With a 5 lakh loan without interest in Pakistan, you can fulfill your dream of starting a small business, buying some stuff, fulfilling any urgent financial need, and so on.

Many loan schemes/programs in Pakistan can provide you with interest-free loans of up to Rs.5 Lakh or even more e.g. Prime Minister Youth Loan Program, the Akhuwat Foundation, and the Pakistan Poverty Alleviation Fund.

Which Foundations give 5 Lakh loans without interest in Pakistan?

The following welfare organizations give 5 Lakh loans without interest in Pakistan:

- Prime Minister Youth Loan Program Online Apply | Kamyab Jawan Program Loan

- Akhuwat Loan Scheme

- Pakistan Poverty Alleviation Fund Loan Scheme

This article guides the readers through eligibility, documentation, and the application process for these programs to get loans within no time. So, let’s get started!

Recommended Reading: Instant Cash Loan In 1 Hour Without Documents In Pakistan {10K-50K}

Get A 5 Lakh Loan Without Interest In Pakistan | Interest-Free Loan

Table Of Contents

- Get A 5 Lakh Loan Without Interest In Pakistan | Interest-Free Loan

- 5 Lakh Loan Without Interest In Pakistan

- Prime Minister Youth Loan Program Online Apply | Kamyab Jawan Program Loan

- Akhuwat Loan Scheme

- Akhuwat Loan Eligibility Criteria

- Akhuwat Loan Apply Online | Akhuwat Loan Application Form Online

- Step 1: Locate the Nearest Akhuwat Center

- Step 2: Gather Required Documents

- Step 3: Visit the Akhuwat Center

- Step 4: Fill in the Loan Application Form

- Step 5: Submit Your Application and Documents

- Step 6: Attend an Interview (If Required)

- Step 7: Wait for Loan Approval and Disbursement

- Pakistan Poverty Alleviation Fund Loan Scheme

- FAQs | 5 Lakh Loan Without Interest In Pakistan

5 Lakh Loan Without Interest In Pakistan

5 Lakh Loan Without Interest In Pakistan: There are many government and non-governmental organizations and schemes to get a 5 Lakh loan without interest in Pakistan.

Here, we will explore only 3 of them i.e. PM Youth Loan Program, Akhuwat Foundation Loans, and Pakistan Poverty Alleviation Fund (PPAF). Let’s start our guide!

Recommended Reading: Instant Loan In Pakistan | Fori Loan In Pakistan (10K-30K) {Updated}

Prime Minister Youth Loan Program Online Apply | Kamyab Jawan Program Loan

PM Youth Loan Eligibility

- Citizenship: The Prime Minister Youth Loan Program is open to all citizens of Pakistan who hold a valid Computerized National Identity Card (CNIC). This criterion ensures that the program is accessible to individuals residing within the country.

- Age Range: Applicants must fall within the age range of 21 to 45 years to be eligible for the loan program. This requirement aims to target individuals in their prime working years, allowing them to utilize the loan for business or entrepreneurial endeavors effectively.

- IT/E-Commerce Related Businesses: For individuals involved in IT/E-Commerce-related businesses, the age limit is reduced to 18 years. This modification acknowledges the early start and potential for success in these industries, encouraging young entrepreneurs to leverage the loan program to kickstart their ventures.

Recommended Reading: 10 Pakistani Banks Offering Personal Loan For Wedding | Marriage Loans

PM Youth Loan Application Process

5 Lakh Loan Without Interest In Pakistan: The Prime Minister Youth Loan Program offers a valuable opportunity for individuals in Pakistan to access financial support for their entrepreneurial endeavors.

| Step | Description |

|---|---|

| Step 1: Visit Official Website: | Visit the official website of the Prime Minister Youth Loan Program by typing the following URL in your web browser: https://pmyp.gov.pk/bankform/newapplicantform. |

| Step 2: Create an Account: | On the loan application portal, find the option to create a new account. Provide necessary information such as name, contact details, email address, and CNIC number. Generate a secure password for your account. |

| Step 3: Log in to Your Account: | Once the account is successfully created, log in using the username (email address) and password chosen during registration. |

| Step 4: Fill Application Form: | After logging in, access the loan application form. Fill in all required fields accurately, including personal details, business information (if applicable), educational background, and financial data. |

| Step 5: Upload Supporting Docs: | These may include CNIC copies, educational certificates, business plans, bank statements, and relevant documents. Scan or photograph documents clearly and upload them to the portal. |

| Step 6: Review and Submit: | Before submission, carefully review all information provided. Check for errors or omissions and ensure uploaded documents are clear. Click “Submit” once confident the application is complete. |

| Step 7: Follow Up on the Application: | Upon submission, receive a confirmation message. Note any reference numbers or application IDs provided. Monitor email and the program’s website for updates on application status. |

Recommended Reading: Instant Loan In Pakistan | Fori Loan In Pakistan (10K-30K) {Updated}

Akhuwat Loan Scheme

Akhuwat Loan Eligibility Criteria

- Citizenship: The Akhuwat Loan Scheme is open to all citizens of Pakistan who hold a valid Computerized National Identity Card (CNIC). This criterion ensures that the scheme is accessible to individuals residing within the country.

- Age Range: Applicants must fall within the age range of 21 to 62 years to be eligible for the Akhuwat Loan Scheme. This requirement aims to target individuals in various stages of their working lives, allowing them to benefit from the financial support provided.

- Business Plan or Running Business: To be eligible for the loan, applicants must either have a well-defined business plan or be currently running a business. This criterion ensures that the loan is utilized for productive purposes and helps individuals strengthen or expand their existing ventures.

- Proximity to Akhuwat Center: Applicants must be located within a 2 to 2.5 radius of the nearest Akhuwat Center. This requirement aims to ensure that individuals can easily access the support and services provided by Akhuwat for smooth loan processing and ongoing assistance.

Akhuwat Loan Apply Online | Akhuwat Loan Application Form Online

5 Lakh Loan Without Interest In Pakistan: The Akhuwat Loan Scheme offers individuals in Pakistan the opportunity to access financial support for their business ventures.

To apply for a 5 Lakh Loan Without Interest In Pakistan by Akuwat Foundation, follow this step-by-step guide by visiting your nearest Akhuwat Center:

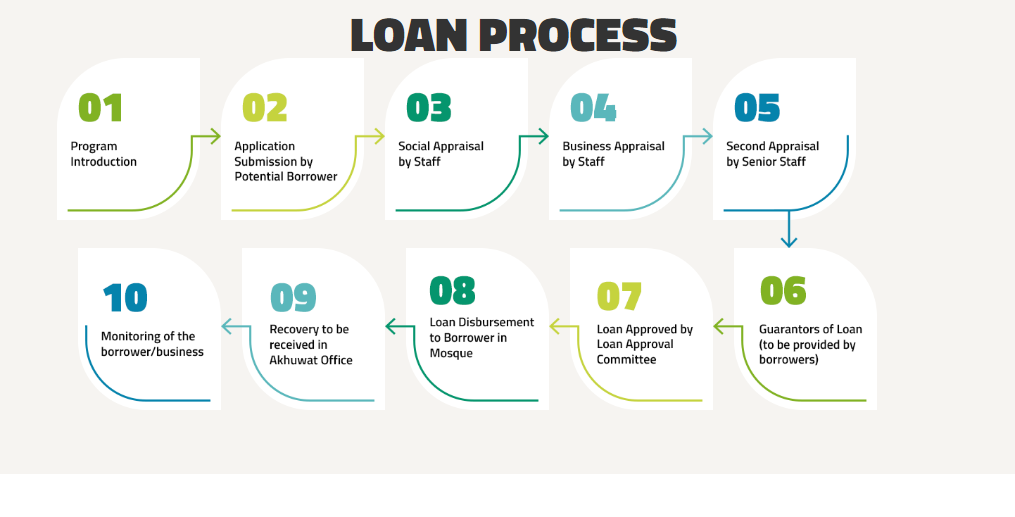

Step 1: Locate the Nearest Akhuwat Center

Identify the nearest Akhuwat Center in your locality. You can find this information by visiting the official Akhuwat website, contacting their helpline, or seeking assistance from local community organizations. Ensure that the center is within a 2 to 2.5 radius of your location for eligibility.

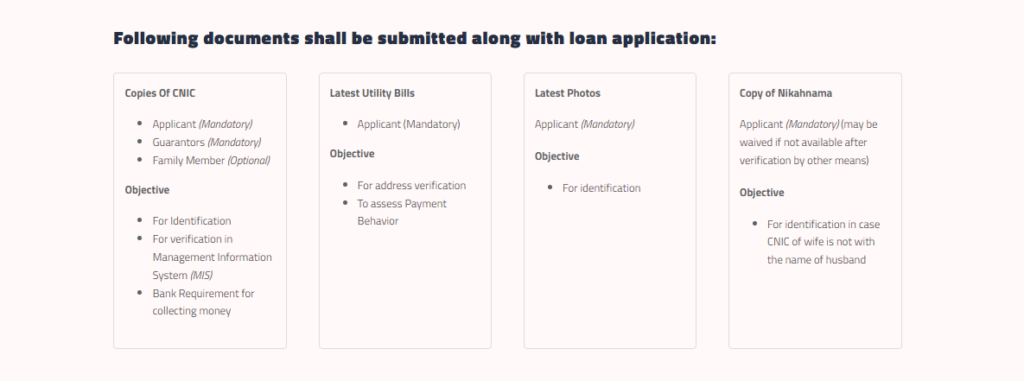

Step 2: Gather Required Documents

Before visiting the Akhuwat Center, gather the necessary documents for your loan application.

Step 3: Visit the Akhuwat Center

Go to the identified Akhuwat Center during their operating hours. The center staff will guide you through the loan application process.

Step 4: Fill in the Loan Application Form

At the Akhuwat Center, you will be provided with a loan application form to fill out. Ensure that you provide all the required information accurately.

Step 5: Submit Your Application and Documents

Once you have filled out the application form, submit it along with the required documents to the designated staff member at the Akhuwat Center.

Step 6: Attend an Interview (If Required)

Depending on the specific requirements of the loan application and the evaluation process, you may be called for an interview.

Step 7: Wait for Loan Approval and Disbursement

After the submission of your application and completion of the evaluation process, you will need to wait for the loan approval decision.

Recommended Reading: How To Get Marriage Loan In Pakistan | Qarz-e-Hasna For Marriage {10K-5Lakh}

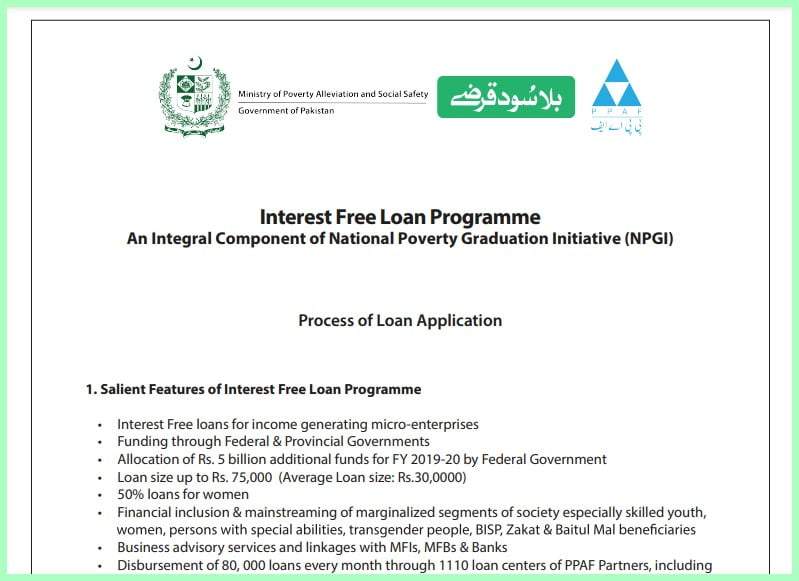

Pakistan Poverty Alleviation Fund Loan Scheme

PPAF Loan Eligibility Criteria

- Age Range: The Pakistan Poverty Alleviation Fund (PPAF) Loan Scheme is open to individuals between the ages of 18 and 60 years. This criterion ensures that a broad range of individuals, including young entrepreneurs and experienced individuals, can benefit from the financial support provided.

- Poverty Score Card: Eligible individuals for the PPAF Loan Scheme are those from households with a poverty score ranging from 0 to 40 on the Poverty Score Card. This criterion aims to target individuals who are most in need of financial assistance and support to uplift themselves from poverty.

- Valid National Identity Card (CNIC): Applicants must possess a valid National Identity Card (CNIC) issued by the relevant authorities in Pakistan. The CNIC serves as proof of identity and is essential for the loan application process.

- Residence in Targeted Union Council: To be eligible for the PPAF Loan Scheme, individuals must be residents of the targeted union council within their respective districts. This criterion ensures that the program focuses on providing financial assistance to individuals within specific communities or areas as part of poverty alleviation efforts.

- Economically Viable Business Plan: Applicants are required to present an economically viable business plan that demonstrates the potential for sustainable income generation and long-term viability. The business plan serves as a crucial factor in evaluating the feasibility and impact of the proposed venture.

Recommended Reading: 10 Pakistani Banks Offering Personal Loan For Wedding | Marriage Loans

PPAF Loan Application Process | PPAF Application Form

5 Lakh Loan Without Interest In Pakistan: To provide a step-by-step guide for the loan application process at the nearest Pakistan Poverty Alleviation Fund (PPAF) center, it is important to note that the specific application process may vary slightly depending on the center and any recent changes.

The following is a step-by-step guide for getting a 5 Lakh Loan Without Interest In Pakistan by PPAF, the general outline of the loan application process is as follows:

Research And Preparation

- Gather information about the PPAF loan programs, eligibility criteria, and the types of loans available.

- Identify the nearest PPAF center by referring to their official website or contacting their helpline.

Visit The PPAF Nearest Center

- Visit the nearest PPAF center during their operational hours.

- Carry any required documents or information, such as identification documents, income details, and any specific documents mentioned in the loan application criteria.

Consultation And Guidance

- Upon arrival at the center, approach the designated staff or reception to inquire about the loan application process.

- Seek guidance and clarification regarding the loan programs and eligibility criteria.

- They may provide you with application forms and explain the necessary steps to complete them accurately.

Loan Application Form Submission

- Obtain the 5 Lakh Loan Without Interest In Pakistan loan application form and carefully fill it out, providing accurate and complete information.

- Attach any required documents as mentioned in the application form or as advised by the PPAF staff.

- Review the application form and attached documents to ensure everything is in order.

Document Verification

- Submit the completed application form and attached documents to the staff at the center.

- They will review the documents to verify your eligibility and assess the feasibility of your loan application.

- If any documents are found to be missing or incomplete, you may be asked to provide the necessary information or complete the missing sections.

Loan Assessment And Approval

- After document verification, the PPAF staff will assess your loan application based on their criteria and policies.

- The assessment process may involve reviewing your financial situation, business plan (if applicable), and any other relevant factors.

- The approval process duration may vary, and you may be informed of the outcome either in person or through a subsequent communication.

Loan Disbursement

- If your loan application is approved, the PPAF staff will guide you through the loan disbursement process.

- They will provide you with the necessary documents, terms, and conditions related to the loan agreement.

- Review the loan agreement thoroughly, ask any questions you may have, and sign it if you agree to the terms.

Recommended Reading: How To Get Marriage Loan In Pakistan | Qarz-e-Hasna For Marriage {10K-5Lakh}

FAQs | 5 Lakh Loan Without Interest In Pakistan

How can we get a 5 Lakh loan without interest in Pakistan

Some institutions like Akuwat Organization offer a 5 Lakh loan without interest in Pakistan or even more i.e. 5-15 Lakh loans for personal and business use.

Which Organization offers interest-free loans in Pakistan?

Pakistan Poverty Alleviation Fund (PPAF) offers interest-free loans to all Pakistanis to help pay living expenses and start a small business.

Akhuwat Foundation is a wonderful organization that gives interest-free loans without distinction. It requires little or no documents to process a loan application.

How can I get a Qarz-e-Hasana (Interest-free loan) in Pakistan?

All the students can get Qarz-e-Hasana (5 Lakh Loan Without Interest In Pakistan or even more) if:

He/she gets admission to a public university/college.

He or she does have not any permanent source of income or employment.

What is the Prime Minister Youth Loan Program, and who is eligible to apply?

The Prime Minister Youth Loan Program is a loan scheme (5 Lakh Loan Without Interest In Pakistan or even higher amounts) in Pakistan aimed at supporting young entrepreneurs and business owners. All citizens of Pakistan holding a valid CNIC, aged between 21 and 45 years (or 18 years for IT/E-Commerce-related businesses), are eligible to apply.

How can I apply for a loan through the Prime Minister Youth Loan Program?

To apply for a loan through the Prime Minister Youth Loan Program, you can visit the program’s official website or apply online through the designated application portal. Alternatively, you can contact relevant authorities or visit designated banks to access the loan application form.

What is the Akhuwat Loan Scheme, and who can benefit from it?

The Akhuwat Loan Scheme (5 Lakh Loan Without Interest In Pakistan or more) is a financial assistance program in Pakistan that provides loans to individuals for their business ventures. It primarily targets individuals residing within a 2 to 2.5 radius of the nearest Akhuwat Center, aged between 21 to 62 years, and with a business plan or existing business.

How can I apply for an Akhuwat loan?

To apply for an Akhuwat loan, you need to visit your nearest Akhuwat Center. Locate the center through the Akhuwat website or by contacting their helpline. Gather the required documents, including your CNIC, and visit the center to fill out the loan application form and submit the necessary documents.

What is the Pakistan Poverty Alleviation Fund (PPAF) Loan Scheme, and who is eligible to apply?

The Pakistan Poverty Alleviation Fund (PPAF) Loan Scheme provides financial assistance to individuals living in poverty. Eligibility criteria include being between the ages of 18 and 60 years, belonging to households with a poverty score of 0-40 on the Poverty Score Card, having a valid CNIC, being a resident of a targeted union council, and having an economically viable business plan.

How can I apply for a loan through the Pakistan Poverty Alleviation Fund (PPAF) Loan Scheme?

To apply for a 5 Lakh Loan Without Interest In Pakistan or higher amounts through the PPAF Loan Scheme, you need to visit your nearest Akhuwat Center, which is part of the PPAF network. Locate the center through the PPAF or Akhuwat website. Collect the loan application form, fill it out accurately, attach the required documents, and submit them at the Akhuwat Center.

Recommended Reading: Cash Loan In Pakistan | Emergency Cash Loan In Pakistan (5-15Lakhs)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment