Study Loan In Pakistan: As the world becomes increasingly interconnected and the demand for quality education rises, pursuing higher studies abroad has emerged as a compelling option for Pakistani students.

However, the financial burden associated with international education can be overwhelming for many.

Recognizing the importance of empowering the youth and bridging the gap, both governmental bodies and private institutions in Pakistan have introduced various study loan programs.

These initiatives aim to provide financial assistance to aspiring students, enabling them to embark on their educational journeys without constraints.

In this article, we will explore the avenues available for obtaining a study loan in Pakistan, ranging from government-sponsored programs to financial support provided by banks and welfare organizations.

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Up To 50Lakh Via Top 5 Banks]

Study Loan In Pakistan | Student Loan For International Studies

Table of Contents

- Study Loan In Pakistan | Student Loan For International Studies

- Best Banks To Get Study Loan In Pakistan

- Study Loan In Pakistan From Welfare Organizations

- Practical Tips To Get A Study Loan In Pakistan

Best Banks To Get Study Loan In Pakistan

National Bank Of Pakistan Student Loan

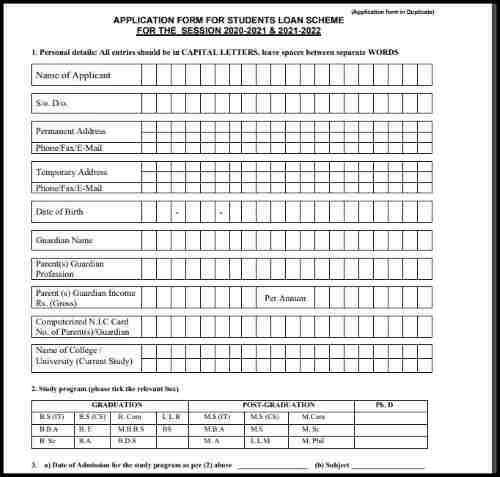

Here’s a step-by-step guide to applying for a student loan from the National Bank of Pakistan (NBP), including filling out the application form that can be downloaded from the NBP website:

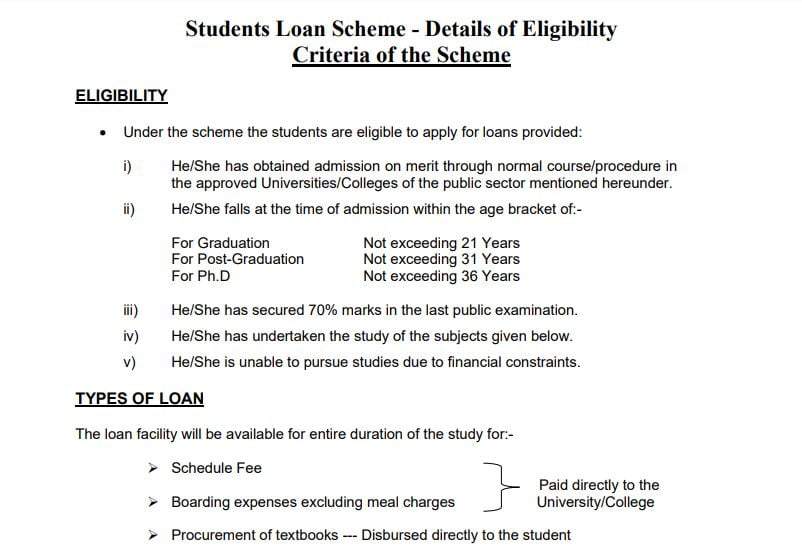

| Eligibility Criteria | Details |

|---|---|

| Admission | Must be admitted on merit to approved public universities/colleges |

| Age Limit | Graduation: Up to 21 years Post-Graduation: Up to 31 years Ph.D: Up to 36 years |

| Academic Performance | Must have secured 70% marks in the last public examination |

| Study Subjects | Must be studying approved subjects |

| Financial Need | Must be unable to continue studies due to financial constraints |

Recommended Reading: NBP Student Loan Scheme | Interest-Free Loans For Students {Updated}

Loan Types

| Types of Loan | Details |

|---|---|

| Schedule Fee | Paid directly to the university/college |

| Boarding Expenses | Excluding meal charges |

| Textbooks | Money for textbooks given directly to the student |

The NBP student loan application form is given below. Fill out this form, attach the required documents, and submit it to the NBP nearest branch.

Meezan Bank Student Loan Application Loan

Here’s a step-by-step guide to applying for a student loan at Meezan Bank by visiting the nearest branch:

Recommended Reading: Interest-free Student Loan In Pakistan (60K-3Lakh) | Kashaf Loan

Standard Chartered Student Loan | Standard Chartered Education Loan

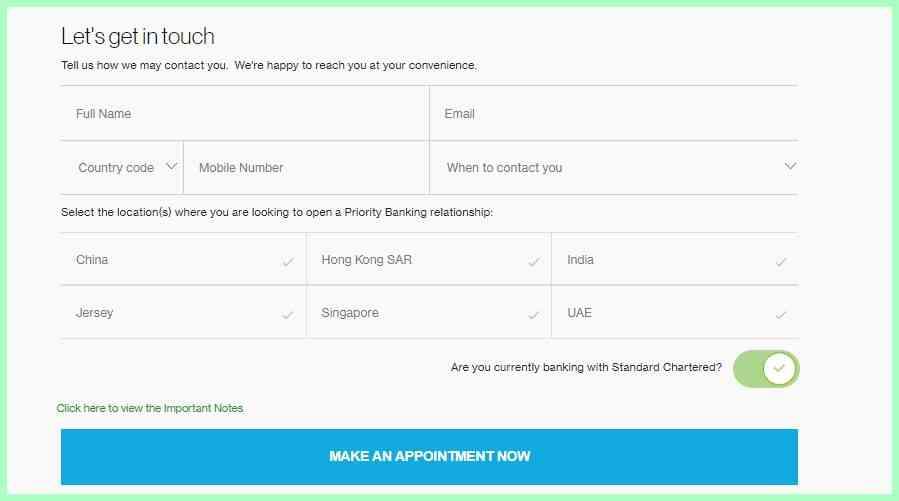

Here is a step-by-step education loan application process. Follow these guidelines and get the desired amount for your children’s education.

- Accessing the Official Website: Access the official website of Standard Chartered at the URL: https://www.sc.com/international-banking/overseas-childrens-education/.

- Appointment Booking Process: On the webpage, you will encounter a form for booking an appointment.

- Providing Loan Details: Complete the appointment booking form by furnishing the necessary information regarding the amount of education loan you require.

- Bank Official Interaction: Subsequent to submitting the appointment booking form, a Standard Chartered Bank representative will contact you.

- In-Person Appointment: Attend the scheduled appointment at the bank’s branch.

- Document Submission and Application: You must provide the necessary documentation at the branch and formally apply for the education loan. The bank will guide you through the application process.

- Loan Application Status: Following the submission of your application, the bank will assess your request.

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

Study Loan In Pakistan From Welfare Organizations

Akhuwat Foundation Study Loan

Follow these exact schemes of steps to avoid rejection of the application. Here are step-by-step guidelines for the study loan in Pakistan by the Akhuwat Foundation.

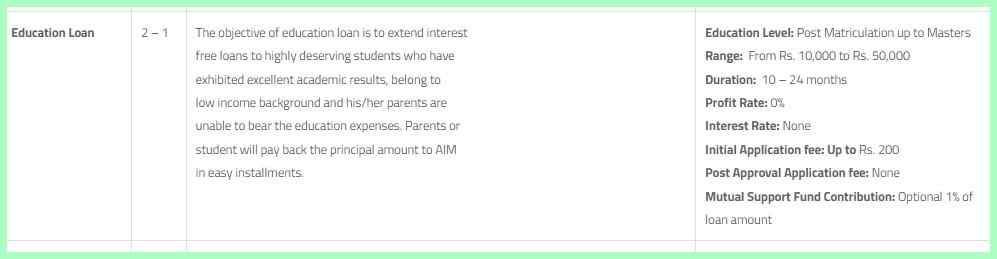

| Education Loan Details | Information |

|---|---|

| Objective | Interest-free loans for deserving students with excellent academic results from low-income backgrounds |

| Repayment | Parents or student repays the principal amount in easy installments to AIM |

| Education Level | Post Matriculation to Masters |

| Loan Range | Rs. 10,000 to Rs. 50,000 |

| Loan Duration | 10 to 24 months |

| Profit Rate | 0% |

| Interest Rate | None |

| Initial Application Fee | Up to Rs. 200 |

| Post Approval Application Fee | None |

| Mutual Support Fund Contribution | Optional 1% of loan amount |

Recommended Reading: Student Loan In Pakistan For Abroad Study 2024 [Up To 50Lakh Via Top 5 Banks]

Kashf Foundation Study Loan

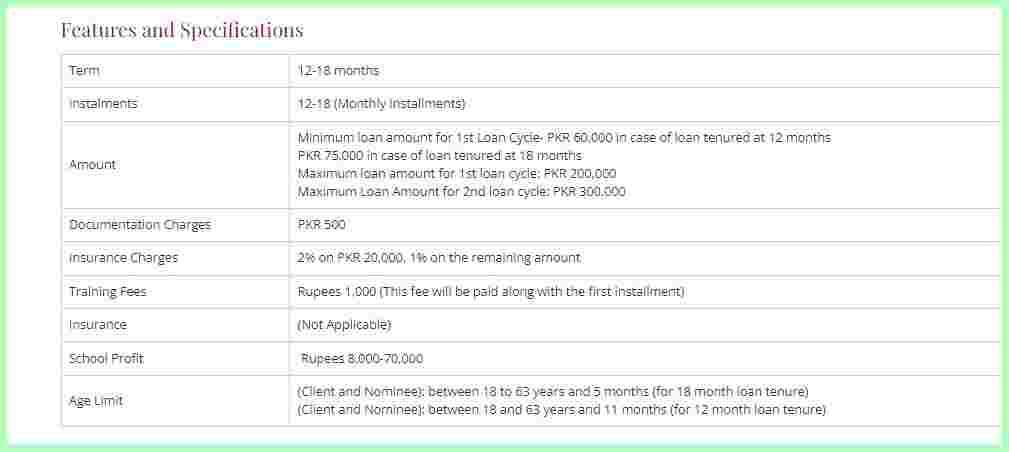

| Features and Specifications | Details |

|---|---|

| Term | 12-18 months |

| Installments | 12-18 monthly installments |

| Loan Amount | Minimum for 1st loan cycle: PKR 60,000 (12 months) PKR 75,000 (18 months) Maximum for 1st loan cycle: PKR 200,000 Maximum for 2nd loan cycle: PKR 300,000 |

| Documentation Charges | PKR 500 |

| Insurance Charges | 2% on PKR 20,000, 1% on the remaining amount |

| Training Fees | PKR 1,000 (paid with first installment) |

| Insurance | Not applicable |

| School Profit | PKR 8,000-70,000 |

| Age Limit | Client and Nominee: 18 to 63 years and 5 months (18-month loan) 18 to 63 years and 11 months (12-month loan) |

Recommended Reading: NBP Student Loan Scheme | Interest-Free Loans For Students {Updated}

Practical Tips To Get A Study Loan In Pakistan

Getting a study loan in Pakistan can be a viable option for students looking to finance their education. Here are some practical tips to help you secure a study loan:

- Research available options: Begin by researching different banks, financial institutions, and government schemes that offer study loans in Pakistan. Compare their interest rates, repayment terms, and eligibility criteria to find the most suitable option for you.

- Determine your financial needs: Assess your educational expenses, including tuition fees, accommodation, books, and living costs. Calculate the amount you require to cover these expenses throughout your study period. This will help you determine the loan amount you need to apply for.

- Meet the eligibility criteria: Understand the eligibility requirements of the loan provider you intend to approach. Typically, these criteria include minimum age, educational qualifications, enrollment in an accredited institution, and a guarantor.

- Prepare necessary documents: Gather all the required documents, such as educational certificates, admission letters, identification proof, income statements, and proof of collateral (if applicable). Having these documents ready will streamline the loan application process.

- Find a reliable guarantor: Many loan providers in Pakistan require a guarantor who can take financial responsibility if you fail to repay the loan. Ensure that your guarantor meets the eligibility criteria specified by the loan provider and is willing to support your application.

- Maintain a good credit score: A good credit score increases your chances of getting a study loan. Establish and maintain a positive credit history by paying bills and other financial obligations on time. This demonstrates your financial responsibility and improves your creditworthiness.

- Approach multiple lenders: Don’t limit your options to just one lender. Explore multiple banks and financial institutions to find the best loan terms and interest rates. Applying to several lenders increases your chances of getting approved and may help you secure more favorable terms.

- Seek government schemes and scholarships: Explore government-backed study loan schemes and scholarships available for Pakistani students. These programs may offer more favorable terms, lower interest rates, or partial loan forgiveness based on academic performance.

- Prepare a convincing loan application: Craft a comprehensive loan application, highlighting your academic achievements, future career prospects, and your ability to repay the loan. Clearly state how the loan will contribute to your education and future success.

- Seek guidance and support: Reach out to educational consultants, career counseling centers, or financial advisors who specialize in student loans. They can provide valuable guidance, answer your questions, and assist you in navigating the loan application process.

Recommended Reading: Interest-free Student Loan In Pakistan (60K-3Lakh) | Kashaf Loan

FAQs | Study Loan In Pakistan

How much study loan could be obtained in Pakistan?

The amount of money that could be obtained as a study loan depends upon which degree you are going to get in Pakistan.

Graduation Students can get Rs.300,000

Post Graduation or Mphill Students can get Rs. 400,000.

Ph.D./Engineering and MBBS students can get Rs. 500,000.

The maximum amount of study loans that can be applied in Pakistan?

Pakistani Students can get a maximum of 2 Million as a study loan i.e 20 Laks in PKR a study loan for getting a degree from a Pakistani university or from a foreign university.

Countries with the highest student loan debt in the world?

The average student owes about $54,00 in the UK, while in the US average student debt is $28,400 at graduation level. This is the highest average of student debt in the world.

Which country in the world offers student loans at the lowest interest rates?

Sweden offers student loans of $21,000 equivalent loan to students at the lowest interest rate of about 0.13%, which is the lowest interest rate for student loans in the world.

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment