Are you a freelancer in Pakistan struggling with delayed payments, high transaction fees, and security concerns?

Between delayed payments, high transaction fees, and the risk of fraud, managing your finances can be a challenge.

Fortunately, Meezan Bank offers a specialized Freelancer Account designed to make banking easier for freelancers.

In this article, we will guide you through the process of opening a Meezan Bank Freelancer Account including:

- Meezan Bank Freelancer Account Document Requirements (In Case Of Freelancer)

- Document Required For Meezan Bank Account

- Meezan Bank Freelancer Account Key Features

- Meezan Freelancer Account Opening Online (Via Digital Channel)

- Meezan Freelancer Account Opening (Via Branch)

- Meezan Bank Freelancer Account Pros And Cons

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

Meezan Bank Freelancer Account Opening

Table of Contents

Recommended Reading: JS Bank Freelancer Account | JS Bank Account Opening Online

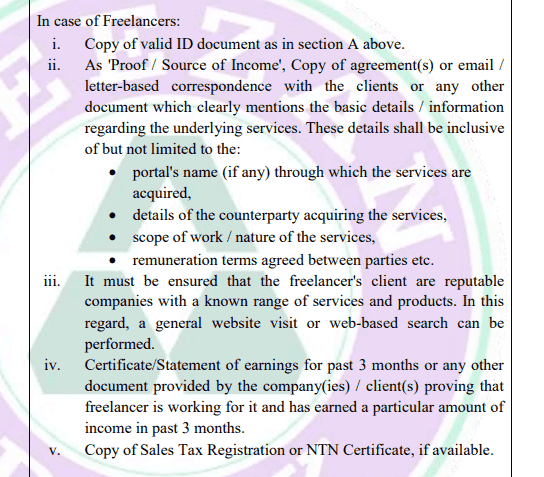

Meezan Bank Freelancer Account Document Requirements (In Case Of Freelancer)

Meezan Bank offers a Freelancer Account designed specifically for freelancers and self-employed individuals who work online.

The account allows you to receive international payments from clients and customers in USD, GBP, and EUR, and convert them into PKR at competitive exchange rates.

| Required Documents | Details |

|---|---|

| Copy of valid ID document: | Provide a copy of a valid identification document as mentioned in section A above. |

| Proof/Source of Income: | Submit copies of agreements, email/letter correspondence with clients, or other documents detailing the services provided. Include information such as portal name, client details, scope of work, and remuneration terms. |

| Verification of Client Reputation: | Ensure clients are reputable companies by conducting a general website visit or web-based search. |

| Certificate/Statement of earnings for the past 3 months: | Furnish a certificate or statement of earnings for the past three months from the company or client, demonstrating income earned during this period. |

| Copy of Sales Tax Registration or NTN Certificate (if any): | Include a copy of the Sales Tax Registration or NTN Certificate if available. |

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

Document Required For Meezan Bank Account

| S. No. | Type of Customer | Documents Required |

|---|---|---|

| 1. | Individual: | General Requirements: |

| 1. Copy of applicable identity (ID) document. | ||

| – For Pakistani citizens: Valid CNIC/SNIC/NICOP/SNICOP. | ||

| – For foreign citizens: Valid Passport. | ||

| – For persons of Pakistani origin: Valid POC. | ||

| – For registered Aliens in Pakistan: Valid ARC. | ||

| – For Afghan refugees residing in Pakistan: Valid POR Card. | ||

| – For Pakistani citizens who are minors: Valid Form-B/Juvenile Card. | ||

| 2. Proof of profession / Source of income. (Indicative list of such documents is enclosed at the end of this table.) |

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Meezan Bank Freelancer Account Key Features

Here are some key features of the Meezan Bank Freelancer Account along with brief descriptions:

| Features | Details |

|---|---|

| Free Chequebook & Pay Orders: | Receive a chequebook and pay orders at no additional cost. |

| Free Online Branch Banking: | Access banking services online without any charges. |

| Free Internet & Mobile Banking App: | Use the bank’s internet and mobile banking app for free. |

| Inward Foreign Remittance: | Receive money from abroad directly into your account. |

| Attractive Conversion Rates: | Benefit from competitive rates when converting currencies. |

| Opportunity to Invest in COIIs: | Receive a checkbook and pay orders at no additional cost. |

| 50% waiver on Processing Fee: | Enjoy a 50% discount on processing fees for Car Ijarah, Apni Bike, and Meezan Solar. |

| Exclusive Pricing on Consumer Products: | Get exclusive discounted pricing on Car Ijarah, Apni Bike, and Meezan Solar products. |

| Collaboration with PAFLA: | Partnered with Pakistan Freelancers Association for mutual benefits. |

| Tax Facilitation Services: | Avail tax facilitation services through Befiler at discounted rates. |

| NTN Registration Fee: | One-time fee for NTN registration with FBR for non-business individuals. |

| Income Tax Return: | One-time fee for annual income tax return filing for both non-business and business individuals. |

| Monthly Sales Tax Filing: | Fee for monthly sales tax filing based on income type and turnover. |

| Other Local Business Income: | Fee for annual turnover-based income tax filing for individuals. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

Meezan Freelancer Account Opening Online (Via Digital Channel)

Meezan Bank allows you to open a Freelancer Account online through their website. Here are the steps to open a Meezan Bank Freelancer Account online:

| Step | Description |

|---|---|

| Download the app: | Install the Meezan Bank app on your phone. |

| Verify your mobile number: | Confirm your mobile number by entering the OTP received. |

| Input your ID details: | Enter your ID details (CNIC, etc.) for verification purposes. |

| Provide your occupation details: | Input your occupation details for identification purposes. |

| Perform biometric verification: | Complete biometric verification using your device’s sensors. |

| Capture a Live Selfie: | Take a live selfie to confirm your identity. |

| Review and submit: | Review all the information provided and submit your application. |

| Welcome to Meezan Bank: | Upon successful submission, you’re all set to start banking with Meezan Bank! |

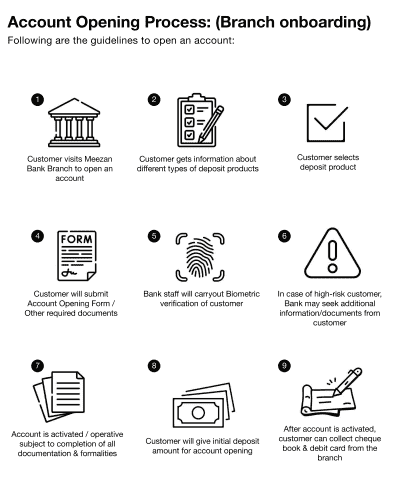

Meezan Freelancer Account Opening (Via Branch)

Be sure to read the terms and conditions of the Freelancer Account carefully before opening an account.

| Step | Details |

|---|---|

| Customer visits branch: | Visit a Meezan Bank branch to open an account. |

| Submit Account Opening Form: | Provide the required Account Opening Form and other necessary documents to the bank staff. |

| Information about deposit products: | Receive information about different types of deposit products available. |

| Biometric verification: | Undergo biometric verification conducted by bank staff. |

| Select deposit product: | Choose the desired deposit product for your account. |

| Initial deposit: | Provide the initial deposit amount required for account opening. |

| Additional information/documents: | If deemed necessary, provide additional information or documents requested by the bank. |

| Account Activation: | Once all documentation and formalities are completed, the account will be activated. |

| Collect cheque book & debit card: | After activation, collect your checkbook and debit card from the branch. |

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

Meezan Bank Freelancer Account Pros And Cons

Meezan Bank Freelancer Account Pros

- Dedicated account for freelancers: Meezan Bank’s Freelancer Account is designed specifically to cater to the needs of freelancers, making it easier for them to manage their finances.

- Low fees: The account has minimal transaction fees, which makes it affordable for freelancers, especially those just starting.

- Islamic banking principles: Meezan Bank operates on Islamic banking principles, which means that the bank’s financial products and services are compliant with Shariah law.

- Easy account opening: Opening a Meezan Bank Freelancer Account is an easy process that can be completed online or at a bank branch.

Meezan Bank Freelancer Account Cons

- Limited accessibility: Meezan Bank has a limited number of branches and ATMs compared to other banks in Pakistan, which may be inconvenient for some freelancers.

- Restrictions on non-halal income: As an Islamic bank, Meezan Bank does not allow its customers to earn income from non-halal sources. T

- No international transactions: The Freelancer Account does not support international transactions, which can be a drawback for freelancers who work with clients outside of Pakistan.

- No interest: Meezan Bank does not pay interest on its accounts due to its adherence to Islamic banking principles, which may be a con for freelancers who are looking for interest-earning accounts.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

FAQs | Meezan Bank Freelancer Account

Who is eligible for a Meezan Bank Freelancer Account?

Any individual who is a resident of Pakistan and earns income through freelance work is eligible for a Meezan Bank Freelancer Account.

What documents are required to open a Meezan Bank Freelancer Account?

You will need to provide a valid CNIC or passport, proof of freelance income, and other basic information such as your address and contact details.

Can I use my Meezan Bank Freelancer Account for international transactions?

Yes, the Freelancer Account fully supports international transactions.

What are the fees for using a Meezan Bank Freelancer Account?

The account has minimal transaction fees, which vary based on the type of transaction.

How can I access my Meezan Bank Freelancer Account?

You can access your account online through Meezan Bank’s website or mobile app. You can also visit a bank branch or use an ATM to perform transactions.

Can I link my Meezan Bank Freelancer Account to a payment gateway?

Yes, Meezan Bank allows freelancers to link their Freelancer accounts to various payment gateways, including PayPal and Skrill.

Is the Freelancer Account compliant with Islamic banking principles?

Yes, Meezan Bank operates on Islamic banking principles, and the Freelancer Account is designed to be compliant with Shariah law.

How long does it take to open a Meezan Bank Freelancer Account?

The account opening process can be completed online or at a bank branch and typically takes a few days to a week, depending on the verification process.

Can I link my Meezan Bank Freelancer Account to my PayPal account?

Yes, you can link your Freelancer Account to your PayPal account to receive payments from international clients.

Are there any minimum balance requirements for the Meezan Bank Freelancer Account?

Meezan Bank may have certain minimum balance requirements for the Freelancer Account. It is advisable to check with the bank for the specific minimum balance requirements applicable to the account.

What happens if I no longer work as a freelancer? Can I convert my account to a different type?

If you transition to a different profession or employment status, you can consult with Meezan Bank to explore the possibility of converting your Freelancer Account to a different type of personal account that better suits your new financial needs.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment