan | Student Loan For International Studies

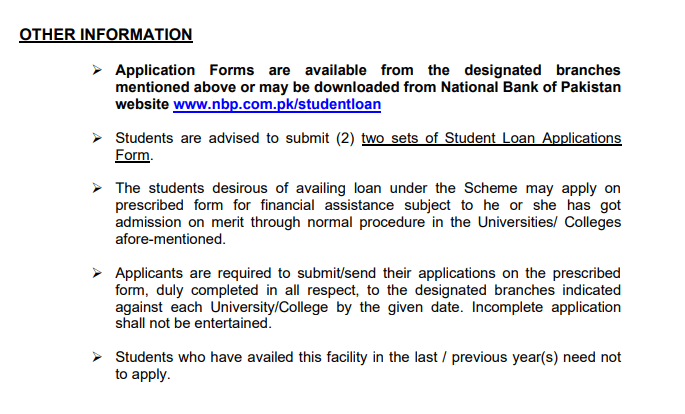

NBP Student Loan Online Application Process

The National Bank of Pakistan (NBP) provides an online application process for the NBP Student Loan Scheme. Here are the steps for the NBP Student Loan Online Apply:

- Visit the NBP website: The first step is to visit the official website or the App National Bank of Pakistan.

- Click on the “Student Loan Scheme” option: On the homepage, you will find an option for the “Student Loan Scheme.”

- Read the instructions: Before you start the online application, it is important to read the instructions provided on the webpage carefully.

- Click on “Apply Now”: Once you have read the instructions, click on the “Apply Now” button to start the application process.

- Fill in the application form: The next step is to fill in the online application form with your personal, educational, and loan-related information.

- Upload required documents: You will also need to upload the required documents, such as your CNIC, educational documents, admission letter from the university or college, and proof of income from the guarantor.

- Submit the application: After completing the application form and uploading the required documents, review your application thoroughly and submit it.

- Receive confirmation: Once your application is submitted, you will receive a confirmation message on your registered email address or phone number.

- Wait for the loan approval: The NBP will review your application and the documents provided.

Students who are applying for loans for foreign studies will have to apply through the manual application process at an NBP branch.

NBP Student Loan Registration Form

The NBP Student Loan Scheme registration form is given below or can be obtained from any NBP branch.

Here is the information that you will be required to provide in the registration form:

- Personal Information: This section requires the student’s personal information, such as name, date of birth, and gender.

- Contact Information: This section requires the student’s contact information, such as an address, telephone number, and email address.

- Educational Information: This section requires the student’s educational information, such as the name of the university or college, the course of study, and the duration of the course.

- Loan Information: This section requires the student to provide information about the loan, such as the loan amount, the purpose of the loan, and the repayment plan.

- Guarantor Information: This section requires the student to provide information about the guarantor, such as name, occupation, and contact information.

- Declaration: This section requires the student to sign a declaration stating that the information provided in the registration form is accurate and complete.

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

NBP Student Loan Documents Required

Here are the documents required for the NBP Student Loan Scheme:

- Student’s CNIC: A copy of the student’s Computerized National Identity Card (CNIC) is required to verify the student’s identity.

- Educational Documents: Copies of educational documents, such as matriculation certificate, intermediate certificate, and bachelor’s degree (if applicable), are required to verify the student’s educational background.

- Admission Letter: An admission letter from the university or college where the student is enrolled is required to verify the student’s admission.

- Fee Structure: A fee structure provided by the university or college is required to calculate the loan amount.

- Guarantor’s CNIC: A copy of the guarantor’s CNIC is required to verify the guarantor’s identity.

- Income Proof: Proof of income of the guarantor, such as salary slips or income tax returns, is required to determine the guarantor’s ability to repay the loan.

- Property Documents (Optional): Property documents, such as title deeds or ownership documents, can be provided as collateral security for the loan.

NBP Student Loan Scheme Approved Subjects

| Sr. # | Approved Subjects |

|---|---|

| 1 | Engineering |

| 2 | Electronics |

| 3 | Oil Gas & Petro-Chemical Technology |

| 4 | Agriculture |

| 5 | Medicine |

| 6 | Physics |

| 7 | Chemistry |

| 8 | Biology, Molecular Biology & Genetics |

| 9 | Other Natural Sciences |

| 10 | Mathematics |

| 11 | DAWA and Islamic Jurisprudence (LL.B/LL.M Sharia) |

| 12 | Computer Science/Information Systems and Technology including hardware |

| 13 | Economics, Statistics, and Econometrics |

| 14 | Commerce |

| 15 | Business Management Sciences |

Recommended Reading: Interest-free Student Loan In Pakistan (60K-3Lakh) | Kashaf Loan

NBP Student Loan Pros And Cons

Pros Of The NBP Student Loan Scheme:

- Easy Accessibility: The NBP Student Loan Scheme is easily accessible to students pursuing higher education in Pakistan.

- Interest-free loans: The NBP Student Loans are completely interest-free.

- Flexible Repayment Options: The repayment options of the NBP Student Loan Scheme are flexible and can be customized according to the student’s needs.

- No Collateral Required: The NBP Student Loan Scheme does not require any collateral or security, making it easier for students to apply for the loan.

- Multiple Loan Types: The NBP Student Loan Scheme offers multiple types of loans, such as tuition fees, boarding expenses, and textbooks.

Cons Of The NBP Student Loan Scheme:

- Limited Universities: The NBP Student Loan Scheme is only available for students who are enrolled in approved universities and colleges.

- Limited Loans: The NBP Student Loan Scheme has a limited number of loans available, and not all applicants may be approved for the loan.

- Guarantor Requirement: The NBP Student Loan Scheme requires a guarantor, which can be difficult for students to arrange.

- Time-Consuming Process: The loan application process for the NBP Student Loan Scheme can be time-consuming and may require several visits to the bank.

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Up To 50Lakh Via Top 5 Banks]

FAQs | NBP Student Loan

What is the maximum loan amount offered under the NBP Student Loan Scheme?

The maximum loan amount offered under the NBP Student Loan Scheme is up to PKR 2.5 million.

Is there any age limit to apply for the NBP Student Loan Scheme?

Yes, applicants must be between the ages of 18 and 35 years to apply for the NBP Student Loan Scheme.

Can I apply for the NBP Student Loan Scheme if I am studying abroad?

No, the NBP Student Loan Scheme is only available for students who are pursuing higher education in Pakistan.

How can I repay the NBP Student Loan?

The NBP Student Loan can be repaid through equal monthly installments (EMIs) or bullet repayment, as per the repayment plan agreed upon with the bank.

Do I need a guarantor to apply for the NBP Student Loan?

Yes, a guarantor is required to apply for the NBP Student Loan Scheme.

Can I apply for multiple types of loans under the NBP Student Loan Scheme?

Yes, you can apply for multiple types of loans, such as tuition fees, boarding expenses, and textbooks, under the NBP Student Loan Scheme.

What is the interest rate on NBP Student Loans?

There Is no interest on these loans, NBP Student Loans are completely interest-free.

How long does it take to get the loan approved?

The loan approval time can vary and depends on factors such as the completeness of the application, the accuracy of the information provided, and the bank’s internal procedures. Generally, it can take up to two to four weeks to get the loan approved.

Recommended Reading: Study Loan In Pakistan | Student Loan For International Studies

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment