Marriage is considered one of the most significant events in Pakistani culture, marked by grand celebrations and traditions.

However, with the increasing costs of wedding arrangements and expenses, it has become difficult for many families to bear the financial burden of a wedding.

This is where the concept of Qarz-e-Hasna, a type of interest-free loan option in Pakistan to help families fund their children’s weddings.

In this article, we will explore how to get a marriage loan in Pakistan through Qarz-e-Hasna schemes, ranging from Rs.10K-5Lakh, we will also cover the necessary steps to apply for and secure a marriage loan.

Recommended Reading: 5 Ways To Get Business Loans For Women In Pakistan

How To Get A Marriage Loan In Pakistan | Interest-Free Loan For Marriage In Pakistan

Table Of Contents

- How To Get A Marriage Loan In Pakistan | Interest-Free Loan For Marriage In Pakistan

- Marriage Loan via Government Schemes

- Marriage Loan via NGOs And Charitable Organizations

- Marriage Loan via Banks

Recommended Reading: Instant Cash Loan In 1 Hour Without Documents In Pakistan {10K-50K}

How Much Marriage Loan One Can Get In Pakistan?

The amount of marriage loan that one can get in Pakistan may vary depending on various factors such as the lending institution, the borrower’s creditworthiness, income level, and the specific terms and conditions of the loan.

Generally, marriage loans in Pakistan can range from a few hundred thousand rupees to several million rupees.

Marriage Loan via Government Schemes

Marriage Grant Scheme by Pakistan Bait-ul-Mal

The primary goal is to offer financial aid to unmarried women or their guardians who are unable to afford wedding expenses.

Eligibility Criteria

- Approval Process: District Bait-ul-Maal Committees assess the eligibility of applicants based on their area of permanent residence.

- Income Level: Applicants must be living below the poverty line, with priority given to widows and orphans.

- Financial Limit: Assistance is capped at PKR 100,000 per family per daughter.

- Eligibility for Married Daughters: Daughters whose Nikkah (marriage contract) has already taken place can receive assistance upon presenting their Nikkah Nama within 90 days.

- Priority Groups: Widows, guardians of orphan girls, and poor parents receive priority.

How to Apply

- Online Application: Submit an application via bm.punjab.gov.pk.

- Mobile Application: Download the mobile app from Google Play Store to apply.

- In-Person Application: Visit the local Bait-ul-Maal Committee office, where staff will assist in submitting the application on the applicant’s behalf.

Summary Table:

| Aspect | Details |

|---|---|

| Eligibility Criteria | – Assessed by District Bait-ul-Maal Committees |

| – Below poverty line, with preference for widows and orphans | |

| – Maximum assistance of PKR 100,000 per family per daughter | |

| – Assistance for daughters married within the last 90 days upon presenting Nikkah Nama | |

| – Priority to widows, orphan guardians, and poor parents | |

| Application Methods | – Online via bm.punjab.gov.pk |

| – Mobile app from Google Play Store | |

| – In-person at local Bait-ul-Maal Committee office |

Recommended Reading: Instant Cash Loan In 5 Minutes | Urgent Loan 10,000-50,000

Marriage Loan via NGOs And Charitable Organizations

Thardeep Foundation Marriage Loan

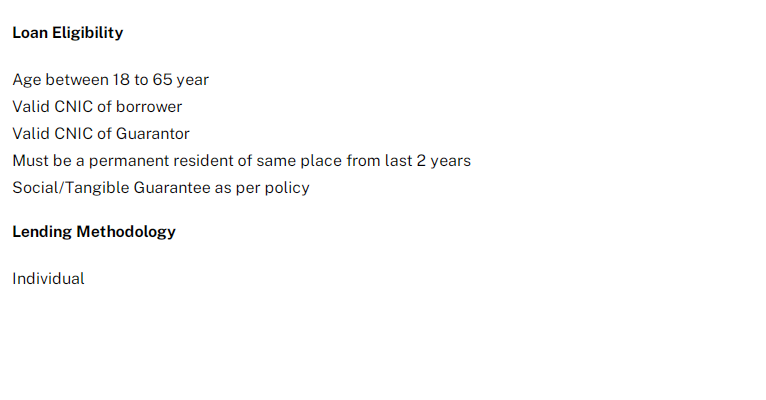

Eligibility Criteria

To be eligible for a marriage loan from Thardeep Foundation, applicants must meet the following criteria:

- Age Requirement: The borrower must be between 18 to 65 years old, ensuring that they fall within the specified age range set by Thardeep Foundation.

- Valid CNIC (Computerized National Identity Card): The borrower is required to possess a valid CNIC as proof of their identity and citizenship in Pakistan. This ensures that the borrower’s identity can be verified.

- Valid CNIC of Guarantor: In addition to the borrower’s CNIC, a valid CNIC of a guarantor is also required. The guarantor serves as a form of security for the loan, ensuring that there is a reliable individual who can vouch for the borrower’s repayment capacity.

- Residency Requirement: The borrower must be a permanent resident of the same place for at least the past two years. This criterion ensures that the borrower has a stable residential status and helps establish their connection to the community.

- Social/Tangible Guarantee: Thardeep Foundation may require a social or tangible guarantee as per their policy. This guarantee serves as an additional security measure for the loan, ensuring that there are measures in place to mitigate the risk associated with lending.

It is important for applicants to meet all these eligibility criteria to be considered for a marriage loan from Thardeep Foundation.

Adhering to these requirements increases the likelihood of a successful loan application and subsequent approval.

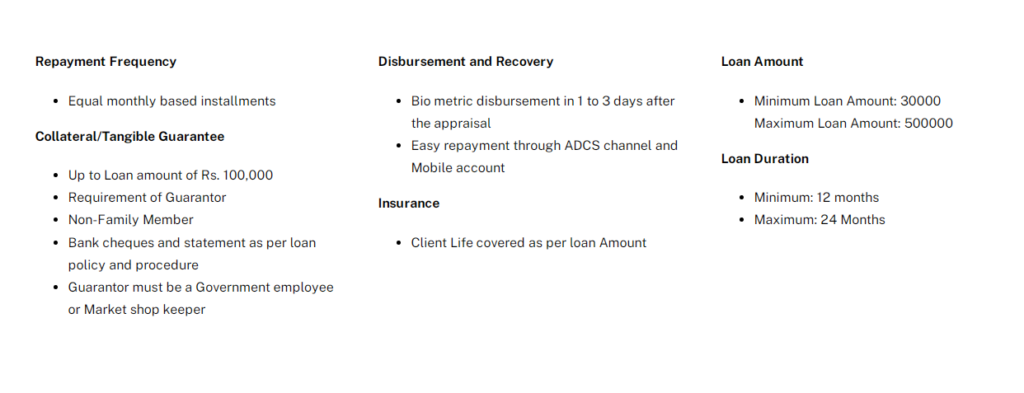

Thardeep Foundation Marriage Loan Key Features

Thardeep Foundation offers marriage loans with the following key features:

- Loan Amount: Thardeep Foundation provides marriage loans ranging from a minimum amount of 30,000 rupees to a maximum amount of 500,000 rupees. Borrowers can choose an amount within this range based on their specific wedding-related financial requirements.

- Loan Tenure: The loan tenure for Thardeep Foundation marriage loans ranges from a minimum of 12 months (1 year) to a maximum of 24 months (2 years). Borrowers can select a repayment period that suits their financial capabilities and preferences.

- Quick Disbursement: Thardeep Foundation ensures swift loan disbursement through a biometric system. Upon successful appraisal and approval, borrowers can expect the loan amount to be disbursed within 1 to 3 days, providing timely access to the funds needed for wedding expenses.

- Equal Monthly Installments: Repayment of the marriage loan is structured in the form of equal monthly installments. Borrowers are required to make regular payments, typically every month, ensuring a systematic approach to loan repayment.

- Guarantor Requirement: Thardeep Foundation may require a guarantor for the marriage loan. A guarantor acts as a security measure, assuring loan repayment in case the borrower faces difficulties in meeting the loan obligations. The guarantor should meet the specified criteria set by the Thardeep Foundation.

Recommended Reading: How To Get 5 Lakh Loan Without Interest In Pakistan (In 7 Days) {Updated}

Thardeep Foundation Marriage Loan Application Process

To apply for a marriage loan from Thardeep Foundation, you can follow the application process outlined below by visiting the nearest Thardeep Foundation Center:

- Visit the Website: Start by visiting the official website of the Thardeep Foundation at www.tmf.org.pk. This website serves as a valuable resource to gather information about the organization, its services, and the locations of its centers.

- Locate the Nearest Center: On the website, navigate to the “Locations” or “Branches” section to find the nearest Thardeep Foundation Center. This will provide you with the address and contact details of the center closest to your location. Note down the center’s information for future reference.

- Visit the Center: Once you have identified the nearest Thardeep Foundation Center, physically visit the center during its operational hours. It is advisable to call ahead or check their website for any specific requirements or appointment scheduling, if applicable.

- Meet with a Representative: At the Thardeep Foundation Center, you will have the opportunity to meet with a representative who will guide you through the application process. Inform them that you are interested in applying for a marriage loan, and they will provide you with the necessary forms and documentation requirements.

- Complete the Application: Fill out the loan application form provided by the representative. Make sure to provide accurate and complete information regarding your details, income, expenses, and the loan amount you are seeking. Attach all the required documents as specified by Thardeep Foundation, such as your CNIC, the guarantor’s CNIC, and any other supporting documentation.

- Submit the Application: Once you have completed the application form and gathered all the necessary documents, submit them to the representative at the center. Ensure that you have copies of all the submitted documents for your reference.

- Application Processing: Thardeep Foundation will review your application and conduct an appraisal to assess your eligibility and creditworthiness. This may involve verification of the provided information and documents.

- Loan Approval and Disbursement: If your application is approved, you will be notified by Thardeep Foundation. Upon receiving approval, the loan amount will be disbursed through a biometric system within 1 to 3 days, as per the organization’s procedures.

Akhuwat Foundation Mariage Loan

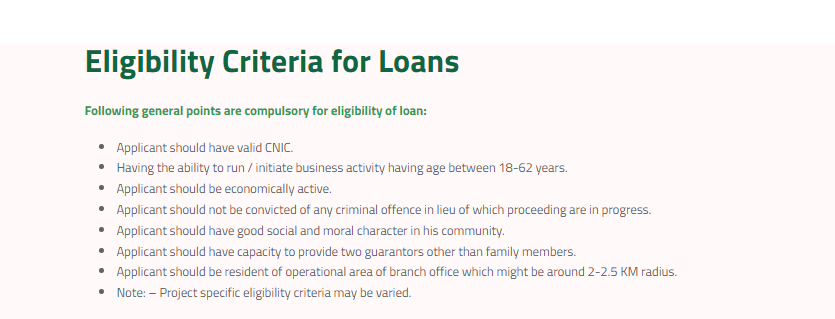

Eligibility Criteria

To be eligible for a marriage loan from the Akhuwat Foundation, applicants must meet the following eligibility criteria:

- Age Requirement: The minimum age requirement for a marriage loan from the Akhuwat Foundation is 18 years old. Applicants must be at least 18 years of age to be considered for the loan.

- Valid CNIC (Computerized National Identity Card): Applicants are required to possess a valid CNIC as proof of their identity and citizenship in Pakistan. The CNIC serves as a vital document for the loan application process.

- Guarantors: Akhuwat Foundation typically requires two guarantors for marriage loan applications. The guarantors act as a form of security, ensuring that the borrower’s repayment obligations are met. The guarantors should meet the specified criteria set by the Akhuwat Foundation.

- Residency Radius: Applicants must reside within a radius of 2 to 2.5 kilometers from the nearest Akhuwat Foundation branch. This criterion ensures that the borrowers live close to the organization’s branch, facilitating easier communication and loan management.

- Income and Financial Assessment: While specific income requirements may vary, the Akhuwat Foundation evaluates the financial capabilities of applicants to determine their repayment capacity. This assessment may include analyzing income statements, expenses, and any existing financial obligations.

- Commitment to Interest-Free Loans: As Akhuwat Foundation provides interest-free loans, applicants must commit to the organization’s principle of interest-free borrowing and repay the loan without any interest charges.

Akhuwat Marriage Loan Key Features

Akhuwat Foundation offers marriage loans with the following key features:

- Loan Amount: Akhuwat Foundation provides marriage loans ranging from a minimum amount of 10,000 rupees to a maximum amount of 50,000 rupees. Borrowers can select an amount within this range based on their specific wedding-related financial needs.

- Loan Tenure: The loan tenure for Akhuwat Foundation marriage loans ranges from a minimum of 12 months (1 year) to a maximum of 24 months (2 years). Borrowers can choose a repayment period that suits their financial capabilities and preferences.

- Application Fee: To process the loan application, Akhuwat Foundation charges a nominal application fee of 200 rupees. This fee covers administrative costs associated with the application process.

- Profit Rate: Akhuwat Foundation operates on the principle of providing interest-free loans. Hence, their marriage loans have an interest rate of 0%, ensuring borrowers are not charged with interest.

- Mutual Support Fund Contribution: While optional, Akhuwat Foundation allows borrowers to contribute to the Mutual Support Fund, which is 1% of the loan amount. This contribution helps sustain the organization’s efforts in providing interest-free loans to individuals in need.

Recommended Reading: 10 Pakistani Banks Offering Personal Loan For Wedding | Marriage Loan

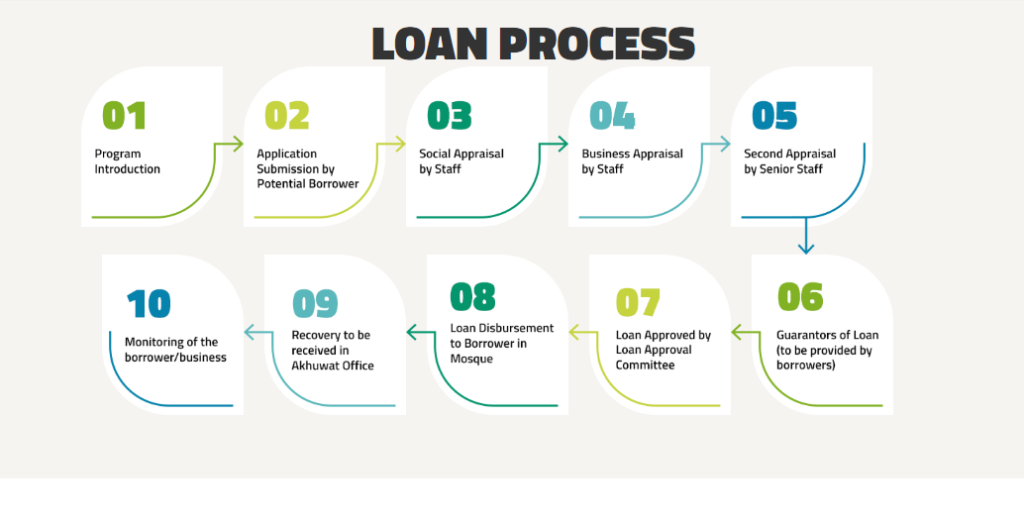

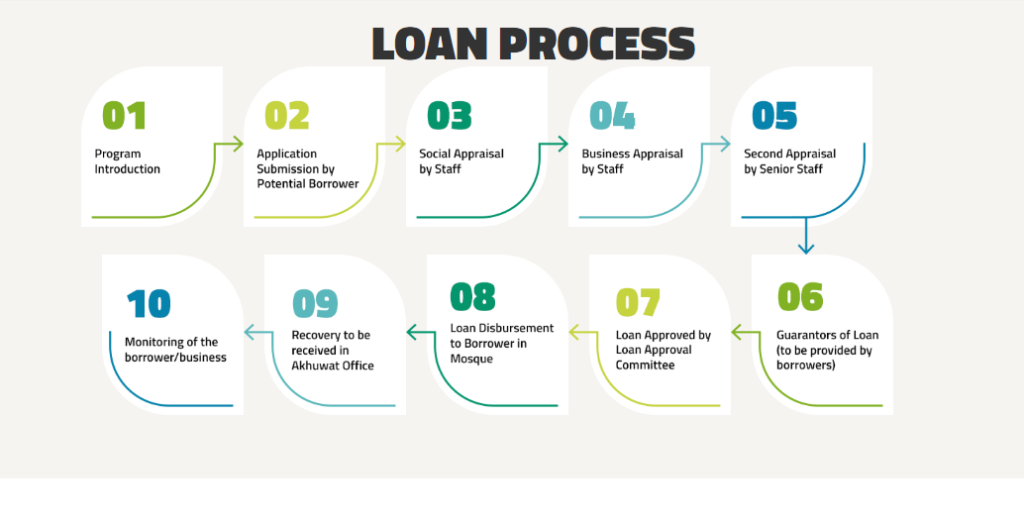

Akhuwat Foundation Loan Application Process

To apply for a marriage loan from the Akhuwat Foundation, follow the application process below by visiting the nearest Akhuwat Foundation Center:

- Visit the Website: Start by visiting the official website of the Akhuwat Foundation at https://akhuwat.org.pk/branch-network. This website provides valuable information about the organization, its services, and the locations of its centers.

- Find the Nearest Center: On the website, navigate to the “Branch Network” section to access the list of Akhuwat Foundation Centers. Locate the center nearest to your location by referring to the provided addresses and contact details. Note down the center’s information for your convenience.

- Visit the Center: Once you have identified the nearest Akhuwat Foundation Center, personally visit the center during its operating hours. It is advisable to call ahead or check their website for any specific requirements or appointment scheduling, if applicable.

- Meet with a Representative: At the Akhuwat Foundation Center, you will have the opportunity to meet with a representative who will guide you through the loan application process. Inform them that you are interested in applying for a marriage loan, and they will provide you with the necessary forms and documentation requirements.

- Complete the Application: Fill out the loan application form provided by the representative. Ensure that you provide accurate and complete information regarding your personal details, income, expenses, and the desired loan amount. Attach all the required documents as specified by Akhuwat Foundation, such as your CNIC, proof of residence, and any other supporting documentation.

- Submit the Application: Once you have completed the application form and gathered all the necessary documents, submit them to the representative at the center. Keep copies of all the submitted documents for your records.

- Application Processing: Akhuwat Foundation will review your application and assess your eligibility for the marriage loan. This may involve verification of the provided information and documents. The processing time may vary, and you will be informed of the outcome of your application.

- Loan Disbursement: If your application is approved, Akhuwat Foundation will disburse the loan amount to you as per their procedures. The loan disbursement process typically involves signing the necessary documents and receiving the funds.

Marriage Loan via Banks

Faysal Bank Islamic Loan Without Interest In Pakistan

Introduction to Faysal Islami Personal Financing

- Faysal Islami offers a Shariah-compliant, Riba-free personal financing solution.

- Based on the Tawarruq Islamic structure, this facility provides affordable and hassle-free financing.

- Suitable for various needs such as education, wedding, and hospitalization.

Key Features

- Islamic Mode: Tawarruq

- Financing Amount: From PKR 50,000 to PKR 4,000,000

- Tenure: 1 to 4 years

- Profit Type: Fixed

- Repayment Plan: Fixed and equal monthly installments

- Processing Fee: Non-refundable, PKR 7,000 + FED (Fixed)

- Charity for Late Payment: PKR 500 per missed installment

Eligibility Criteria

- Age:

- Minimum: 18 years

- Maximum: 70 years (at maturity of financing)

- Senior Citizens: No maximum age limit

- Income Requirements:

- Salaried Individuals: Minimum PKR 50,000

- Self-Employed Individuals: Minimum PKR 100,000

How to Apply

- Visit Branches: Apply in-person at Faysal Bank branches.

- Contact Center: Call 021 111 06 06 06.

- SMS: Send “IPF City Name CNIC” to 9181.

Summary Table:

| Aspect | Details |

|---|---|

| Islamic Mode | Tawarruq |

| Financing Amount | PKR 50,000 – PKR 4,000,000 |

| Tenure | 1 – 4 years |

| Profit Type | Fixed |

| Repayment Plan | Fixed and equal monthly installments |

| Processing Fee | Non-refundable, PKR 7,000 + FED (Fixed) |

| Late Payment Charity | PKR 500 per missed installment |

| Age Requirement | 18 – 70 years (No max age for Senior Citizens) |

| Income Requirement | – Salaried: Min PKR 50,000 |

| – Self-Employed: Min PKR 100,000 | |

| Application Methods | – Visit branches |

| – Call Contact Center at 021 111 06 06 06 | |

| – SMS “IPF City Name CNIC” to 9181 |

Bank Alfalah Rida Marriage Plan

The Rida Marriage Plan from Bank Alfalah Limited, in collaboration with Jubilee Life Insurance Company Limited, provides a structured savings solution to help families prepare financially for their child’s wedding.

Features and Benefits

- Secure Investment: All premiums invested are fully secured, ensuring the policyholder receives the accumulated cash values at the plan’s maturity.

- Flexibility: The plan allows the policyholder to choose the sum assured according to their needs.

- Sum Assured Calculation: The sum assured is determined by multiplying the annual basic premium by a cover multiple (ranging from 5 to 15). For example, an annual premium of PKR 100,000 with a cover multiple of 10 results in a sum assured of PKR 1,000,000.

- Maximum Sum Assured: Up to PKR 3,000,000.

- Death Benefit: If the life assured passes away during the plan’s term, the beneficiaries receive the higher of the sum assured or the policy’s cash value.

- Investment Options: Contributions can be invested in one of four funds (Meesaq, Managed, Capital Growth, or Yaqeen Growth Fund), managed by expert investment managers for optimized returns and manageable risk.

Payment Frequency and Minimum Contributions

| Frequency | Minimum Contribution |

|---|---|

| Yearly | Rs. 36,000 |

| Half Yearly | Rs. 18,000 |

| Quarterly | Rs. 9,000 |

| Monthly | Rs. 5,000 |

Eligibility

Available to Bank Alfalah Limited customers aged 18 to 65 years.

Term of Plan

| Minimum Term | Maximum Term |

|---|---|

| 10 years | 57 years |

Summary Table:

| Aspect | Details |

|---|---|

| Secure Investment | Premiums fully secured; receive accumulated cash values at maturity |

| Flexibility | Choose sum assured based on needs; cover multiple ranges from 5 to 15 |

| Sum Assured Calculation | Example: Annual premium PKR 100,000 x cover multiple 10 = PKR 1,000,000 |

| Maximum Sum Assured | PKR 3,000,000 |

| Death Benefit | Higher of sum assured or cash value if life assured dies during term |

| Investment Options | Meesaq, Managed, Capital Growth, or Yaqeen Growth Fund |

| Payment Frequency | Yearly (Rs. 36,000), Half Yearly (Rs. 18,000), Quarterly (Rs. 9,000), Monthly (Rs. 5,000) |

| Eligibility | Customers aged 18 to 65 years |

| Term of Plan | Minimum 10 years, maximum 57 years |

| Claims Process | Contact Jubilee Life at (021) 111-111-554; submit required documents, additional documents for specific cases |

Marriage Loan Application Tips

When applying for a marriage loan in Pakistan, it’s essential to follow certain tips to increase the chances of a successful application.

Here are some key tips to consider:

- Research and Compare: Before applying for a marriage loan, research different lenders, including banks, microfinance institutions, and welfare organizations. Compare their interest rates, loan terms, eligibility criteria, and application procedures. This will help you choose the most suitable option that aligns with your financial needs and capabilities.

- Determine Loan Requirements: Understand the specific requirements for the marriage loan you intend to apply for. This includes gathering necessary documents such as identification proofs, income statements, wedding-related estimates, and any other documents requested by the lender. Having all the required documents in order will streamline the application process.

- Assess Eligibility: Each lender will have specific eligibility criteria for their marriage loans. Evaluate your own eligibility based on factors such as income, credit history, employment status, and any additional requirements set by the lender. This will help you determine if you meet the necessary criteria before submitting an application.

- Calculate Loan Affordability: Determine the loan amount you need for your wedding expenses and assess your ability to repay it. Consider your income, existing financial obligations, and monthly budget. Ensure that the loan installment will be comfortably affordable within your financial means to avoid any difficulties in repayment.

- Prepare a Strong Application: Fill out the loan application form accurately and completely. Provide all the required information and supporting documents as requested by the lender. Be transparent and honest in your application to build trust with the lender.

- Maintain Good Credit: If you have an existing credit history, make sure it is in good standing. Pay your bills on time, avoid defaults, and keep your credit utilization within reasonable limits. A good credit history can positively impact your loan application and increase the chances of approval.

- Seek Guidance: If you are unsure about the application process or have any queries, don’t hesitate to seek guidance from the lender’s customer service representatives or financial advisors. They can provide valuable insights and clarify any doubts you may have.

By following these tips, you can enhance your chances of a successful marriage loan application in Pakistan.

Remember to carefully review the terms and conditions of the loan before accepting any offer, and ensure that you have a clear repayment plan in place to manage the loan responsibly.

Recommended Reading: Cash Loan In Pakistan | Emergency Cash Loan In Pakistan (5-15Lakhs)

Marriage Loan In Pakistan | FAQs

How can I get a marriage loan in Pakistan?

We can get marriage loans from banks as well as from some organizations like Akhuwat etc.

Can a housewife apply for a loan?

Yes, housewives can get loans by submitting gold, property, or fixed deposits in their names to get an instant loan for business or their personal needs.

Can I get a Loan in Pakistan being Unemployed?

Yes, but banks and lending institutions ensure that how their loan amount would be repaid by a lending person. i.e. you should present a proper business plan for repayment while applying the loan amount.

What is the minimum and maximum loan amount offered by the Akhuwat Foundation for marriage loans?

Akhuwat Foundation offers marriage loans ranging from a minimum amount of 10,000 rupees to a maximum amount of 50,000 rupees.

What is the loan tenure for marriage loans from the Thardeep Foundation?

The loan tenure for Thardeep Foundation marriage loans ranges from a minimum of 12 months (1 year) to a maximum of 24 months (2 years).

Are there any application fees for marriage loans from the Akhuwat Foundation?

Yes, the Akhuwat Foundation charges a nominal application fee of 200 rupees to process the loan application.

Does the Akhuwat Foundation charge any interest on their marriage loans?

No, the Akhuwat Foundation operates on the principle of providing interest-free loans, ensuring that borrowers are not burdened with interest charges.

How many guarantors are required for a marriage loan from the Akhuwat Foundation?

Akhuwat Foundation typically requires two guarantors for marriage loan applications. The guarantors act as a form of security for the loan.

What are the eligibility criteria for Thardeep Foundation marriage loans?

The eligibility criteria for Thardeep Foundation marriage loans include age between 18 to 65 years, possession of a valid CNIC, residency at the same place for the last 2 years, and the provision of a social/tangible guarantee as per policy.

Where can I find the nearest Akhuwat Foundation Center to apply for a marriage loan?

You can find the nearest Akhuwat Foundation Center by visiting their official website at https://akhuwat.org.pk/branch-network. The website provides a list of centers along with their addresses and contact details.

How long does it take for the loan amount to be disbursed by the Thardeep Foundation after the appraisal?

Thardeep Foundation disburses the loan amount through a biometric system within 1 to 3 days after the appraisal.

Is the contribution to the Mutual Support Fund mandatory for Akhuwat Foundation marriage loans?

No, the contribution to the Mutual Support Fund is optional for Akhuwat Foundation marriage loans. Borrowers may choose to contribute 1% of the loan amount to support the organization’s efforts.

Can I apply for a marriage loan if I reside outside the specified radius of the nearest Akhuwat Foundation Branch?

To be eligible for a loan, Akhuwat Foundation requires applicants to reside within a radius of 2 to 2.5 kilometers from the nearest branch. Applicants residing outside this range may need to explore alternative loan options.

Are self-employed individuals eligible for marriage loans?

Yes, both Akhuwat Foundation and Thardeep Foundation consider applications from self-employed individuals, as long as they meet the other eligibility criteria and can demonstrate their income and financial stability through appropriate documentation.

Can I apply for a marriage loan if I already have existing loans?

Having existing loans may affect your eligibility and loan approval. It is advisable to consult with the respective organizations to understand their policies regarding borrowers with existing loan obligations.

What happens if I am unable to repay the marriage loan on time?

It is essential to communicate any difficulties in loan repayment to the respective organizations as soon as possible. They may provide options for rescheduling payments or offer assistance to ensure timely repayment.

What documents are generally required for a marriage loan application?

Commonly required documents include a valid CNIC, proof of residence, income verification (such as bank statements or salary slips), and any other documents specified by the organizations during the application process.

Recommended Reading: Instant Loan In Pakistan | Fori Loan In Pakistan (10K-30K) {Updated}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment