In Pakistan, the cost of education has been rising steadily, and many students are forced to take out loans to finance their studies, including tuition fees, living expenses, and other educational expenses.

To address this issue, the Kashf Foundation has launched an interest-free student loan program to support deserving students from economically challenged backgrounds.

In this article, we will explain the eligibility criteria, documents required, and application process to apply for a student loan from Kashf Foundation. So, let’s get started!

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

Interest-free Student Loan In Pakistan | Kashaf Loan

Table of Contents

Recommended Reading: NBP Student Loan Scheme | Interest-Free Loans For Students {Updated}

Key Features Of The Student Loan Program

Here are the key features of the student loan program offered by the Kashf Foundation in Pakistan:

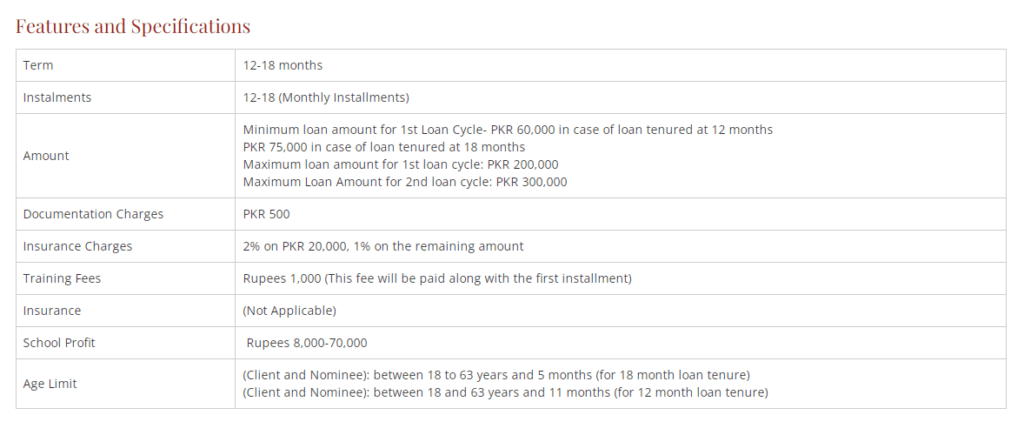

| Feature/Specification | Details |

|---|---|

| Term | 12-18 months |

| Installments | 12-18 (Monthly Installments) |

| Minimum Loan Amount (1st Loan Cycle) | PKR 60,000 (12 months), PKR 75,000 (18 months) |

| Maximum Loan Amount (1st Loan Cycle) | PKR 200,000 |

| Maximum Loan Amount (2nd Loan Cycle) | PKR 300,000 |

| Documentation Charges | PKR 500 |

| Insurance Charges | 2% on PKR 20,000, 1% on the remaining amount |

| Training Fees | Rupees 1,000 (paid with the first installment) |

| Insurance | Not Applicable |

| School Profit | Rupees 8,000-70,000 |

| Age Limit | 18 to 63 years and 5 months (18-month tenure) 18 to 63 years and 11 months (12-month tenure) |

Student Loan By Kashf Foundation Eligibility Criteria

The interest-free student loan program offered by the Kashf Foundation in Pakistan is designed to support deserving students from economically disadvantaged backgrounds.

To be eligible for this loan program, applicants must meet the following criteria:

- Financial need: Applicants must demonstrate a genuine financial need for the loan, as determined through a thorough assessment of their family’s income and assets.

- Academic merit: Applicants must have a strong academic record and must be enrolled in a recognized academic institution in Pakistan.

- Age limit: Applicants must be between 18 to 65 years of age.

- Pakistani nationality: Only Pakistani nationals are eligible to apply for the program.

- Marginalized communities: The program is particularly aimed at supporting students from marginalized communities, including orphans, widows, and disabled individuals.

Recommended Reading: Student Loan In Pakistan For Abroad Study [Up To 50Lakh Via Top 5 Banks]

Documents Required

To apply for the interest-free student loan program offered by the Kashf Foundation in Pakistan, applicants are required to provide the following documents:

- National Identity Card (NIC): A copy of the applicant’s National Identity Card (NIC) is required to verify their Pakistani nationality and age.

- Educational documents: Applicants must provide copies of their academic transcripts and certificates to demonstrate their academic merit and enrollment in a recognized academic institution.

- Income documents: Applicants must provide income documents of their parents or guardians, to determine their family’s financial need for the loan.

- Proof of residence: Applicants must provide proof of their residential address, such as a utility bill or rental agreement.

- References: Applicants must provide at least two references, preferably from their teachers or academic advisors, who can vouch for their academic abilities and character.

- Photographs: Applicants must provide passport-sized photographs for identification purposes.

Application Process For Student Loan

Kashf Foundation offers an interest-free student loan program to support deserving students from economically disadvantaged backgrounds in Pakistan.

The application process for this loan scheme can be completed by visiting the nearest Kashf Center, and the following steps are involved:

- Find the nearest Kashf Center: The first step is to locate the nearest Kashf Center by visiting the foundation’s website or contacting their customer service helpline.

- Schedule an appointment: Once you have identified the nearest Kashf Center, you need to schedule an appointment by calling the center or visiting in person. During the appointment, you will be given an application form to complete.

- Submit the application form and required documents: After receiving the application form, you need to fill it out completely and attach all the required documents, including educational documents, income documents, proof of residence, and references. You will also need to provide a recent passport-sized photograph.

- Assessment and verification: Once your application form and documents are submitted, the Kashf Foundation will assess your eligibility and verify your application details. This may involve a visit to your residence and a discussion with your references.

- Loan approval: If your application is approved, you will receive a notification from the Kashf Foundation, and the loan amount will be disbursed to your academic institution’s account directly.

- Loan repayment: The loan amount is interest-free and must be repaid in monthly installments over the agreed-upon repayment period. The repayment period may vary depending on the loan amount and the applicant’s financial situation.

Recommended Reading: Study Loan In Pakistan | Student Loan For International Studies

Kashaf Foundation Contact Number

Here is the contact information for the Kashf Foundation in Pakistan:

- Website: https://www.kashf.org

- Email: info@kashf.org

- Helpline: 0800-92743

- Address: Kashf Foundation Head Office, 49-C-1, Gulberg III, Lahore, Pakistan.

Student Loan By Kashf Foundation Pros And Cons

The Kashf Foundation’s interest-free student loan program in Pakistan offers several benefits for eligible students, including:

Pros:

- Financial support: The program provides financial support to deserving students who may not have the means to afford the high costs of higher education in Pakistan.

- Interest-free loans: The loans are interest-free, which means that eligible students can focus on their education without worrying about the burden of accumulating interest on their loans.

- Inclusive approach: The program aims to support students from marginalized communities, including orphans, widows, and disabled individuals, to promote inclusive and equitable access to education in Pakistan.

- Empowering women: The program prioritizes female applicants to promote gender equality and women’s empowerment in Pakistan.

- Repayment flexibility: The repayment period for the loan can be tailored to the student’s financial situation, providing flexibility in the repayment schedule.

Cons:

- Eligibility criteria: The program’s eligibility criteria may limit the number of students who can benefit from the program, as only those who meet the specific criteria can apply.

- Loan amount: The loan amount may not cover all the costs of higher education, which means that eligible students may still need to find additional funding sources to cover the remaining expenses.

- Repayment obligations: While the loans are interest-free, eligible students are still required to repay the loan amount over the agreed-upon repayment period, which can be a burden for graduates who may face challenges in securing employment or earning enough income to repay the loan.

- Availability: The program may not be available in all areas of Pakistan, which may limit its accessibility for some students.

Recommended Reading: School Loan In Pakistan {PKR 3-30 Lakh} [Mobilink Bank]

FAQs | Student Loan In Pakistan

Who is eligible for the Kashf Foundation’s student loan program?

The program is available to Pakistani citizens who are enrolled in a recognized academic institution and meet the foundation’s eligibility criteria, which include financial need and academic merit.

Priority is given to female applicants and individuals from marginalized communities.

What is the loan amount offered by the Kashf Foundation?

The loan amount varies depending on the applicant’s financial needs and academic merit. The foundation offers interest-free loans ranging from PKR 60,000 to PKR 300,000.

How long is the repayment period for the loan?

The repayment period varies depending on the loan amount and the applicant’s financial situation. The repayment period can range from 12 months to 36 months.

Is there any processing fee for the student loan application?

There is a PKR 500 processing fee for the loan application.

How can I apply for the student loan program?

You can apply for the program by visiting the nearest Kashf Center, scheduling an appointment, and submitting the required documents, including academic documents, income documents, and references.

Can I apply for the loan if I am already enrolled in an academic program?

Yes, you can apply for the loan if you are already enrolled in an academic program and meet the foundation’s eligibility criteria.

Is there any penalty for late payment or default on the loan?

No, there is no penalty for late payment or default on the loan.

How long does it take for the loan application to be processed?

The loan application processing time can vary depending on the volume of applications received and the applicant’s eligibility. Generally, it can take up to two weeks for the application to be processed.

Can I apply for the loan program multiple times?

Yes, you can apply for the loan program multiple times if you continue to meet the eligibility criteria and have successfully repaid any previous loans received from the Kashf Foundation.

What happens if I drop out of the academic program or fail to complete my degree?

If you drop out of the academic program or fail to complete your degree, you are still required to repay the loan amount according to the agreed-upon repayment schedule.

Recommended Reading: NBP Student Loan Scheme | Interest-Free Loans For Students {Updated}

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment