In Pakistan, various institutions and organizations have stepped forward to provide interest-free agriculture loans to farmers, enabling them to expand their operations and improve their productivity.

This article explores various sources that provide interest-free agriculture loans in Pakistan ranging from PKR 5 to 75 lakh rupees within a few weeks.

We will explore key initiatives such as the Prime Minister Youth Business and Agriculture Loan, and Akhuwat Agriculture Loan, as well as loans offered by the Pakistan Poverty Alleviation Authority and prominent banks like Zarai Taraqiati Bank (ZTBL) and National Bank of Pakistan (NBP).

By exploring these sources farmers can get Interest-Free Agriculture Loan to expand their operations, improve productivity, and contribute to sustainable agricultural development in the country. So, let’s start our guide!

Recommended Reading: 10 Lakh Loan For Business By Government | Insaf Rozgar Scheme

Interest-Free Agriculture Loan In Pakistan | Agriculture Loan Schemes In Pakistan

Table of Contents

- Interest-Free Agriculture Loan In Pakistan | Agriculture Loan Schemes In Pakistan

- Prime Minister Youth Business and Agriculture Loan | Prime Minister Youth Loan Scheme

- Akhuwat Agriculture Loan

- Pakistan Poverty Alleviation Authority Agriculture Loan

- Zarai Taraqiati Bank (ZTBL) Agriculture Loan

- National Bank of Pakistan (NBP) Agriculture Loan

- Pros And Cons Of Agriculture Loan In Pakistan

Recommended Reading: Prime Minister Solar Panel Scheme 2024 | Solar Tubewell Scheme

Following are the top sources to get Interest-Free Agriculture Loan In Pakistan:

- Prime Minister Youth Business and Agriculture Loan

- Akhuwat Agriculture Loan

- Pakistan Poverty Alleviation Authority

- Zarai Taraqiati Bank (ZTBL) Agricultural Loan

- National Bank of Pakistan (NBP) Agriculture Loan.

We will discuss the requirements and step-by-step application process to get agriculture loans from these sources one by one. Let’s start!

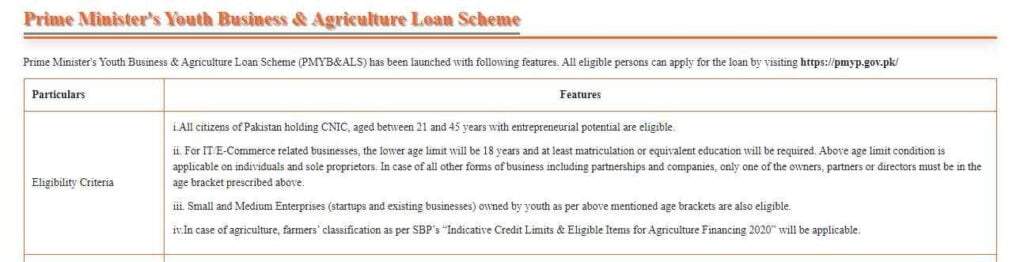

Prime Minister Youth Business and Agriculture Loan | Prime Minister Youth Loan Scheme

Eligibility Criteria

Eligibility Criteria for the Prime Minister Youth Business and Agriculture Loan (Prime Minister Youth Loan Scheme):

| Particulars | Features |

|---|---|

| Eligibility Criteria: | 1) All citizens of Pakistan holding CNIC, aged between 21 and 45 years with entrepreneurial potential are eligible. 2) For IT e-commerce-related businesses, the lower age limit will be 18 years and at least matriculation or equivalent education will be required. 3) Small and Medium Enterprises (startups and existing businesses) owned by youth within the specified age brackets are also eligible. 4) In the case of agriculture, farmers’ classification as per SBP’s “Indicative Credit Limits & Eligible Items for Agriculture Financing 2020” will be applicable. |

| Application Website: | Visit https://pmyp.gov.pk/ to apply for the loan. |

Recommended Reading: Solar Tubewell Scheme Pakistan | Solar Tubewell+Bio Gas Plant

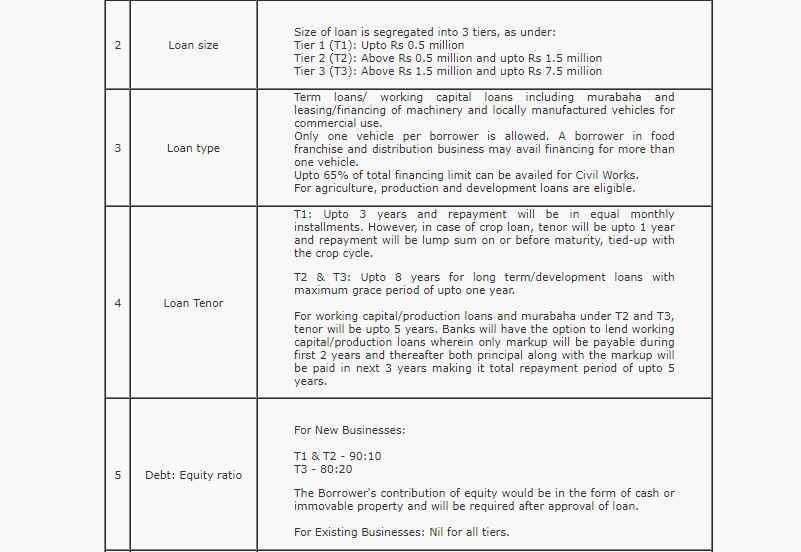

Loan Limit For Prime Minister Youth Loan Scheme

Loan Limits for the Prime Minister Youth Loan Scheme:

| Particulars | Features |

|---|---|

| Eligibility Criteria: | All citizens of Pakistan holding CNIC, aged between 21 and 45 years with entrepreneurial potential are eligible. |

| For IT e-commerce-related businesses, the lower age limit is 18 years with at least matriculation or equivalent education. | |

| Small and Medium Enterprises (startups and existing businesses) owned by youth in the specified age brackets are also eligible. | |

| For agriculture, classification as per SBP’s “Indicative Credit Limits & Eligible Items for Agriculture Financing 2020” applies. | |

| Loan Size: | Tier 1 (T1): Up to Rs 0.5 million |

| Tier 2 (T2): Above Rs 0.5 million and up to Rs 1.5 million | |

| Tier 3 (T3): Above Rs 1.5 million and up to Rs 7.5 million | |

| Loan Type: | Term loans, working capital loans, murabaha, leasing, and financing of machinery and locally manufactured vehicles for commercial use. |

| Only one vehicle per borrower is allowed. | |

| Up to 65% of the total financing limit can be availed for Civil Works. | |

| For agriculture, production, and development loans are eligible. | |

| Loan Tenor: | T1: Up to 3 years with equal monthly installments. |

| T2 & T3: Up to 8 years for long-term/development loans with a maximum grace period of up to one year. | |

| Debt: Equity Ratio: | – For New Businesses: |

| T1 & T2: 90:10 | |

| T3: 80:20 | |

| Equity contribution can be in the form of cash or immovable property and is required after approval of the loan. | |

| For Existing Businesses: Nil for all tiers. |

How To Apply For PM Youth Business and Agriculture Loan

You have two options to apply for the PM Youth Business and Agriculture Loan: through the PM Youth Official Portal (https://pmyp.gov.pk/BankForm/newApplicantForm) or by visiting a nearby bank.

Most banks facilitate the submission of loan application forms. Here is a step-by-step guide on the application process when visiting a bank:

- Obtain the PM Youth Business and Agriculture Loan Application Form: Visit the bank in your area that offers this loan scheme. Request the application form from the bank representative.

- Fill out the Application Form: Carefully complete the application form, ensuring that all required information is accurately provided.

- Prepare Required Documents: Gather the necessary documents as per the bank’s requirements. These documents typically include your valid CNIC, proof of residence, business registration, etc.

- Submit the Application: Once you have completed the application form and gathered the required documents, return it to the bank and submit your application package.

- Follow-up and Await Approval: After submitting your application, the bank will review your information and documents.

Recommended Reading: PM Youth Laptop Scheme 2024 Online Apply | Shahbaz Sharif Laptop Scheme

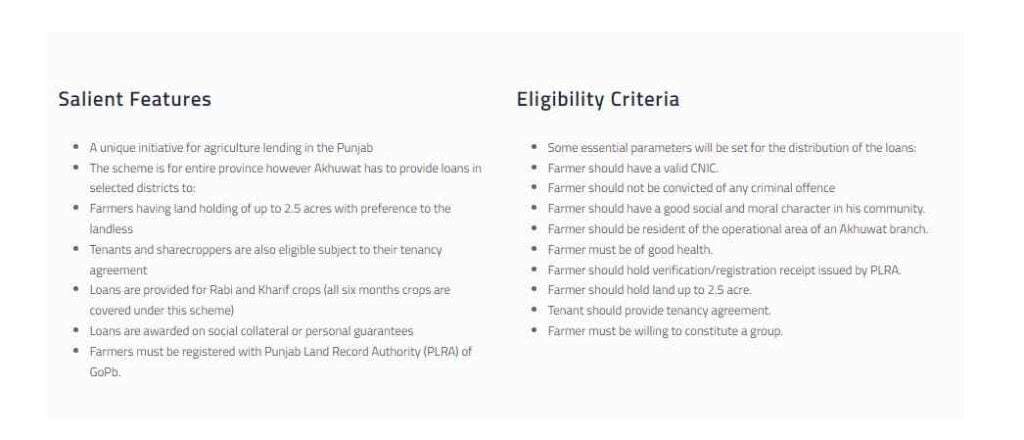

Akhuwat Agriculture Loan

Akhuwat Loan Requirements (Agriculture Loan)

Requirements for Akhuwat Foundation Agriculture Loan:

- Land Ownership: Farmers applying for an agricultural loan from the Akhuwat Foundation should possess a minimum of 2.5 acres of land.

- Tenancy Agreement (for Tenants): In the case of tenants, having a valid tenancy agreement is necessary.

- Valid CNIC: Applicants must have a valid CNIC issued by the relevant authorities.

- Registration with Punjab Land Record Authority (PLRA): Farmers are required to be registered with the Punjab Land Record Authority (PLRA)

- Residency in the Operational Area of the Akhuwat Branch: Applicants should be residents of the operational area of an Akhuwat Foundation branch.

Recommended Reading: Gilgit-Baltistan Agriculture Loan Scheme | ZTBL Loan Scheme 2024

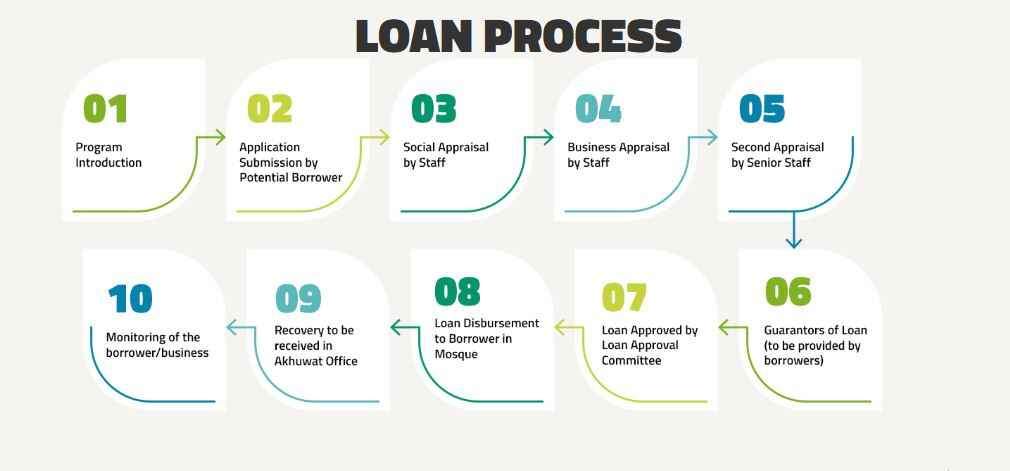

How Can I Get A Loan From Akhuwat Foundation | Akhuwat Foundation Loan Process?

To obtain a loan from the Akhuwat Foundation, you can follow the loan process outlined below:

- Locate the Nearest Akhuwat Branch: Find the nearest Akhuwat Foundation branch in your area.

- Obtain the Loan Application Form: Visit the

- Complete the Application Form: Fill out the loan application form with all the required information.

- Gather Necessary Documents: Along with the completed application form, gather all the necessary documents as specified by the Akhuwat Foundation.

- Submit the Application: Once you have filled out the application form and assembled all the required documents, return it to the Akhuwat Foundation branch.

- Application Status Notification: After submitting your application, you will be informed about the acceptance or rejection of your loan application.

Recommended Reading: Khud Mukhtar Program (72K-1.5 Lakh Interest-Free Loan For Business)

Pakistan Poverty Alleviation Authority Agriculture Loan

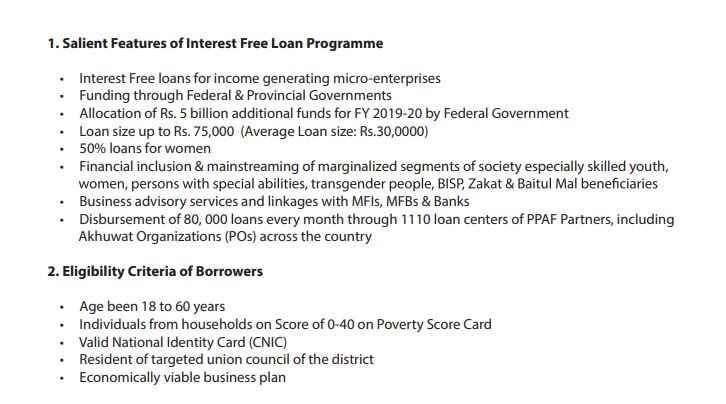

PPAF Interest-Free Agriculture Loan Requirements

Requirements for Pakistan Poverty Alleviation Fund (PPAF) Interest-Free Agriculture Loan:

| Particulars | Details |

|---|---|

| Salient Features of Interest-Free Loan Programme: | Features Details |

| Loan Purpose: | Interest loans for income-generating micro-enterprises |

| Funding Sources: | Funding through Federal & Provincial Governments |

| Additional Funds Allocation: | Allocation of Rs. 5 billion in additional funds for FY 2019-20 by the Federal Government |

| Loan Size: | Up to Rs. 75,000 (Average Loan size: Rs.30,0000) |

| Target Demographic: | 50% loans for women |

| Financial Inclusion Focus: | Financial inclusion & mainstreaming of marginalized segments of society, especially skilled youth, women, persons with special abilities, transgender people, BISP, Zakat & Baitul Mal beneficiaries |

| Support Services: | Business advisory services and linkages with MFIs, MFBs & Banks |

| Loan Disbursement: | Disbursement of 80,000 loans every month through 1110 loan centers of PPAF Partners, including Akhuwat Organizations (POs) across the country |

| Eligibility Criteria of Borrowers: | |

| Age: | 18 to 60 years |

| Household Poverty Score: | Individuals from households with a Score of 0-40 on the Poverty Score Card |

| Identification: | Valid National Identity Card (CNIC) |

| Residency: | A resident of the targeted union council of the district |

| Business Plan: | Economically viable business plan |

Recommended Reading: 10 Lakh Loan For Business By Government | Insaf Rozgar Scheme

PPAF Interest-Free Loan Application Process

To apply for the PPAF Interest-Free Loan, follow the application process outlined below:

- Locate the Nearest Partner Organization: Visit the PPAF website at https://www.ppaf.org.pk/NPGI to access information about the nearest partner organization in your area. The website provides details regarding the partner organizations and their addresses across 110 districts in Pakistan.

- Visit the Nearest Partner Organization: Once you have identified the nearest partner organization, visit their office in person.

- Obtain the agricultural loan Application: Request the agricultural loan application form from the partner organization.

- Complete the Application Form: Fill out the loan application form with all the required information. Ensure that you provide accurate details regarding your personal information.

- Prepare Required Documents: Gather all the necessary documents as specified by the partner organization.

- Submit the Application: Once you have filled out the application form and assembled all the required documents, submit your application package to the partner organization.

- Await Approval: After submitting your application, the partner organization will review your application, assess your eligibility, and make a decision regarding the approval of your loan.

Recommended Reading: DAP Subsidy Registration Online 2024 | DAP Subsidy Check Online

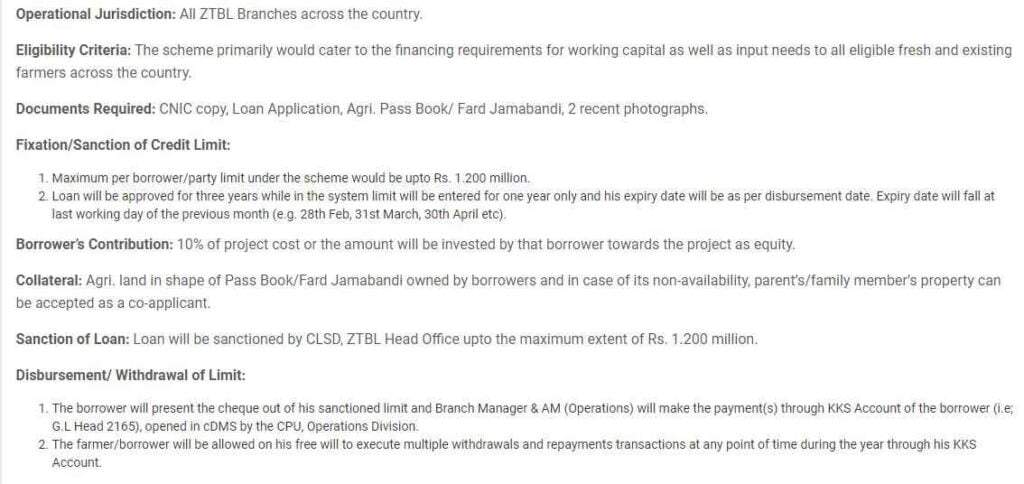

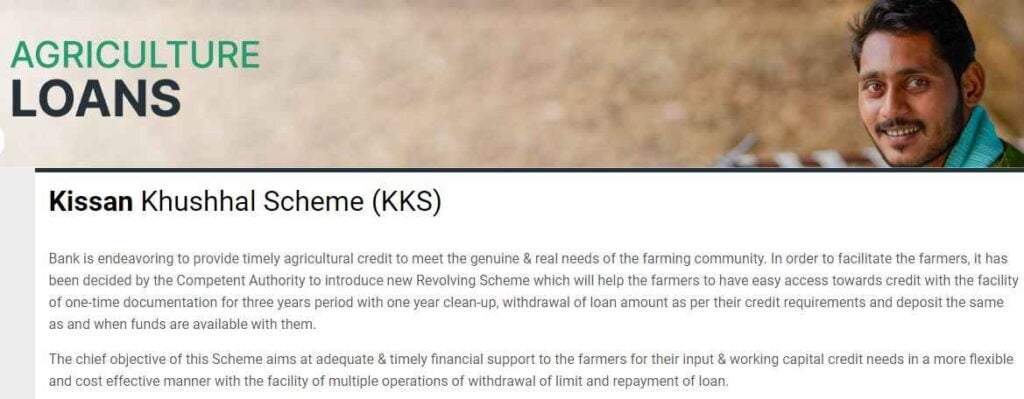

Zarai Taraqiati Bank (ZTBL) Agriculture Loan

Zarai Taraqiati Bank Agriculture Loan Requirements

Requirements for Zarai Taraqiati Bank (ZTBL) Agriculture Loan:

| Particulars | Details |

|---|---|

| Operational Jurisdiction: | All ZTBL Branches across the country |

| Eligibility Criteria: | The scheme primarily caters to the financing requirements for working capital and input needs of all eligible fresh and existing farmers across the country |

| Documents Required: | CNIC copy, Loan Application, Agri. Pass Book/Fard Jamabandi, 2 recent photographs |

| Fixation/Sanction of Credit Limit: | |

| 1. Maximum per borrower/party limit under the scheme would be up to Rs. 1.200 million | |

| 2. The loan will be approved for three years while in the system limit will be entered for one year only, with the expiry date as per the disbursement date. The expiry date will fall on the last working day of the previous month (e.g., 28th Feb, 31st March, 30th April, etc.) | |

| Borrower’s Contribution: | 10% of project cost or the amount invested by the borrower towards the project as equity |

| Guaranteer: | Agri. land in the form of Pass Book/Fard Jamabandi owned by borrowers. If unavailable, the parent’s/family member’s property can be accepted as collateral with a co-applicant. |

| Sanction of Loan: | The loan will be sanctioned by CLSD, ZTBL Head Office up to a maximum extent of Rs. 1.200 million |

| Disbursement/Withdrawal of Limit: | |

| 1. The Loan holder will present a cheque out of his sanctioned limit, and the Branch Manager & AM (Operations) will make the payment(s) through the KKS Account of the borrower (i.e., G.L Head 2165), opened in CDMS by the CPU, Operations Division. | |

| 2. The farmer/borrower will be allowed to execute multiple withdrawals and repayment transactions at any time during the year through his KKS Account. |

How To Apply For Zarai Taraqiati Bank Agriculture Loan

To apply for the Zarai Taraqiati Bank (ZTBL) agricultural loan, follow the steps outlined below:

- Locate the Nearest ZTBL Branch: Visit the official website of ZTBL at https://ztbl.com.pk/ztbl-islamic-banking-branches/ to find the nearest ZTBL branch.

- Visit the Nearest ZTBL Branch: Once you have identified the nearest ZTBL branch, visit the branch in person.

- Obtain the agricultural loan Application Form: Request the agricultural loan application form from the ZTBL branch.

- Complete the Application Form: Fill out the loan application form with all the required information.

- Prepare Required Documents: Gather all the necessary documents as mentioned by ZTBL.

- Submit the Application: After completing the application form and assembling all the required documents, submit your application package to the ZTBL branch.

- Application Status Notification: ZTBL will review your application and inform you of the acceptance or rejection of your loan application.

National Bank of Pakistan (NBP) Agriculture Loan

NBP Agriculture Loan Requirements

Requirements for National Bank of Pakistan (NBP) Agriculture Loan:

- All Farmers (Land Owner/Tenants): The NBP Agriculture Loan is available to all farmers, whether they are landowners or tenants. Both categories of farmers are eligible to apply for the loan, providing opportunities for a wide range of individuals involved in agricultural activities.

- Financing Against Different Assets: NBP allows financing against various assets, including Pass Book, Property (residential/commercial), Gold (at least 21 karats), and Paper Security. Farmers can utilize these assets as collateral or security to obtain an agriculture loan from NBP.

- Duly Filled Application Form: Applicants need to complete the loan application form provided by NBP.

- Two CNIC Copies: Applicants are required to provide two copies of their Computerized National Identity Card (CNIC).

- Two Fresh Photographs: Along with the application form and CNIC copies, applicants must submit two recent passport-sized photographs.

Recommended Reading: Prime Minister Solar Panel Scheme 2024 | Solar Tubewell Scheme

How To Apply For NBP Agriculture Loan

To apply for the NBP Agriculture Loan, follow the step-by-step process below:

- Locate the Nearest NBP Branch: Visit the official NBP App or website of NBP at https://www.nbp.com.pk/BRNTWRK/DomesticBrLocator.aspx to find the nearest NBP branch.

- Visit the Nearest NBP Branch: Once you have identified the nearest NBP branch, visit the branch in person.

- Obtain the Loan Application Form: Request the NBP Agriculture Loan application form from the branch.

- Complete the Application Form: Fill out the loan application form with all the required information.

- Prepare Required Documents: Gather all the necessary documents as mentioned by NBP.

- Submit the Application: After completing the application form and assembling all the required documents, submit your application package to the NBP branch.

- Application Status and Approval: NBP will review your application and assess your eligibility for the agriculture loan.

Recommended Reading: Solar Tubewell Scheme Pakistan | Solar Tubewell+Bio Gas Plant

Pros And Cons Of Agriculture Loan In Pakistan

Pros Of Agriculture Loan In Pakistan

- Financial Support for Farmers: Agriculture loans provide much-needed financial support to farmers in Pakistan.

- Expansion of Agricultural Operations: With access to agriculture loans, farmers can expand their agricultural operations.

- Technological Advancements: Agriculture loans facilitate the adoption of modern technology and equipment in farming practices.

- Rural Development and Poverty Alleviation: By providing agriculture loans, financial institutions contribute to rural development and poverty alleviation.

Cons Of Agriculture Loan In Pakistan

- Risk of Indebtedness: One of the major concerns associated with agriculture loans is the risk of indebtedness. Farmers may struggle to repay the loan if they face unfavorable weather conditions, market fluctuations, or crop failure.

- Dependency on External Factors: Agriculture is heavily dependent on external factors such as weather conditions, pests, and diseases.

- Lack of Access for Small-Scale Farmers: Access to agriculture loans may be limited for small-scale farmers, who often face difficulty in meeting the collateral requirements and fulfilling the eligibility criteria set by financial institutions.

- High-Interest Rates: Agriculture loans in Pakistan may come with high interest rates, making it challenging for farmers to bear the cost of borrowing.

Recommended Reading: PM Youth Laptop Scheme 2024 Online Apply | Shahbaz Sharif Laptop Scheme

FAQs | Agriculture Loan In Pakistan

Who is eligible to apply for an agriculture loan in Pakistan?

Farmers, including landowners and tenants, are eligible to apply for agriculture loans in Pakistan.

What are the common requirements for an agriculture loan in Pakistan?

The common requirements include a valid CNIC, ownership or tenancy of agricultural land, residency in the targeted area/union council, and age between 18 and 60 years.

What are the sources of agriculture loans in Pakistan?

The sources of agriculture loans in Pakistan include the Prime Minister Youth Business and Agriculture Loan Scheme, Akhuwat Foundation, Pakistan Poverty Alleviation Authority, Zarai Taraqiati Bank (ZTBL), and the National Bank of Pakistan (NBP).

How can I apply for an agriculture loan from the Prime Minister Youth Loan Scheme?

You can apply for an agriculture loan through the Prime Minister Youth Official Portal or by visiting the nearest bank branch. Fill out the loan application form and submit it along with the required documents.

What assets can be used as collateral for an agriculture loan from the National Bank of Pakistan (NBP)?

NBP allows financing against assets such as Pass Book, Property (residential/commercial), Gold (at least 21 karats), and Paper Security.

Can small-scale farmers access agriculture loans in Pakistan?

Access to agriculture loans may be limited for small-scale farmers due to collateral requirements and eligibility criteria set by financial institutions. However, some loan schemes and organizations specifically target small-scale farmers to promote inclusivity.

What are the potential risks associated with agriculture loans in Pakistan?

The potential risks include the risk of indebtedness if farmers are unable to repay the loan due to factors such as adverse weather conditions or crop failure. Other risks include dependency on external factors and high interest rates.

How can I locate the nearest branch of a specific bank for applying for an agriculture loan?

You can visit the official website of the respective bank, such as Zarai Taraqiati Bank (ZTBL) or National Bank of Pakistan (NBP), to find a branch locator tool or contact their customer service for assistance in locating the nearest branch.

How long does it take to get approval for an agriculture loan in Pakistan?

The time taken for approval may vary depending on the loan scheme and the specific bank or organization. It is advisable to inquire about the expected timeframe during the application process.

How can I get more information about agriculture loans in Pakistan?

You can visit the official websites of the relevant loan schemes, banks, or organizations mentioned above, or contact their customer service for more detailed information regarding agriculture loans in Pakistan.

What is the loan limit for the Prime Minister Youth Loan Scheme in Pakistan?

The Prime Minister Youth Loan Scheme is divided into three tiers:

Tier 1 with a loan limit of PKR 5 Lakhs, Tier 2 with a limit of PKR 15 Lakhs, and Tier 3 with a limit of PKR 75 Lakhs.

Are interest-free agriculture loans available in Pakistan?

Yes, there are interest-free agriculture loan options available in Pakistan, such as the Prime Minister Youth Loan Scheme and certain loan programs offered by organizations like the Akhuwat Foundation.

What documents are typically required to apply for an agriculture loan in Pakistan?

The required documents usually include a valid CNIC, land ownership or tenancy documents, proof of residency, loan application form, passbook/fard Jamabandi, recent photographs, and any additional documents specified by the lending institution.

Are there any specific age requirements for obtaining an agriculture loan in Pakistan?

The age requirement may vary depending on the loan scheme or organization. However, the Prime Minister Youth Loan Scheme typically requires applicants to be between 21 and 45 years old.

Can women farmers apply for agriculture loans in Pakistan?

Yes, women farmers are eligible to apply for agriculture loans in Pakistan. In fact, some loan schemes and organizations actively encourage women’s participation in agriculture and provide specific support and incentives for them.

Can I use an agriculture loan to invest in livestock or poultry farming?

Depending on the loan scheme or organization, agriculture loans can be utilized for various purposes within the agricultural sector, including livestock or poultry farming. However, it is advisable to check the specific loan guidelines and restrictions.

Can I get an agriculture loan if I do not have collateral to offer?

Some loan schemes and organizations may have alternative options for collateral, such as utilizing agricultural land or other assets as security. Additionally, certain loans, like interest-free loans, may have relaxed collateral requirements.

Can I apply for an agriculture loan if I am a tenant farmer and do not own the land?

Yes, tenant farmers are generally eligible to apply for agriculture loans in Pakistan. They can provide the necessary tenancy agreement and other relevant documents as proof of their farming activities.

Are there any specific requirements for obtaining an agriculture loan from the Pakistan Poverty Alleviation Authority (PPAF)?

The specific requirements for agriculture loans from PPAF may vary. However, common requirements include age between 18 and 60 years, a valid CNIC, ownership or tenancy of agricultural land, and residency in the targeted union council or area.

Can I use the agriculture loan to purchase agricultural machinery or equipment?

Yes, agriculture loans can be utilized for purchasing agricultural machinery, equipment, or tools that enhance farming operations and productivity.

What happens if I am unable to repay the agriculture loan on time?

Failure to repay the loan on time can lead to penalties, increased interest charges, and potentially legal actions by the lending institution.

Communicate with the lender and discuss any difficulties faced in meeting the repayment obligations to explore possible solutions.

Can I prepay the agriculture loan before the scheduled repayment period?

Prepayment options may vary depending on the loan scheme and the specific terms and conditions set by the lending institution.

Inquire about prepayment options (from the lender) and any associated charges or conditions before availing of the loan.

What is the loan amount range for NBP’s agriculture loan?

NBP offers agriculture loans starting from 10 lakh rupees and upward, depending on the specific loan program.

What is the maximum loan amount available through the PM Youth Business and Agriculture Loan program?

Borrowers can access loans of up to 7.5 million PKR under this scheme.

Who is eligible to apply for the PM Youth Business and Agriculture Loan program?

Eligibility criteria include age, business category, and other factors. Interested applicants should visit the program’s official website for detailed requirements.

Recommended Reading: Gilgit-Baltistan Agriculture Loan Scheme | ZTBL Loan Scheme 2024

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment