There are hundreds of Instant loan apps on Google Play Store that provide digital loan services in Pakistan and other countries around the world.

Unfortunately, most of these “Fori Loan Apps” are spammy and fake. Because personal data provided by the applicant is not secure, in these cases, SECP took action and banned many loan apps, and some loan apps were approved.

SECP Approved Instant Loan Apps:

- Barwaqt Loan App

- Paisayaar Loan App

- Abhi- Your Salary Now Loan App

- SmartQarza Loan App

Some Organizations give Interest-Free Instant loans in Pakistan:

- Akuwat Foundation

- Alkhidmat Foundation

- Kashf Foundation

- Saylani Welfare Trust

In this article, we will discuss these loan apps and Organizations that give instant loans in Pakistan. So, Let’s discuss it!

Recommended Reading: 10 Pakistani Banks Offering Personal Loan For Wedding | Marriage Loan

Instant Loan In Pakistan | Fori Loan In Pakistan

Table of Contents

- Instant Loan In Pakistan | Fori Loan In Pakistan

Recommended Reading: How To Get 5 Lakh Loan Without Interest In Pakistan (Within 7 Days) {Updated}

What is a Fori Loan In Pakistan?

In Pakistan, many organizations and loan apps provide interest-free Instant loans ranging from 1,000 to 100,000 rupees. These organizations provide interest-free loans, but loan apps take charge of the loan. It’s essential to identify and choose the organizations that genuinely provide interest-free loans.

Some Organizations give Interest-Free Instant Loan In Pakistan:

- Akuwat Foundation

- Alkhidmat Foundation

- Kashf Foundation

- Saylani Welfare Trust

Akuwat Foundation

You can easily get interest-free Instant Loans ranging from 10,000 to 100,000 through the Akhuwat Foundation in Pakistan. As the largest organization of its kind in the country, they have helped over 4.6 million people.

The foundation according to Islamic finance principles provides various loan types, such as Family Enterprises Loans for small businesses, Agricultural Loans to support farmers, and Liberation Loans for income-generating activities. These loans aim to help individuals meet their financial needs without any interest charges.

Akhuwat Foundation Helpline

Phone: (042) 35112146

Email: info@akhuwat.org.pk

Address: 19 Civic Center, Minhaj Ul Quran University Rd، Sector A-II Twp Commercial Area Lahore, Punjab

Alkhidmat Foundation

Alkhidmat is a welfare organization, that provides Instant Loan in Pakistan through the Mawakhat program following Islamic principles. This program provides interest-free loans, with the Qarze-e-Hasna concept to help those in need.

Alkhidmat aims to reduce poverty and help poor families. The Mawakhat Program supports families with interest-free loans, offering guidance, training, and a PKR 100,000 Small Business Loan for 2 months to promote financial independence.

Instant Loan in Pakistan Details:

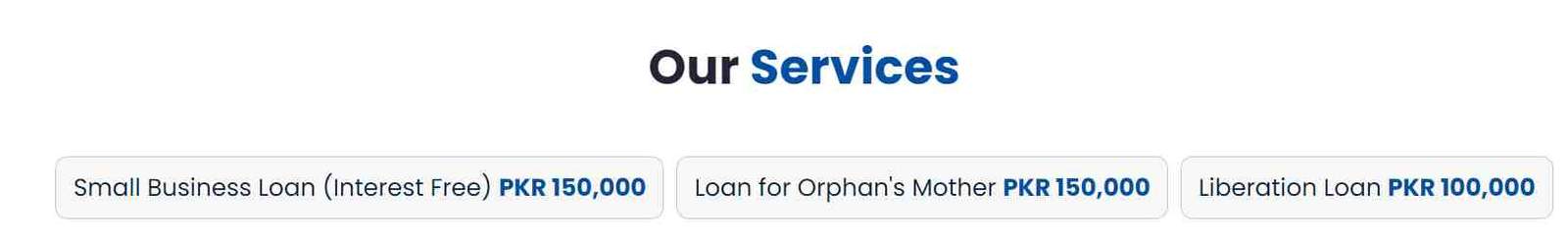

Alkhidmat Foundation Pakistan provides various Instant Loan in Pakistan to meet different needs without interest:

| Loan Type | Amount | Purpose |

|---|---|---|

| Small Business Loan | PKR 150,000 | Start or expand small businesses |

| Loan for Orphan’s Mother | PKR 150,000 | Assist mothers of orphans |

| Liberation Loan | PKR 100,000 | Support income-generating activities |

| Mawakhat Program Loan | PKR 100,000 | Promote financial independence for families |

Recommended Reading: Cash Loan In Pakistan | Emergency Cash Loan In Pakistan (5-15Lakhs)

Alkhidmat Foundation Helpline

Email: info@alkhidmat.org

Phone: +92 42 3595 7260

Address: Alkhidmat Foundation Headoffice, 3km Khayaban-e-Jinnah, Lahore, Punjab, Pakistan

Kashf Foundation

Kashf Foundation is a helpful organization in Pakistan that offers interest-free Instant Loan in Pakistan. One of their main loan products is called Kashf Karobar Karza (KKK), which lasts for either 12 or 18 months.

| Loan Product | Duration | Amount Range | Purpose |

|---|---|---|---|

| Kashf Karobar Karza (KKK) | 12 or 18 months | PKR 45,000 to PKR 70,000 | Start/expand businesses, support family businesses, reopen closed businesses (women) |

| Repeat Loan | 18 months | Up to PKR 300,000 | For repeat borrowers to support business growth |

Recommended Reading: How To Get Marriage Loan In Pakistan | Qarz-e-Hasna For Marriage {10K-5Lakh}

Kashf Foundation Helpline

Phone: +92-42-111-981-981

Email: info@kashf.org

Address: 1 C Shahrah Nazaria-e-Pakistan, Lahore, Pakistan

Saylani Welfare Trust

Saylani Welfare International Trust offers interest-free Instant Loan in Pakistan, providing financial Instant Loan ranging from Rs. 10,000 to Rs. 200,000 without any interest charges.

Their commitment extends to helping people from various economic backgrounds, including the middle class and lower middle class. The Instant Loan in Pakistan is designed to support economic empowerment and entrepreneurship. Saylani Welfare caters to different needs through specific loan categories.

For education, they provide Instant loans in Pakistan ranging from Rs. 10,000 to Rs. 200,000, while emergency loans are offered for unforeseen crises. Small business loans aim to boost entrepreneurship with amounts ranging from Rs. 10,000 to Rs. 200,000.

Recommended Reading: 5 Ways To Get Business Loans For Women In Pakistan

Saylani Welfare Trust Helpline

Phone: 92-311-1729526

Email: info@SaylaniWelfare.com

Address: A-25, Bahadurabad Chowrangi Karachi, Pakistan

Review Your Financials

It’s smart to review your financial situation before looking for a loan. Is it going to be easy? Probably not.

But that means you’ll have a realistic view of what you need, what you don’t, and what sacrifices might be needed to make your business work.

When you get started, think about documenting:

- How much money is coming into your business;

- How much is going out;

- How much cash do you have on hand at any given moment?

Recommended Reading: Instant Cash Loan In 1 Hour Without Documents In Pakistan {10K-50K}

All You Need To Know About Personal Loan For Wedding (Q&A)

Which app gives a loan immediately in Pakistan?

Several apps offer immediate loans in Pakistan, including:

- Abhi – Your Salary Now!

- Barwaqt

- Paisayaar

- Zoodpay

- Muawin

How to get a loan in 2 minutes?

Abhi – Your Salary Now! is an app offering quick loans in Pakistan. It provides loans ranging from PKR 1,000 to PKR 30,000 with repayment periods of up to 90 days. Users can apply for a loan within minutes through the app, SMS, or WhatsApp.

Barwaqt is another option for obtaining fast loans in Pakistan. It offers loans ranging from PKR 1,500 to PKR 25,000 with flexible repayment terms. You can apply for a loan online through the Barwaqt app or website.

Paisayaar is also known for its quick loan approval process. It provides loans from PKR 5,000 to PKR 25,000, which can be accessed through the mobile app anytime, anywhere in Pakistan.

What is the urgent loan scheme in Pakistan?

The Kashf Easy Loan is an easy loan option in Pakistan designed to address urgent financial needs. It offers small loan amounts ranging from PKR 10,000 to PKR 35,000, making it easy for individuals requiring immediate financial assistance for various purposes.

Instant Loans In Pakistan FAQs

Which bank offers instant loans in Pakistan?

Bank Alfalah gives instant loans up to 1 Million (10 Lakh PKR) to its selected account holders through its mobile app.

Write Top 4 Organizations Give Interest-Free Instant Loan In Pakistan.

List of Organizations give Interest-Free Instant Loan In Pakistan:

Akuwat Foundation

Alkhidmat Foundation

Kashf Foundation

Saylani Welfare Trust

What is a Fori Loan In Pakistan?

In Pakistan, many organizations and loan apps provide interest-free loans ranging from 1,000 to 100,000 rupees. These organizations provide interest-free loans, but loan apps take charge of the loan. It’s essential to identify and choose the organizations that genuinely provide interest-free loans.

How much loan provide Saylani Welfare?

Saylani Welfare International Trust offers interest-free Instant Loans in Pakistan, ranging from Rs. 10,000 to Rs. 200,000. These loans cater to various economic backgrounds, supporting the middle and lower middle class. Designed for economic empowerment and entrepreneurship, Saylani Welfare provides Instant Loans for education (Rs. 10,000 to Rs. 200,000), emergencies, and small businesses (Rs. 10,000 to Rs. 200,000).

What is the Akhuwat Foundation loan program?

Akhuwat Foundation in Pakistan offers interest-free Instant Loans ranging from 10,000 to 100,000, assisting over 4.6 million people. As the largest organization of its kind, it operates based on Islamic finance principles, providing Family enterprise loans for small businesses, Agricultural Loans for farmers, and Liberation Loans for income-generating activities.

How much loan was provided Kashf Foundation?

Kashf Foundation in Pakistan offers interest-free Instant Loans through Kashf Karobar Karza (KKK), lasting 12 or 18 months with amounts from PKR 45,000 to PKR 70,000. It supports entrepreneurs and women reopening businesses, promoting economic empowerment. Repeat loans in the 18-month cycle can go up to PKR 300,000. Similarly, the Akhuwat Foundation provides interest-free Instant Loans from 10,000 to 100,000, helping over 4.6 million people. Guided by Islamic finance principles, they offer various loans for small businesses, farmers, and income-generating activities, prioritizing individuals’ financial needs without interest charges.

Recommended Reading: Instant Cash Loan In 1 Hour Without Documents In Pakistan {10K-50K}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment