In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving us with no other option than the Instant Cash Loan.

Fortunately, the digital era has revolutionized the lending industry, offering convenient and efficient solutions to obtain Instant Cash loans in 1 Hour Without Documents In Pakistan.

Gone are the days of lengthy paperwork and endless queues, as several loan apps and non-profit institutions have emerged, providing quick access to funds within minutes.

From welfare organizations dedicated to assisting the underprivileged to government institutions aiming to support the masses, this article explores instant cash loan providers without documents.

Which Apps give instant Cash Loans?

The following Apps give instant Cash Loans in Pakistan:

- Muawin Loan App

- Paisayaar Loan App

- Barwaqt Loan App

Which Foundations give instant Cash Loans?

These Foundations give instant Cash Loans In Pakistan:

- Ihsaas Trust

- PPAF

- Alkhidmat

- Akhuwat

Recommended Reading: How To Get Marriage Loan In Pakistan | Qarz-e-Hasna For Marriage {10K-5Lakh}

Instant Cash Loan | Instant Cash Loan Without Documents

Table of Contents

- Instant Cash Loan | Instant Cash Loan Without Documents

- Ihsaas Trust Urgent Cash Loan In Pakistan

- PPAF Interest-Free Loan Apply Online

Recommended Reading: 10 Pakistani Banks Offering Personal Loan For Wedding | Marriage Loans

What is an Instant Cash Loan In 1 Hour?

Getting an instant cash loan in Pakistan can seem like an easy process, but with the right steps, you can get money right away and be on your way to solving all your short-term money problems.

we will explore different opportunities for getting instant cash loans, exploring their benefits, eligibility criteria, and the ease with which everyone can get an urgent cash loan in just five minutes.

Here is our guide to follow to help you get an Instant Cash Loan In 1 Hour Without Documents In Pakistan today by applying online through mobile, anytime, anywhere in Pakistan.

Recommended Reading: Instant Cash Loan In 5 Minutes | Urgent Loan 10,000-50,000

Ihsaas Trust Urgent Cash Loan In Pakistan

Ihsaas Trust Urgent Cash Loan Eligibility Criteria

Eligibility Criteria for Ihsaas Trust Urgent Cash Loan:

- Gender: The applicant must be male. This criterion is set to ensure that the loan program is accessible to a specific demographic, potentially targeting individuals who may face unique financial challenges.

- Age Range: The applicant must fall within the age range of 22 to 55 years. This requirement is likely established to ensure that individuals who are in their prime working years and possess a certain level of financial stability are eligible for the loan.

- NADRA CNIC Holder: The applicant must possess a valid National Database and Registration Authority (NADRA) Computerized National Identity Card (CNIC). This criterion ensures that the applicant has legal identification and is a recognized citizen of Pakistan.

- Business Experience: The applicant should have a minimum of 1-year business experience. This criterion is likely in place to assess the applicant’s understanding of entrepreneurial activities and their ability to handle financial responsibilities associated with running a business.

- References: The applicant must provide references from three individuals. These references serve as a means for the organization to gather information about the applicant’s character, reliability, and financial track record. It helps establish trust and validate the applicant’s credibility.

- Residency: The applicant should have been a resident in the specific area for the past 2 years. This criterion ensures that the loan is primarily accessible to individuals who have established a stable presence within the community. It demonstrates a commitment to the locality and indicates the likelihood of repayment.

Recommended Reading: 5 Lakh Loan Without Interest In Pakistan Online Apply (10-75Lakh) {Interest-free}

How To Get An Instant Cash Loan From Ihsaas Trust

Step-by-Step Guide to Get an Instant Cash Loan from Ihsaas Trust by Filling out the Online Application Form:

- Step 1: Visit the Official Website Go to the official website of Ihsaas Trust by typing in the URL: https://ihsaas.pk/start-your-micro-business/#application-form. Ensure that you are on the correct website to access the application form.

- Step 2: Locate the Application Form Navigate through the website and look for the “Application Form” section. It may be labeled as “Apply Now” or something similar. Read any instructions or guidelines provided to familiarize yourself with the application process.

- Step 3: Start the Application Click on the provided link or button to start the application process. The link should lead you to the online application form.

- Step 4: Personal Information Fill in the required personal information accurately. This may include your full name, date of birth, gender, contact details (such as phone number and email address), and residential address. Make sure to double-check the information for accuracy before proceeding to the next step.

- Step 5: NADRA CNIC Details Enter your NADRA CNIC details, including your CNIC number and its expiry date. Ensure that the information matches your official identification documents.

- Step 6: Employment and Business Information Provide details about your employment status and business, as required in the application form. This may include information about your current job, business name, type of business, years of operation, and annual income. Fill in all the relevant details accurately.

- Step 7: References Enter the required information for the three references, as specified in the application form. This may include their full names, contact numbers, and their relationship to you. Make sure to provide accurate and reliable references.

- Step 8: Loan Amount and Purpose Indicate the desired loan amount and specify the purpose for which you require the loan. Be clear and concise in explaining the purpose of the loan to assist the organization in assessing your eligibility.

- Step 9: Review and Submit Review all the information you have provided in the application form. Make any necessary corrections or adjustments before submitting the form. Ensure that all the required fields are filled out correctly.

- Step 10: Submit the Application Once you are confident that the application form is complete and accurate, submit it by clicking the “Submit” or “Apply Now” button on the form. Wait for the confirmation message or notification that your application has been successfully submitted.

- Step 11: Await Response After submitting the application, patiently await a response from Ihsaas Trust. They will review your application and may contact you for any additional information or documentation if required. The response time may vary, so be prepared to wait for their decision.

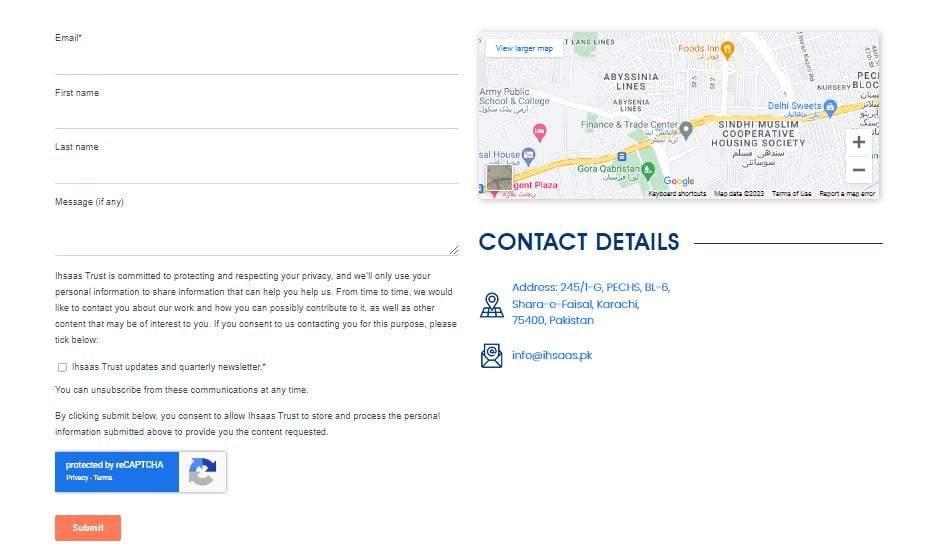

Ihsaas Trust Contact Details

Website: Visit the official website of Ihsaas Trust at https://ihsaas.pk/ to learn more about their programs and services.

Email: For any inquiries or communication, you can reach out to Ihsaas Trust via email at info@ihsaas.pk. Feel free to send your questions or concerns to this email address.

Address: The physical address of Ihsaas Trust is 245/1-G, PECHS, BL-6, Shara-e-Faisal, Karachi, 75400, Pakistan. If you prefer to contact them through traditional mail or visit their office in person, you can use this address.

Recommended Reading: 5 Ways To Get Business Loans For Women In Pakistan

PPAF Interest-Free Loan Apply Online

PPAF Interest-Free Loan Eligibility

- Age: The applicant must be between 18 to 60 years old. This age range ensures that both young adults and individuals in their productive working years have the opportunity to access interest-free loans. It aims to support individuals in different stages of their lives.

- Valid National Identity Card (CNIC): The applicant must possess a valid National Identity Card (CNIC). This criterion ensures that the applicant is a recognized citizen of Pakistan and has proper identification.

- Residency: The applicant should be a resident of the targeted union council of the district. This criterion ensures that the loan program is specifically designed to benefit individuals within a particular geographic area. It aims to provide financial support and opportunities to individuals residing in specific communities.

- Business Plan: The applicant is required to have a business plan. This plan outlines the applicant’s proposed business activities and serves as a means to assess the viability and sustainability of the venture. It helps determine the loan amount and ensures that the funds are used for productive purposes.

- Loan Size: The loan size can range from a minimum of Rs. 30,000 to a maximum of Rs. 75,000. The specific loan amount granted may depend on the applicant’s business plan, financial needs, and the assessment of their repayment capacity. This range allows for flexibility in accommodating various business requirements.

- 50% Loans for Women: The loan program reserves 50% of the loans for women. This provision aims to empower and support women entrepreneurs by ensuring they have equal access to financial resources. It promotes gender equality and encourages women’s participation in economic activities.

Recommended Reading: 10 Easy Ways To Get A Loan In Pakistan | Urgent Loan In Pakistan

www.ppaf.org.pk loan online apply | PPAF Application Form

Step-by-Step Guide: How to Apply for PPAF Loan

- Visit the official website of PPAF at https://www.ppaf.org.pk/NPGI to find the nearest PPAF-affiliated center where you can apply for a loan. Look for a section on the website that provides information about locating the nearest center.

- Identify the nearest PPAF-affiliated center based on the information provided on the website. Make a note of the center’s address, contact number, and any other relevant details you may need.

- Once you have the details of the nearest center, visit the center in person.

- At the PPAF center, approach the designated personnel or officer responsible for loan applications. Inform them about your intention to apply for a loan and express your interest in participating in the PPAF loan program.

- Request an application form from the personnel or officer. They will provide you with the necessary paperwork required to apply for the loan.

- Carefully fill out the application form with accurate and complete information. Make sure to provide all the required details, such as personal information, contact information, financial information, and business details if applicable.

- Attach any supporting documents as specified in the application form. This may include copies of your National Identity Card (CNIC), proof of residence, business plan (if required), and any other relevant documents mentioned in the form.

- Once you have completed the application form and attached the necessary documents, submit it to the personnel or officer at the center.

- After submitting the application, inquire about the next steps and the timeline for the loan processing. The personnel or officer will provide you with information on the evaluation process, verification, and any subsequent actions required from your end.

- Be patient and await a response from PPAF regarding the status of your loan application.

PPAF Helpline

Phone: You can contact the PPAF Helpline by dialing +92 (51) 8439450-79 and 0300-5016957. This phone number allows you to reach out to their helpline for assistance, inquiries, or any related support you may require.

UAN: The PPAF Helpline can also be reached through the UAN at (+92-51) 111-000-102. The UAN serves as a centralized contact number for easy access to various services and information.

Fax No.: If you prefer to communicate via fax, you can send documents or correspondence to the PPAF Helpline using the following fax number: (+92-51) 2234343-79.

Email: For any general inquiries, questions, or information, you can contact the PPAF Helpline via email at info@ppaf.org.pk. Feel free to send an email to this address with your queries or concerns, and the PPAF team will respond to you accordingly.

Recommended Reading: Instant Loan In Pakistan | Fori Loan In Pakistan (10K-30K) {Updated}

All You Need To Know About Instant Cash Loan (Q&A)

Which app gives a loan in 5 minutes in Pakistan?

Barwaqt is an app in Pakistan where you can get a loan quickly. You just need to download the app, sign up, and apply for a loan. Within 5 minutes, you can have the money in your account. It’s super fast and easy to use. Barwaqt offers loans ranging from PKR 1,500 to PKR 25,000. The repayment period for these loans is between a few weeks to a few months. As for the interest rate, it can be as low as 0.067% per day and can go up to 0.56% per day, depending on the loan amount and repayment duration.

How can I get an Instant Loan from the Easypaisa app?

Simply dial *786# from your mobile.

Select Get a loan

then reply with 1

Reply with a preselected amount of instant loan. (or you can enter the desired amount within the maximum limit)

The loan would be transferred within a few seconds.

What documents are required to apply for an instant cash loan?

Many lenders offer document-free loan options, requiring minimal paperwork. However, some may ask for basic documents such as a copy of the CNIC and proof of income. Students may have specific documentation requirements, such as proof of enrollment.

Instant Cash Loan FAQs

Top 3 apps to get urgent money in Pakistan?

A list of the top 3 apps to get urgent money in Pakistan is given below

ForiLoan

AiCash

Barwaqt

What is the maximum amount of Cash Loans offered by the TEZ App?

TEZ App offers Rs.10,000/- cash loans instantly. It also provides opportunities oh health and life insurance policies to all Pakistani Residents.

How can I apply for an instant cash loan from Ihsaas Trust?

To apply for an instant cash loan from Ihsaas Trust, you can visit their official website at https://ihsaas.pk/start-your-micro-business/#application-form and fill out the online application form.

Make sure to meet the eligibility criteria and provide accurate information in the application.

What are the eligibility criteria for an instant cash loan from Ihsaas Trust?

The eligibility criteria for an instant cash loan from Ihsaas Trust include being a male between the ages of 22 to 55, holding a valid NADRA CNIC, having at least 1-year business experience with 3 references, and being a resident in the area for the past 2 years.

What is the loan amount offered by Ihsaas Trust for instant cash loans?

The loan amount offered by Ihsaas Trust for instant cash loans can vary, but the minimum loan size is Rs.30,000, and the maximum loan size is Rs.75,000. The loan amount may be determined based on the individual’s business plan and financial needs.

Are women eligible for instant cash loans from Ihsaas Trust?

Yes, women are eligible for instant cash loans from Ihsaas Trust. The organization encourages gender equality and reserves a portion of the loans for women, providing them with equal opportunities to access financial resources.

What are the eligibility criteria for PPAF’s instant cash loan?

The eligibility criteria for PPAF’s instant cash loan include being between 18 to 60 years old, possessing a valid National Identity Card (CNIC), being a resident of the targeted union council of the district, having a business plan (if applicable), and meeting the specified loan size requirements.

Additionally, 50% of the loans are reserved for women applicants.

How much loan amount can I receive through PPAF’s instant cash loan?

The loan size for PPAF’s instant cash loan program can range from a minimum of Rs. 30,000 to a maximum of Rs. 75,000.

The specific loan amount granted depends on various factors, including your business plan, financial needs, and repayment capacity.

What documents are required to apply for PPAF’s instant cash loan?

The required documents may include a copy of your National Identity Card (CNIC), proof of residence, and a business plan (if applicable).

It is recommended to inquire at the PPAF-affiliated center regarding the specific documents needed for your loan application.

Recommended Reading: 5 Lakh Loan Without Interest In Pakistan Online Apply (10-75Lakh) {Interest-free}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment