As the gig economy continues to expand, it becomes imperative for freelancers to have a dedicated banking solution that caters to their unique needs.

In this article, we will explore eligibility criteria, required documents, key features, and the JS Bank Freelancer Account opening process online for free. So, let’s start our guide!

- JS Bank Freelancer Account Eligibility Criteria

- JS Bank Freelancer Account Documents Required

- JS Bank Freelancer Account Key Features

- JS Bank Freelancer Account Opening Online

- JS Bank Freelancer Account Pros And Cons

Recommended Reading: Faysal Bank Freelancer Account | Faysal Bank Online Account Opening

JS Bank Freelancer Account | JS Bank Account Opening Online

Table of Contents

Eligibility Criteria

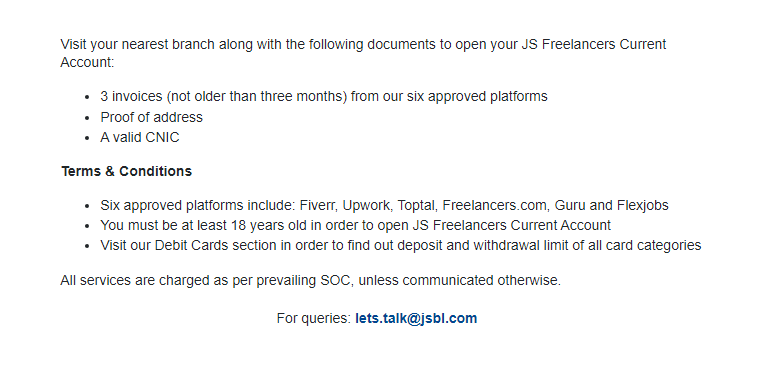

To be eligible for the JS Bank Freelancer Account, applicants must meet the following criteria:

- Proof of Freelancing Activity: Provide three invoices, dated within the last three months, from approved freelancing platforms such as Fiverr, Upwork, Toptal, Freelancers.com, Guru, or Flexjobs. These invoices serve as evidence of your active participation in the freelancing industry.

- Minimum Age Requirement: Applicants must be at least 18 years old.

- Proof of Address: Submit a valid document that verifies your current residential address. This could include utility bills, bank statements, or a rental agreement. It is important to ensure that the document is in your name and clearly displays your address.

- Valid CNIC: Possess a valid Computerized National Identity Card (CNIC) issued by the National Database and Registration Authority (NADRA). The CNIC serves as a crucial identification document for the account opening process.

Recommended Reading: Bank Of Punjab Freelancer Account | BOP Account Opening Online

Documents Required

To open a JS Bank Freelancer Account, you need to provide the following documents:

| Document Required | Details |

|---|---|

| Scan of Original ID Card (front and back): | Submit scanned copies of both sides of your valid Original ID Card, such as CNIC, SNIC, or NICOP, for verification purposes. |

| Self-Declaration over the company letterhead: | Provide a self-declaration statement on your company’s letterhead, including details like your name, address, contact info, and a declaration affirming the accuracy of the provided information. |

| Latest Bank Account Statement or Proof of Business: | Submit your most recent bank statement or any relevant document demonstrating your freelance business activities, such as invoices or receipts. |

| Zakat Declaration (if applicable): | If eligible for Zakat as per Islamic principles, furnish a Zakat Declaration to confirm your eligibility and intention to fulfill Zakat obligations. |

| Signature Specimen: | Furnish a specimen of your signature to be used for verifying future transactions, ensuring security and authentication. |

Recommended Reading: Askari Bank Freelancer Account | Askari Bank Account Opening Online

JS Bank Freelancer Account Key Features

The JS Bank Freelancer Account offers a range of key features designed to cater to the specific requirements of freelancers. These features include:

| Features | Details |

|---|---|

| Link Switch Fee Waiver: | Transfer funds between accounts without any fees, making it convenient and cost-effective for freelancers to manage their finances across different accounts. |

| e-Payment Realisation Certificate: | Obtain an e-Payment Realisation Certificate easily, providing proof of payment received from global freelance platforms. This certificate aids in verifying income, ensuring smooth transactions and financial credibility for freelancers. |

| No Minimum Balance Requirement: | Enjoy the flexibility of managing finances without worrying about maintaining a minimum balance in the JS Bank Freelancer Account. Freelancers can operate their accounts without any constraints, giving them more control over their funds. |

| Fee Waiver on Online Purchases: | Benefit from fee waivers on online purchases made through the JS Bank Freelancer Account, enabling freelancers to maximize earnings by minimizing transaction costs. This feature enhances the profitability of online transactions, supporting freelancers in their business endeavors. |

| Online Inter-city Funds Transfer: | Transfer funds between cities within Pakistan conveniently using JS Bank’s secure and user-friendly online platform. This service saves freelancers time and effort, providing a seamless solution for managing finances across different locations. |

| Smooth Inward Foreign Remittance: | Experience a hassle-free process of inward foreign remittance for payments received from international clients. This feature simplifies access to earnings from global freelance work, ensuring that freelancers can efficiently utilize their funds for personal and business purposes. |

Recommended Reading: How To Open UBL Freelancer Account Online {Benefits+Requirements}

JS Bank Freelancer Account Minimum Balance

The JS Bank Freelancer Account has the following minimum balance requirement and cash withdrawal limit:

- Minimum Balance Limit: The minimum balance requirement for the JS Bank Freelancer Account is USD 5,000 in cash. This means that you are required to maintain a minimum balance of at least USD 5,000 in your account.

- Cash Withdrawal Limit: The account allows for cash withdrawals up to a limit of PKR 500,000 per day. This means that you can withdraw a maximum of PKR 500,000 in cash from your JS Bank Freelancer Account in a single day.

Note that these limits are subject to change and may vary based on the bank’s policies and regulations.

Check with JS Bank for the most up-to-date information regarding minimum balance requirements and withdrawal limits for the Freelancer Account.

Recommended Reading: Free! MCB Freelancer Account Opening Online {Freelancers+Students}

JS Bank Freelancer Account Opening Online

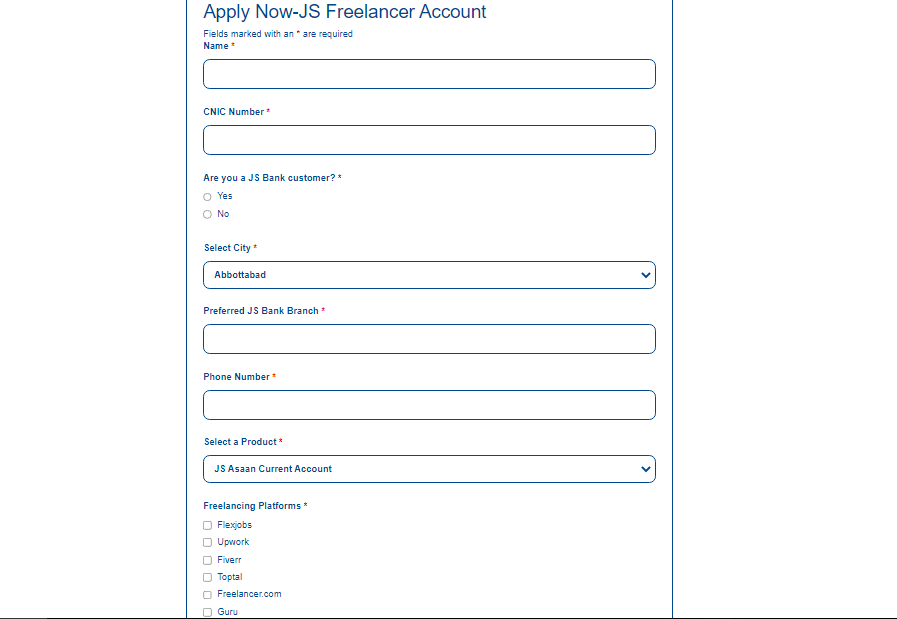

To open a JS Bank Freelancer Account online, follow the step-by-step process outlined below:

Step 1: Visit the JS Bank Website

Go to the JS Bank app or website by entering the following URL in your web browser: https://jsbl.com/apply-now-js-freelance-account/

Step 2: Select “Apply Now”

On the JS Bank Freelancer Account page, locate the “Apply Now” button, and click on it to begin the account opening process.

Step 3: Fill in the Application Form

You will be directed to an online application form. Fill in the required information accurately, including your personal details, contact information, and address.

Step 4: Upload Supporting Documents

Upload the necessary supporting documents as per the requirements mentioned on the application form. This may include scanned copies of your valid CNIC, proof of address, and three recent invoices from approved freelance platforms.

Step 5: Review and Confirm

Review all the provided information and uploaded documents to ensure accuracy and completeness. Double-check the details before proceeding.

Step 6: Submit the Application

Once you are satisfied with the information provided, submit the application form by clicking the “Submit” or “Apply” button.

Step 7: Wait for Confirmation

After submitting the application, wait for a confirmation message or email from JS Bank regarding the status of your application. This may include further instructions or documents required for verification.

Step 8: Account Activation

Upon successful verification and approval, JS Bank will activate your Freelancer Account. You will receive your account details, including your account number and login credentials.

Step 9: Access Online Banking Services

Using the provided account details, log in to the JS Bank online banking portal or mobile app to access and manage your Freelancer Account online. Explore the range of features and services available, such as fund transfers, e-statements, and online bill payments.

Recommended Reading: How To Open Bank Alfalah Freelancer Account Online {Within 5 Minutes}

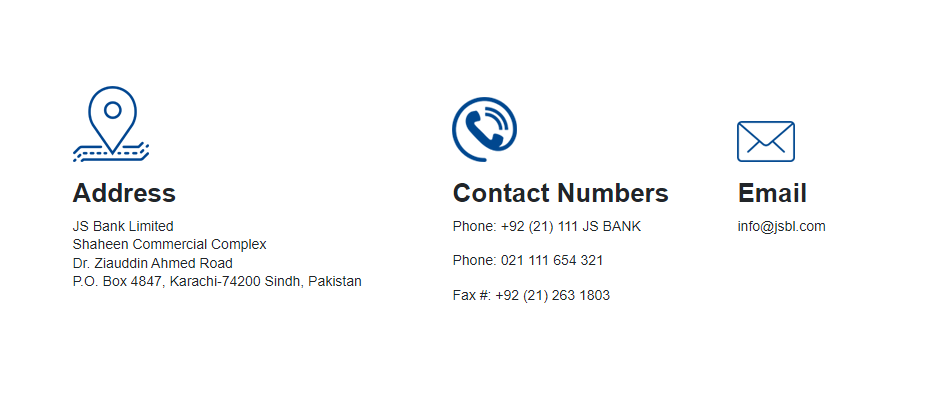

JS Bank Helpline

For any inquiries or assistance related to JS Bank, you can reach their helpline through the following contact information:

- Phone: +92 (21) 111 JS BANK (111 57 2265)

- Alternate Phone: 021 111 654 321

- Fax: +92 (21) 263 1803

- Email: info@jsbl.com

Feel free to contact the JS Bank helpline number or send an email to the provided address for any queries, support, or information you may require.

Recommended Reading: HBL Freelancer Account Opening Online (Islamic Banking) {Updated}

JS Bank Freelancer Account Pros And Cons

Pros Of JS Bank Freelancer Account

| Pros | Description |

|---|---|

| For Freelancers: | Specifically designed to meet the unique financial needs of freelancers, offering specialized features and services to support and enhance their freelance businesses. |

| Easily Online Account Opening: | Easily open an account through the online application process, saving time and providing a hassle-free experience for freelancers. |

| No Minimum Balance Requirement: | Enjoy the flexibility of managing finances without the pressure of maintaining a specific balance in the account. |

| Fee Waivers: | Benefit from fee waivers on various transactions, including online purchases, helping freelancers save on transaction costs and maximize earnings. |

| Inward Foreign Remittance: | Simplifies the process of receiving payments from international clients, making it easier to access and utilize earnings. |

Cons Of JS Bank Freelancer Account

| Cons | Details |

|---|---|

| Minimum Balance for Account Opening: | Requires a minimum balance of USD 5,000 in cash for account opening, which may be a significant amount for some freelancers to maintain. |

| Cash Withdrawal Limit: | Has a daily cash withdrawal limit of PKR 500,000, which may be restrictive for freelancers needing larger amounts for business expenses or personal use. |

| Limited Approved Platforms: | Requires providing three invoices from specific platforms like Fiverr, Upwork, etc., potentially limiting freelancers who work on other platforms or have diverse client bases. |

| Biometric Verification Requirement: | Requires visiting a physical branch for biometric verification, which may pose an inconvenience for freelancers with limited access to branch locations. |

Recommended Reading: Free! Standard Chartered Freelancer Account | SC Digital Account

JS Bank Freelancer Account FAQs

What are the approved freelance platforms for the JS Bank Freelancer Account?

The approved freelance platforms for the JS Bank Freelancer Account include Fiverr, Upwork, Toptal, Freelancers.com, Guru, and Flexjobs. You need to provide three invoices from these platforms as part of the account opening process.

Is there a minimum balance requirement for the JS Bank Freelancer Account?

No, the JS Bank Freelancer Account does not have a minimum balance requirement. You are not obligated to maintain a specific balance in your account.

Can I withdraw cash from my JS Bank Freelancer Account?

Yes, you can withdraw cash from your JS Bank Freelancer Account. The account has a daily cash withdrawal limit of PKR 500,000.

How can I apply for a JS Bank Freelancer Account?

You can apply for a JS Bank Freelancer Account online by visiting the JS Bank website and following the account opening process. Fill out the application form, provide the required documents, and submit the application for processing.

How long does it take to open a JS Bank Freelancer Account?

The turnaround time for processing a JS Bank Freelancer Account is approximately 2 working days.

What is JS Bank freelancer account opening charges?

No, opening a JS Bank Freelancer Account is free of charge. There are no fees associated with the account opening process.

Can I receive international payments in my JS Bank Freelancer Account?

Yes, the JS Bank Freelancer Account facilitates smooth inward foreign remittance, allowing you to receive international payments from clients or platforms.

Can I link my JS Bank Freelancer Account to other bank accounts?

Yes, you can link your JS Bank Freelancer Account to other bank accounts for convenient fund transfers and transactions.

How can I contact JS Bank for further assistance or inquiries?

You can contact JS Bank’s helpline at +92 (21) 111 JS BANK (111 57 2265) or send an email to info@jsbl.com for any further inquiries or assistance regarding the JS Bank Freelancer Account.

Recommended Reading: Free! Dubai Islamic Bank Freelancer Account Opening Online (Ultimate Guide)

If you like this article, please comment and share this article with others on Facebook, WhatsApp, or any other platform.

If you have any questions contact us (email) at Contact@personalloan.pk | Personalloan.pk@gmail.com or leave us a comment, we would love to answer all of your queries. Thanks for reading!

Add a Comment