The Khud Mukhtar Program is launched to meet the needs of married couples falling within the age range of 18 to 29 years, with the added criteria of having at least one child under the age of five years.

Under this program govt. would provide up to Rs. 7,200 for starting a small business to young couples who are already registered with the Benazir Income Support Program (BISP).

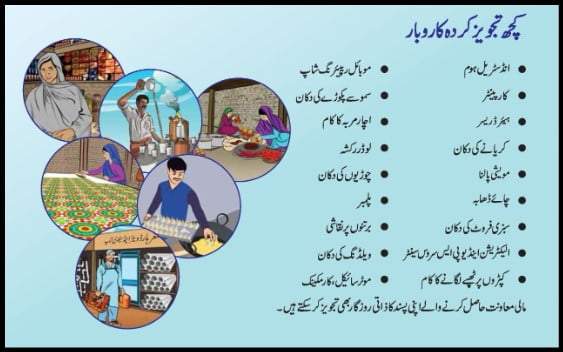

The list Of Recommended Businesses Under The Khud Mukhtar Program is as follows:

- Delivery Services

- Garment Stitching

- Tea Topa (Tea Stall)

- Vegetable and Fruit Shop

- Pot Polishing

- Hairdressing Services

- Bicycle Repairing Shop

- Industrial Home

- Electrician and UPS Service Center

- Plumbing Services

- Bangles Shop

- Animal Husbandry

- Shidakari (Farming)

- Melting Shop

- Pickle Square

- Carpentry Services

- Grocery Store

- Samosa Pakoda Shop

- Beauty Parlor

Recommended Reading: 10 Lakh Loan For Business By Government | Insaf Rozgar Scheme

Interest-Free Business Loan In Pakistan | Khud Mukhtar Program

Table Of Contents

- Interest-Free Business Loan In Pakistan | Khud Mukhtar Program

- What Is The Khud Mukhtar Program?

What Is The Khud Mukhtar Program?

The Khud Mukhtar Program is a component of the Benazir Income Support Program, specifically designed as a Self-Employment Program.

The following is a brief overview of the Khud Mukhtar Scheme:

| Aspect | Details |

|---|---|

| Program Name | Khud Mukhtar Program |

| Program Type | Component of the Benazir Income Support Program (BISP) |

| Target Audience | Married couples aged 18 to 29 years with at least one child under the age of five years |

| Purpose | Self-employment program aimed at economic empowerment |

| Program Features | Provides comprehensive business training, necessary skills, and knowledge |

| Purpose Of Loans | Offers financial assistance to start small businesses |

| Recommended Businesses | Delivery Services, Garment Stitching, Tea Stall, Vegetable and Fruit Shop, Pot Polishing, Hairdressing, Bicycle Repair, Industrial Home, Electrician Services, Plumbing, Bangles Shop, Animal Husbandry, Farming, Melting Shop, Pickle Square, Carpentry, Grocery Store, Snack Shop, Beauty Parlor |

| Eligibility Criteria | – Age: 18 to 29 years |

| – Presence of a child under five years | |

| – Enrollment in Benazir Income Support Program (BISP) | |

| – Permanent residency in the program area | |

| Maximum Loan Limits | Ranges from 72,000 to 150,000 rupees |

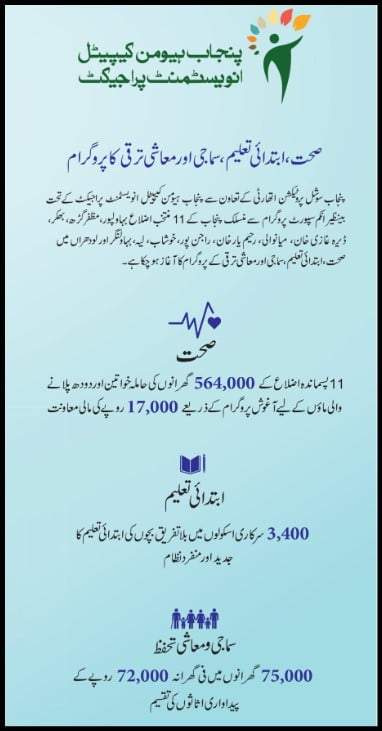

| Number of Beneficiary Households | 75,000 households |

Benefits Of Khud Mukhtar Program

| Feature | Description |

|---|---|

| Local Verification | BISP household eligibility verified by locals. |

| Housewife Nomination | The housewife nominates an individual for personal employment. |

| Business Training | Training sessions on business running and management for better planning and profitability. |

| Supervised Asset Purchase | Asset purchases are supervised by a local committee. |

| Household Investment Planning | Investment planning is supported by a social organizer at the household level. |

| Technical Support | Operational support from IRM and NRSP. |

| Financial Assistance | Financial assistance is strictly used for relevant personal employment. |

| Identification through NSER | Eligible households are identified through the Professional Social Insurance Registry (NSER). |

| Tehsil-Level Registration | Door-to-door registration is conducted at the tehsil level. |

| ‘Give and Give’ Philosophy | Success in personal business leads to more hard work and community benefit. |

| Youth Employment | Focus on providing employment opportunities for youth. |

Recommended Reading: DAP Subsidy Registration Online | DAP Subsidy Check Online

Eligibility Criteria To Get A Business Loan Under The Khud Mukhtar Program

Here are the eligibility criteria to get a business loan under the Khud Mukhtar Program:

- Age Criteria: To be eligible for the Khud Mukhtar Program must fall within the age range of 18 to 29 years.

- Presence of a Child Under Five Years: Eligible households must have at least one child under the age of five years.

- Enrollment in Benazir Income Support Program: Families seeking participation in the Khud Mukhtar Program should already be registered with the Benazir Income Support Program.

- Permanent Residency in Program Area: Prospective beneficiaries must be permanent residents of the specific area covered by the Khud Mukhtar Program.

Maximum Loan Limits Offered Under Khud Mukhtar Program

- Loan Range: The Benazir Income Support Program provides loans within the range of 72 thousand to 1.5 lakh rupees. This flexible loan range allows for customization based on individual business plans and requirements.

- Number of Households Benefiting: The program extends its financial support to a substantial number of households, with loans being offered to 75,000 beneficiary households. This broad reach ensures that a significant portion of the target demographic receives financial assistance.

List Of Recommended Businesses Under The Khud Mukhtar Program

The list Of Recommended Businesses Under The Khud Mukhtar Program is as follows:

ChatGPT

| Business Idea | Description |

|---|---|

| Delivery Services: | Starting a delivery service to meet local demand for transportation of goods. |

| Garment Stitching: | Using stitching skills to meet the local demand for clothing and textiles. |

| Tea Topa (Tea Stall): | Setting up a small tea stall to serve the community. |

| Vegetable and Fruit Shop: | Establishing a shop selling fresh produce to the local community. |

| Pot Polishing: | Offering pot polishing services, a traditional craft with a market niche. |

| Hairdressing Services: | Starting a business offering grooming and personal care services. |

| Bicycle Repairing Shop: | Providing repair services for bicycles, a common mode of transport. |

| Industrial Home: | Home-based industrial activities that align with local skills and resources. |

| Electrician and UPS Service Center: | Offering electrical and UPS repair services to meet ongoing community needs. |

| Plumbing Services: | Starting a plumbing business to address essential infrastructure needs. |

| Bangles Shop: | Establishing a shop selling traditional accessories and cultural items. |

| Animal Husbandry: | Engaging in small-scale livestock farming for sustainable income. |

| Shidakari (Farming): | Promoting agricultural entrepreneurship to boost local food production. |

| Melting Shop: | Operating a shop focused on metalworking and related industries. |

| Pickle Square: | Establishing a business selling homemade and locally produced pickles. |

| Carpentry Services: | Offering carpentry services to meet local construction and furniture needs. |

| Grocery Store: | Starting a store to sell essential food and household items. |

| Samosa Pakoda Shop: | Operating a shop selling popular snack items like samosas and pakodas. |

| Beauty Parlor: | Setting up a beauty parlor to provide beauty and wellness services to the local community. |

Recommended Reading: Solar Tubewell Scheme Pakistan | Solar Tubewell+Bio Gas Plant

How To Apply For The Khud Mukhtar Program? | Khud Mukhtar Program Registration

The following is a step-by-step process to apply for the Khud Mukhtar Program:

Step No.1: Business Training Preparation

The initial step in applying for the Khud Mukhtar Program involves undergoing business training to acquire the necessary skills for effective business management.

Step No.2: Investment Consultation

Participants engage in consultation sessions to plan their investments wisely.

Step No.3: Registration at Tehsil Office

For the Khud Mukhtar Program, applicants need to register at the Tehsil Office.

Step No.4: Application Submission

The application process for the Self-Employment Program is managed by the Punjab Social Protection Authority.

Khud Mukhtar Program Helpline Number

- Official Website: https://phcip.com.pk/

- Phone: 1221

- Email: info@phcip.com.pk

- Address: 78-79, D-Block, New Muslim Town, Wahdat Road, Lahore

Recommended Reading: How To Get Interest-Free Agriculture Loan In Pakistan {5-75Lakh}

FAQs | Khud Mukhtar Program

What is the age range for eligibility in the Khud Mukhtar Program?

The Khud Mukhtar Program targets individuals falling within the age range of 18 to 29 years. It is designed specifically for married couples, providing a focused approach to address the economic needs of this demographic.

How does the program aim to uplift families from poverty, and what is the primary goal of the Khud Mukhtar initiative?

The overarching goal of the Khud Mukhtar Program is to uplift participating families from poverty. It achieves this by offering financial support through loans provided within the range of 72 thousand to 1.5 lakh rupees, reaching 75,000 beneficiary households.

What is the significance of the Pak Rano system within the Khud Mukhtar Program, and how does it validate the competence of individuals?

The Khud Mukhtar Program validates the competence of individuals through the Pak Rano system, adding credibility and recognition within the local community. This acknowledgment aims to enhance the confidence and competence of program participants.

What are some of the practical implementation issues addressed by the Khud Mukhtar Program, and how does it ensure transparency in its processes?

The self-empowerment program actively acknowledges and addresses practical implementation issues, including those related to the Independent Review Mechanism (IRM) and the National Social Responsibility Program (NSRP). This commitment ensures transparency and accountability in the program’s operations.

How does the Khud Mukhtar Program recommend diversifying economic opportunities, and what businesses are suggested for participants?

The Khud Mukhtar Program recommends a diverse range of businesses to participants, including delivery services, garment stitching, tea stalls, vegetable and fruit shops, and various other ventures. These recommendations aim to provide participants with a spectrum of choices catering to different skills and market demands.

What is the process for applying to the Khud Mukhtar Program, and what are the key steps involved in becoming a participant?

The application process involves initial business training, investment consultation, registration at Tehsil Qisa, and submission through the Punjab Social Protection Authority in collaboration with IRN and NRSP. These steps streamline the application process and ensure a comprehensive review of potential beneficiaries.

How does the Khud Mukhtar Program contribute to financial inclusion, and what is the maximum loan limit provided to eligible households?

The program extends financial support through loans within the range of 72 thousand to 1.5 lakh rupees, benefiting a substantial number of households 75,000 to be precise.

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment. We would love to answer all of your queries. Thanks for reading!

Add a Comment